2 General

Reports

2.1 Statement

of Investments - December 2020

TRIM

REFERENCE: 2021/4

AUTHOR: Julie

Murray, Financial Accountant

EXECUTIVE SUMMARY

The purpose of this report is to provide a statement of

Council’s investments held as at 31 December 2020.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “17.2 Collaborate - Ensure financial

stability and support efficient ongoing operation”.

Financial Implications

Nil

Policy and Governance Implications

Nil

|

Recommendation

That Council resolves:

1 To note the Statement

of Investments as at 31 December 2020.

2 To

adopt the certification of the Responsible Accounting Officer.

|

further considerations

Consideration has been given to the recommendation’s

impact on Council’s service delivery; image and reputation; political;

environmental; health and safety; employees; stakeholders and project

management; and no further implications or risks have been identified.

SUPPORTING INFORMATION

Section 212(1) of the Local Government (General) Regulation

2005 requires that a written report be presented each month at an Ordinary

Meeting of the Council detailing all money that Council has invested under

Section 625 of the Local Government Act 1993.

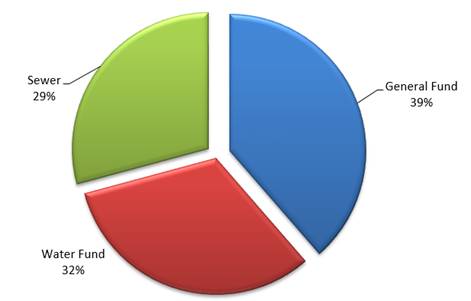

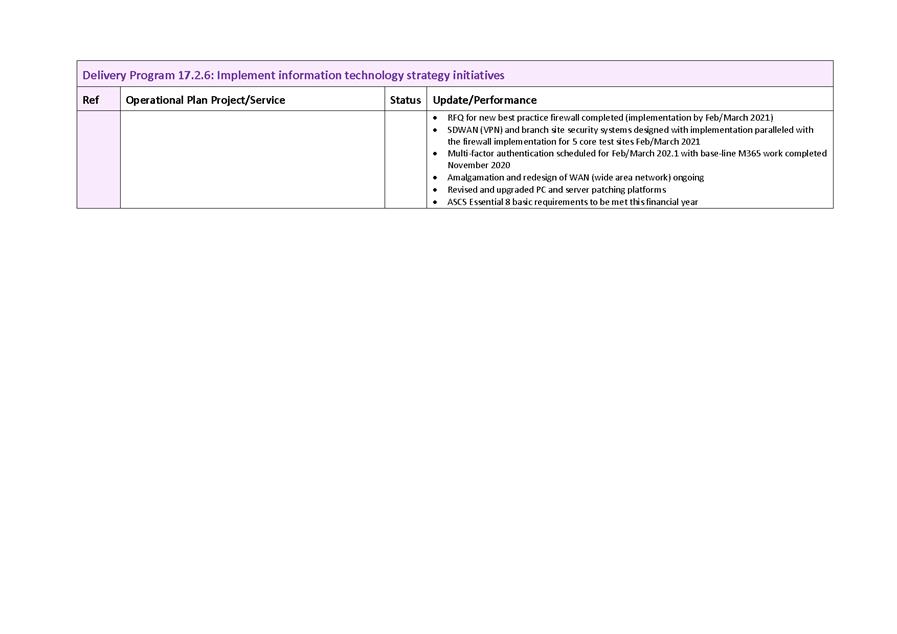

As at 31 December 2020, the investments held by Council in

each fund is shown below:

|

|

31/12/2020

|

30/11/2020

|

|

General

Fund

|

72,090,110.55

|

74,191,923.58

|

|

Water Fund

|

60,204,933.64

|

59,706,595.16

|

|

Sewer

Fund

|

54,510,635.20

|

53,144,050.39

|

|

|

|

|

|

Total

Funds

|

186,805,679.39

|

187,042,569.13

|

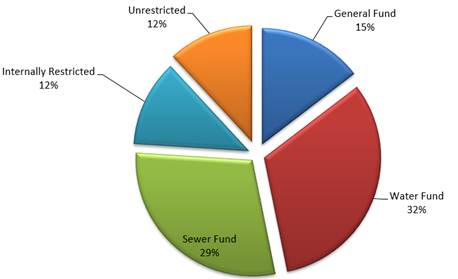

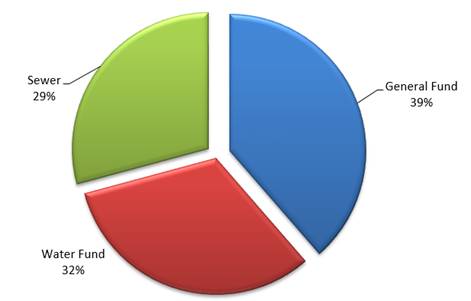

A reconciliation of Council’s investment portfolio

provides a summary of the purposes for which Council’s investments are

being held. The summary is as follows:

|

31/12/2020

|

30/11/2020

|

|

Externally

Restricted

|

|

|

|

- General Fund

|

27,248,222.24

|

28,633,855.13

|

|

- Water Fund

|

60,204,933.64

|

59,706,595.16

|

|

- Sewer Fund

|

54,510,635.20

|

53,144,050.39

|

|

Internally

Restricted

|

22,639,658.08

|

21,557,442.57

|

|

Unrestricted

|

22,202,230.23

|

24,000,625.88

|

|

Total

Funds

|

186,805,679.39

|

$187,042,569.13

|

The unrestricted cash position movements during the month

are normal as projects commence and income is received. Movements may also

arise following processing of income received between funds or into restricted

assets to appropriately allocate for the purposes Council has determined. Council’s

cash flow is monitored on a daily basis and some investments may be redeemed

rather than rolled over to support operational requirements.

Portfolio Advice

Council utilises the services of an

independent investment advisor in maintaining its portfolio of investments.

Council’s current investment advisor is Imperium Markets, an independent

asset consultant that works with wholesale investors to develop, implement and

manage their investment portfolio. Imperium Markets is a leading provider of

independent investment consulting services to a broad range of institutional

investors including government agencies, superannuation funds and

not-for-profit organisations.

Imperium Markets major services

provided to Council include:

· Quarterly

portfolio summary reports

· Advice

on investment opportunities, in particular Floating Rate Note products

· Advice

on policy construction

· Year-end

market values for Floating Note Rate products held by Council.

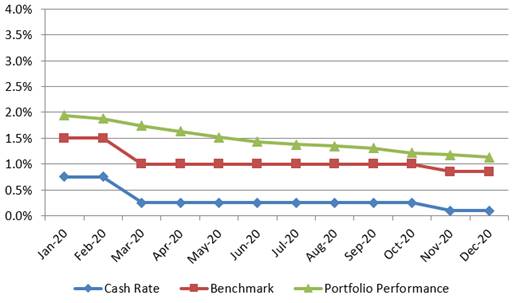

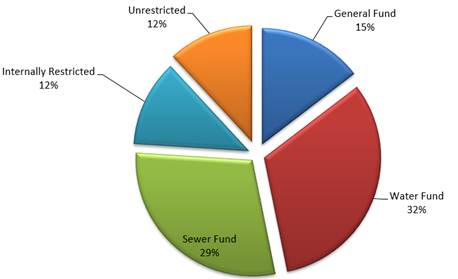

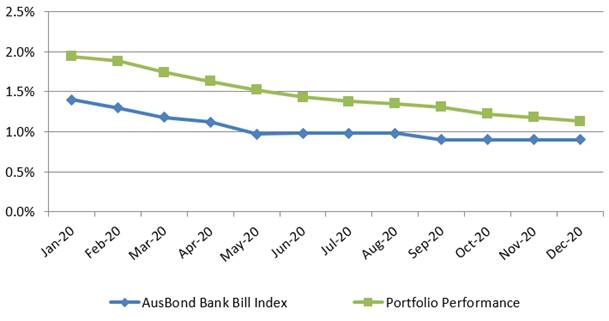

Portfolio Performance

Council’s current Long Term Financial Plan establishes

the benchmark for Council’s interest on investments at “75 basis

points above the current cash rate”. The cash rate as at 31 December 2021

remained at 0.10 per cent. The weighted average interest rate of

Council’s investment portfolio at the same reporting date was 1.13 per

cent which continues to exceed Council’s benchmark i.e. the cash rate of

0.10 per cent plus 0.75 per cent (or 85 basis points).

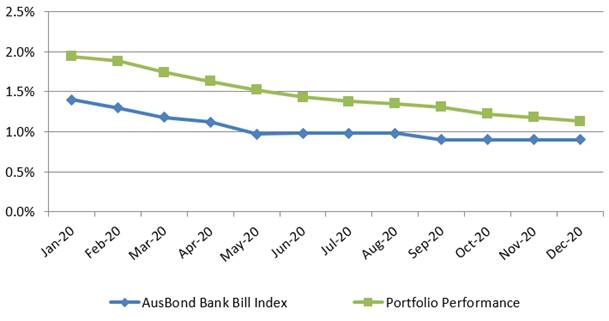

Council has also utilised the AusBond Bank Bill Index to

provide a further benchmark focused towards long term investments. As at 31

December 2021, the AusBond rate was 0.90 per cent. The weighted average

interest rate of Council’s investment portfolio at the same reporting

date was 1.13 per cent.

Council’s Investment Policy establishes limits in

relation to the maturity terms of Council’s investments as well as the

credit ratings of the institutions with whom Council can invest.

The following tables provide a dissection of Council’s

investment portfolio as required by the Policy. The Policy identifies the

maximum amount that can be held in a variety of investment products or with

institutions based on their respective credit ratings.

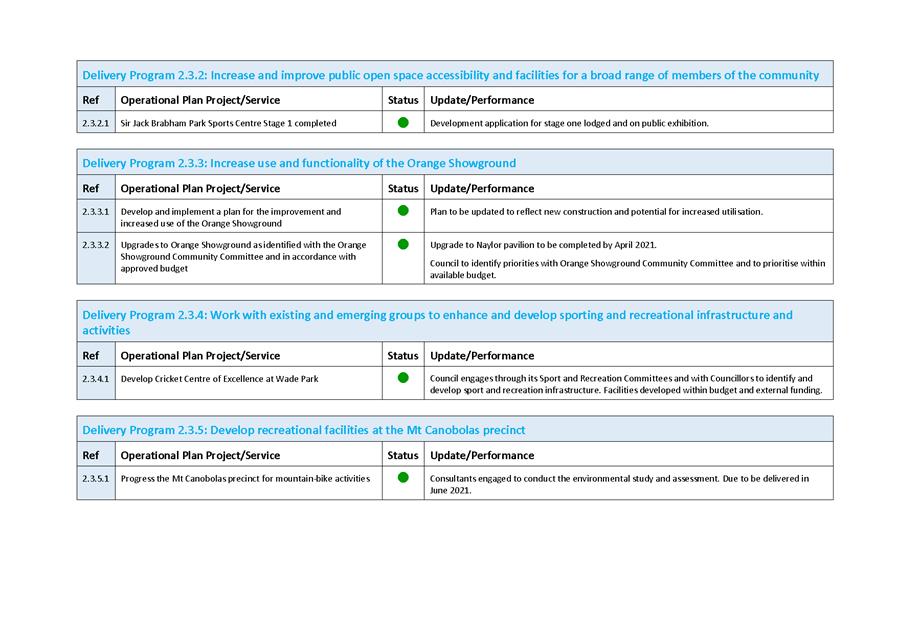

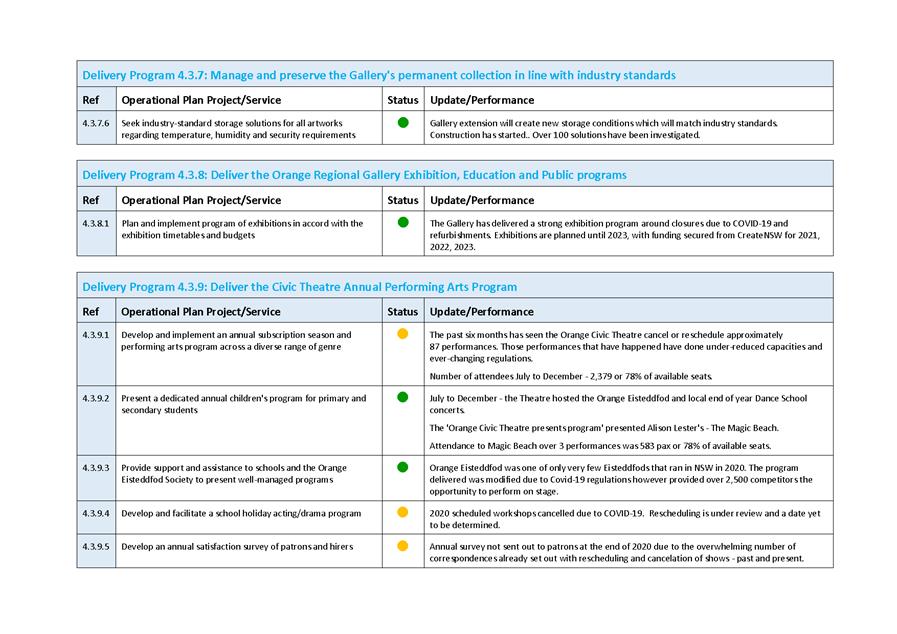

Table 1 shows the percentage held by Council (holdings) and

the additional amount that Council could hold (capacity) for each term to

maturity allocation in accordance with limits established by Council’s

Policy.

Table

1: Maturity – Term Limits

|

Term to Maturity Allocation

|

Maximum

|

Holding

|

Remaining Capacity

|

|

0 - 3 Months

|

100.00%

|

26.46%

|

73.54%

|

|

3 - 12 Months

|

100.00%

|

44.33%

|

55.67%

|

|

1 - 2 Years

|

70.00%

|

15.99%

|

54.01%

|

|

2 - 5 Years

|

50.00%

|

13.22%

|

36.78%

|

|

5+ Years

|

25.00%

|

0.00%

|

25.00%

|

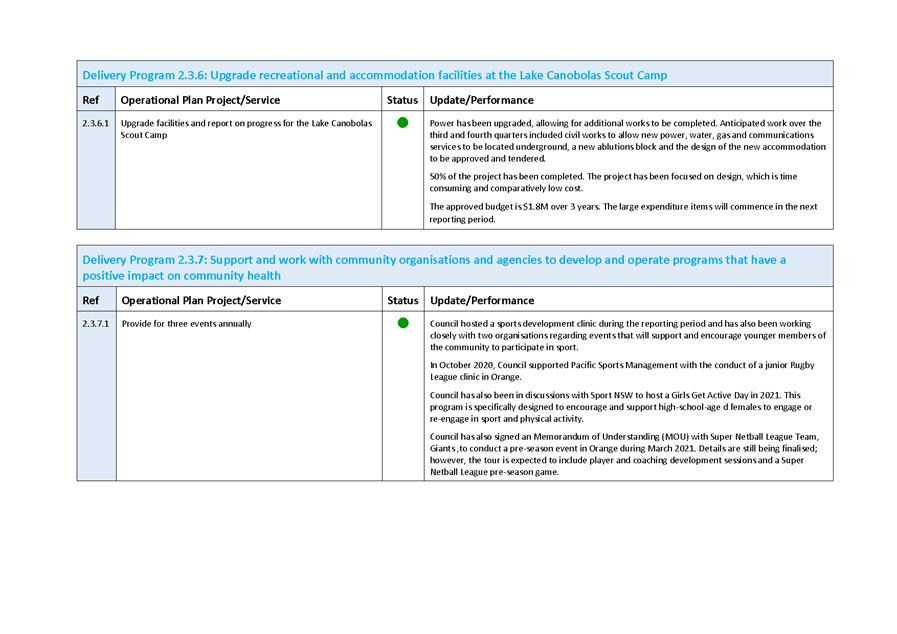

Table 2 shows the total amount held, and the weighted

average interest rate (or return on investment), by credit rating. The credit

rating is an independent opinion of the capability and willingness of a

financial institution to repay its debts, or in other words, the

providers’ financial strength or creditworthiness. The rating is

typically calculated as the likelihood of a failure occurring over a given

period, with the higher rating (AAA) being superior due to having a lower

chance of default. However, it is generally accepted that this lower risk will

be accompanied by a lower return on investment.

The level of money held in the bank accounts has been added

to the table to illustrate the ability of Council to cover the operational

liabilities that typically occur (for example payroll, materials and contracts,

utilities).

Table 2: Credit Rating Limits

|

Credit

Rating

|

Maximum

|

Holding

|

Remaining

Capacity

|

Value

|

Return

on Investment

|

|

Bank

Accounts

|

100.00%

|

5.25%

|

94.75%

|

$9,812,646.60

|

0.10%

|

|

AAA

|

100.00%

|

0.00%

|

100.00%

|

N/A

|

N/A

|

|

AA

|

100.00%

|

42.16%

|

57.84%

|

$78,756,160.00

|

1.27%

|

|

A

|

60.00%

|

24.57%

|

35.43%

|

$45,900,000.00

|

1.04%

|

|

BBB

& NR

|

40.00%

|

28.02%

|

11.98%

|

$52,336,872.79

|

1.00%

|

|

Below

BBB

|

0.00%

|

0.00%

|

0.00%

|

N/A

|

N/A

|

Certification by Responsible

Accounting Officer

I, Jason Cooke, hereby certify that all investments have

been made in accordance with Section 625 of the Local Government Act 1993,

Clause 212 of the Local Government (General) Regulation 2005 and

Council’s Investment Policy.

