ORANGE CITY COUNCIL

Employment and Economic

Development Policy Committee

Agenda

1 May 2018

Notice

is hereby given, in accordance with the provisions of the Local Government Act

1993 that a Employment and Economic

Development Policy Committee meeting

of ORANGE CITY COUNCIL will be held in the Council Chamber, Civic Centre, Byng Street, Orange on Tuesday,

1 May 2018.

Garry

Styles

General Manager

For apologies please

contact Michelle Catlin on 6393 8246.

1 Introduction

1.1 Declaration

of pecuniary interests, significant non-pecuniary interests and less than

significant non-pecuniary interests

The

provisions of Chapter 14 of the Local Government Act, 1993 (the Act)

regulate the way in which Councillors and designated staff of Council conduct

themselves to ensure that there is no conflict between their private interests

and their public role.

The

Act prescribes that where a member of Council (or a Committee of Council) has a

direct or indirect financial (pecuniary) interest in a matter to be considered

at a meeting of the Council (or Committee), that interest must be disclosed as

soon as practicable after the start of the meeting and the reasons given for

declaring such interest.

As

members are aware, the provisions of the Local Government Act restrict any

member who has declared a pecuniary interest in any matter from participating

in the discussion or voting on that matter, and requires that member to vacate

the Chamber.

Council’s Code of Conduct provides that if members

have a non-pecuniary conflict of interest, the nature of the conflict must be

disclosed. The Code of Conduct also provides for a number of ways in which a

member may manage non pecuniary conflicts of interest.

|

Recommendation

It is recommended that Committee Members now disclose any

conflicts of interest in matters under consideration by the Employment and

Economic Development Policy Committee at this meeting.

|

2 Committee

Minutes

2.1 Minutes

of the Economic Development Community Committee Meeting held 18 April 2018

RECORD

NUMBER: 2018/1040

AUTHOR: Nick

Redmond, Manager Corporate and Community Relations

EXECUTIVE Summary

The minutes of the Economic Development Community Committee

meeting held 18 April 2018 are attached for Council’s adoption.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “11.1 Our Economy

– Encourage the growth of local business, support emerging industry

sectors and attract new investment to Orange”.

Financial Implications

Nil

Policy and Governance Implications

Nil

|

Recommendation

1 That

Council acknowledge the reports presented to the Economic

Development Community Committee at its meeting held on 18 April 2018.

2 That

Council determine Item 3.1 of the Minutes of the Economic Development

Community Committee held on 18 April 2018.

3 That

the remainder of the minutes of the Economic

Development Community Committee meeting held on 18 April 2018 be adopted.

|

further considerations

Consideration has

been given to the recommendation’s impact on Council’s service

delivery; image and reputation; political; environmental; health and safety;

employees; stakeholders and project management; and no further implications or

risks have been identified.

SUPPORTING INFORMATION

The meeting held 18 April 2018 was primarily to resolve an

action list for the Committee. The action list was drafted from comments from

Committee members through email feedback prior to the meeting.

Bells Line Expressway

A potential Action List item was the Bells Line Expressway.

The Committee discussed the issue at length and made a recommendation to

Council to support an expressway. The Committee also expressed a desire to

highlight some significant issues to Council in their continued lobbying for an

expressway across the mountains.

The first issue raised is that the state and federal

government have already constructed expressways north and south of Sydney,

which has led to additional economic activity occurring along these routes. It

is now the time for a western expressway to open up the economic potential of

Central NSW and beyond. It was also suggested that there could be an

alternative to Bells Line further to the south that could be expedited because

it would be a greenfield site and could be tunnelled, cutting travelling time

from Lithgow to the Sydney basin to just 30 minutes. As a greenfield site,

construction costs would be reduced as there is no requirement to keep a lane

of traffic open while construction occurs.

A Committee member reported that the sale of public owned

infrastructure by the NSW Government has seen an allocation of infrastructure

funds to metropolitan Sydney equal to $12,000 per person. It is estimated that

an expressway through or over the mountains would service 300,000 people in

Central and Western NSW. Applying $12,000 per person to 300,000 people equates

to $3.6 billion, or the reported cost of an expressway. Alternatively, the

government could just put aside $150 million per year (indexed) to begin and

maintain construction over a 20 or 30 year period.

The Committee strongly recommended that any expressway limit

any urbanisation along its route, otherwise the expressway will resemble the

current crossings with fluctuating speed limits and local traffic merging with

inter-regional traffic. Urbanisation should be restricted to existing routes.

NBN

The Committee also recommended that Council actively pursue

an upgrade from Fibre to the Node (FTTN) to Fibre to the Premises (FTTP) in

Orange, commencing with the business and industrial areas in Orange. The

Committee also requested Council investigate becoming involved in the Smart

Cities Program as well as consider how to best utilise the existing

infrastructure for businesses in Orange.

Attachments

1 Minutes

of the Meeting of the Economic Development Community Committee held on 18 April

2018

2 EDCC

21 March 2018 Agenda, 2018/621⇩

3 Action

Plan - Economic Development Community Committee, D18/18634⇩

ORANGE CITY COUNCIL

MINUTES OF THE

Economic Development

Community Committee

HELD IN Councillors Workroom, Civic Centre, Byng Street,

Orange

ON 18 April 2018

COMMENCING AT 8.00AM

1 Introduction

Cr J Whitton (Chairperson), Cr R Kidd (Mayor)

(8.30am), Cr T Mileto, Mr Tim Hall, Mr Russell Tym (8.10am), Mr Wayne

Sutherland, Mr Tony Healey, Mr Greg Beileiter, Mr Phil Gunn, Miss Gemma

McDonald, Mrs Neina Campbell, Mr Craig Hort, Ms Annella Powell, Mr Darryl

Curran, Dr David Mallard, Acting Director Corporate and Commercial Services,

Manager Business Development, Business Project Officer

1.1 Apologies and Leave of

Absence

|

RESOLVED

Cr

J Whitton/Mr T Healey

That the apologies be

accepted from Mr Michael Banks, Mr Phillip Donato, Mr Andrew Gee, Mr

Todd Bryant and Ms Learne Spicer for the Economic Development Community

Committee meeting on 18 April 2018.

|

1.2 Acknowledgement of Country

1.3 Declaration of pecuniary

interests, significant non-pecuniary interests and less than significant

non-pecuniary interests

Nil

2 Previous

Minutes

|

RESOLVED

Mr

T Hall/Mr G Beileiter

That the Minutes of the

Meeting of the Economic Development Community Committee held on 21 March 2018

(copies of which were circulated to all members) be and are hereby confirmed

as a true and accurate record of the proceedings of the Economic Development

Community Committee meeting held on 21 March 2018.

|

3 General Reports

3.1 Review of action plan

TRIM Reference: 2018/975

Cr Whitton declared a less than

significant non-pecuniary interest in the discussion on NBN as his company operates

in the information and communication technology sector.

