2 General

Reports

2.1 Quarterly

Budget Review and Progress Report - Quarter 1 of 2021/2022

RECORD

NUMBER: 2021/2457

AUTHOR: Josie

Sanders, Management Accountant

EXECUTIVE Summary

This report provides the first quarter review of the

2019-2022 Delivery/Operational Plan, as required under section 403 of the Local

Government Act 1993. This report illustrates the progress Council is making

on the strategies and tasks identified in its strategic planning documents.

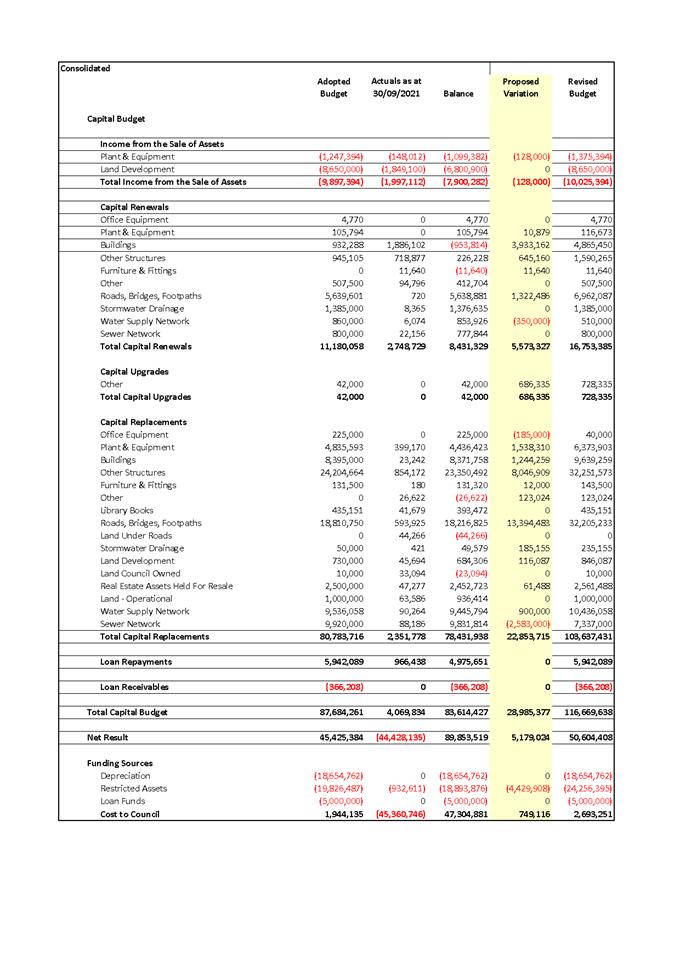

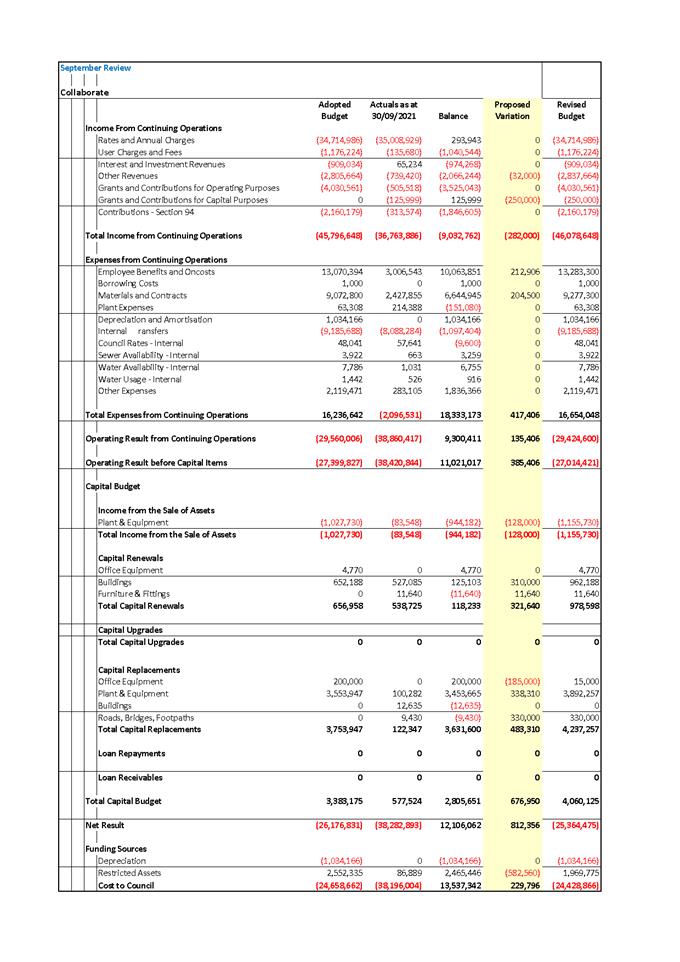

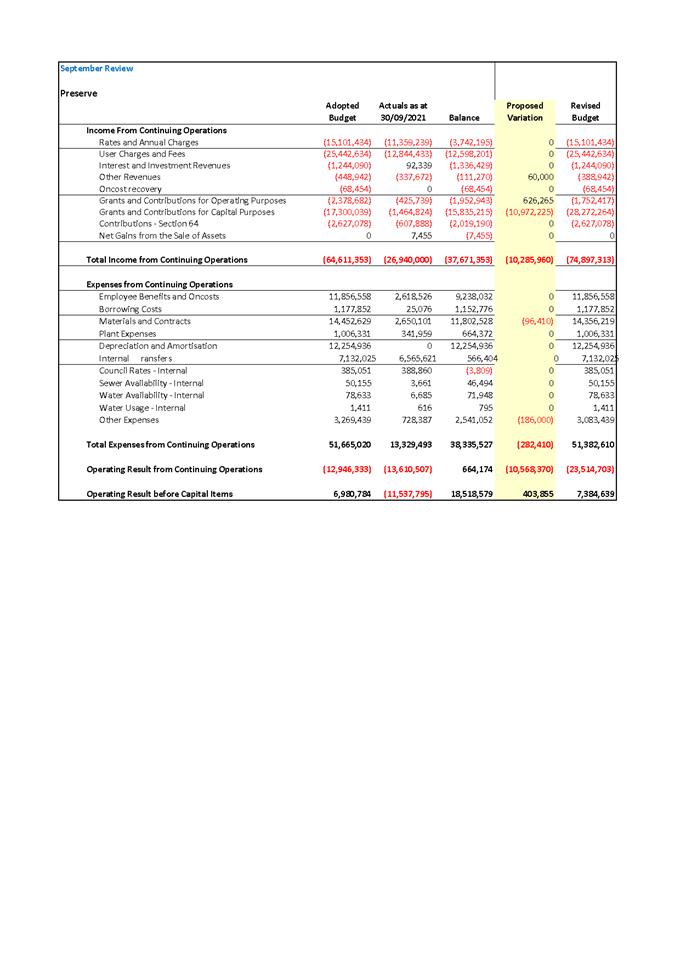

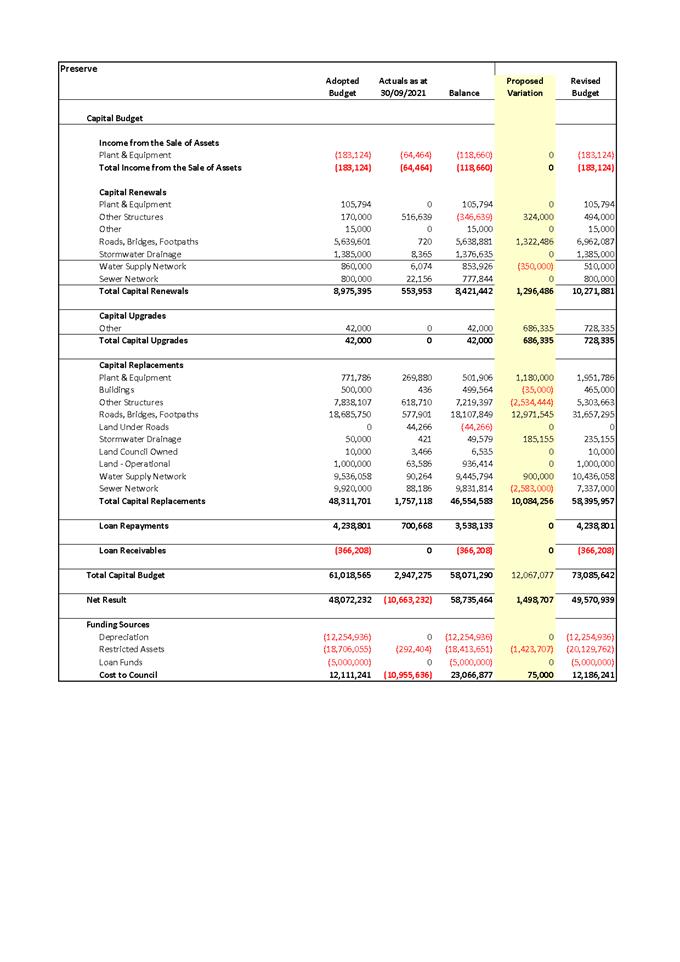

This report also provides a summary of Council’s

financial position over the quarter. The Directions (Collaborate, Live,

Prosper, Preserve) financial summary tables with the attached Performance

Indicators and quarterly review documents have been reviewed and updated and

include projects across all three funds (General, Water and Sewer).