2.2 Quarterly

Budget Review and Progress Report - Quarter 2 of 2020/2021

RECORD

NUMBER: 2021/22

AUTHOR: Jason

Cooke, Chief Financial Officer

EXECUTIVE Summary

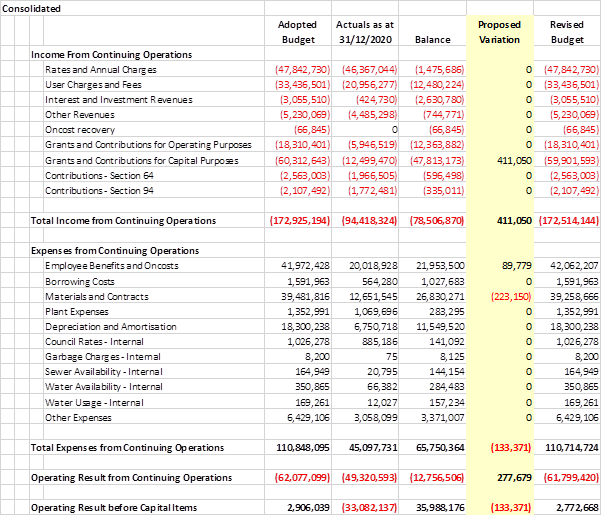

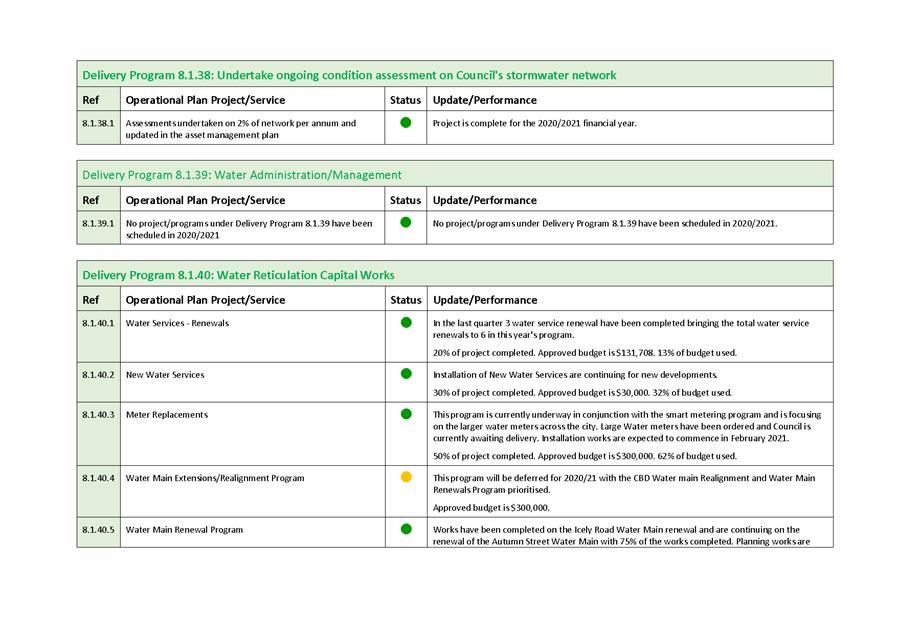

This report provides the first quarter review of the

2019-2022 Delivery/Operational Plan, as required under section 403 of the Local

Government Act 1993. This report illustrates the progress Council is making

on the strategies and tasks identified in its strategic planning documents.

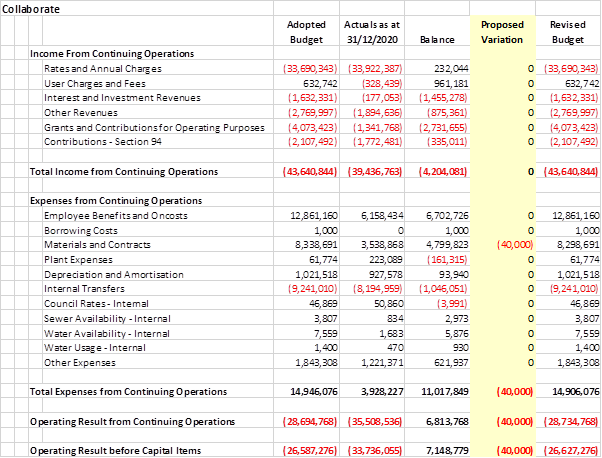

This report also provides a summary of Council’s

financial position over the quarter. The Directions (Collaborate, Live,

Prosper, Preserve) financial summary tables with the attached Performance

Indicators and quarterly review documents have been reviewed and updated and

include projects across all three funds (General, Water and Sewer).

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “17.2 Collaborate - Ensure financial

stability and support efficient ongoing operation”.

Financial Implications

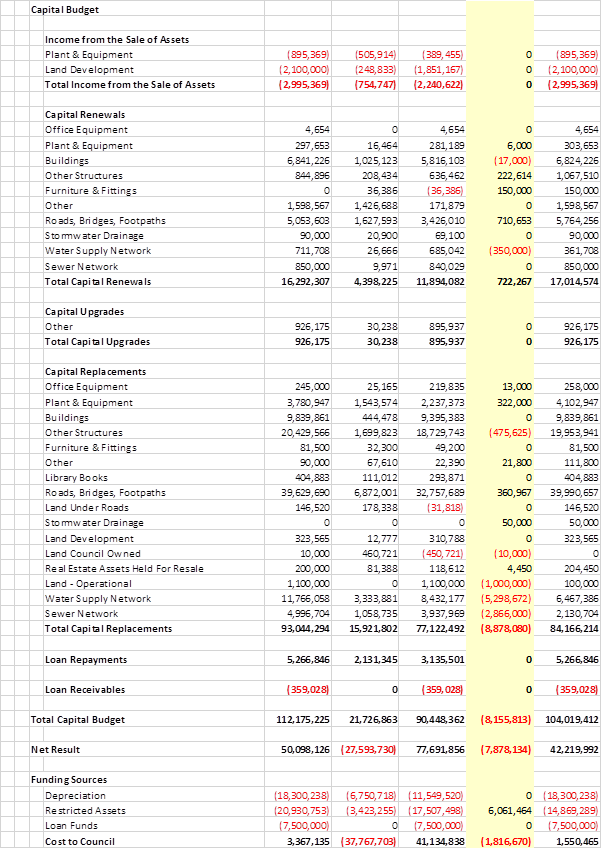

The Quarterly Review has identified favourable variations

totalling $1,816,670 to Council’s adopted September 2020 quarterly

budget. The effect of these variations results in Council’s projected

overall year-end consolidated position becoming a much smaller deficit of

$1,550,465 including capital.

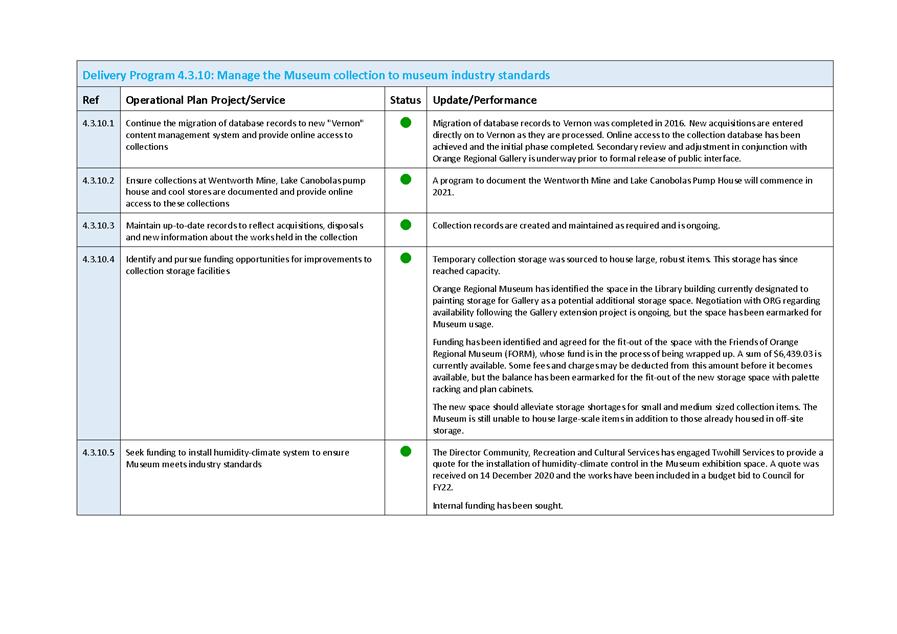

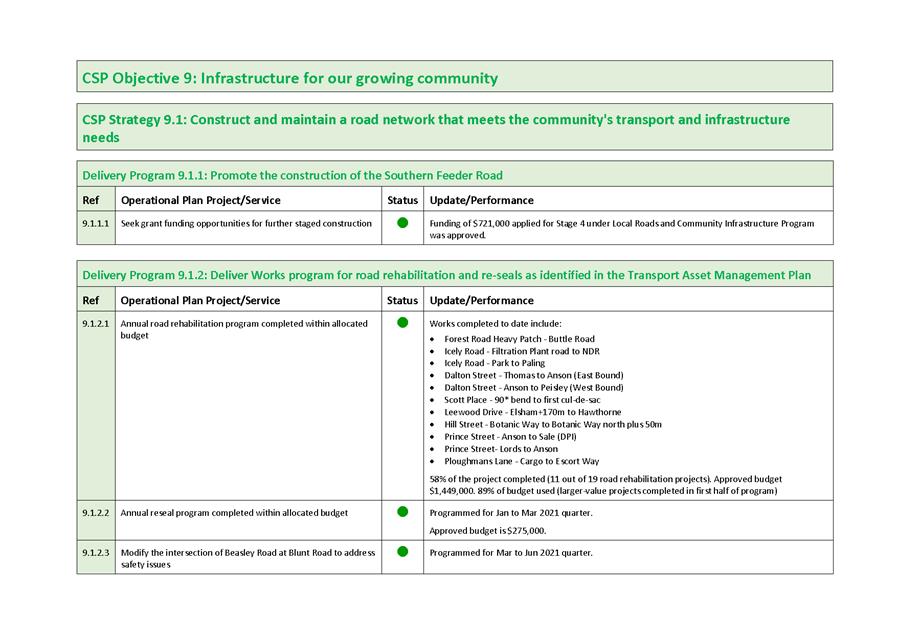

Table 1 below presents Council’s projected year-end

result by Direction as identified in the Community Strategic Plan and the

Delivery/Operational Plan. It is important to note that all red bracketed

numbers in Tables 1-3 below indicate a surplus result for Council.

|

Direction

|

Adopted Budget

|

Proposed Variations

|

Proposed Budget

|

|

Collaborate

|

(24,545,595)

|

111,000

|

(24,434,595)

|

|

Live

|

15,583,654

|

(33,679)

|

15,549,975

|

|

Prosper

|

1,083,255

|

72,728

|

1,155,983

|

|

Preserve

|

11,245,821

|

(1,966,719)

|

9,279,102

|

|

Total

|

3,367,135

|

(1,816,670)

|

1,550,465

|

Table 1: Projected year-end

position by Direction

Table 2 presents Council’s projected year-end result

by Fund, showing Cost to Council (which includes capital expenditure, capital

income and funding).

|

Fund

|

Adopted Budget

|

Proposed Variations

|

Proposed Budget

|

|

General

|

4,341,028

|

150,049

|

4,491,077

|

|

Water

|

(105,581)

|

(1,166,719)

|

(1,272,300)

|

|

Sewer

|

(868,312)

|

(800,000)

|

(1,668,312)

|

|

Total

|

3,367,135

|

(1,816,670)

|

1,550,465

|

Table 2: Projected year-end

position by Fund

Table 3 presents Council’s

projected year-end Operating Result (before capital) by Fund.

|

Fund

|

Adopted Budget

|

Proposed Variations

|

Proposed Budget

|

|

General

|

3,691,189

|

(163,371)

|

3,527,818

|

|

Water

|

4,975

|

30,000

|

34,975

|

|

Sewer

|

(790,125)

|

0

|

(790,125)

|

|

Total

|

2,906,039

|

(133,371)

|

2,772,668

|

Table 3: Projected year-end

operating result by Fund

Material

changes to budget in the December quarterly review

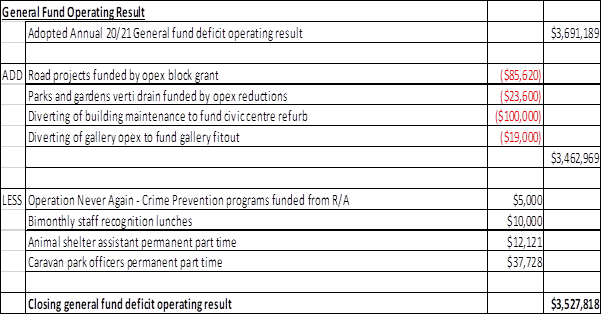

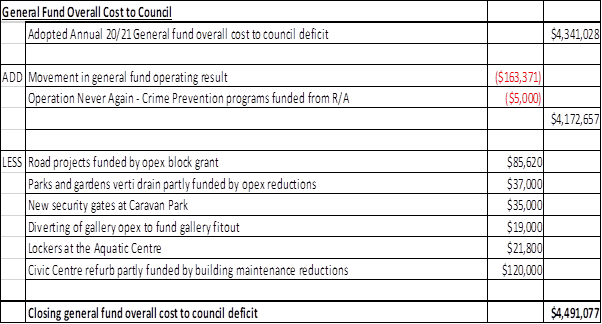

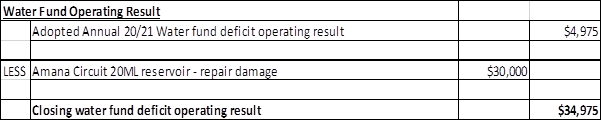

Further information on the individual variations proposed as

part of this review, which have a material effect on Council’s financial

results, is detailed in Tables 4 to 9 below.

While there are a number of variations detailed in the

Tables, the significant contributors to the overall net variation are the

deferment of several water and sewer capital projects. Four new positions have

been added to the budget with recruitment to happen if this quarterly report is

resolved by Council. The new positions are a conversion of casual staff to a

permanent part time assistant at the animal shelter, conversion of two

temporary roles to permanent part time roles at the Caravan Park and a

permanent part time swim schools program coordinator at the aquatic centre.

There is minor budgetary impact in the current financial year however the

positions are ongoing and included in the structure going forward.