Cr Whitton declared a less than

significant non-pecuniary interest in the discussion on Collective Renewable

Energy Purchasing as his company provides services to major companies

operating within the region.

|

|

Recommendation Cr J Whitton/Mr G Beileiter

1

That the Committee review the draft Action Plan and provide comment

back to the Committee Clerk by 27 April 2018 for inclusion in the new Action

Plan.

2

That the Committee strongly support an expressway crossing of the Blue

Mountains and support Council in actively pursuing lobbying on the matter, in

particular in relation to:

2.1 That the

Government has already provided expressways north and south of Sydney which

has opened up economic activity along those routes. It is now time for the

west to be opened up and given the same opportunity.

2.2 The sale

of the infrastructure by the government equates to around $12,000 per person.

Since the expressway would service around 300,000 people, it equates to $3.6

billion dollars, which is about the estimated cost to build an expressway.

2.3 If the

government could commit to an annual budget of $150 million dollars, the

expressway could be built in 20 to 30 years.

2.4 That the

government must seek to limit urbanisation along the expressway or it will

end up the same as the Great Western Highway.

3

That the Committee requests Council take every opportunity to lobby

the Federal Member and the Federal Government to upgrade the NBN to Fibre to

the Premises for Orange.

|

The Meeting

Closed at 9.12AM.

Economic Development Community Committee

1 May 2018

2.1 Minutes

of the Economic Development Community Committee Meeting held 18 April 2018

Attachment 1 EDCC 21

March 2018 Agenda

ORANGE CITY COUNCIL

Economic Development

Community Committee

Agenda

21 March 2018

Notice is hereby given, in

accordance with the provisions of the Local Government Act 1993 that a Economic Development Community Committee

meeting of ORANGE CITY

COUNCIL will be held in the Councillors

Workroom, Civic Centre, Byng Street, Orange on Wednesday, 21

March 2018 commencing at 8.00AM.

Garry

Styles

General Manager

For apologies please

contact Tony Boland on 6393 8250.

Agenda

EVACUATION

PROCEDURE

In the event of an emergency, the building may be evacuated. You will

be required to vacate the building. The Committee Clerk will now identify the

emergency muster point.

Under no circumstances is anyone permitted to re-enter the building

until the all clear has been given and the area deemed safe by authorised

personnel.

In the event of an

evacuation, a member of Council staff will assist any member of the public with

a disability to vacate the building.

1 Introduction.. 12

1.1 Apologies and Leave of Absence. 12

1.2 Acknowledgement of Country. 12

1.3 Declaration of pecuniary interests, significant non-pecuniary

interests and less than significant non-pecuniary interests. 12

2 Previous

Minutes. 12

3 General

Reports. 13

3.3 Committee Charter. 13

3.6 Quarterly employment and unemployment data. 16

3.7 Quarterly Housing Data for Orange. 24

3.8 Future reports to the Economic Development Community Committee. 30

Economic Development Community Committee

1 May 2018

2.1 Minutes

of the Economic Development Community Committee Meeting held 18 April 2018

Attachment 1 EDCC 21

March 2018 Agenda

1 Introduction

MEMBERS

Cr J Whitton (Chairperson), Cr R Kidd

(Mayor), Cr T Mileto, Cr M Previtera, Mr Tim Hall, Mr Russell Tym, Mr

Bruce Buchanan, Mr Michael Banks, Mr Tony Healey, Mr Greg Beileiter, Mr Phil

Gunn, Miss Gemma McDonald, Mrs Neina Campbell, Mr Craig Hort, Ms Annella

Powell, Mr Darryl Curran, Mr Learne Spicer, Mrs Bernadette Novotny, Dr David

Mallard, TAFE NSW Representative, Director Corporate and Commercial Services,

Manager Corporate and Community Relations, Manager Business Development,

Business Project Officer

1.1 Apologies and

Leave of Absence

1.2 Acknowledgement of

Country

I would like to acknowledge the Wiradjuri people who are the

Traditional Custodians of the Land. I would also like to pay respect to the

Elders both past and present of the Wiradjuri Nation and extend that respect to

other Aboriginal Australians who are present.

1.3 Declaration of

pecuniary interests, significant non-pecuniary interests and less than

significant non-pecuniary interests

The

provisions of Chapter 14 of the Local Government Act, 1993 (the Act)

regulate the way in which Councillors and designated staff of Council conduct

themselves to ensure that there is no conflict between their private interests

and their public role.

The

Act prescribes that where a member of Council (or a Committee of Council) has a

direct or indirect financial (pecuniary) interest in a matter to be considered

at a meeting of the Council (or Committee), that interest must be disclosed as

soon as practicable after the start of the meeting and the reasons given for

declaring such interest.

As

members are aware, the provisions of the Local Government Act restrict any

member who has declared a pecuniary interest in any matter from participating

in the discussion or voting on that matter, and requires that member to vacate

the Chamber.

Council’s Code of Conduct provides that if members

have a non-pecuniary conflict of interest, the nature of the conflict must be

disclosed. The Code of Conduct also provides for a number of ways in which a

member may manage non pecuniary conflicts of interest.

|

Recommendation

It is recommended that Committee Members now disclose any

conflicts of interest in matters under consideration by the Economic Development

Community Committee at this meeting.

|

2 Previous Minutes

3 General

Reports

RECORD

NUMBER: 2018/358

AUTHOR: Michelle

Catlin, Manager Administration and Governance

EXECUTIVE Summary

Orange City Council has developed and

adopted the Charter for the Economic Development Community Committee. The

Community Committee structure was determined late in 2017 with Council adopting

the Charters in February 2018.

The Charter sets out the operations and composition of the

Committee, and is presented for consideration and adoption by the Committee.

If required, the Committee may recommend to Council a change

to the Charter, however any such change must be consistent with Council’s

Code of Meeting Practice.

Link To Delivery/OPerational Plan

The recommendation in this report

relates to the Delivery/Operational Plan strategy “1.4

Our City - Ensure a framework that Council’s policies, procedures and

programs relate to the vision and directions of the Community Strategic Plan,

including a disability action plan”.

Financial Implications

Nil

Policy and Governance Implications

All Community Committee Charters have

been updated to reflect Council’s requirements and to comply with

Council’s Code of Meeting Practice.

|

Recommendation

That the Charter for the Economic Development Community

Committee be adopted.

|

further considerations

Consideration has

been given to the recommendation’s impact on Council’s service

delivery; image and reputation; political; environmental; health and safety;

employees; stakeholders and project management; and no further implications or

risks have been identified.

SUPPORTING INFORMATION

The Charter for the current term of

the Committee is attached for consideration and adoption by the Committee.

The Committee may, if needed, recommend changes to the

Charter be considered. Any such changes cannot be inconsistent with

Council’s Code of Meeting Practice.