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “17.2 Collaborate - Ensure financial

stability and support efficient ongoing operation”.

Financial Implications

The Quarterly Review has identified unfavourable variations

totalling $749,116 to Council’s adopted budget. The effect of these

variations results in Council’s projected overall year-end consolidated

position becoming a slightly larger deficit of $2,693,251 including capital.

Table 1 below presents Council’s projected year-end

result by Direction as identified in the Community Strategic Plan and the

Delivery/Operational Plan. It is important to note that all red bracketed

numbers in Tables 1-3 below indicate a surplus result for Council.

|

Direction

|

Adopted Budget

|

Proposed Variations

|

Proposed Budget

|

|

Collaborate

|

(24,658,662)

|

229,796

|

(24,428,866)

|

|

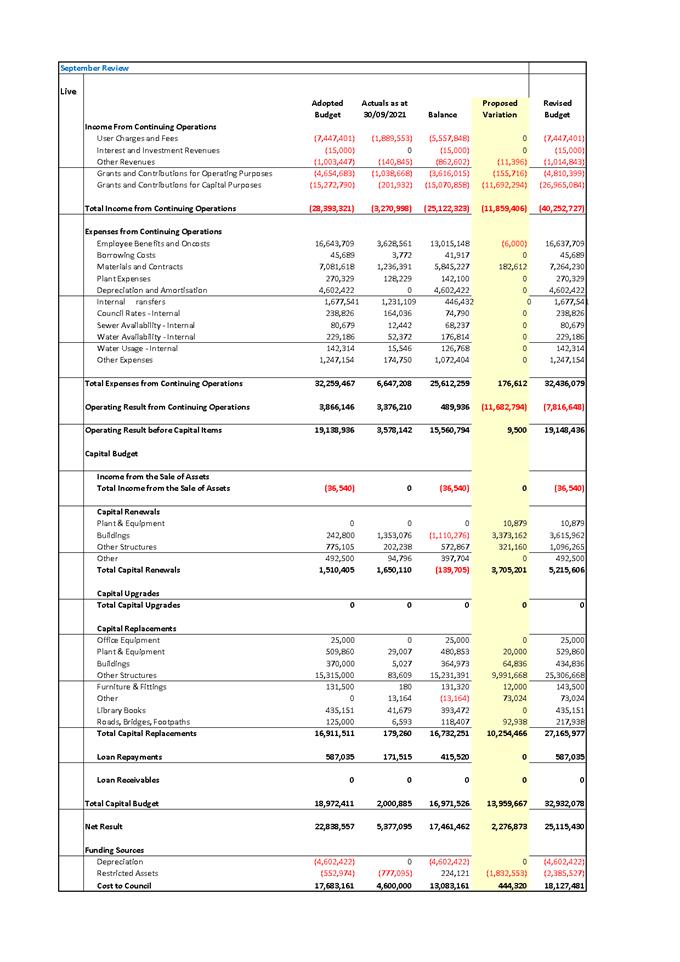

Live

|

17,683,161

|

444,320

|

18,127,481

|

|

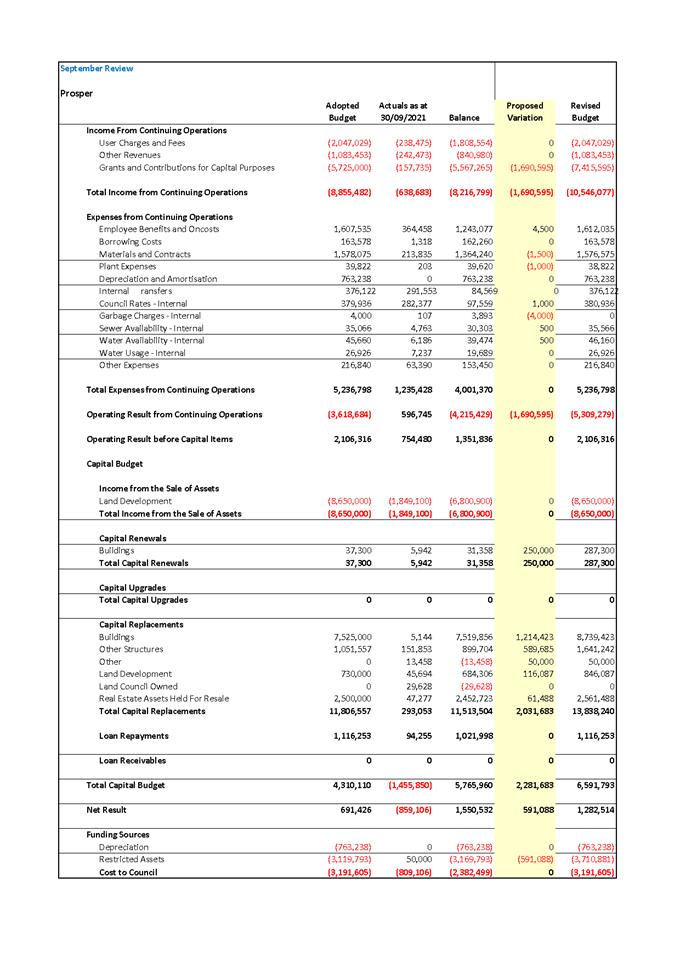

Prosper

|

(3,191,605)