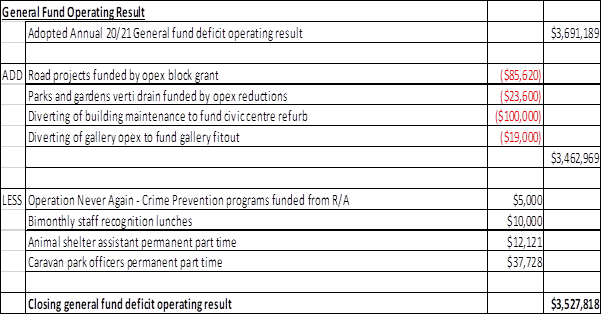

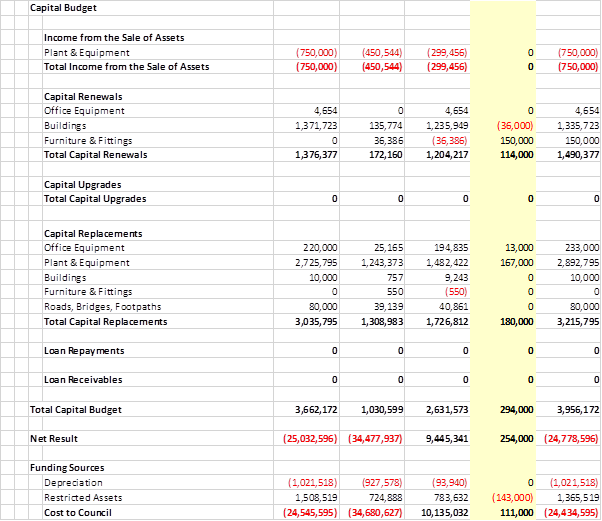

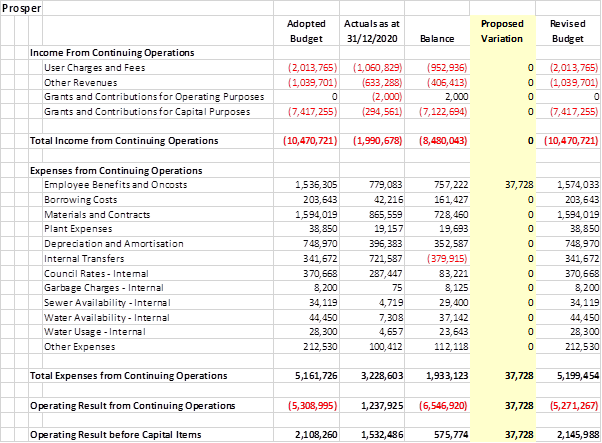

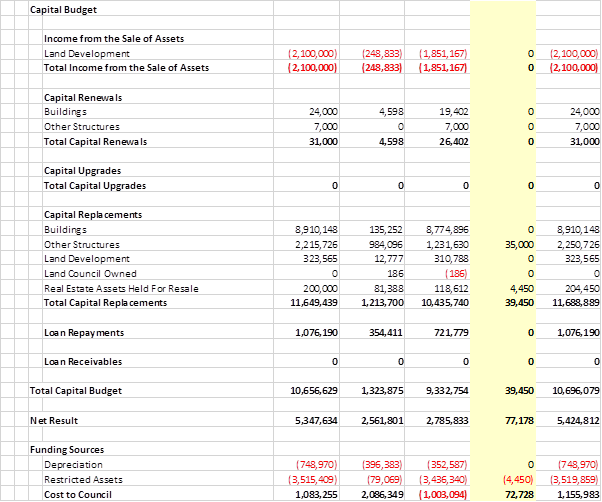

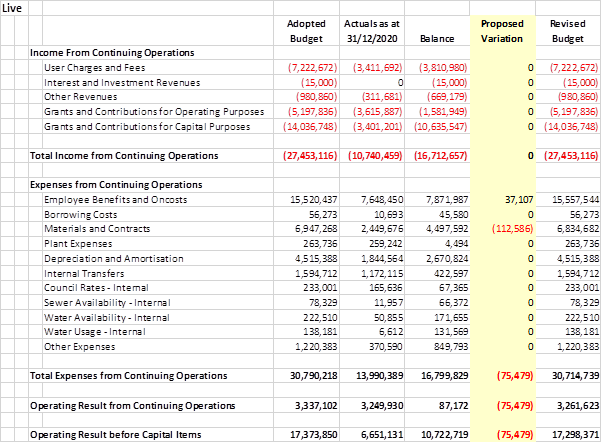

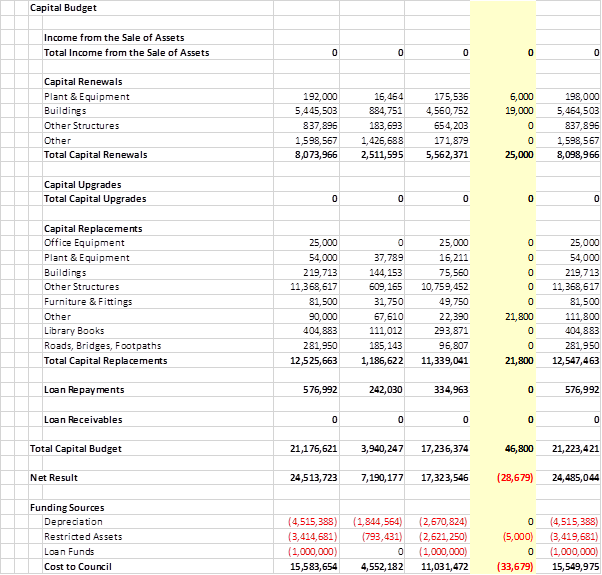

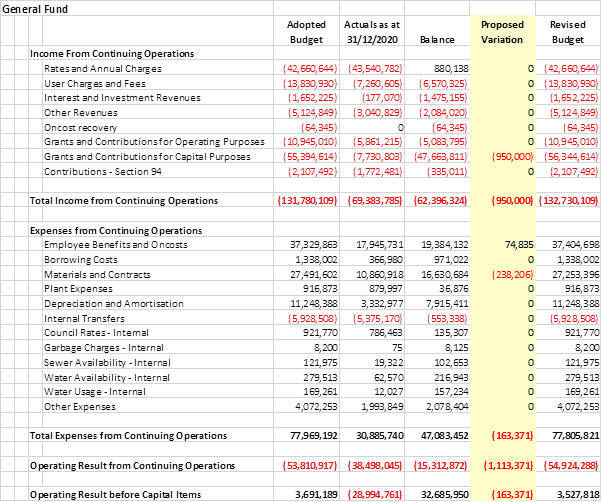

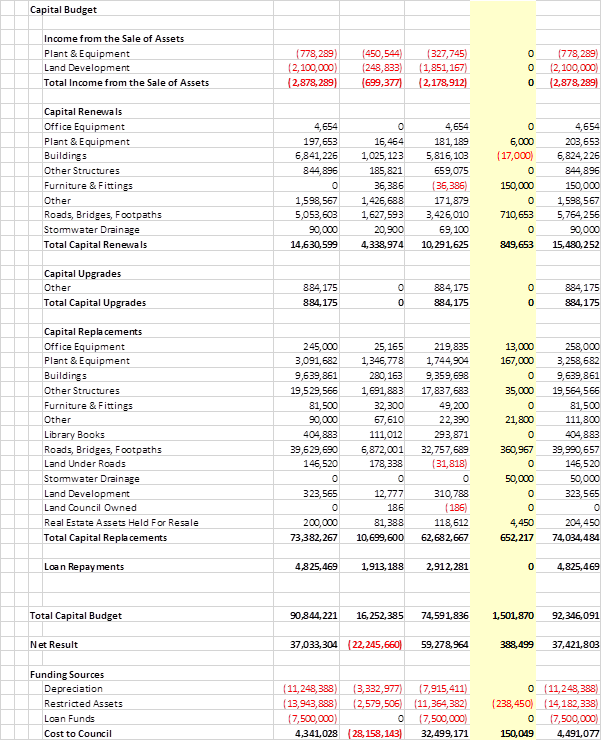

Table 4: General Fund

Operating Result

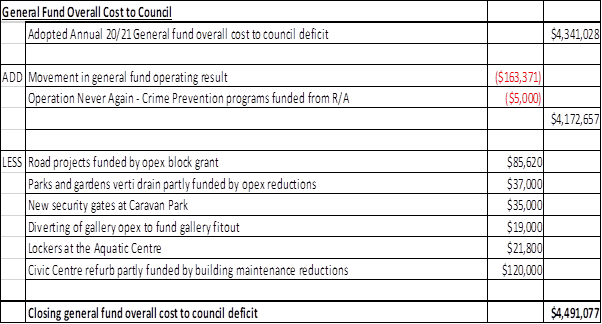

Table 5: General Fund

Overall Cost to Council

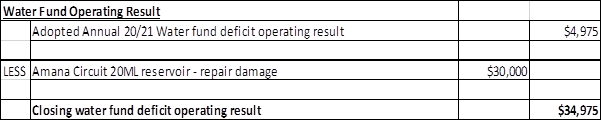

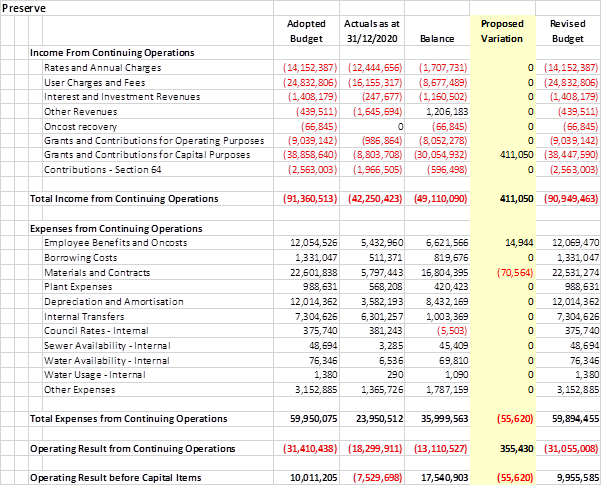

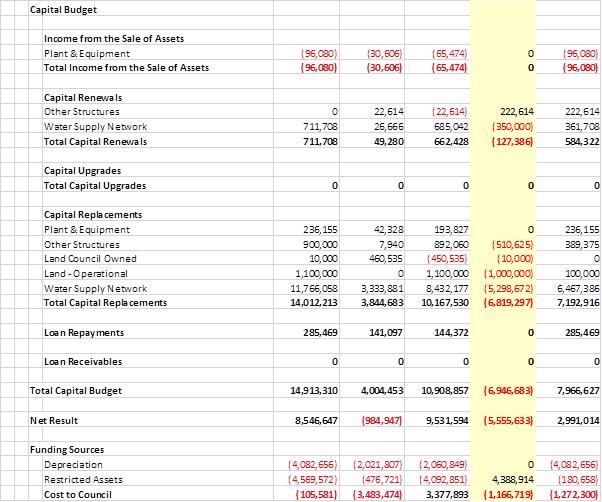

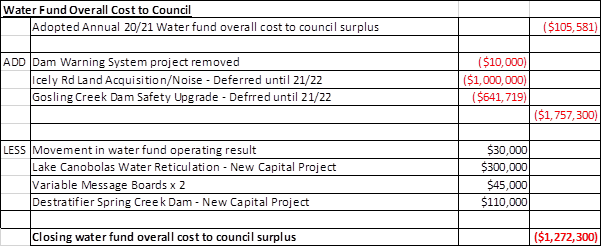

Table 6: Water Fund

Operating Result

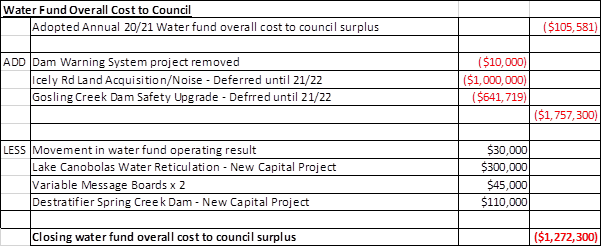

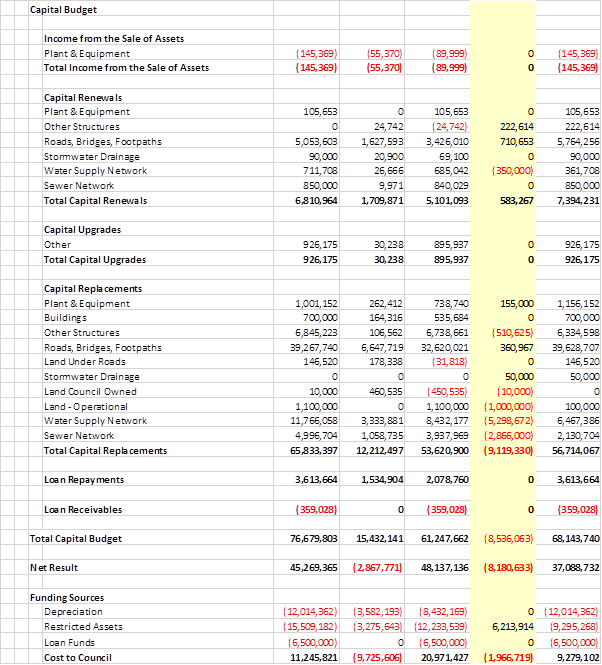

Table 7: Water Fund Overall Cost to Council

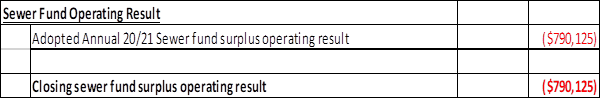

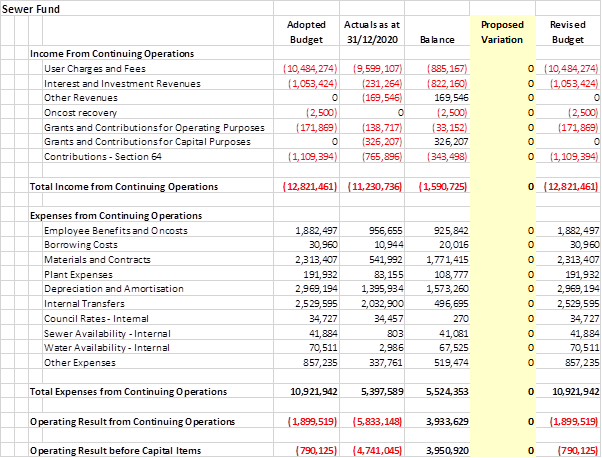

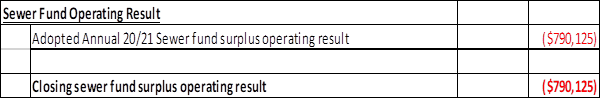

Table 8: Sewer Fund

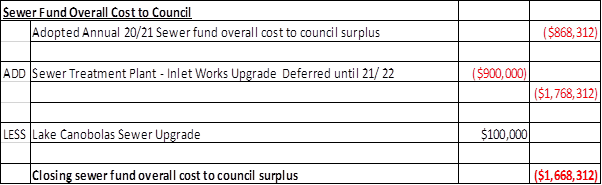

Operating Result

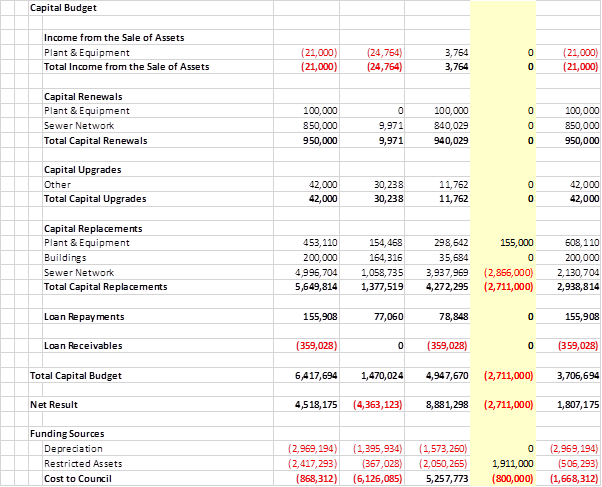

Table 9: Sewer Fund Overall

Cost to Council

Policy and Governance Implications

Nil

|

Recommendation

That Council resolves:

1 That

the information provided in the report on the quarterly budget and

performance indicators review for October 2020 to December 2020 be

acknowledged.

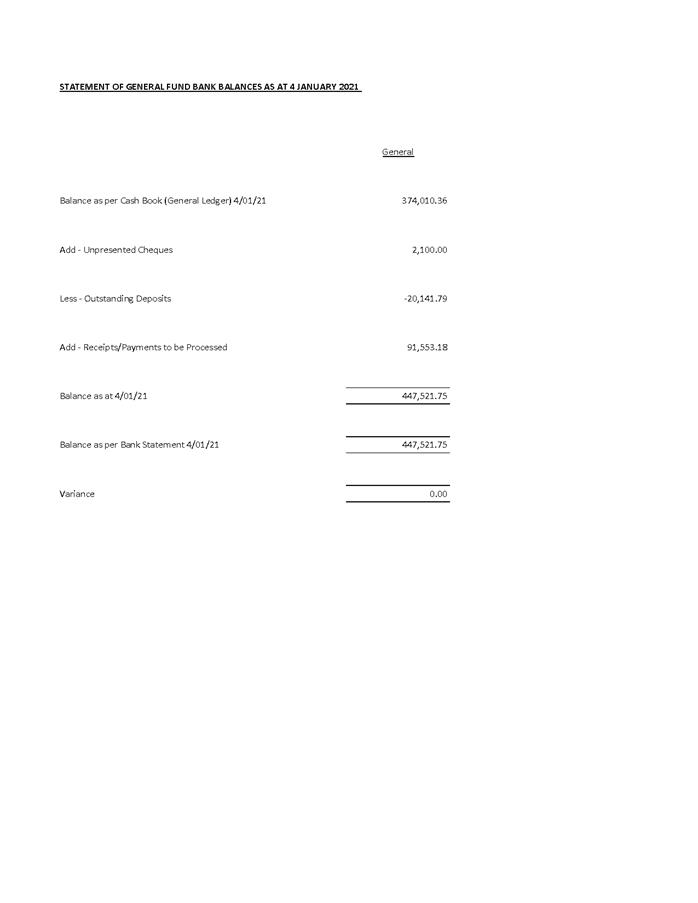

2 The

bank reconciliation statement be acknowledged.