Attachments

1 Charter

- Economic Development Community Committee - 2017, 2017/2277

Economic Development Community Committee

1 May 2018

2.1 Minutes

of the Economic Development Community Committee Meeting held 18 April 2018

Attachment 1 EDCC 21

March 2018 Agenda

ECONOMIC DEVELOPMENT

ECONOMIC DEVELOPMENT

COMMUNITY COMMITTEE

2017/2277 F1508

purpose

To advise Council and make recommendations in relation to the

implementation of economic development strategies contained within

Council’s Delivery/Operational Plan.

The

Committee does not have a role in the operational function of Council. This is

the responsibility of the General Manager and staff. Equally, where Council has

adopted a Strategic Policy or Strategic Planning document, the Committee must

observe the Council position as set out in that policy, plan or document.

Reports

to

Employment

and Economic Development Policy Committee

Term

The

Economic Development Community Committee shall dissolve at the General Election

of Orange City Council. Council may dissolve the Committee at any time by

resolution of Council.

Membership

Three

Councillors (one of whom shall be Chairperson, as elected by Council)

General

Manager (or nominee)

Non-voting

Committee Clerk

Council

staff as required (non-voting)

Community

Representatives

Up to 16

community members with a particular interest in economic development and/or

experience in:

· Health

· Tourism

· Education

· Manufacturing/Engineering

· Agribusiness

· Mining

· Small business

· Property development/sales

Other

Representatives

· Federal Member for Calare (not included for quorum

purposes)

· State Member for Orange (not included for quorum

purposes)

· Representative of the Orange Business Chamber

· Representative of the Business Enterprise Centre

· Representative of the NSW Department of Industry (or

equivalent)

ECONOMIC

DEVELOPMENT

COMMUNITY COMMITTEE CHARTER

Quorum

Majority

of community members and at least one Councillor.

meeting Frequency

Every

second month, with specific meeting dates and times to be determined by the

Committee.

voting

Each

member of the Committee is entitled to one vote only. In the equality of votes,

the matter is to be referred to Council for determination.

reports and recording

Matters

to be considered by the Committee must be included in the agenda for the

meeting, and must be provided in writing to the Committee Clerk at least 10

days before the meeting. Formal minutes of meetings of the Committee will be

produced in accordance with Council’s Code of Meeting Practice. The

Committee may make recommendations to Council, via the Employment

and Economic Development Policy Committee. Council may adopt, amend or decline

any recommendation.

Vacancies

Vacancies may arise during the

term of the Committee. If a vacancy does occur, the Committee may invite an

individual to join the Committee, or seek expressions of interest to fill the

vacancy.

Committee Clerk

The General Manager will provide

a Committee Clerk who will be the representative of the General Manager, and

will exercise the functions of the General Manager so far as they are relevant

to the Committee and its Chairperson.

Relevant Policies/Documents

Orange City Council Code

of Conduct

Orange

City Council Code of Meeting Practice

Orange

Community Strategic Plan

Delivery/Operational

Plan

Asset

Management Plan Strategy and Plans

Statement of Business Ethics

Copies of these and other documents

are available on Council’s website at www.orange.nsw.gov.au

or from the Committee Clerk.

2.1 Minutes

of the Economic Development Community Committee Meeting held 18 April 2018

Attachment 1 EDCC 21

March 2018 Agenda

3.6 Quarterly

employment and unemployment data

TRIM

REFERENCE: 2018/361

AUTHOR: Tony

Boland, Business Projects Officer

EXECUTIVE Summary

This report has historically been provided to the Economic

Development Community Committee on a quarterly basis to monitor employment

levels within the region. The Federal Department of Jobs and Small Business

compiles and reports Small Area Labour Market (SALM) data. This report provides

the most recently published data.

Employment data is one of the measures often used to analyse

the performance of an economy. The comparison between Bathurst and Dubbo is for

the information of the committee members as comments in the media and social

media often portray a particular city doing better or worse than another. This

independent measurement helps to clarify that situation.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “11.1 Our Economy

– Encourage the growth of local business, support emerging industry

sectors and attract new investment to Orange”.

Financial Implications

Nil

Policy and Governance Implications

Nil

|

Recommendation

That the report by the Business Projects Officer on the

employment figures for Orange be acknowledged.

|

further considerations

The recommendation of this report has been

assessed against Council’s other key risk categories and the following

comments are provided:

|

|

|

|

Service Delivery

|

The data provided within this report

is also provided to companies looking for assistance with information as well

as being used by staff in submissions.

|

SUPPORTING INFORMATION

The SALM data is released by the

Department of Jobs and Small Business three to four months after the end of the

quarter. The figures are published on a quarterly basis in the Small Area

Labour Markets publication (https://www.employment.gov.au/small-area-labour-markets-publication

).

The most recent data available is for

the quarter ending 30 September 2017. The data in this report is on a Local

Government Area basis in the first section and then on a city by city (SA2)

basis for the second half of the report. There is additional information on SA2

geography in the second part of the report.

|

Measurement – Orange LGA

|

Sept

Qtr 2017

|

|

Labour force

|

22,320

|

|

Unemployed persons

|

985

|

|

Unemployment rate

|

4.4%

|

The unemployment rate for the Orange

LGA was 4.5% in the September 2016 quarter. The Department of Jobs and Small

Business cautions consideration of quarter on quarter comparison due to the

volatility of the data. It recommends analysis on year to year basis.

A comparison of the Orange LGA results in the September 2017

quarter to other LGAs is shown in the table below (noting this relates to the

LGAs as they were in September 2017):

|

LGA

|

|

|

LGA

|

|

|

Albury

|

8.4%

|

|

Blayney

|

3.6%

|

|

Armidale

|

6.0%

|

|

Cabonne

|

2.6%

|

|

Bathurst

|

3.9%

|

|

Cowra

|

6.4%

|

|

Dubbo Regional+

|

2.5%

|

|

Forbes

|

4.0%

|

|

Tamworth

|

6.1%

|

|

Mid-Western

|

4.9%

|

|

Wagga Wagga

|

4.8%

|

|

Parkes

|

6.2%

|

|

|

|

|

NSW

|

4.6%

|

+

Dubbo City Council was amalgamated with Wellington Shire Council to form the

new merged entity of Western Plains Regional Council and subsequently the Dubbo

Regional Council.

The SALM data has been measured for

over 30 years. This information has been provided on a geographic basis where

the boundaries match the appropriate Local Government Area. The graphs in the

first section below depict the historical data for the Orange LGA. Data has

only been collected on a SA2 basis since 2010. There are two or three SA2 areas

that form an equivalent geographical area to each of the cities.