|

0

|

(3,191,605)

|

|

Preserve

|

12,111,241

|

75,000

|

12,186,241

|

|

Total

|

1,944,135

|

749,116

|

2,693,251

|

Table 1: Projected year-end

position by Direction

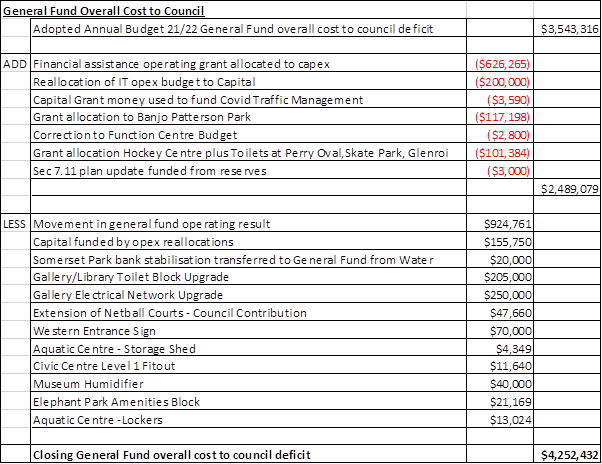

Table 2 presents Council’s projected year-end result

by Fund, showing Cost to Council (which includes capital expenditure, capital

income and funding).

|

Fund

|

Adopted Budget

|

Proposed Variations

|

Proposed Budget

|

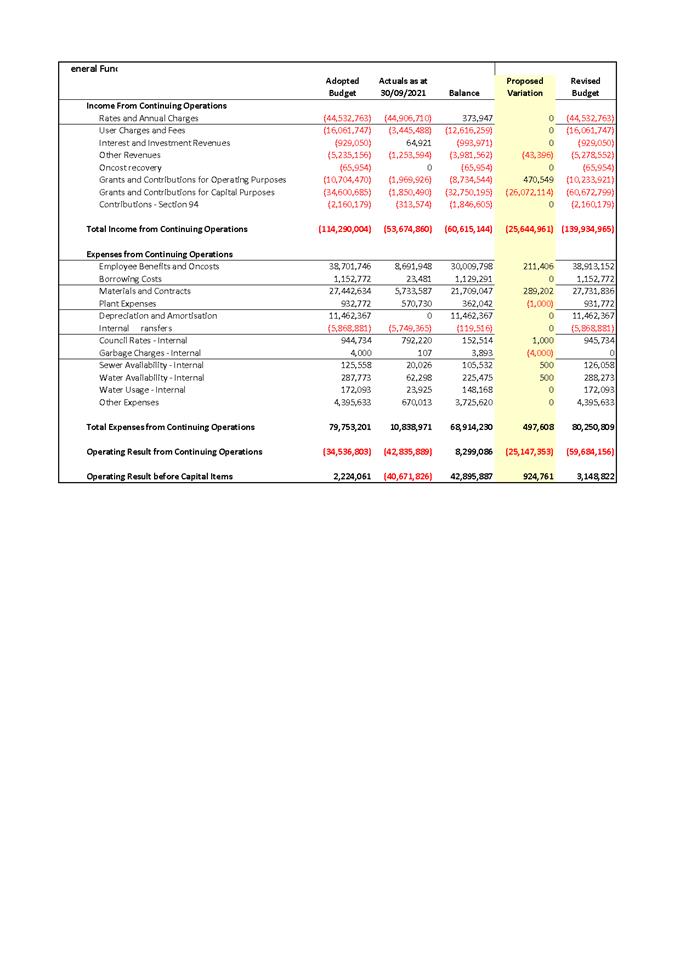

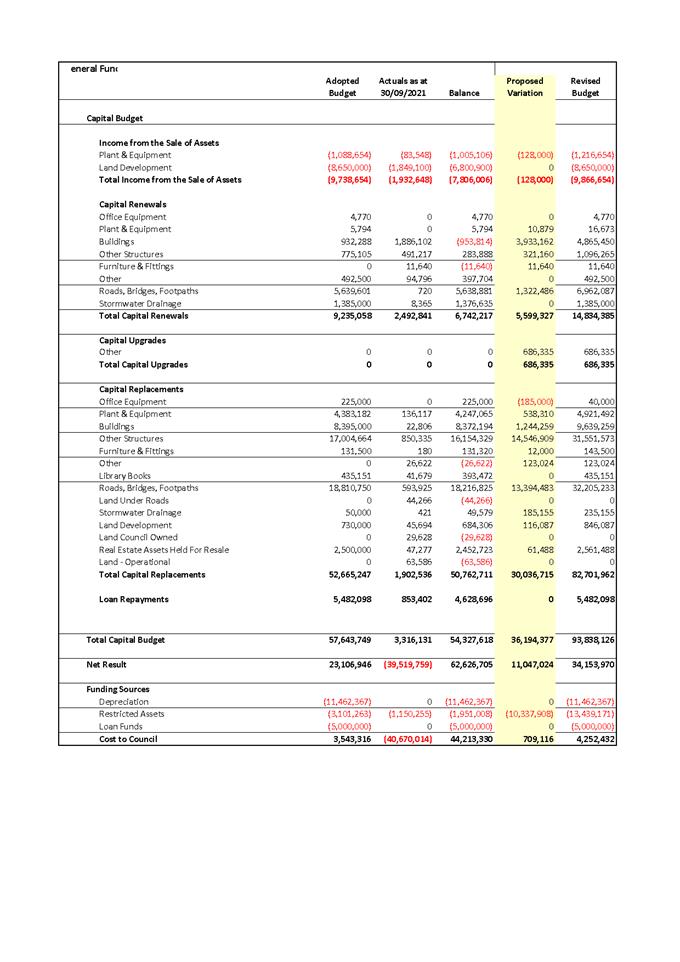

|

General

|

3,543,316

|

709,116

|

4,252,432

|

|

Water

|

(250,204)

|

40,000

|

(210,204)

|

|

Sewer

|

(1,348,977)

|

0

|

(1,348,977)

|

|

Total

|

1,944,135

|

749,116

|

2,693,251

|

Table 2: Projected year-end

position by Fund

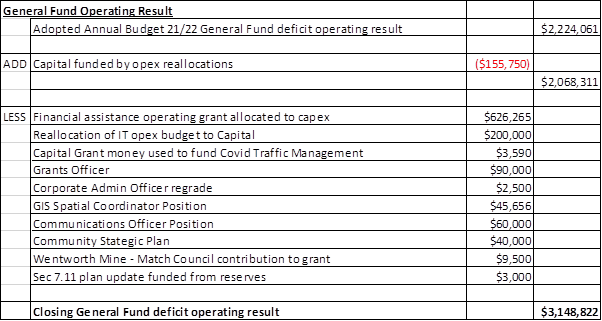

Table 3 presents Council’s projected

year-end Operating Result (before capital) by Fund.