3 To

adopt favourable variations in the consolidated overall cost to council

arising from the December 2020 quarterly review amounting to $1,816,670.

|

further considerations

The recommendation of this report has been assessed against

Council’s other key risk categories and the following comments are

provided:

|

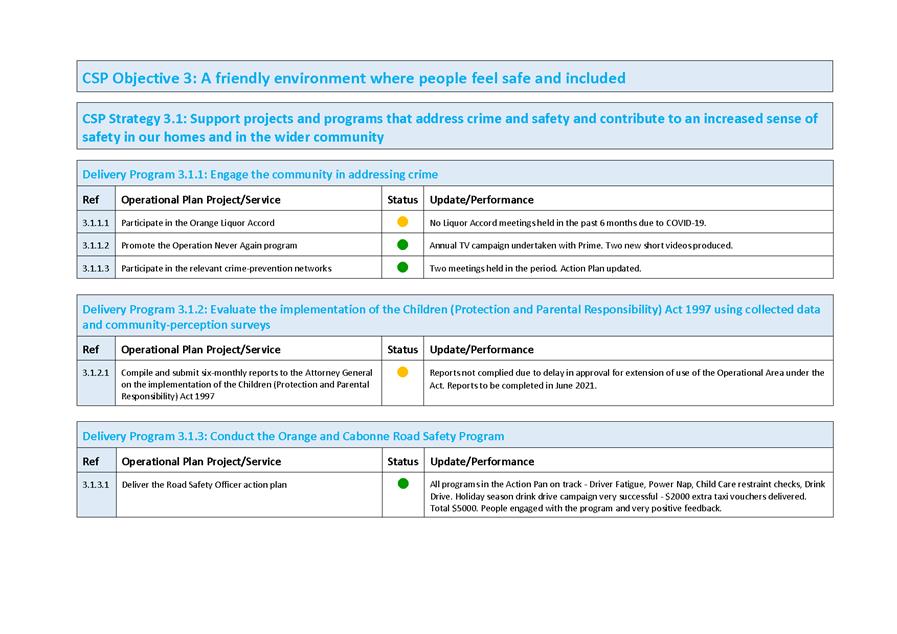

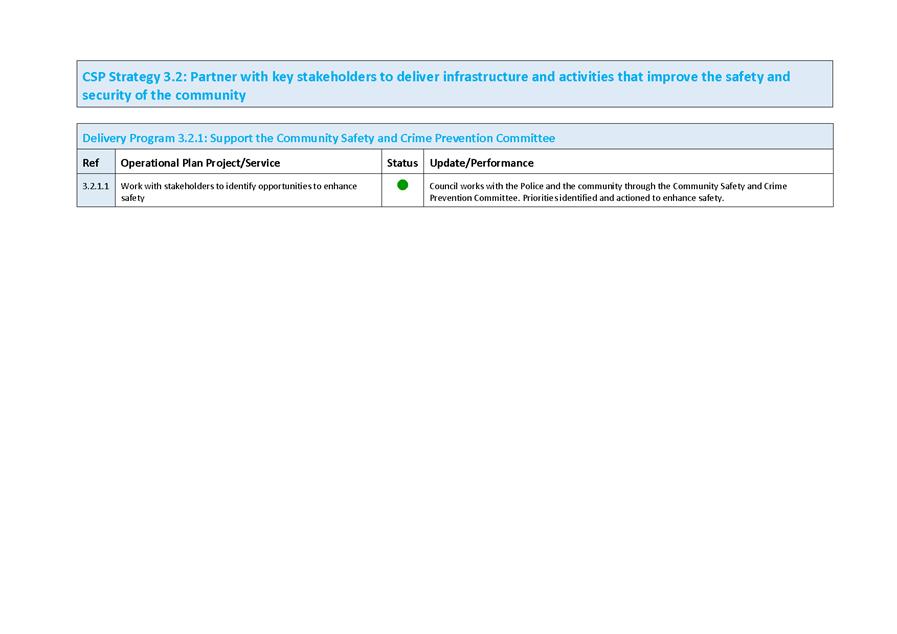

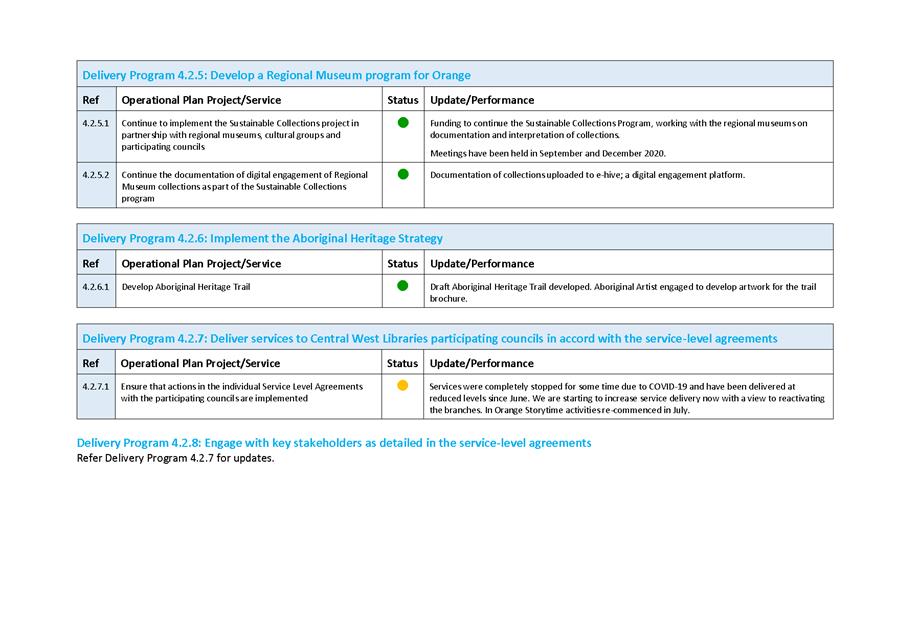

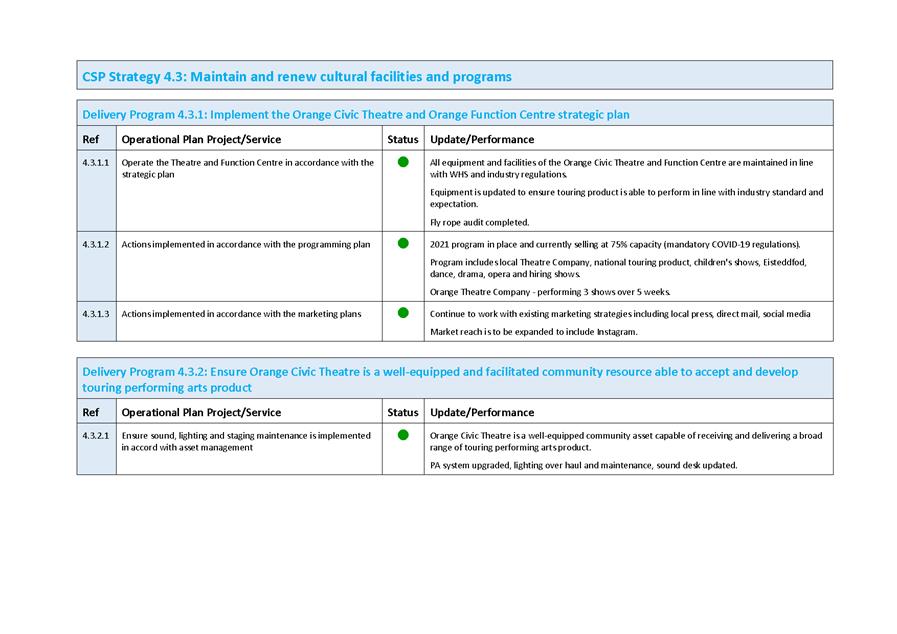

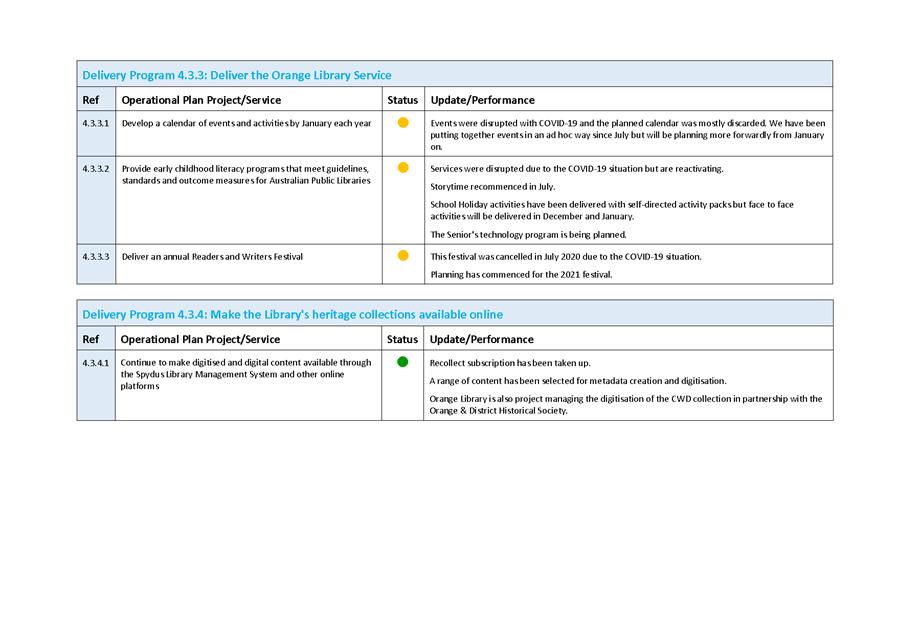

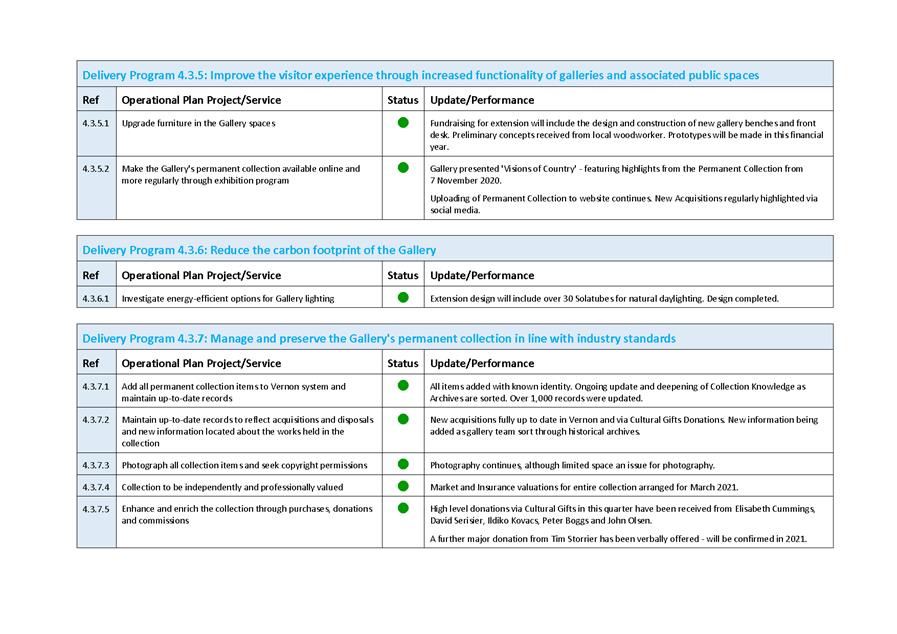

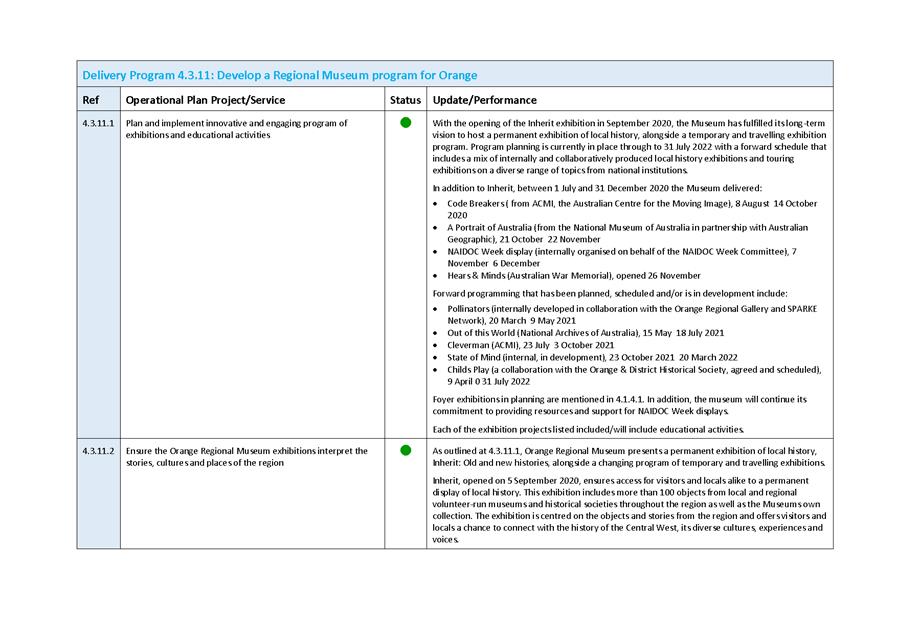

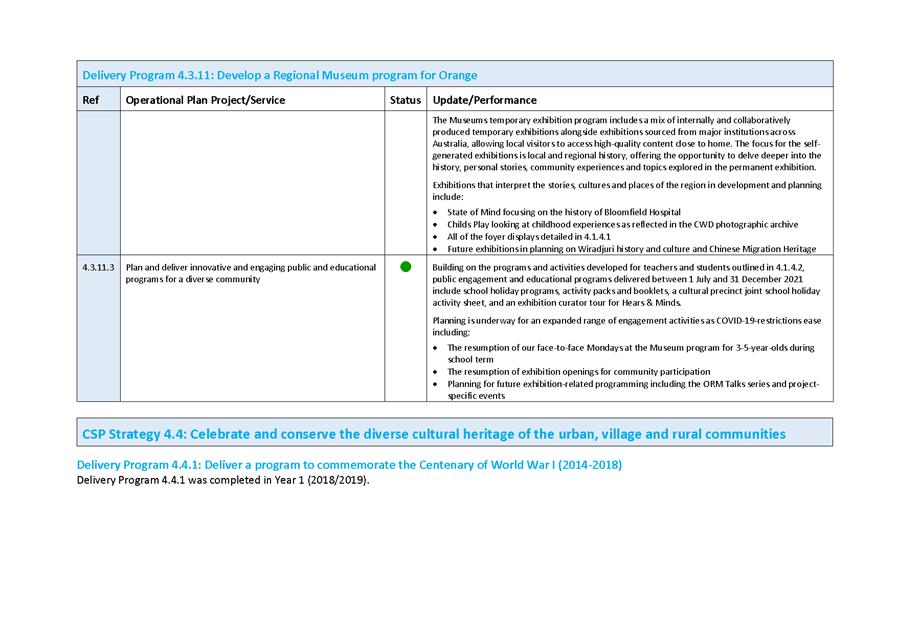

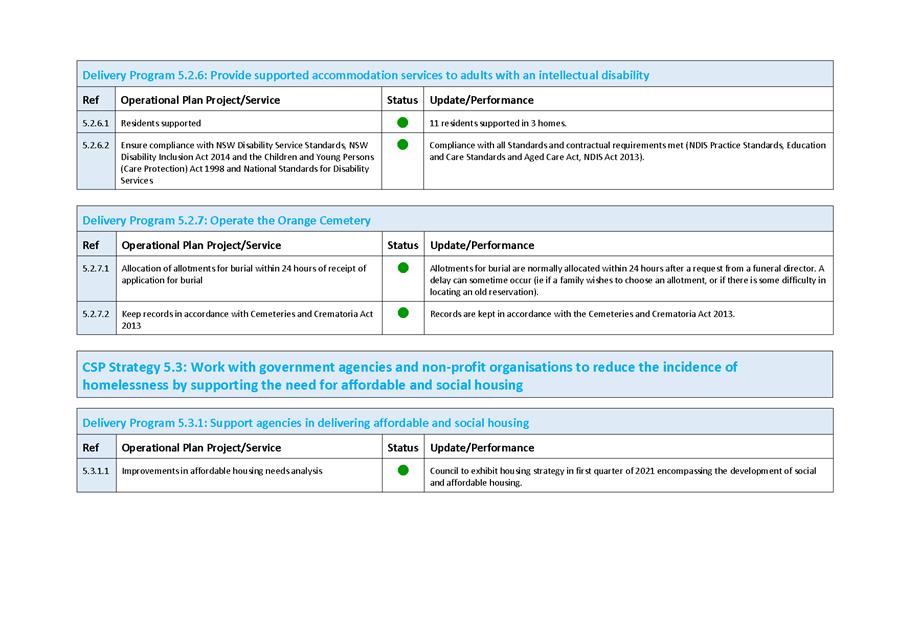

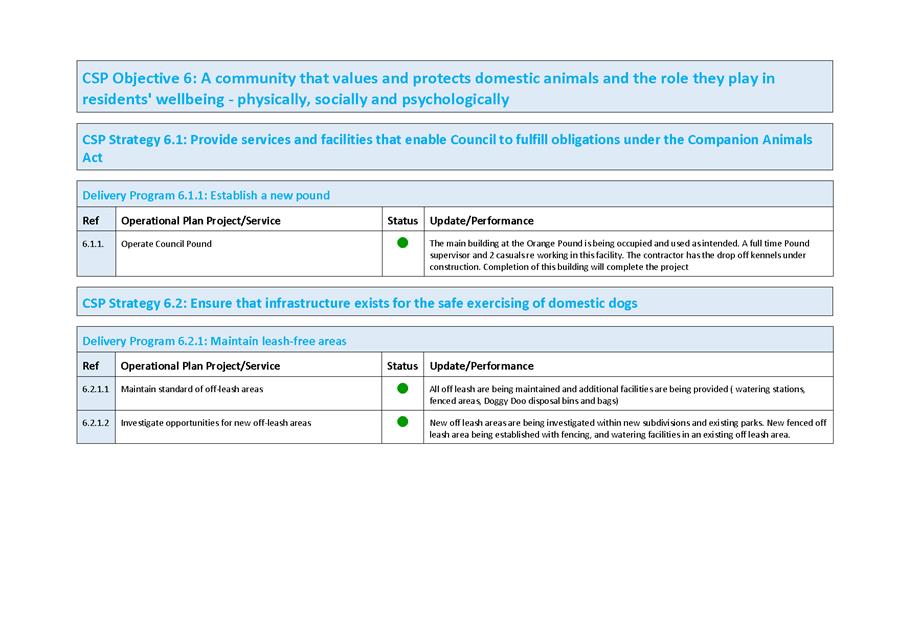

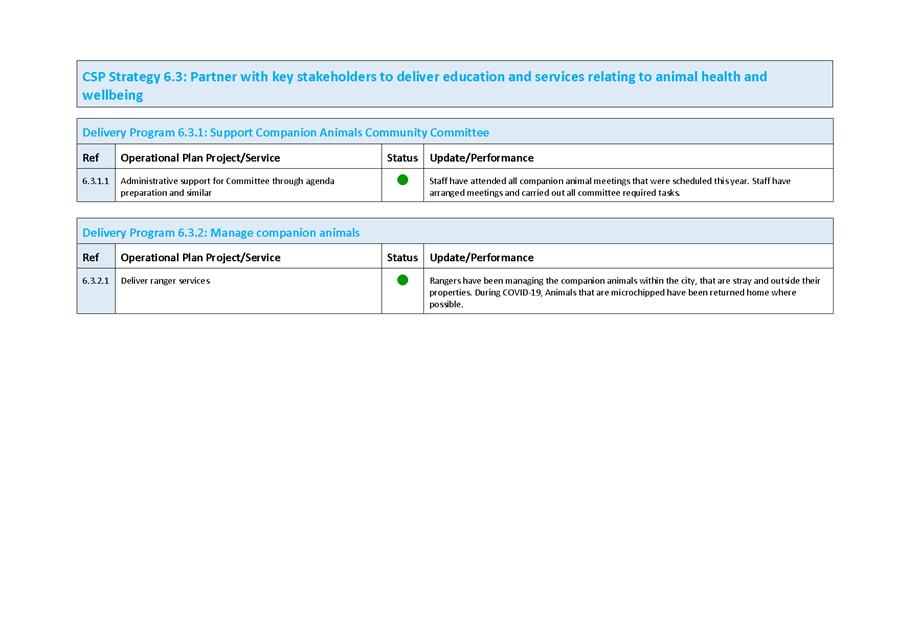

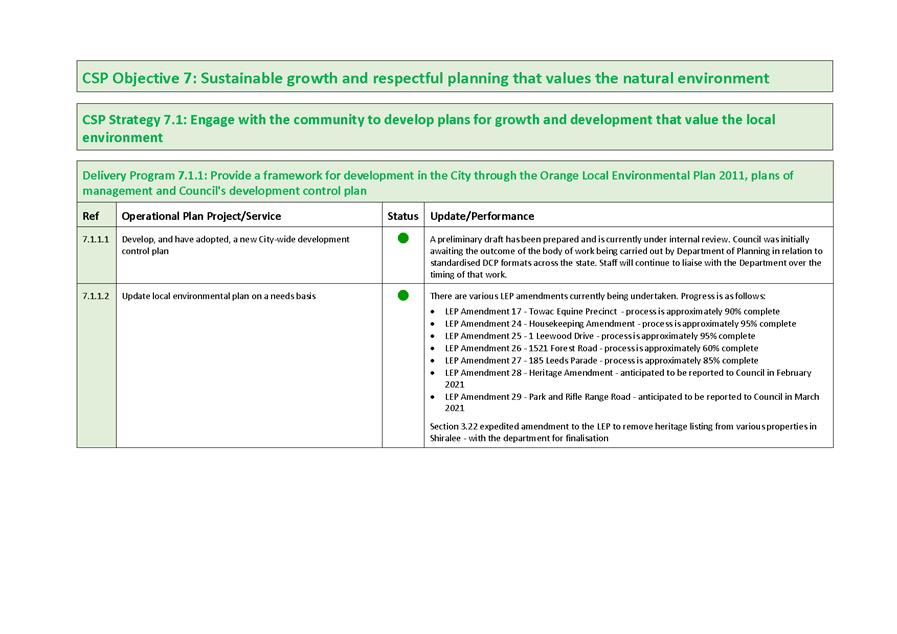

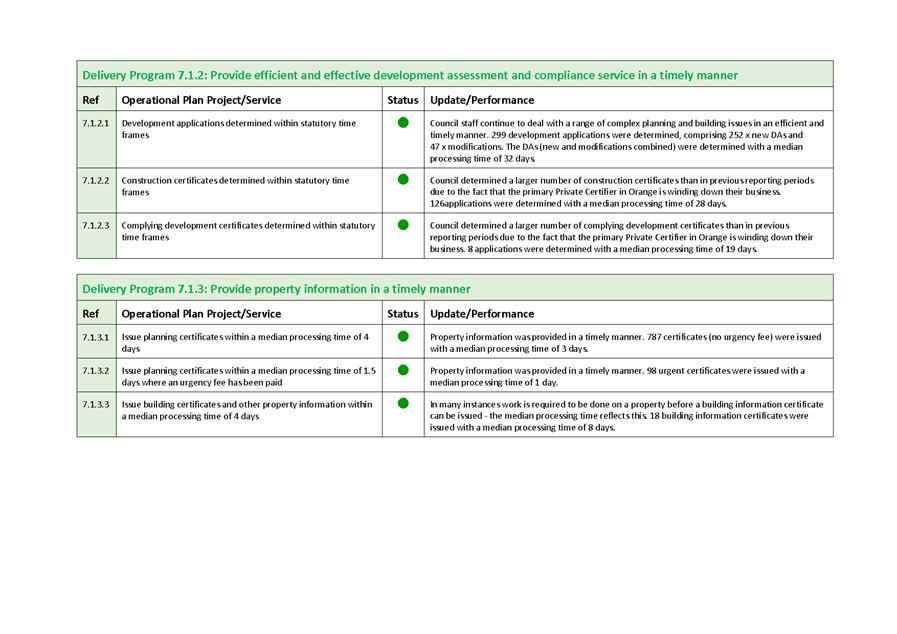

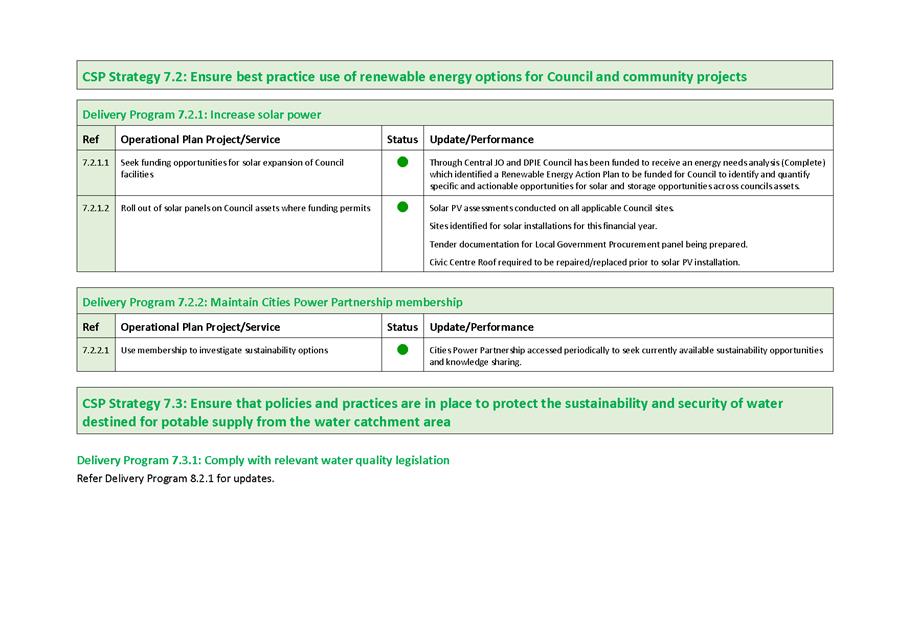

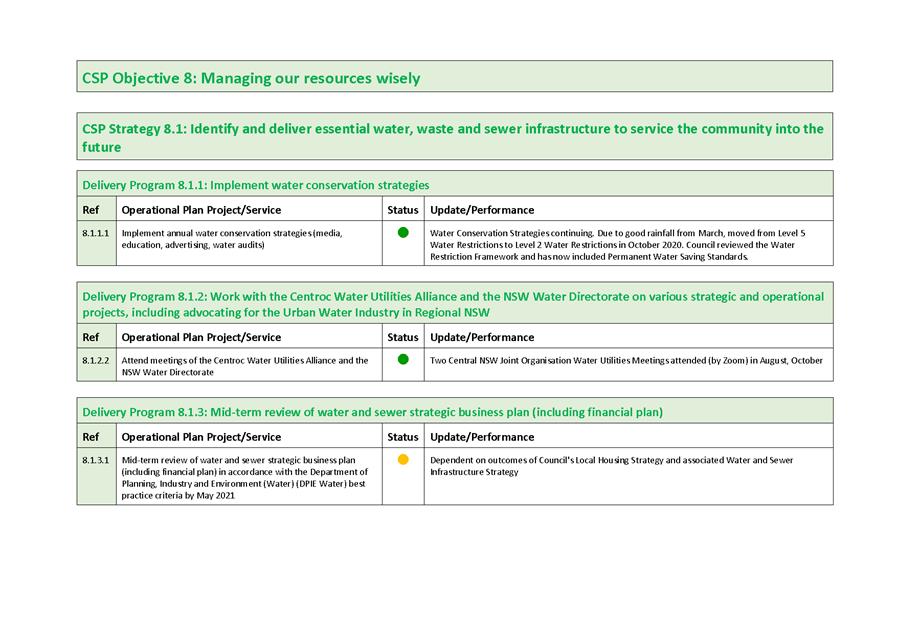

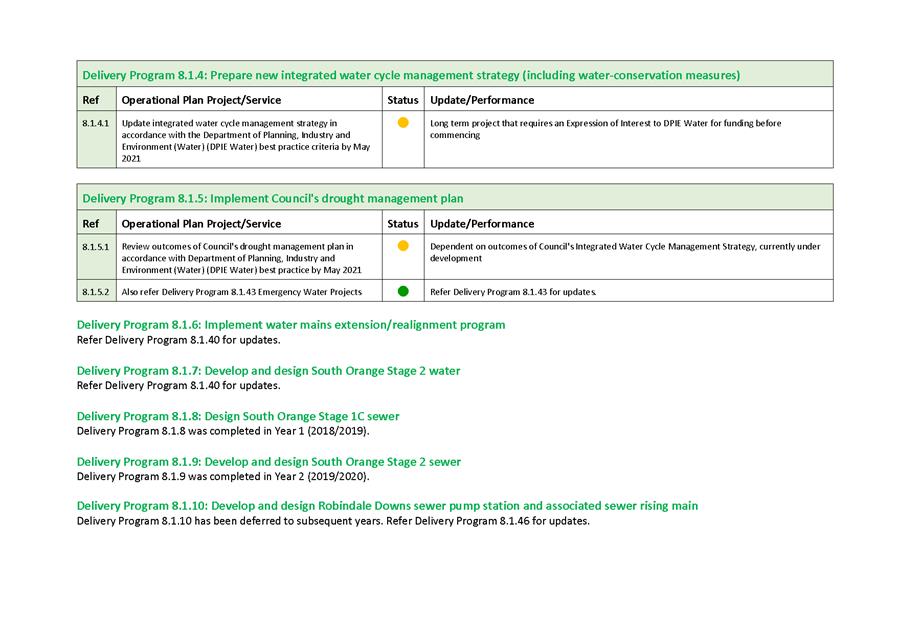

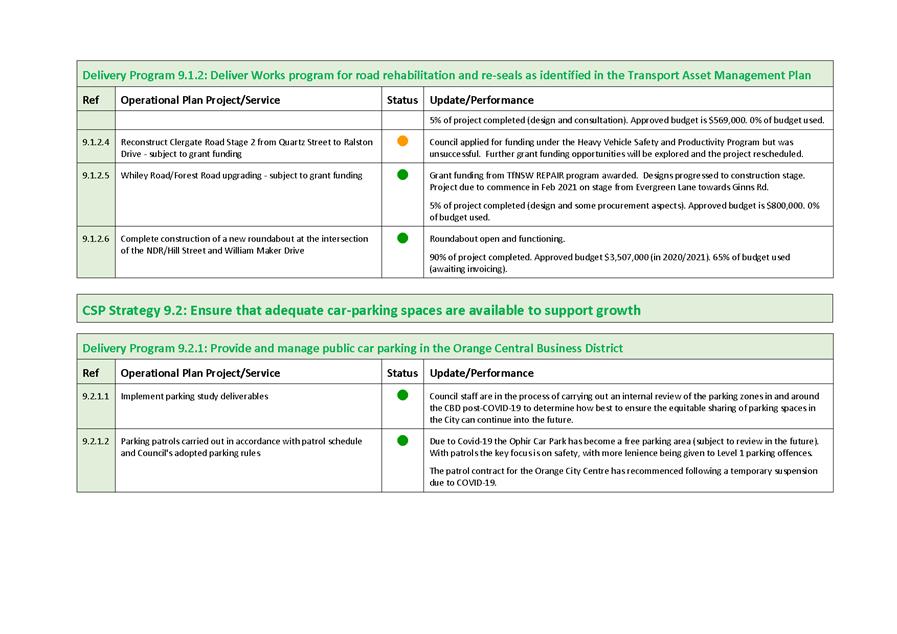

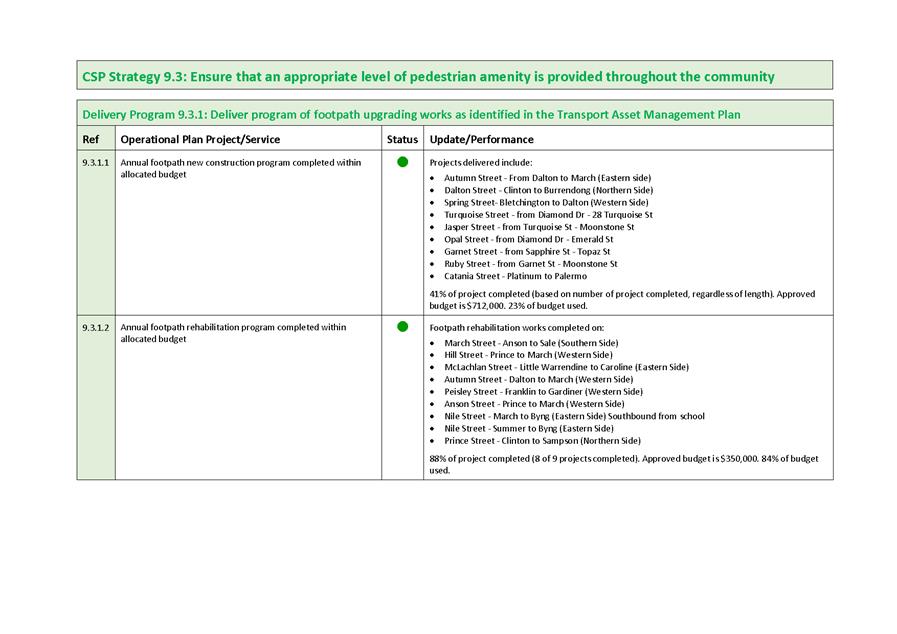

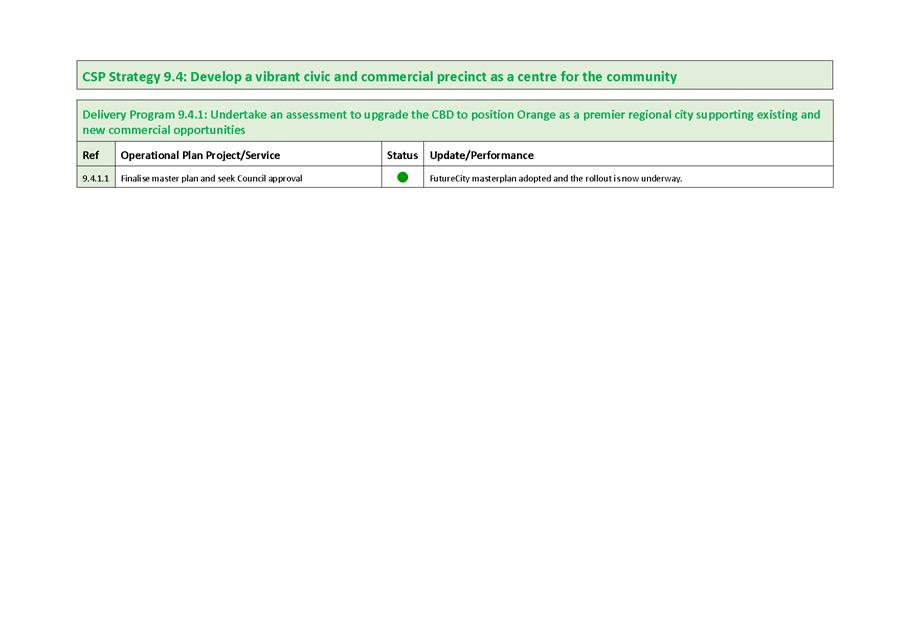

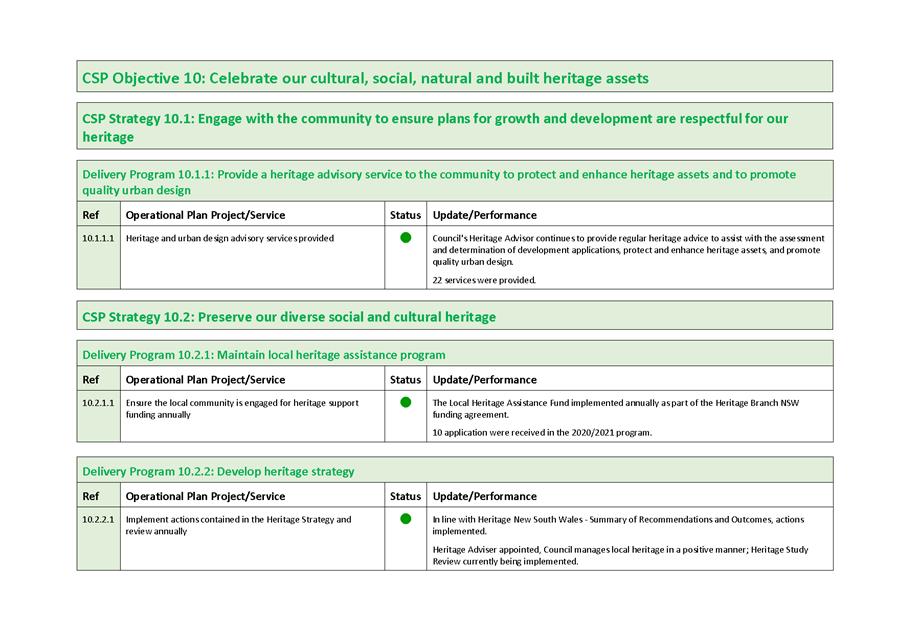

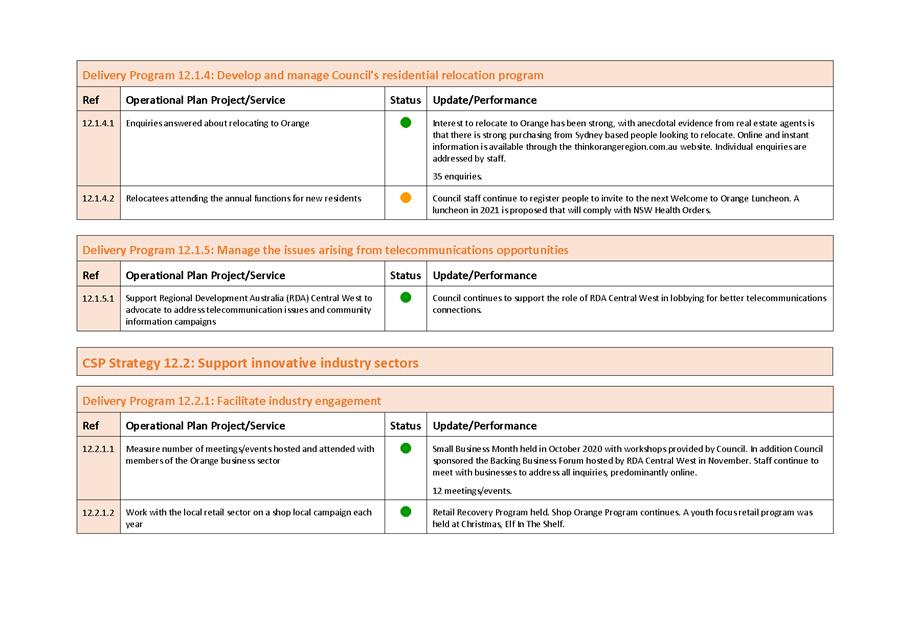

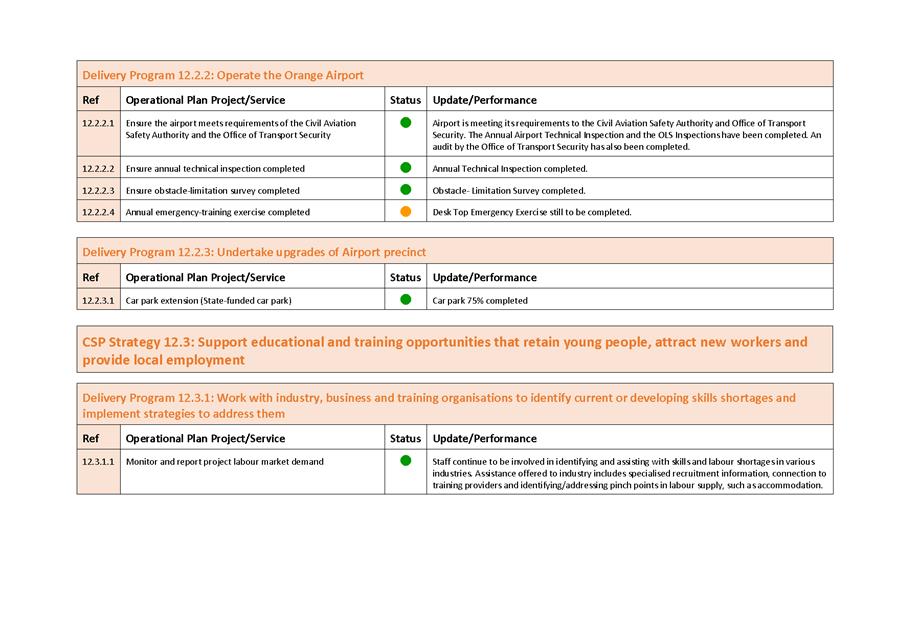

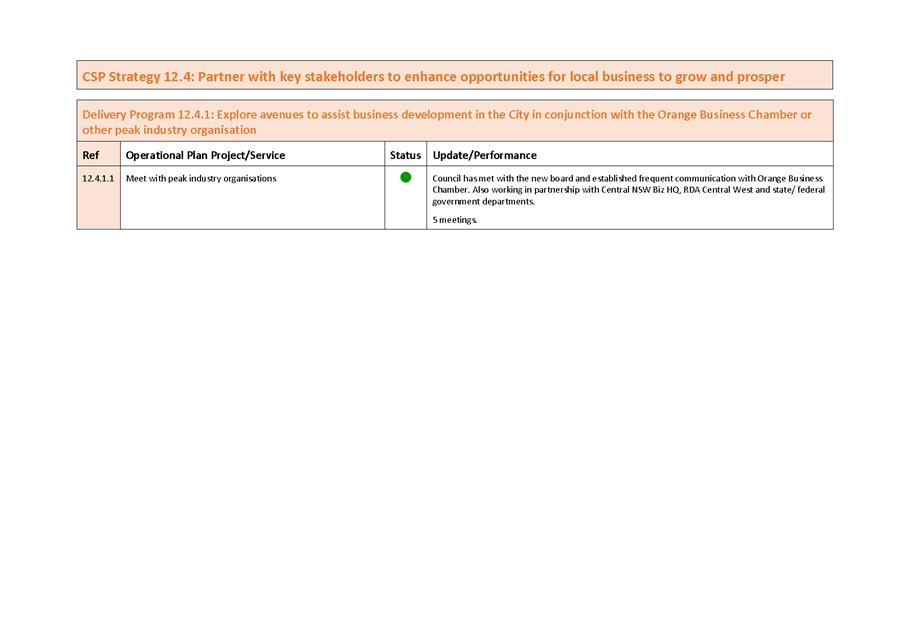

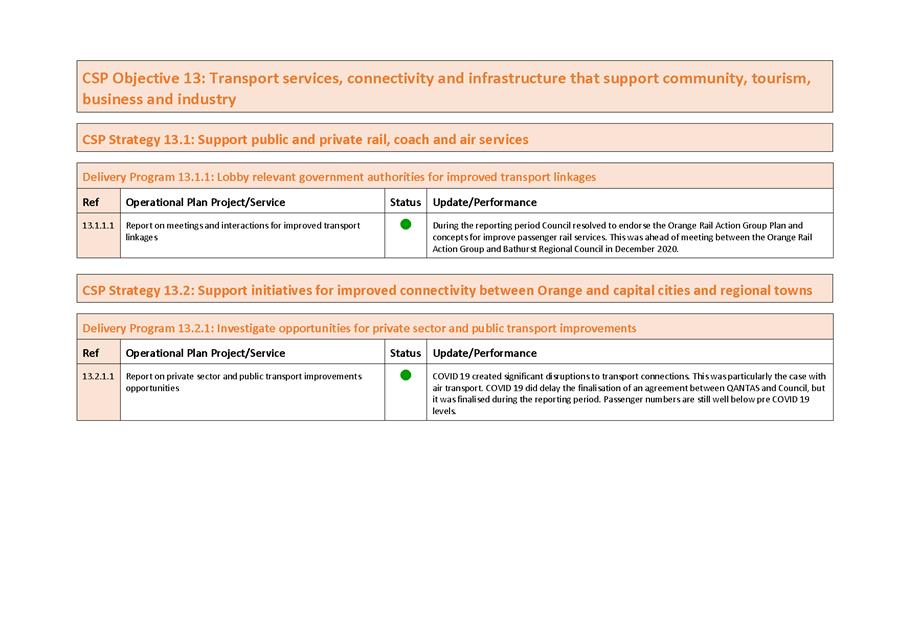

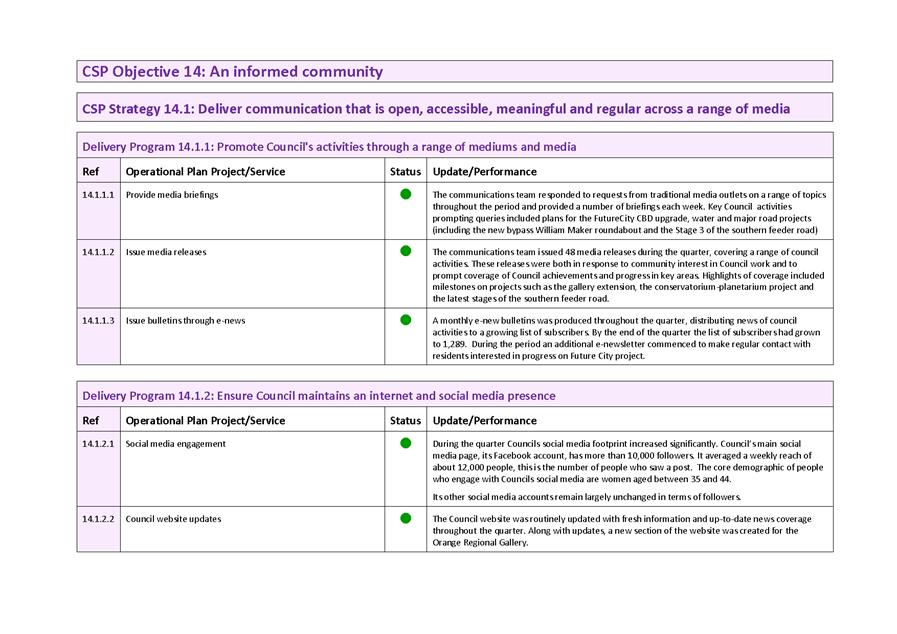

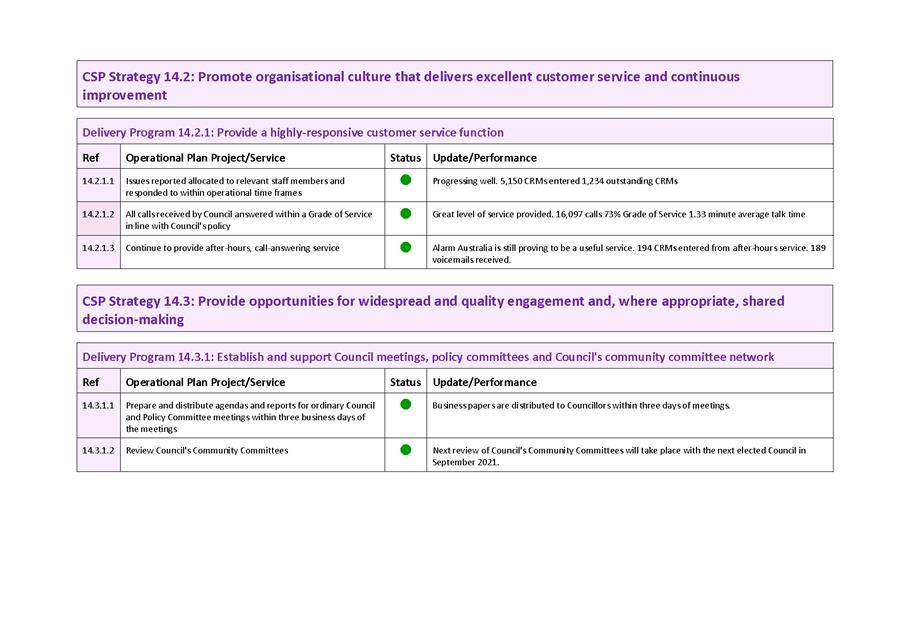

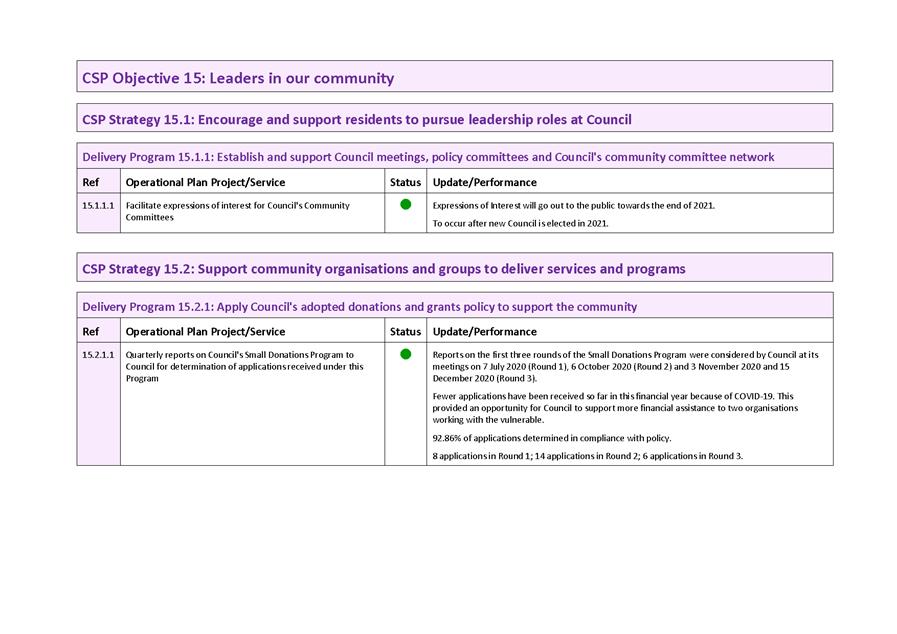

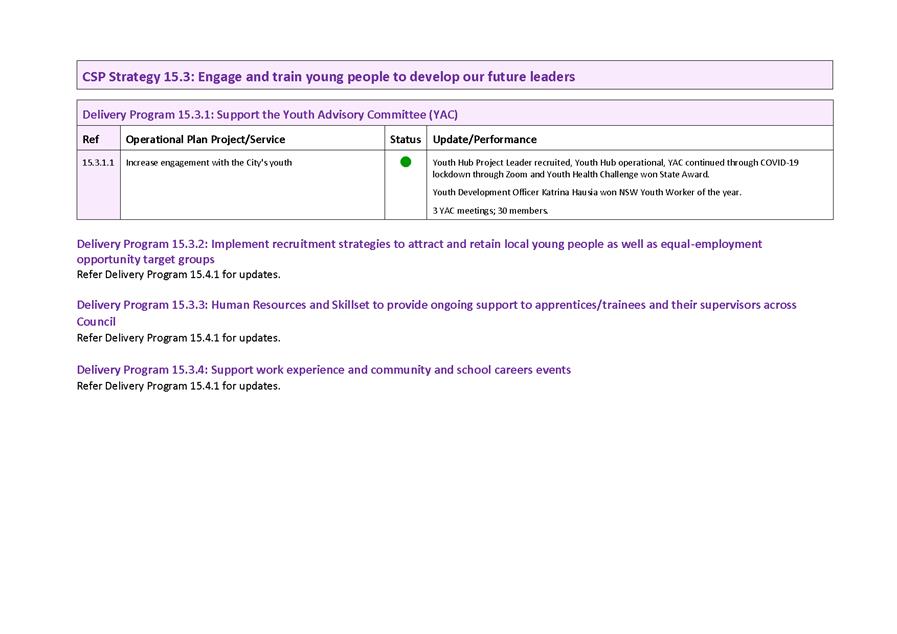

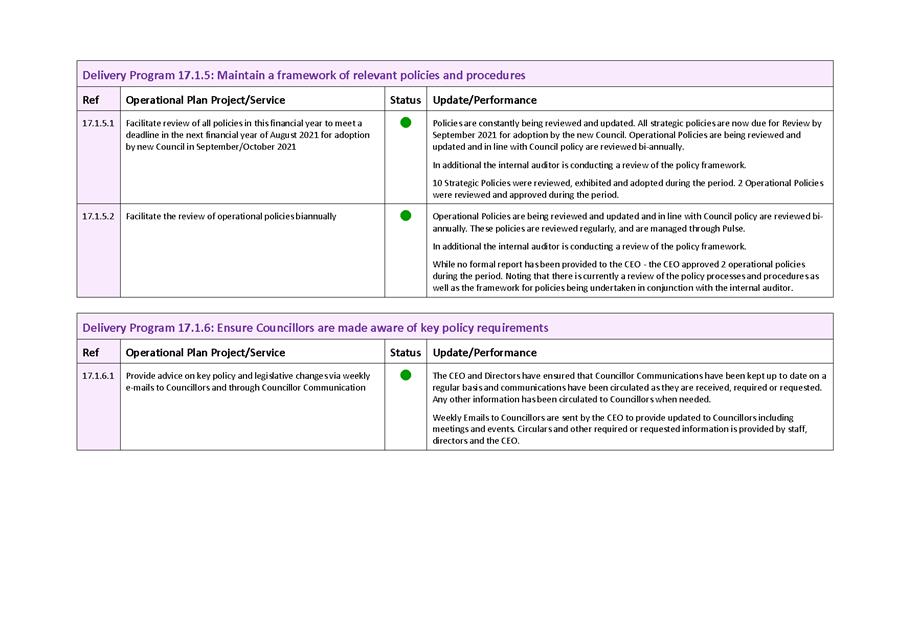

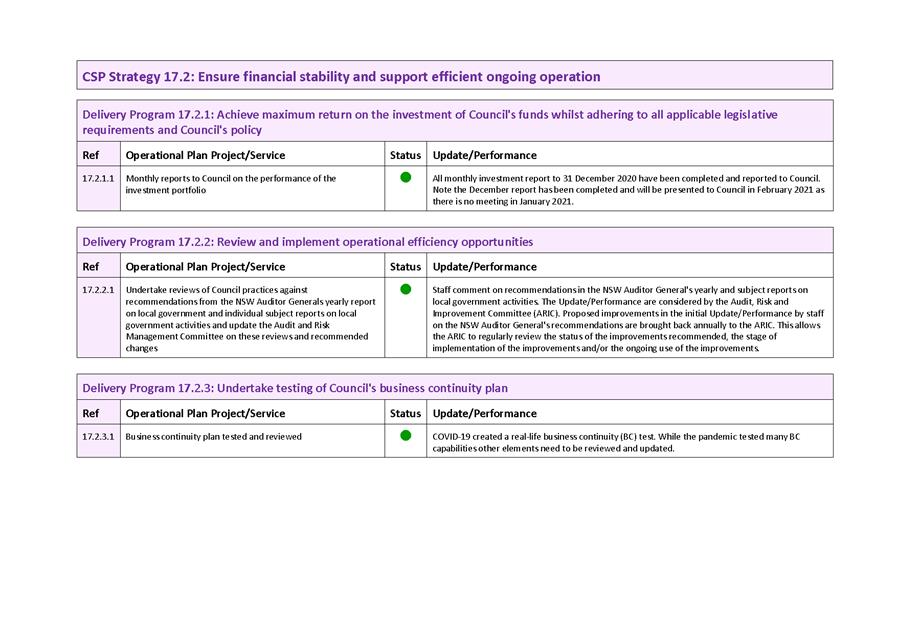

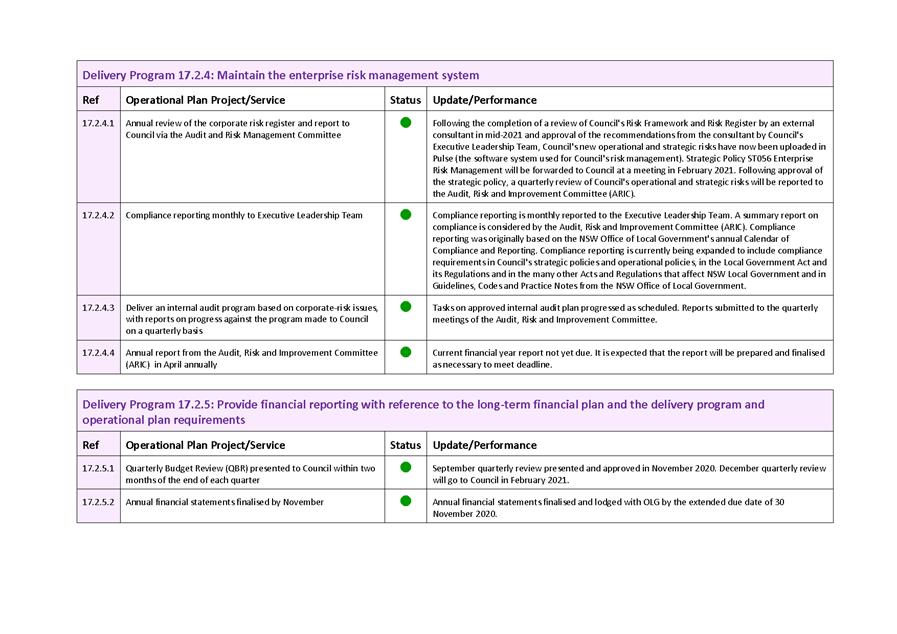

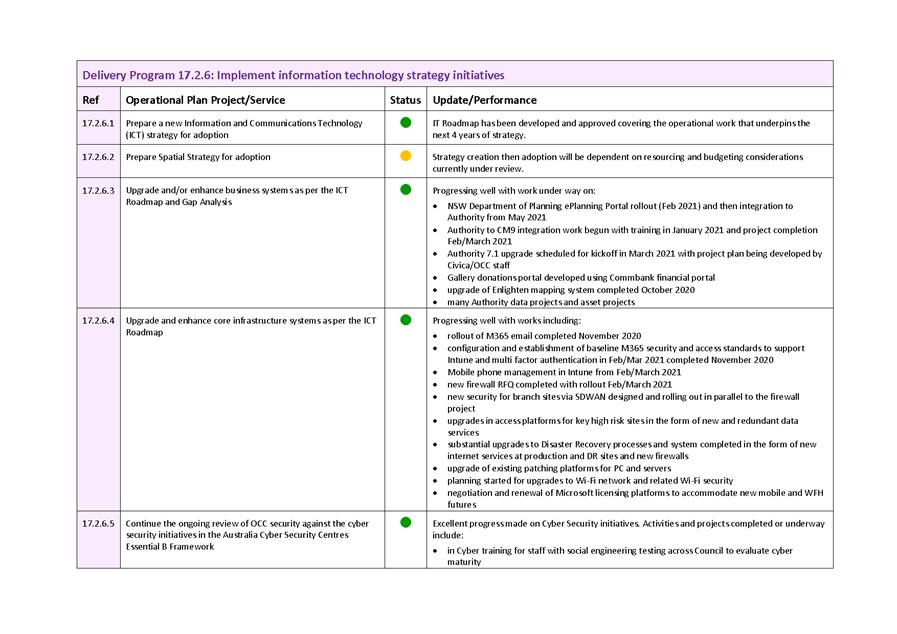

Service Delivery

|

The Performance Indicators

highlight progress in achieving the strategies and actions set by

Council’s Delivery/Operational Plan. The “traffic light”

indicators show the status of each task. A green light indicates the task is

on track. An amber light suggests some delay and a red light is provided to

those tasks that are unable to be achieved. All tasks have a comment that

indicates progress.

|

SUPPORTING INFORMATION

Highlights of the Quarter

· Work

began on the Orange Regional Gallery’s $5 million extension after a