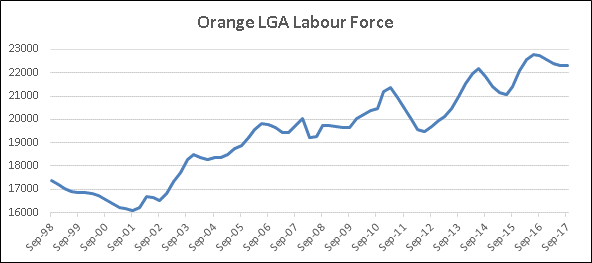

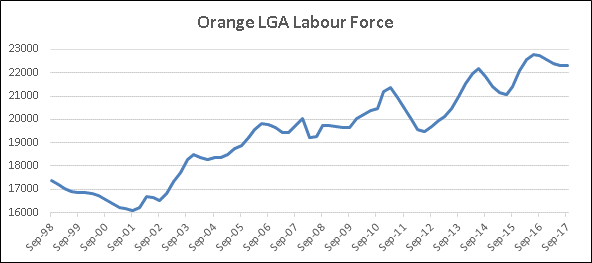

Labour Force

The labour force is the number of persons aged over 15 years

with the exclusion of certain persons, including those in permanent defence

force positions, overseas residents in Australia and some diplomatic roles. The

labour force is the number of non-excluded people who are working or actively

looking for work, so the labour force figure includes people who are

unemployed.

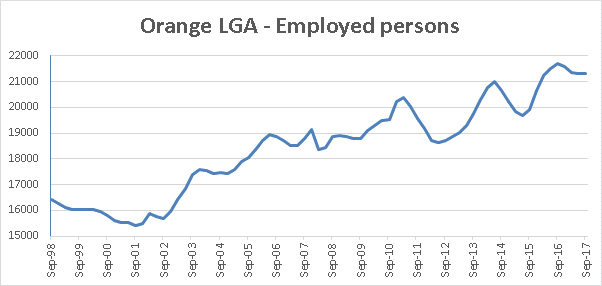

For Orange LGA, the graph below displays a peak in the

labour force in March 2011 which

coincided with a significant number of construction projects including Cadia

East, CSU and new hospital by the Orange Health Service.

The period from December 2013 to September 2014 includes a

significant number of people who relocated for the purposes of the Cadia East

construction project and Orange Airport Development. This is reflected within

our population statistics. September 2014 saw the completion of the last of

these projects, with the conclusion of the Cadia East construction.

From September 2014 to June 2015 there was a significant reduction

in the labour force. This was potentially linked to jobseeker confidence in the

light of the scaling back of Electrolux operations. Jobseeker confidence and

jobs have recovered well for the labour force to be at an all time high in June

2016 and only slightly less than that in the September 2016 quarter.

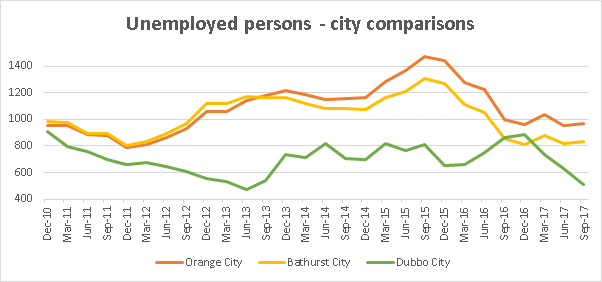

Unemployed

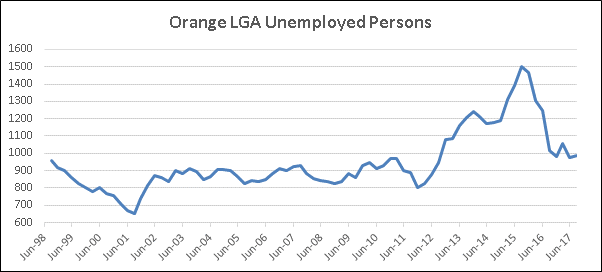

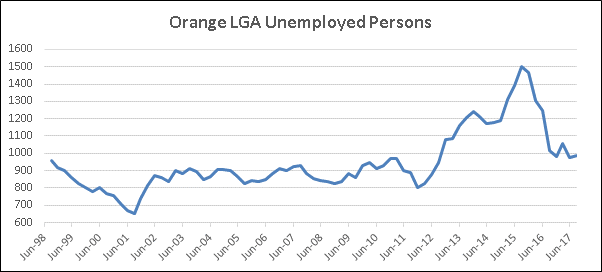

persons

The number of unemployed persons in Orange LGA has

traditionally been less than 1,000 persons.

The 1,000 person ‘barrier’ was broken after

September 2012 quarter. This coincided with the completion of a number of large

projects. The number of unemployed continued to climb quarter on quarter (with

the exception of March and June 2014) until a peak of 1,504 was realised in

September 2015 quarter.

There was a rapid decline in the number of unemployed people

(to 1,018) in the twelve months from September 2015 to September 2016. This is

a net reduction of 486 unemployed people over the twelve month period. The

labour force also increased by 1047 people in this same period. This decline

continued in the December quarter, albeit at a lesser rate of decline.

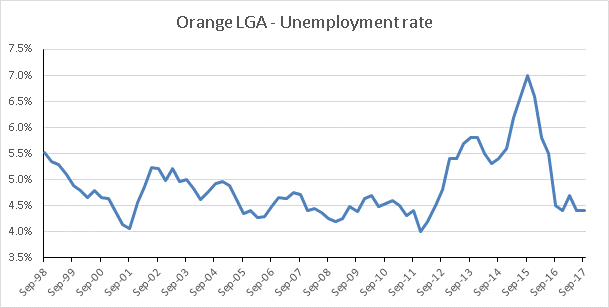

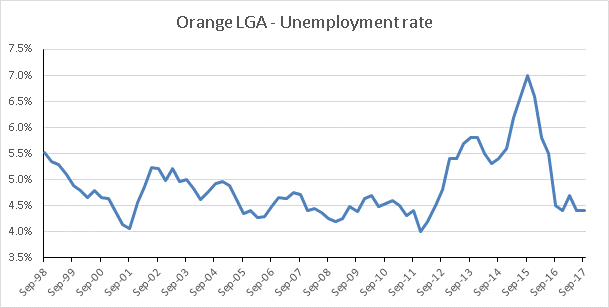

Unemployment rate

The unemployment rate has historically been relatively

conservative in the 4-5 per cent range. The unemployment rate peaked in

September 2015 at 7.0%. This quarter coincided with a significant number of

retrenchments from Electrolux and the reduction of contractors at Cadia Valley

Operations.

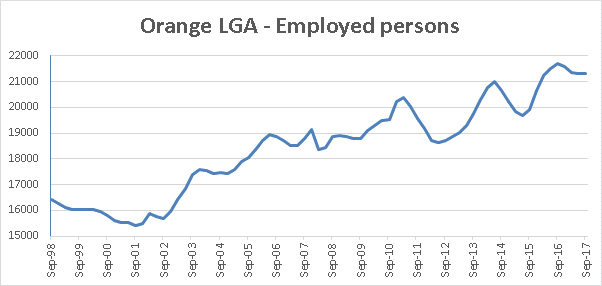

Employed

persons

The figure for employed persons is not reported by the

Department of Employment but is derived by taking the unemployed persons out of

the labour force. The December 2016 quarter saw a slight drop from the highest

ever level of people in employment (21,724 people) achieved in Orange. This

figure is higher than the number of people employed at any time during the

major construction projects or in the mining boom. The September 2017 data

shows employment remaining consistently high, approximately 400 people less

than the peak record one year earlier.