|

Fund

|

Adopted Budget

|

Proposed Variations

|

Proposed Budget

|

|

General

|

2,224,061

|

924,761

|

3,148,822

|

|

Water

|

(140,617)

|

(126,000)

|

(266,617)

|

|

Sewer

|

(1,257,235)

|

0

|

(1,257,235)

|

|

Total

|

826,209

|

798,761

|

1,624,970

|

Table 3: Projected year-end

operating result by Fund

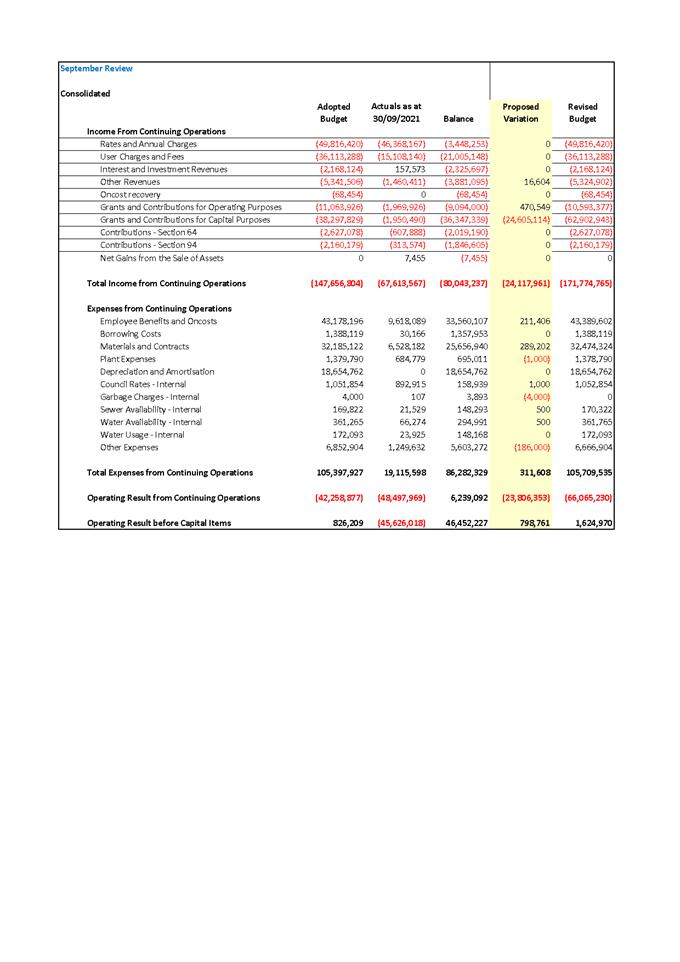

Material

changes to budget in the September quarterly review

Further information on the individual variations proposed as

part of this review, which have a material effect on Council’s financial

results, is detailed in Tables 4 to 7 below.

While there are a number of variations detailed in the

Tables, the significant contributors to the overall net variation are the

reallocation of operating grants and funds to capital projects, capital works

in and around the new gallery extension and new positions in corporate and

commercial services. Three new positions have been added being the Grants

Officer, GIS & Spatial Coordinator and Communications Coordinator. There is

a budgetary impact in the current financial year however these positions are

proposed as ongoing and if successful will be included in the structure going

forward.