sod–turning event attended by the NSW Arts Minister Don Harwin. The

extension is funded by the NSW Government’s Regional Cultural Fund

($4,052,990) and Orange City Council ($1,000,000) with community contributions.

· There

was activity on the FutureCity program:

o A series of community

information sessions were held to keep the community in touch with unfolding

aspects of the Future City plans to upgrade the CBD. Sessions were held with

residents and members of the business community.

o Among the first changes in

places were large heritage images fitted to the windows of vacant shops in a

bid to revitalise the streetscape and make walking in the centre of town more

enjoyable for locals and visitors alike.

o The $1.5 million Future City

‘Whiteway’ project, an upgrade of footpath lighting in Summer

Street, was turned on. Council and community leaders were on hand on to see the

automatic lights switch on for the first time on 30 October.

o As part of Future City,

Council funded up to $50,000 worth of Christmas decorations to beautify the

area and brighten people’s sprits. The extra spend on Christmas decorations

was in lieu of the annual Carols by Candlelight event which could not go ahead

because of Coronavirus restrictions.

· The

lack of international holiday options led to increased numbers of tourists in

Orange. A record number of travellers entered the Orange Visitors Centre over

the October long weekend, more than double the number from the previous year.

· Water

Polo returned to the line-up of activities at the Aquatic Centre. COVID safe

games were arranged and there was a boost in registrations ahead of its season

opening.

· The

appointment of an expert consultant and a community survey was part of plans to

develop a new guide to the future management of flying foxes.

· Work

continued on a number of major road projects:

o Work began on an upgrade of

Ploughmans Lane, between Coronation Drive and Escort Way.

o Congestion on the Northern

Distributor eased when the $5.5 million roundabout at Hill Street and William

Maker Drive opened to traffic.

o Work has begun on the $7.5 million