City to City Comparisons

It has become increasingly unreliable to do city to city

comparisons using LGA boundaries as a number of Local Government Areas are now

merged, and therefore increase in geographic and population size. The

Department of Jobs and Small Business now releases employment data using the

Australian Statistical Geography Standard Statistical Area Level 2 geography.

This allows data to be closely matched to the geography of a city as well as a

Local Government Area.

By matching to the geography of a city, direct comparisons can

be made between each city’s labour market rather than guessing how much

of the LGA data is attributable to the city and how much is attributable to

villages and rural communities.

To help put the city based employment data in context, it is

useful to gain an understanding of each city’s population. The table

below shows the estimated residential population for the year ending June 30

for each of the cities. Estimated Residential Population is the most accurate

measure of population available from the Australian Bureau of Statistics, even

more accurate than the Census data.

|

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Orange City

|

36,988

|

37,785

|

38,215

|

38,666

|

39,168

|

39,390

|

39,755

|

|

Bathurst City

|

33,328

|

33,754

|

34,105

|

34,561

|

34,985

|

35,510

|

36,013

|

|

Dubbo City

|

35,056

|

35,281

|

35,555

|

35,883

|

36,599

|

36,751

|

37,125

|

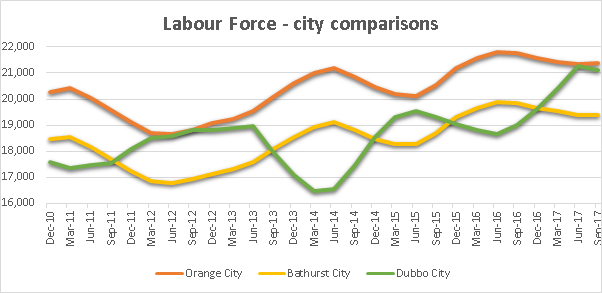

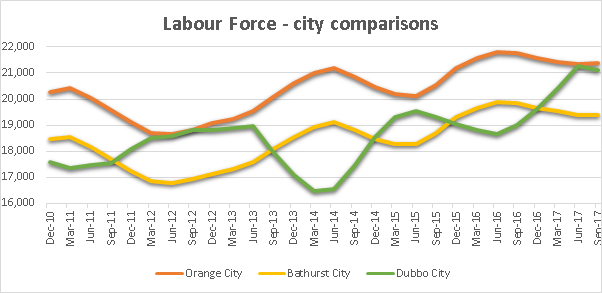

The Labour Force for the three cities is contained in the

following graph. Of note, the lines denoting the Orange and Bathurst labour

force almost run parallel over the entire period. Orange has consistently had a

workforce of around 2,000 more people than Bathurst. This is consistent with

having around an extra 4,000 residents in Orange compared to Bathurst.

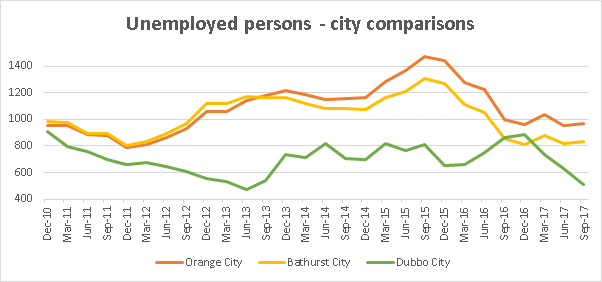

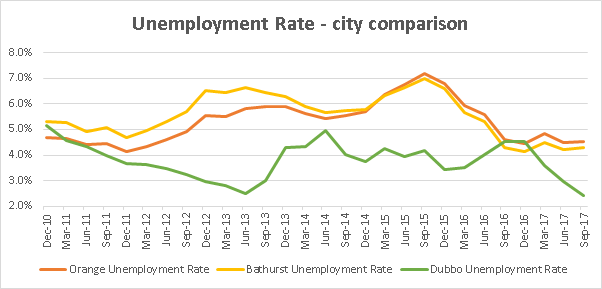

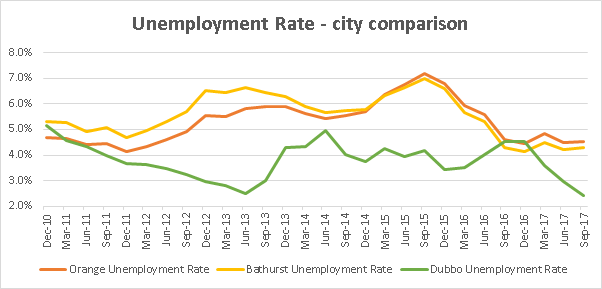

It is interesting to note in the following two graphs that the

unemployed persons and the unemployed rate for Orange and Bathurst follow a

similar trend while the unemployed persons and rate for Dubbo trends

differently. Some of the similarity in the Orange and Bathurst trends could be

apportioned to the relatively close geographic positioning of the two cities to

each other, allowing flexibility of people to move between the two labour

markets for work. This would help to counter individual city labour market

peaks and troughs in Bathurst and Orange.

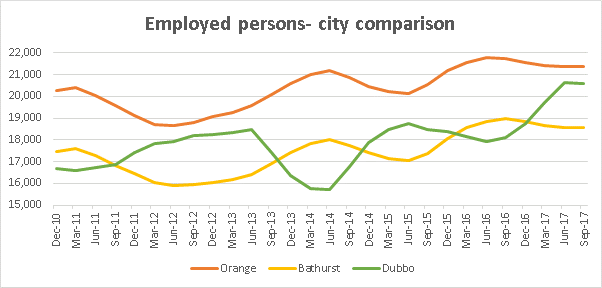

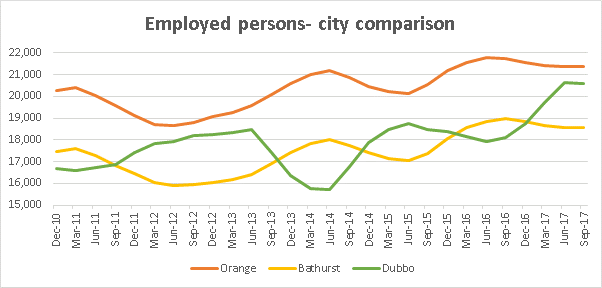

The figure for employed persons is not reported by the Department

of Jobs and Small Business but is derived by taking the number of unemployed

persons out of the labour force figure. The graph below shows Orange has around

2,500 more jobs than Bathurst and just under 1,000 more than Dubbo in September

2017.