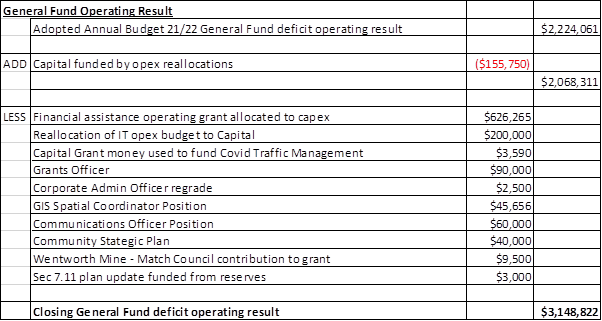

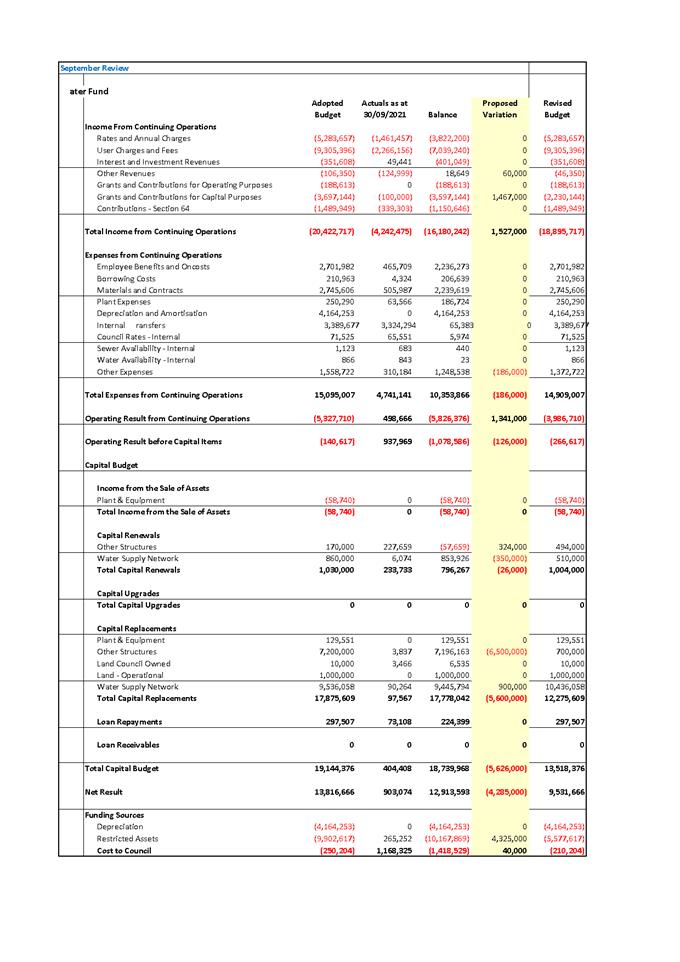

Table 4: General Fund

Operating Result

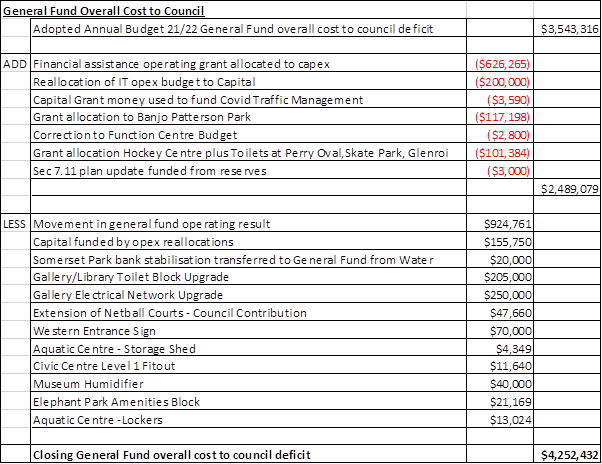

Table 5: General Fund

Overall Cost to Council

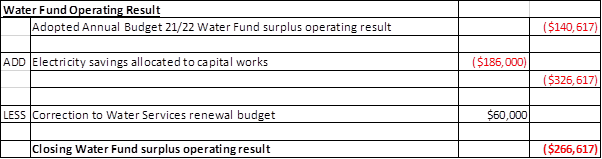

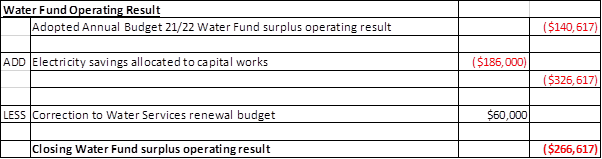

Table 6: Water Fund

Operating Result

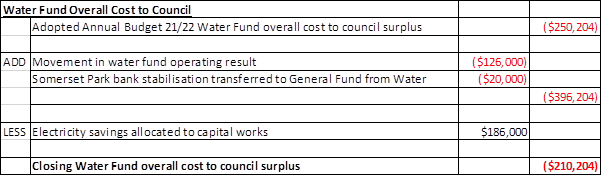

Table 7: Water Fund Overall Cost to Council

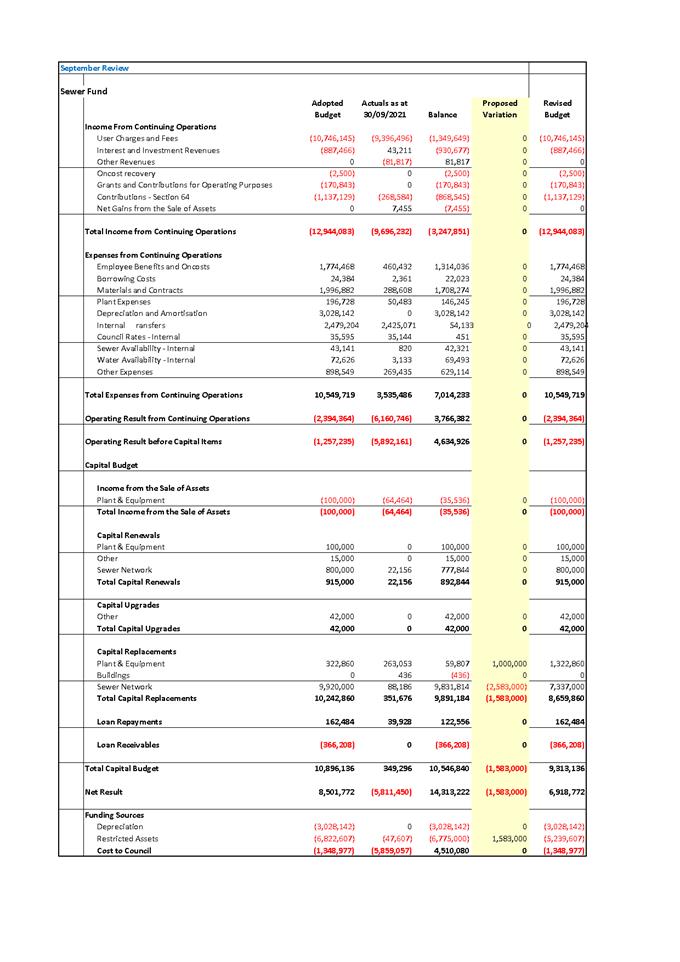

There were no Sewer fund revisions to report in the

September quarter.

Policy and Governance Implications

Nil

|

Recommendation

That Council resolves:

1 That

the information provided in the report on the quarterly budget and

performance indicators review for July 2021 to September 2021 be

acknowledged.

2 The

bank reconciliation statement be acknowledged.

3 To

adopt unfavourable variations in the consolidated overall cost to council

arising from the September 2021 quarterly review amounting to $749,116.

|

further considerations

The recommendation of this report has been assessed against

Council’s other key risk categories and the following comments are provided:

|

Service Delivery

|

The Performance Indicators

highlight progress in achieving the strategies and actions set by

Council’s Delivery/Operational Plan. The “traffic light”

indicators show the status of each task. A green light indicates the task is on

track. An amber light suggests some delay and a red light is provided to

those tasks that are unable to be achieved. All tasks have a comment that

indicates progress.

|

SUPPORTING INFORMATION

Highlights of the Quarter

· A long-term

masterplan was adopted during the quarter, which proposes major upgrades to the

Lake Canobolas precinct - A draft masterplan which was on exhibition for

community comment, attracted seven formal submissions and 192 responses. The

most sought after infrastructure upgrade was for more boardwalks and viewing

platforms.

· In a

long-awaited sign of recovery from the drought, water began flowing over the

wall of Orange’s major water storage dam at Suma Park - The landmark

event began Sunday afternoon, 18 July. By 9am Monday, 19 July, there was 186

mms of water topping the dam wall.

· Work began with

a new Council initiative to attract new customers to CBD businesses through the

creation of their own online presence - As part of the Future City initiative,

Orange City Council engaged digital experts to develop modern and engaging

websites for CBD businesses. Council is funding the development of the websites

and more than 20 CBD businesses took up the offer.

· With the onset

of prolonged rain, Council doubled the number of crews to fill wet weather

potholes in the city’s streets and rural roads - Four crews used 48

tonnes of cold mix asphalt to fill pot-holes in the last week of July, bringing

the total to 117 tonnes of cold mix asphalt used to fill pot-holes in July.

· Plans to build

a new home for the Orange Regional Conservatorium reached another milestone

with work beginning by architectural firm Brewster Hjorth to

create detailed designs for the building - Council awarded the $933,000

contract to produce detailed design plans for the conservatorium and

planetarium to be built in March Street.

· The Landscape

Masterplan for Orange’s new sports precinct was released in August. The

proposed site is next to Sir Jack Brabham Park, creating a parkland setting

with walking trails, recreation and meeting areas, BBQ spaces and water

features - The draft masterplan shows the location of key facilities such

as the 1500-seat stadium alongside Forest Road and a specialist athletics track

next to Huntley Road.

· The rollout of

smart water meters across the city continued during the quarter, with the

potential to save millions of litres of wasted water each year - The aim is

to better understand water usage and water loss across the city, as well as

encouraging users to be more water efficient. The system has been up and

running since the end of 2020.

· Work on a major

safety upgrade to the intersection of Dalton and Sampson streets will began in

late September - The $145,000 project is funded by the Federal Government through

its Black Spot Program, and will involve the construction of a raised hot-mix

asphalt intersection and pedestrian medians.

· Orange City

Council and Maas Group Properties reached an agreement during the quarter for

the sale of the west end of the former Orange Base Hospital site - The

estimated projected delivery timeframes include 15 Townhouses on the north of

the site by 2024, and 61 Apartments in the south of the site by 2025. These

works will conclude simultaneously in 2025 with the unveiling of a public park

at the centre of the site.

· A new trial was

unveiled aiming to boost revenue from the sale of surplus electricity from

Council’s three largest solar arrays - The Council signed on for a

two-year trial with electricity re-seller, South Street Energy. South Street

Energy sells electricity from solar systems of 40kW or greater to the wholesale

electricity market, sharing income with their customers.

· A network of

more than 100 kilometres of mountain bike trails was unveiled during the

quarter, part of the proposal to make Mount Canobolas a world-class centre to

attract mountain biking enthusiasts - The new map of bike trails was

produced by a firm of environmental consultants (The Environmental

Factor) engaged by Orange City Council, who spent months examining

areas of the mountain which should be protected and avoided by the new trail

network.