next stage of Orange’s southern feeder road. Community leaders gathered

for a brief ceremony to signal the start of work.

· Council

supported plans to take the annual NYE celebrations in a new direction,

replacing fireworks with a major laser show at Wade Park.

· With

total water storage levels hovering around 60 per cent and Orange on Level 2

water restrictions, Council adopted permanent water saving standards,

regardless of the city’s water storage level. The permanent water saving

standards come into effect when the combined water storage level reaches 80 per

cent.

· A new

fence was built around the arena at Orange Showground, aimed at making the

facility safer and more secure for users. The arena is used for the annual

Orange Show, and doubles as a leash-free pet exercise area.

· There

were efforts to boost awareness of a system to help curb incidents of vandalism

in the city. The Council program aims to reward people for information leading

to the conviction of anyone found vandalising.

· Wade

Park was boosted by two new upgrades:

o The cutting of a ribbon

signalled the completion of the state’s latest ‘Cricket &

Community Centre’. The new $3.4 million indoor cricket centre will host

training and educational facilities.

o 698 new grandstand seats were

installed at Wade Park courtesy of a $100,000 grant from the Australian

Government.

· Work

began on a major environmental investigation of Mount Canobolas to see if a

network of mountain bike tracks can be built that are sympathetic to the

environment. The investigation is the latest milestone in a long-running

proposal to make Orange a hub for mountain bike enthusiasts.

· The

first stage of plan for a new sporting precinct, which includes removing trees

on a site alongside Sir Jack Brabham Park, went on-show for community comment.

Due to the size of the $25 million dollar development, planning approval for

the project is being handled progressively in stages.

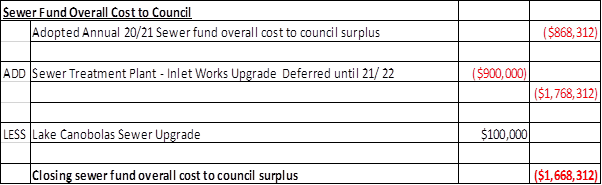

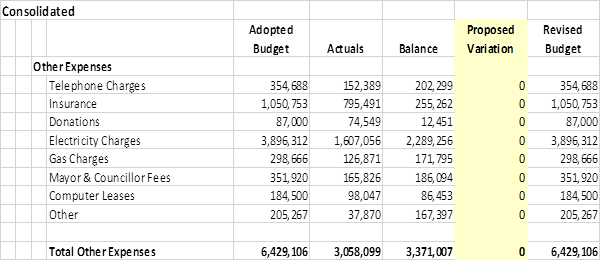

Other Expenses

The format of the attached financial reports and the financial

statements is prescribed. Council has requested details of the