2.1 Minutes

of the Economic Development Community Committee Meeting held 18 April 2018

Attachment 1 EDCC 21

March 2018 Agenda

3.7 Quarterly

Housing Data for Orange

TRIM

REFERENCE: 2018/454

AUTHOR: Tony

Boland, Business Projects Officer

EXECUTIVE Summary

The quarterly housing reports are an indicator of economic

activity and housing pressures and as the report is consistent with the charter

of the Economic Development Community Committee, the report will be provided to

this committee on a quarterly basis.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “11.1 Our Economy

– Encourage the growth of local business, support emerging industry sectors

and attract new investment to Orange”.

Financial Implications

Nil

Policy and Governance Implications

Nil

|

Recommendation

That the Committee acknowledge the report on the

Quarterly Housing Data for Orange.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

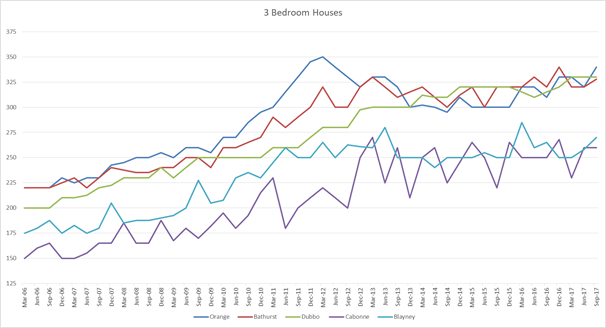

SUPPORTING INFORMATION

The most comprehensive reports on property sales and rental

data is published by Housing NSW. Council has used other data sources to

supplement the Housing NSW information.

There are two other commonly reported sources of data on housing

prices:

· RP Data (trading

as CoreLogic)

· Domain

(combination of former Australian Property Monitors, Pricefinder and owned by

Fairfax media)

Both of these sources are more

commonly reported in the media, however the source of the data and the methodology

applied to the collection and inclusion of the data makes these sources less

certain to use. The only advantage of these data sources is that they are more

‘real time’ than the Housing NSW data.

The supporting information in this

report is broken into three categories:

· median sales price

· median

rental price

· building

approvals.

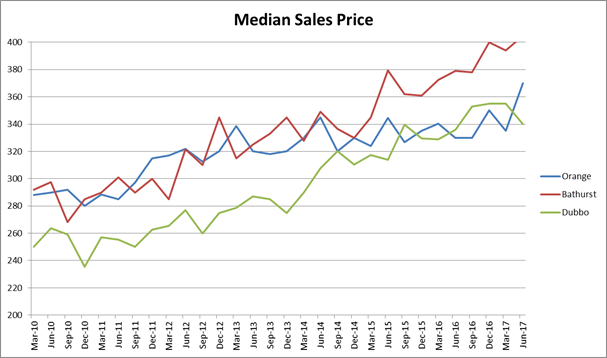

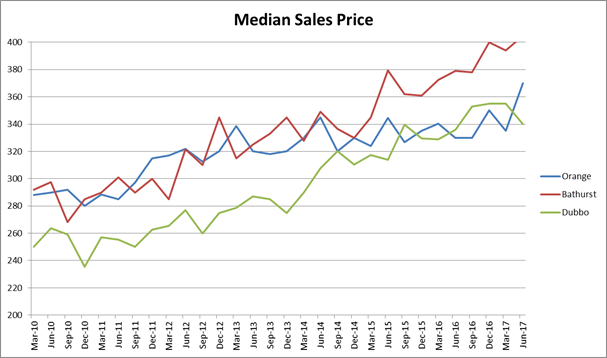

Median Sales Price

The information surrounding housing

sales and rent data is reported in terms of a median price. The median is the

value that divides a set of ordered numbers equally into a bottom half and a

top half. Unlike a mean (average) price, median prices are not significantly

affected by unusually high or low values. Therefore median prices are

considered the better values in assessing the property market.

The Housing NSW sales data is captured 3 months after the

end of the reporting period. On average, around 80% of all sales contracts have

been notified in this timeframe. Statistical analysis and testing by Housing

NSW has shown that the housing mean and median prices do not vary greatly if

data is captured at the 6 month point. The sales statistics are derived from

information provided on the “Notice of Sale or Transfer of Land”

form that is lodged with Land and Property Information NSW.

The Housing NSW median sales price in Orange in the June

2017 quarter was $370,000 which is a new peak for Orange, eclipsing our

previous highest quarterly median of $350,000 (December 2016). This is less

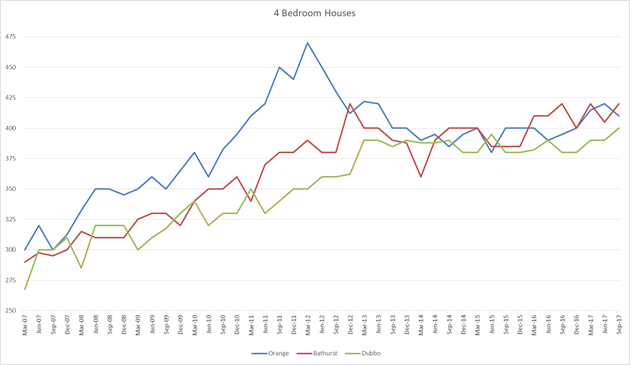

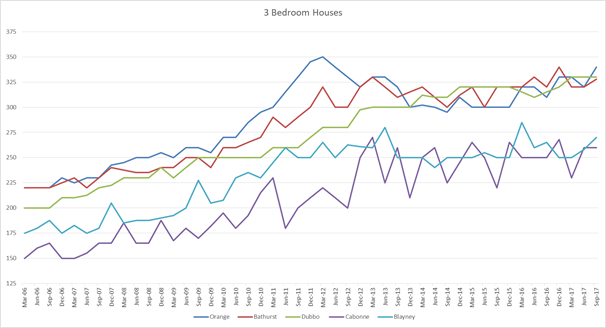

than Bathurst and higher than Dubbo as shown in the graph below.

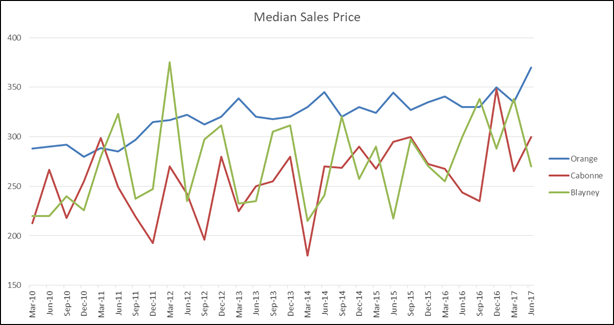

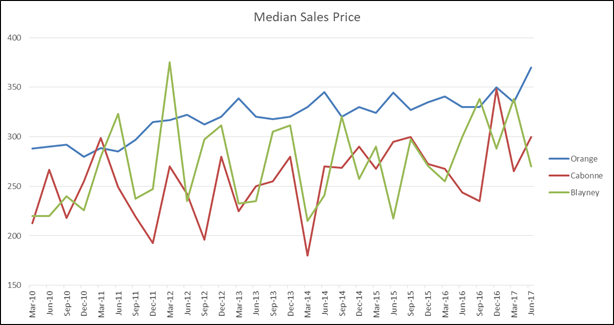

Due to the smaller nature of both the

Cabonne and Blayney residential housing sales markets, the median sales price

is subject to increased volatility in pricing as can be seen in the graph on

the following page.