Review

of Income

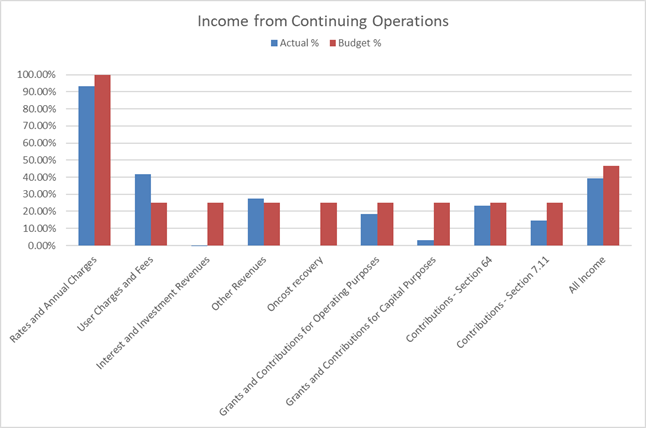

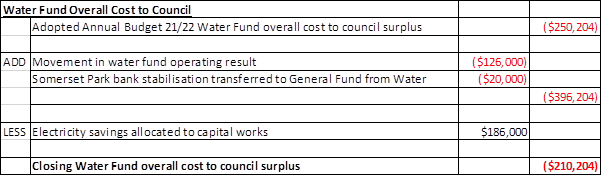

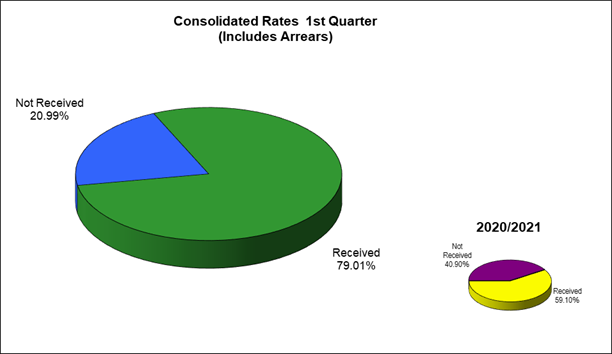

Figure 1 below provides a snapshot of the split of

Council’s income against budget.

Figure 1: Council’s

income as a percentage of annual budget as at 30 September 2021

Income streams such as User Charges and Fees and Other

Revenues are currently on track as generally their rate of receipt is

consistent throughout the year.

As Council’s annual rates are levied in July of each

year, this income is almost fully recognised in the first quarter.

Other income streams are subject to external influences

including interest rates, occurrences of development, or the success of grant

applications. These income streams are routinely reviewed, and adjusted as

appropriate, at each quarterly review.

On the assumption that all income is received at a constant

consistent rate over the year, by the end of the September quarter 25 per cent

should have been received. However, given the recognition of almost all rates

and annual charges in the first quarter, approximately 47 per cent of revenue

should have been received. The “all income” bar of Figure 1

shows progress is slightly below this expected figure due mainly to the timing

of interest due and operating and capital grants still to be received.

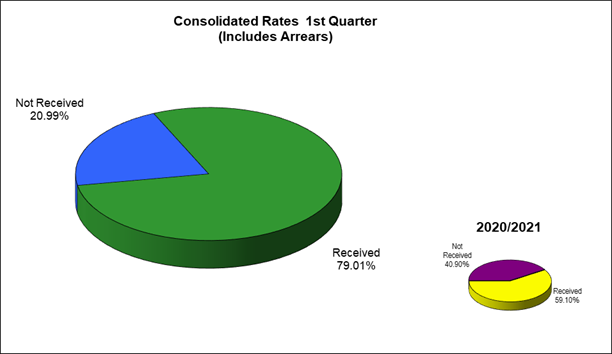

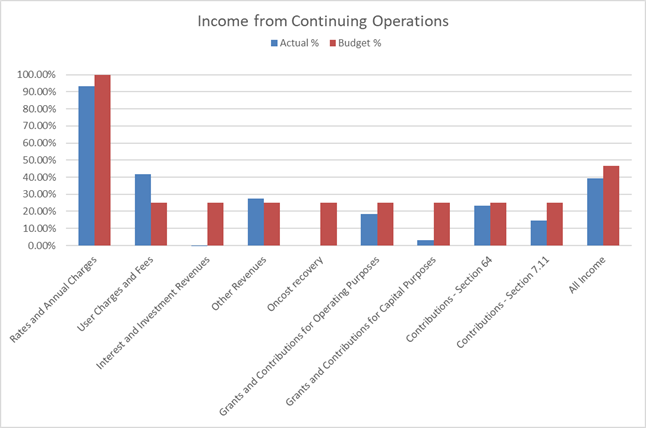

Rates and Charges Collection

For the second quarter, a total of $4.8 million (20.99 per

cent) remained outstanding for rates and annual charges. For the purposes of

comparison, for the same quarter last financial year 40.90 per cent of the

amount payable remained outstanding. The difference between 2020/21 and this

year is due to the mandated Covid-19 legislative provisions that allowed

ratepayers an extra month to pay their first instalment.

Figure 2: Outstanding rates

Q1 2021/22 vs Q1 2020/21

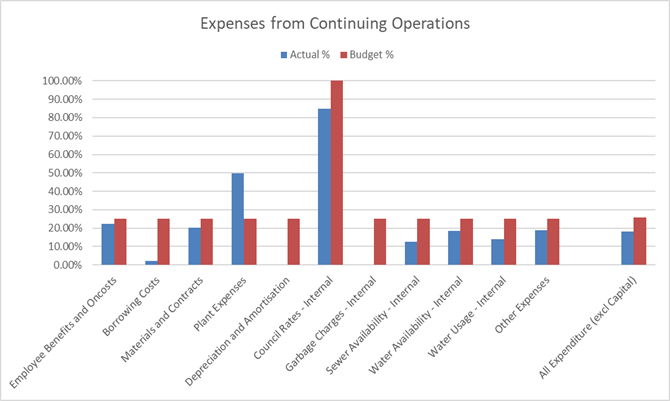

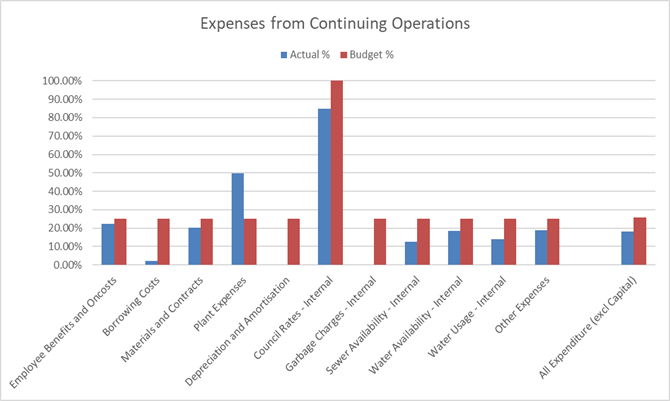

Review of Operating Expenditure

Figure 3 provides a snapshot of

the progress of Council’s operating expenditure.

Figure 3: Details of

Council’s expenditure as a percentage of annual budget as at 30 September

2021

In

general, Council’s routine operational expenses should be incurred at a

consistent rate. These include expense groupings such as Employee Costs,

Materials and Contracts, Depreciation and Other Expenses. As presented in

Figure 3 above, most of these expense groups are slightly below budget.