“Other Expenses” element in the statements given the high value of

this item. The additional information is provided in Table 9 below. As at the

end of December 2020, actual expenses were on track at 48 per cent of the

annual budget.

Table 9: Details of other

expenses

Review

of Income

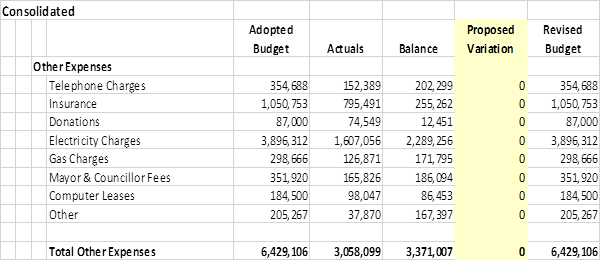

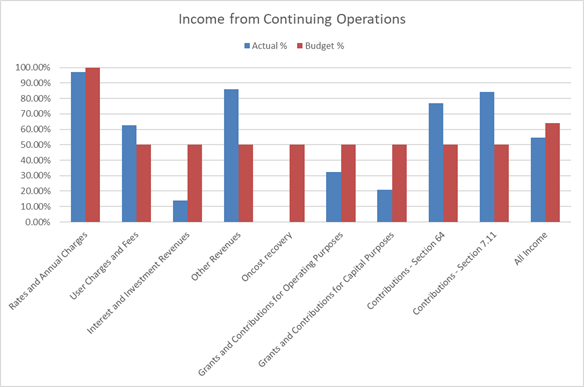

Figure 1 below provides a snapshot of the split of

Council’s income against budget.

Figure 1: Council’s

income as a percentage of annual budget as at 31 December 2020

Income streams such as User Charges and Fees and Other

Revenues are currently slightly above budget but generally their rate of

receipt is consistent throughout the year.

As Council’s annual rates are levied in July of each

year, this income is almost fully recognised in the first quarter.

Other income streams are subject to external influences

including interest rates, occurrences of development, or the success of grant

applications. These income streams are routinely reviewed, and adjusted as

appropriate, at each quarterly review.

On the assumption that all income is received at a constant

consistent rate over the year, by the end of the December quarter 50 per cent

should have been received. However, given the recognition of almost all rates

and annual charges in the first quarter, approximately 64 per cent of revenue

should have been received. The “all income” bar of Figure 1

shows progress is slightly below this expected figure due mainly to the timing

of interest due and grants and contributions not yet received.

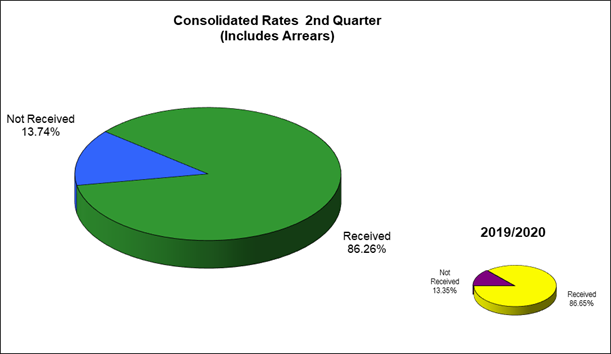

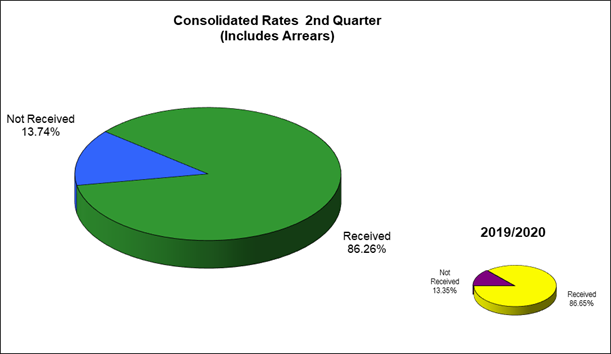

Rates and Charges Collection

For the quarter, a total of $5.4 million (13.7 per cent)

remained outstanding for rates and annual charges. For the purposes of

comparison, for the same quarter last financial year 13.4 per cent of the

amount payable remained outstanding.

Figure 2: Outstanding rates

Q2 2020/21 vs Q2 2019/20

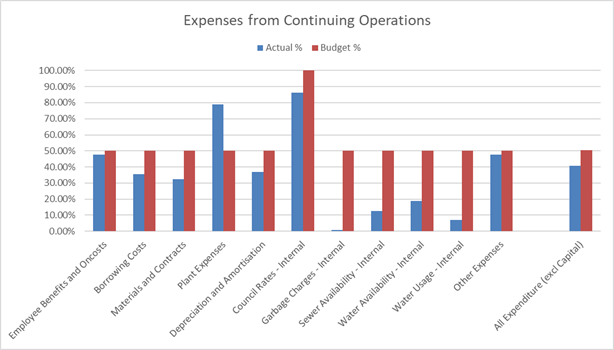

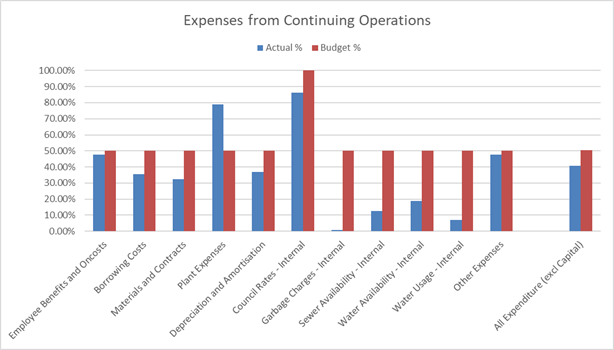

Review of Operating Expenditure

Figure 3 provides a snapshot of

the progress of Council’s operating expenditure.