Data from other sources can fluctuate significantly from the

Housing NSW data. As an example, the median price listed by RP Data on 10

February 2017 was $345,000 and the median price from Domain in their 2017

Domain House Price Report was $368,000. These fluctuations are often seized on

by the media for news.

There are both positives and negatives from the median sales

price. A lower median sales price means it is more affordable to get into the

housing market in Orange. It is also more attractive to investors as the

similar median rent (see later in the report) across the three cities provides

a better return on investment for a lower median sales. The downside of a lower

median sales price is that the growth in capital investment for the home owner.

Median Rental Price

The rental statistics from Housing NSW is derived from

information provided on the rental bond lodgement form that is lodged with the

Office of Fair Trading. Where there are less than 10 bonds lodged in a quarter

the data will return a nil result. Because of this, measuring smaller locations

such as Blayney and Cabonne can be difficult and inconsistent for premises

other than 3 bedroom houses.

The median rents for the region in the September 2017 quarter

are listed in the following table.

The areas are Local Government Area boundaries with the

exception of Dubbo, which is measured on the 2830 postcode due to the

amalgamation with Wellington Shire Council.

|

Type

|

All Dwellings

|

Separate Houses

|

Flats/Units

|

|

Bedrooms

|

1

|

2

|

3

|

4

|

2

|

3

|

1

|

2

|

|

Orange

|

220

|

260

|

335

|

410

|

275

|

340

|

215

|

250

|

|

Bathurst

|

190

|

275

|

320

|

420

|

288

|

328

|

188

|

265

|

|

Dubbo*

|

200

|

270

|

330

|

400

|

280

|

330

|

210

|

240

|

|

Cabonne

|

-

|

-

|

260

|

-

|

-

|

260

|

-

|

-

|

|

Blayney

|

-

|

-

|

270

|

340

|

-

|

270

|

-

|

-

|

The rent for a one bedroom unit is higher in Orange than both

Bathurst and Dubbo. The rent for a two bedroom unit in Bathurst is

significantly higher than for a one bedroom unit. The prices for 2 and 3

bedroom separate houses is very similar across Orange, Bathurst and Dubbo.

Cabonne and Blayney remain more affordable than the regional

cities, providing affordable living for younger families and those on a lower

income who struggle to live in the city but work or study here.

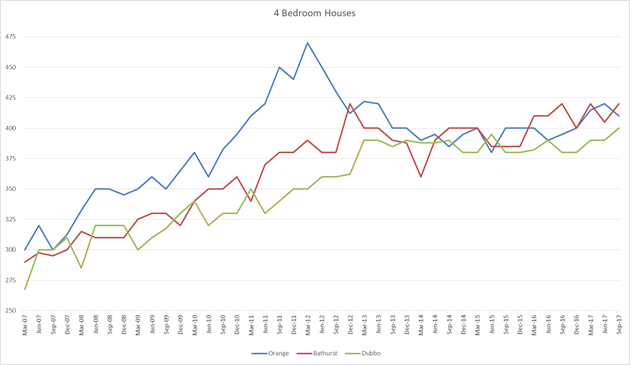

The rental costs for 3 and 4 bedroom houses in Orange were at

an all-time high between June 2011 and September 2012. This was a period of

intense commercial and mining construction with a number of projects going on

in and around the city. Accommodation at that time was at an absolute premium,

driving up the price.

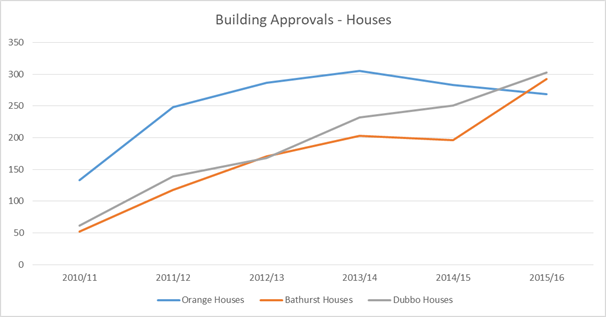

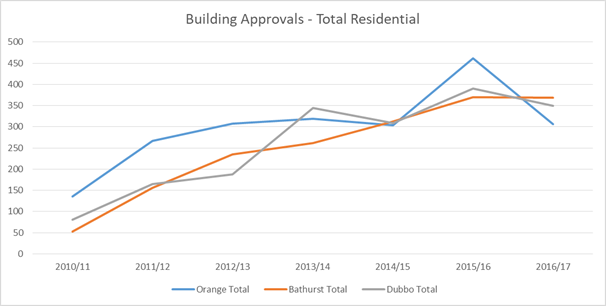

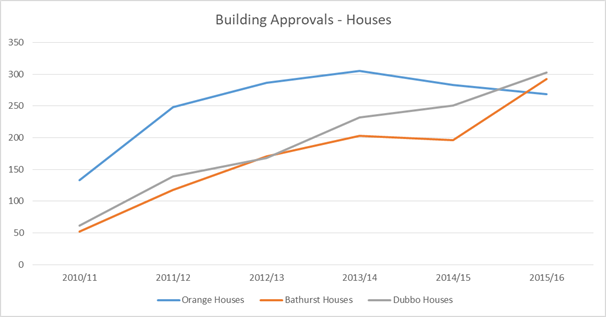

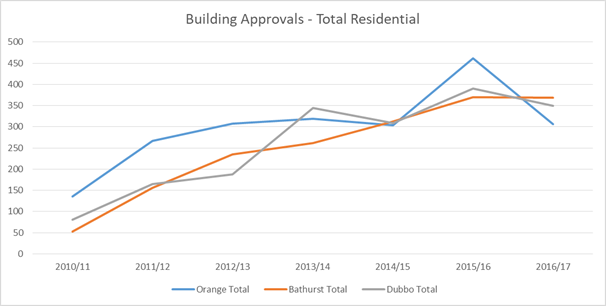

Building approvals

The number of building approvals is a key indicator in the

confidence and growth of a geographic location. While not all approvals

graduate to the commencement of construction, it is a consistent way to measure

potential building activity between regions and from year to year. This

information is from the Australian Bureau of Statistics (Category 8731.0

– Building Approvals).