Depreciation ordinarily would be consistent throughout the year, however

depreciation is not able to be generated until after the finalisation of the

previous year’s financial statements. As at the end of the quarter, these

statements were still in the process of being prepared and audited. Council

rates for Council-owned properties are paid in full at the start of the year,

however these are a minor component of overall expenses.

On the assumption that all expenses are incurred at a constant

consistent rate over the year, by the end of the September quarter 21 per cent

should have been paid out. The “all expenditure” bar of Figure 3

shows performance is better than budget.

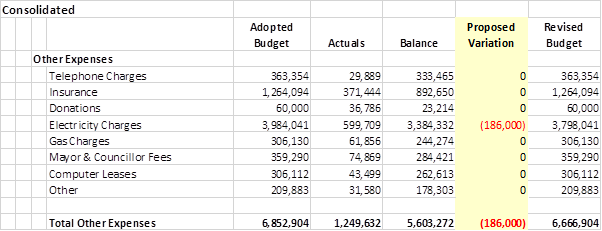

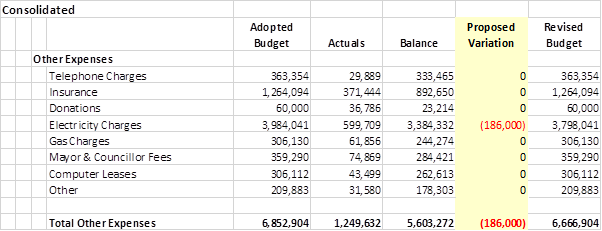

Other Expenses

The format of the attached financial reports and the financial

statements is prescribed. Council has requested details of the

“Other Expenses” element in the statements given the high value of

this item. The additional information is provided in Table 8 below.

Table 8: Details of other

expenses

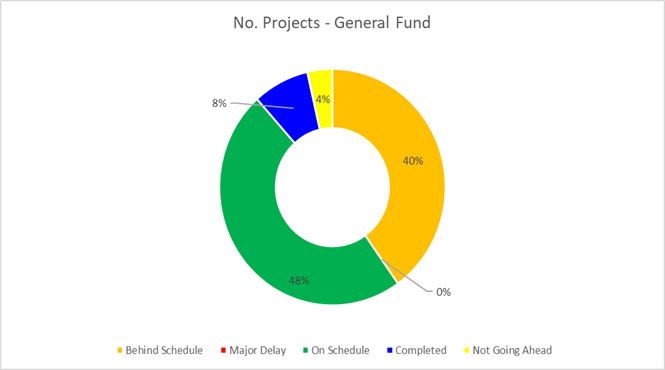

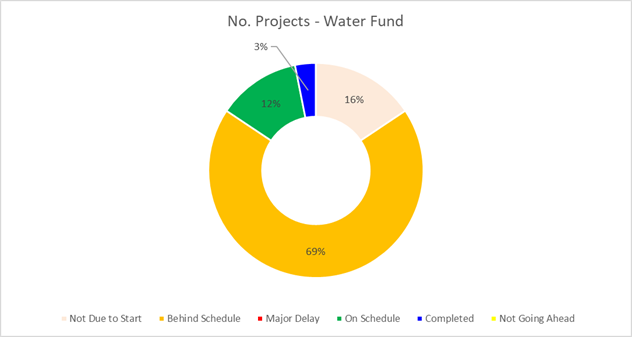

Review of Capital Expenditure

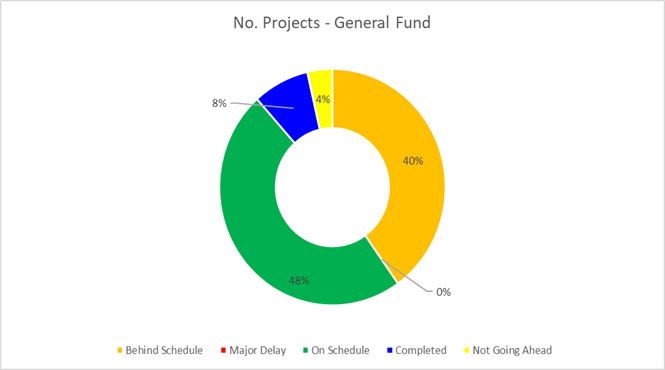

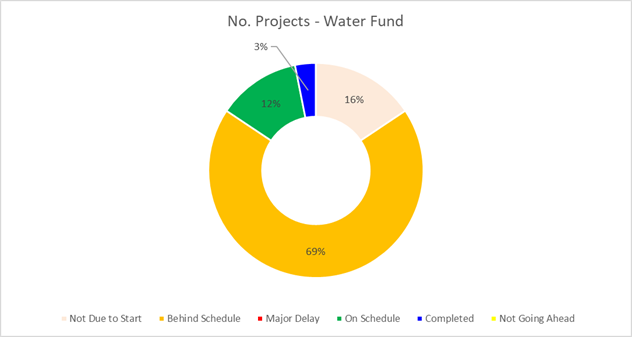

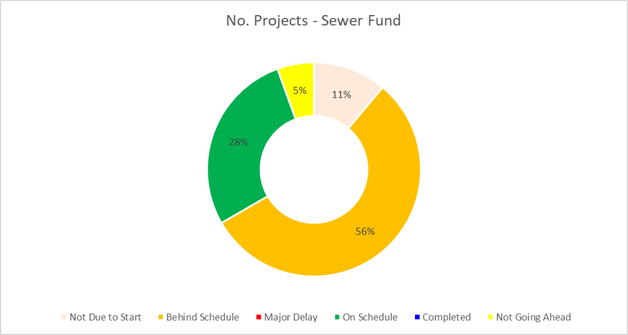

Figures 4 to 6 below provide a

snapshot of the progress of Council’s capital expenditure against budget

by fund. It is important to note that the first three months encompass a lot of

planning and preparation, with many projects not scheduled to commence until

Spring and Summer, and others awaiting confirmation of grants being secured

before being able to proceed.

Figure 4: General Fund

Capital Projects – Progress by number of projects

Figure 5: Water Fund

Capital Projects – Progress by number of projects

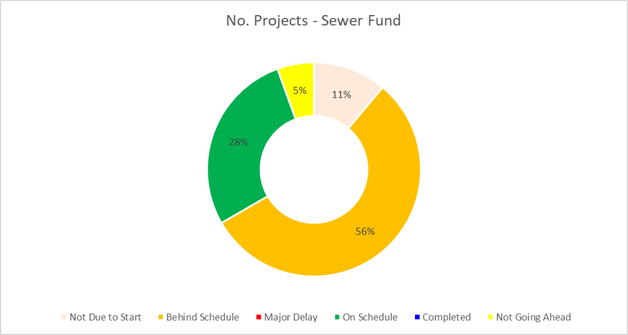

Figure 6: Sewer Fund

Capital Projects – Progress by number of projects

Financial

Performance Indicators

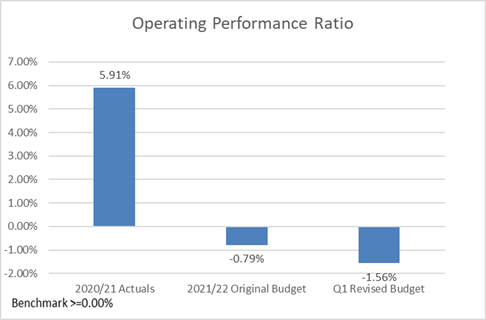

Figures 7 to 9 below represent

financial performance against local government industry indicators from the

annual financial statements. The charts compare annualised actual performance

from 2020/21 against the original 2021/22 budget and the proposed Q1 revised

2021/22 budget.