Figure 3: Details of

Council’s expenditure as a percentage of annual budget as at 31 December

2020

In general, Council’s routine operational expenses

should be incurred at a consistent rate. These include expense groupings such

as Employee Costs, Materials and Contracts, Plant Expenses, Depreciation and

Other Expenses. As presented in Figure 3 above, most of these expense groups

are slightly below budget.

Council rates for Council-owned properties are paid in full at

the start of the year, however these are a minor component of overall expenses.

On the assumption that all expenses are incurred at a constant

consistent rate over the year, by the end of the December quarter 50 per cent

should have been paid out. The “all expenditure” bar of Figure 3

shows performance is better than budget.

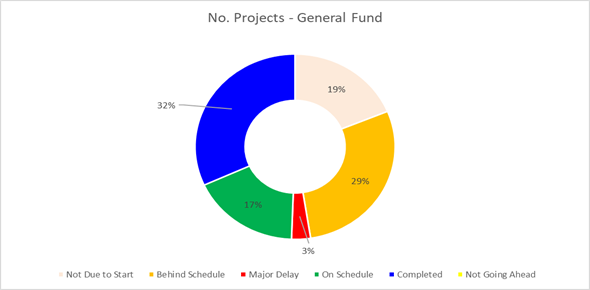

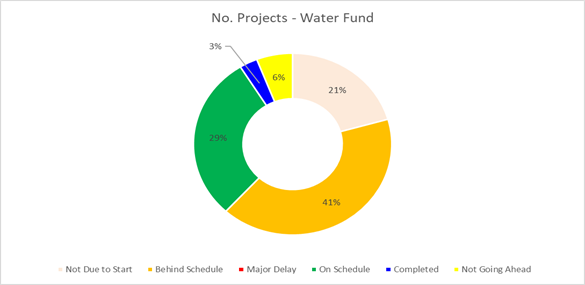

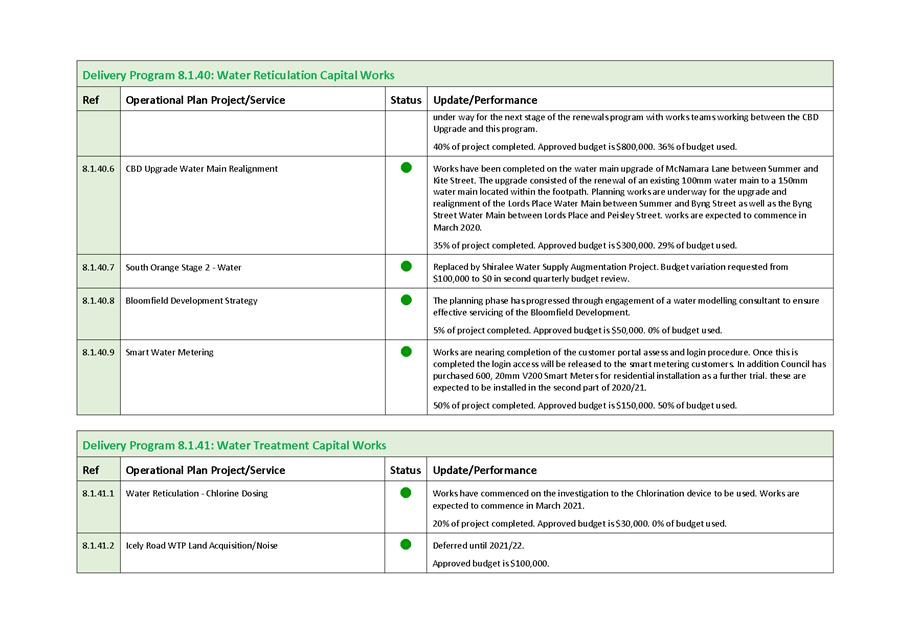

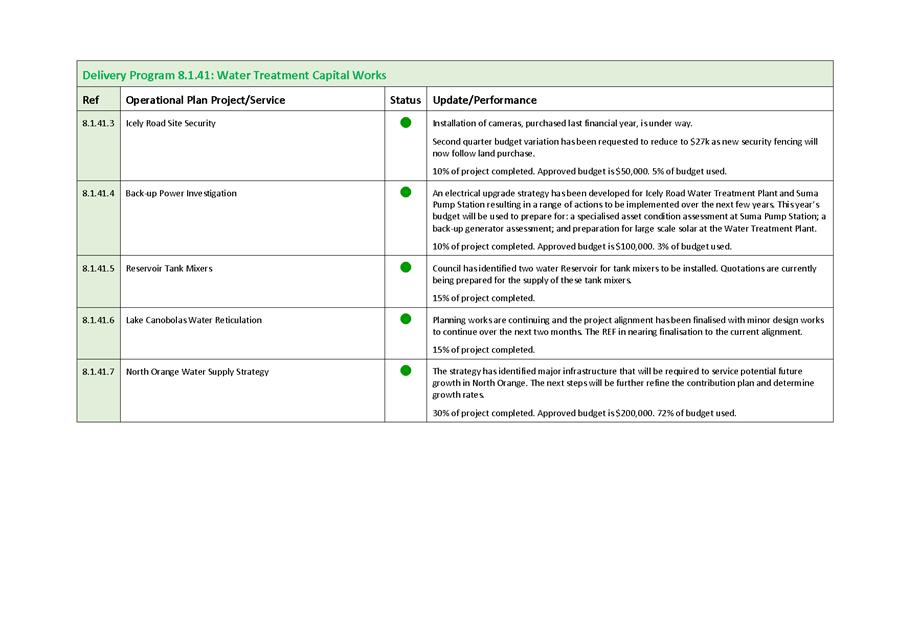

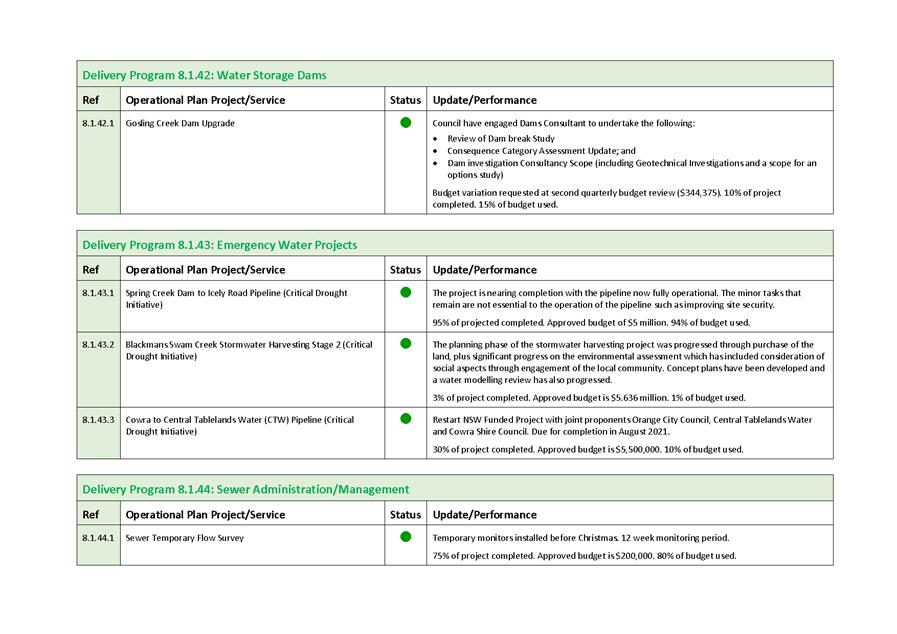

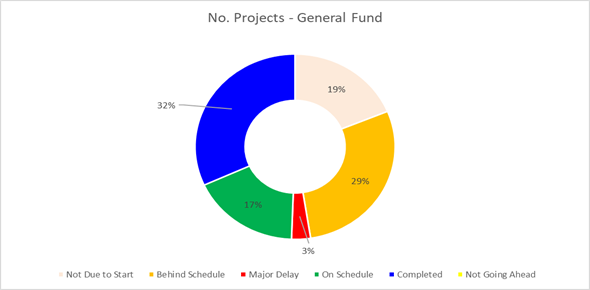

Review of Capital Expenditure

Figures 4 to 6 below provide a

snapshot of the progress of Council’s capital expenditure against budget

by fund. It is important to note that the first half of the year encompasses a

lot of planning and preparation, with many projects not scheduled to be in full

swing until Summer, while others are still awaiting confirmation of grants

being secured before being able to proceed.

Figure 4: General Fund

Capital Projects – Progress by number of projects as at 31 December 2020

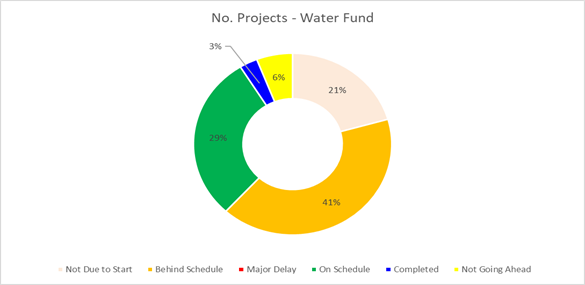

Figure 5: Water Fund

Capital Projects – Progress by number of projects as at 31 December 2020

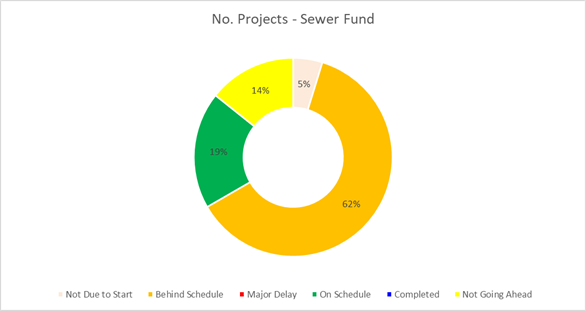

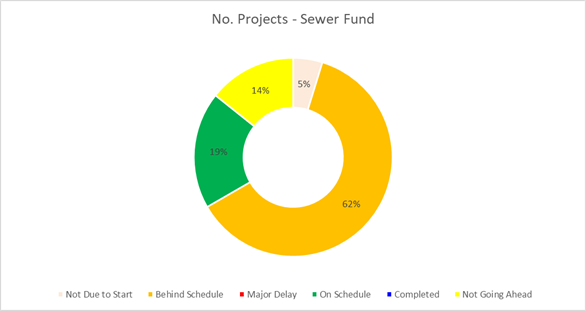

Figure 6: Sewer Fund

Capital Projects – Progress by number of projects as at 31 December 2020

Financial

Performance Indicators

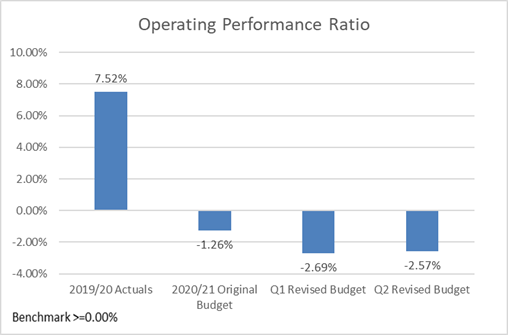

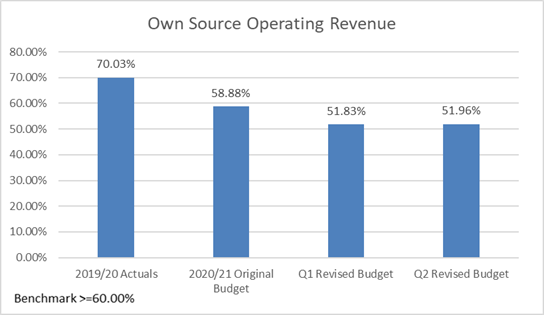

Figures 7 to 9 below represent

financial performance against local government industry indicators from the

annual financial statements. The charts compare annualised actual performance

from 2019/20 against the original 2020/21 budget and the proposed Q1 revised

2020/21 budget.

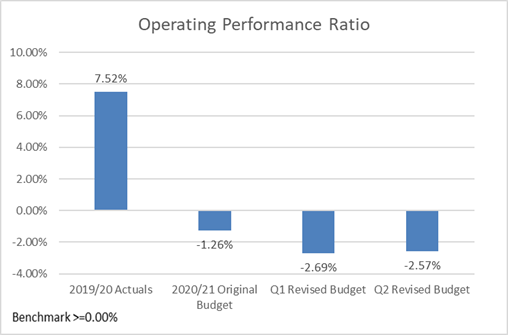

Figure 7: Operating

performance ratio

The purpose of the operating performance ratio is to measure

the extent to which Council succeeds in containing operating expenditure within

operating revenue (excluding capital grants and contributions). The formula is

as follows:

(Total continuing operations revenue excluding capital

grants and contributions minus operating expenses) divided by (Total

continuing operations revenue excluding capital grants and contributions)

The performance to date indicates Council is tracking below

the benchmark due mainly to the forecast operating deficit for the 2020/21 year

when compared to the operating surplus achieved in 2019/20.

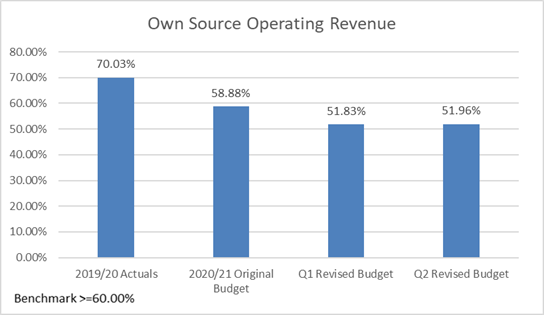

Figure

8: Own source operating revenue ratio

The purpose of the own source

operating revenue ratio is to measure fiscal flexibility by analysing the

degree of reliance on external funding sources. The formula is as follows:

(Total continuing operations revenue minus all grants

and contributions) divided by

(Total continuing operations revenue inclusive of all

grants and contributions)

The performance to date indicates Council is below the

benchmark, with a significant increase in the level of funding expected to come

from capital grants and contributions for major projects in 2020/21.

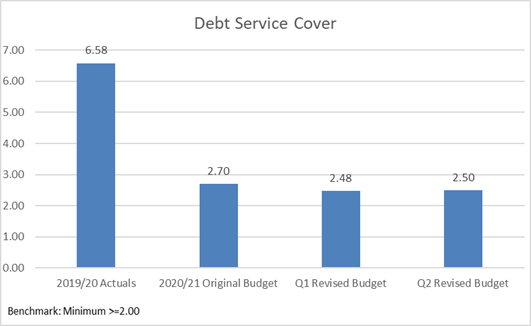

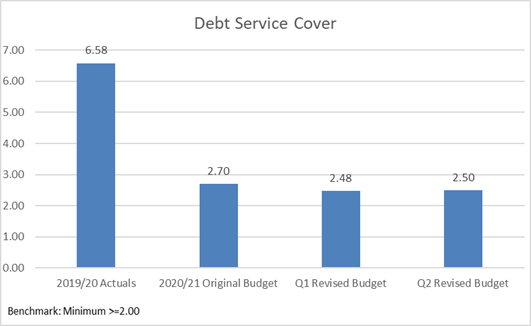

Figure 9: debt service

cover ratio

The purpose of the debt service cover ratio is to measure the

availability of operating cash to service debt including interest, principal

and lease payments. The formula is as follows:

(Operating results before capital excluding interest

and depreciation) divided by

(Principal repayments from the cashflow statement plus

borrowing costs from the income statement)

The performance to date indicates Council is tracking in

advance of the benchmark. The budgeted performance is below the 2019/20 ratio

due to the surplus operating result achieved in 2019/20 combined with lower

loan repayments and interest than is forecast for 2020/21.

Bank

Reconciliation

In addition to the information presented in the report, the

latest bank reconciliation report is attached for Council’s information.

Report by Responsible Accounting Officer

The following statement is made in accordance with Clause

203(2) of the Local Government (General) Regulation 2005:

As

the Responsible Accounting Officer, it is my opinion that the Quarterly Budget

Review Statement for Orange City Council for the quarter ended 30 September

2019 indicates that Council’s projected financial position for 30 June

2020 will be satisfactory having regard to the project estimates of income and

expenditure, and variations contained therein.

Jason

Cooke, Responsible Accounting Officer

Attachments

1 December

2020 Quarterly Bank Reconciliation, D21/3089⇩

2 December

2020 Quarterly Review, D21/3085⇩

3 Progress

Report - 2018/22 Delivery Program (Year 3) - Operational Plan 2020/2021 - First

Six Months (1 July 2020 to 31 December 2020), D21/4019⇩