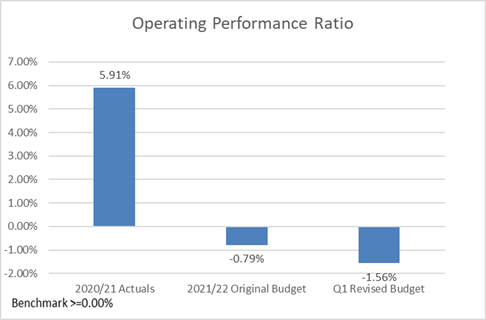

Figure 7: Operating

performance ratio

The purpose of the operating performance ratio is to measure

the extent to which Council succeeds in containing operating expenditure within

operating revenue (excluding capital grants and contributions). The formula is

as follows:

(Total continuing operations revenue excluding capital

grants and contributions minus operating expenses) divided by (Total

continuing operations revenue excluding capital grants and contributions)

The performance to date

indicates Council is tracking below the benchmark due mainly to the forecast

operating deficit for the 2020/21 year when compared to the operating surplus

achieved in 2019/20.

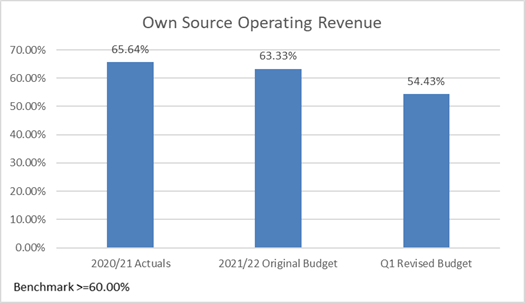

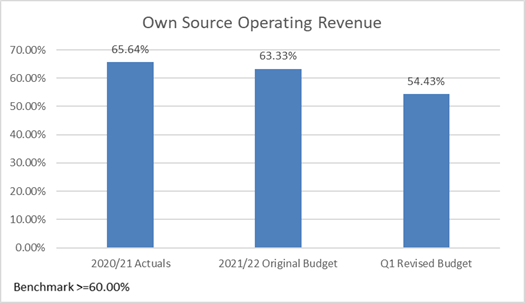

Figure 8: Own source

operating revenue ratio

The purpose of the own source

operating revenue ratio is to measure fiscal flexibility by analysing the

degree of reliance on external funding sources. The formula is as follows:

(Total continuing operations revenue minus all grants

and contributions) divided by

(Total continuing operations revenue inclusive of all

grants and contributions)

The performance to date indicates Council is below the

benchmark, with a significant increase in the level of funding expected to come

from capital grants and contributions for major projects in 2021/22.

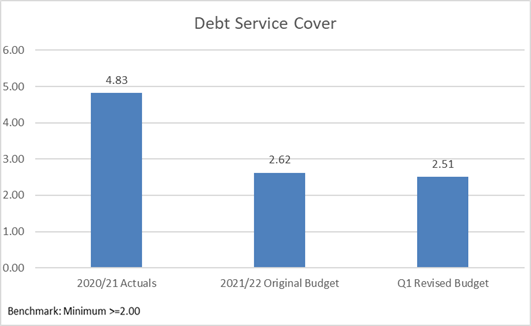

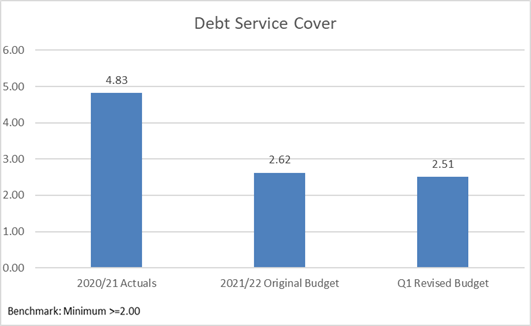

Figure 9: debt service

cover ratio

The purpose of the debt service cover ratio is to measure the

availability of operating cash to service debt including interest, principal

and lease payments. The formula is as follows:

(Operating results before capital excluding interest

and depreciation) divided by

(Principal repayments from the cashflow statement plus

borrowing costs from the income statement)

The performance to date indicates Council is tracking in

advance of the benchmark. The budgeted performance is below the 2020/21 ratio

due to the surplus operating result achieved in 2020/21 combined with lower

loan repayments and interest than is forecast for 2021/22.

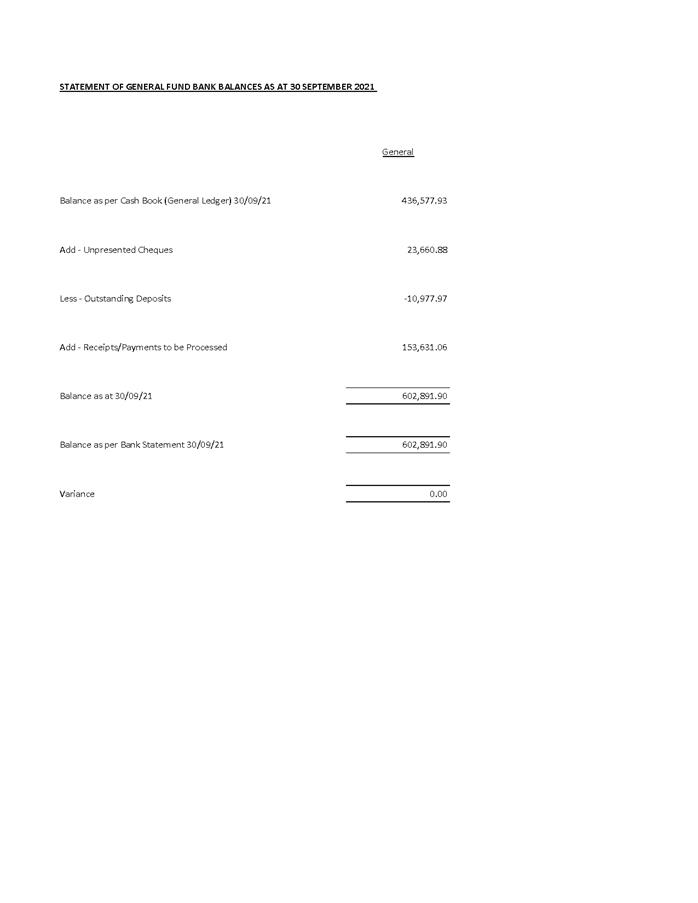

In addition to the information presented in the report, the

latest bank reconciliation report is attached for Council’s information.

Report by Responsible Accounting Officer

The following statement is made in accordance with Clause

203(2) of the Local Government (General) Regulation 2005:

As

the Responsible Accounting Officer, it is my opinion that the Quarterly Budget

Review Statement for Orange City Council for the quarter ended 30 September

2021 indicates that Council’s projected financial position for 30 June

2021 will be satisfactory having regard to the project estimates of income and

expenditure, and variations contained therein.

Jason

Cooke, Responsible Accounting Officer

Attachments

1 September

2021 Quarterly Bank Reconciliation, D21/68453⇩

2 Council

Summary Report - September Review, D21/68454⇩