The table below shows the comparison between the cities (not

LGAs) of Orange, Bathurst and Dubbo. The three measures are new houses

(houses), other new residential premises (other) and the total numbers of new

residential premises approved (Total).

|

|

|

2010/11

|

2011/12

|

2012/13

|

2013/14

|

2014/15

|

2015/16

|

2016/17

|

|

Orange

|

Houses

|

133

|

248

|

287

|

305

|

283

|

269

|

280

|

|

Other

|

2

|

19

|

20

|

14

|

21

|

193

|

26

|

|

Total

|

135

|

267

|

307

|

319

|

304

|

462

|

306

|

|

Bathurst

|

Houses

|

52

|

118

|

171

|

203

|

196

|

293

|

278

|

|

Other

|

0

|

38

|

64

|

58

|

116

|

77

|

90

|

|

Total

|

52

|

156

|

235

|

261

|

312

|

370

|

368

|

|

Dubbo

|

Houses

|

61

|

139

|

168

|

232

|

251

|

303

|

263

|

|

Other

|

20

|

26

|

20

|

112

|

58

|

87

|

86

|

|

Total

|

81

|

165

|

188

|

344

|

309

|

390

|

349

|

There was a rapid growth in building approvals in 2011. This

rapid growth has been sustained and was still at 269 at the end of last

financial year. This rapid growth in approvals (and subsequent construction)

would have contributed to keeping the median sales and rent prices in check in

Orange. Both Dubbo and Bathurst experienced a steady growth in approvals over

the same period. Although they had a higher number of approvals last financial

year, they both had less net approvals over the same period, potentially

leading to shortage in supply and driving up the median sales price.

The total building approvals for Orange shows a rapid growth

from 30/6/14 to 30/6/15. This growth is in spite of a reduction of houses being

approved in the same period. For the majority of the time the total residential

approvals in Orange are higher than in Bathurst and Dubbo. This will be in part

from having a larger population.

Economic Development Community Committee

1 May 2018

2.1 Minutes

of the Economic Development Community Committee Meeting held 18 April 2018

Attachment 1 EDCC 21

March 2018 Agenda

3.8 Future reports to the Economic

Development Community Committee

RECORD

NUMBER: 2018/618

AUTHOR: Tony

Boland, Business Projects Officer

EXECUTIVE Summary

The first meeting of the Economic Development Community Committee

is often dominated by governance issues regarding how meetings are managed and

member obligations. In order to ensure the volume of paperwork and the length

of the meeting is not overwhelming, the number of full operational reports is

limited at the first meeting.

This report summarises some operational matters that may

interest Committee Members and can be brought back to the Committee as full

reports. Alternatively, the Committee may wish to deal with some of these

matters through the Action Plan.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “11.1 Our Economy

– Encourage the growth of local business, support emerging industry

sectors and attract new investment to Orange”.

Financial Implications

Nil

Policy and Governance Implications

Nil

|

Recommendation

That the Committee indicate which reports be prepared

for future meetings.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

SUPPORTING INFORMATION

Council undertakes many activities in the field of economic

development, both at a local and at a regional level. While the general

community is aware of some of the activity undertaken (or participated in) by

Council, most people are unaware of the depth of monitoring, analysis and

activity from Council in trying to maximise economic development in a

sustainable manner.

Listed below are some of the activities that Council are

participating in, or managing, in relation to economic development. Each

activity has an accompanying paragraph summarising the activity. Committee

members may wish to receive a short verbal update on the activity, or where the

issue is more complicated, receive a full report.

Some of the current economic

development activities include:

· Events

– Council organises, funds, provides assistance to and promotes events.

The majority of the events can be found on the visitors website located at https://www.visitorange.com.au/images/Whats_on_in_Orange_2018_V3.pdf.

This document is updated as information becomes available and is free for

people to notify their event (if it is likely to be of interest to visitors).

· Regional

Economic Development Strategy (REDS) – the NSW State government has

funded a joint economic development strategy between Orange, Cabonne and

Blayney Local Government Areas (LGA). The purpose of the REDS is to look at

broader regional development issues and guide the State government on grant

funding. The REDS is in draft form but will be presented to the committee

shortly.

· Evocities –

Orange City Council has re-joined the Evocities program to attract people

living in Sydney to move to one of the seven inland cities. The Evojobs

platform (job vacancy platform) has recently been upgraded and the Evocities

Enquiry function is about to switch to a new platform.

· Shop Orange –

Council has been hosting the Shop Orange gift card program for just on 18

months. The program encourages locals to buy a Shop Orange gift card that can

only be redeemed in Orange stores that have signed up to the program. The aim

of the program is to keep local money local and stop retail leak to other

centres.

· Tourism

Development Organisation (TDO) – Orange, Cabonne and Blayney Councils

and the tourism industry have joined together to form the TDO. The committee

will be kept abreast of developments through verbal updates and formal reports

as the development of the organisation progresses. As it stands, the TDO

is working on organisational governance, regional branding and events.

· Economic

Profile – Council produces an in-depth economic profile in-house to

assist businesses and government organisations by informing them (on an

independent statistical basis) of activity and performance of Orange City,

Orange LGA and the combined Orange, Cabonne and Blayney LGAs. The profile is

continually updated as new data becomes available.

Reports to the previous Economic

Development Community Committee (formal written, conversational briefing or

formal presentation) include:

· Development of

Shiralee

· Development of old

hospital

· Grants received by

Council for economic development or tourism purposes

· Quarterly

employment and housing data

· Tourism campaigns

· Bloomfield Medical

Precinct

· Rail

infrastructure

· NBN progress and

updates

· Recreational

Vehicle parking

· Grow Local

business campaign

· Evocities

· Shop Orange

· Canberra Airport

Freight

· Murray Darling

Medical School

· Regional

Development Australia

· Orange Ex-Services

Club redevelopment

· Wangarang

Industries

· Input into the

Strategic Planning Process for Orange City Council

· Community

Strategic Plan

Council is able to research and

report on many issues related to economic development, however, Council will

not divulge information on commercial-in-confidence negotiations with

individuals, companies or government departments.

Employment

and Economic Development Policy Committee

1 May 2018

2.1 Minutes

of the Economic Development Community Committee Meeting held 18 April 2018

Attachment 2 Action

Plan - Economic Development Community Committee

|

Date

|

Action

|

Who

|

Community Strategic Plan reference

|

Budget status

|

Start

|

End

|

Update/Completed

|

Completed

|

|

18/4/18

|

Blue Mountains Expressway

|

Committee

|

11.1 Our Economy

|

$0

|

18/4/18

|

|

Individual members to lobby local

and federal member. Minutes to reflect committee’s position and

expectation.

|

|

|

18/4/18

|

Council to investigate the use of

green/renewable energy

|

Environmental Sustainability

Community Committee

|

|

$0

|

18/4/18

|

|

Committee Clerk to provide a report

to ESCC to advise them of the EDCC position.

|

|

|

18/4/18

|

Identify large scale industry/

employment opportunities for relocation

|

Committee

|

11.1 Our Economy

|

$0

|

18/4/18

|

ongoing

|

Committee members to identify

actual opportunities to staff.

|

|

|

18/4/18

|

Business Incubators

|

Business Projects Officer

|

11.1 Our Economy

|

NA

|

18/4/18

|

|

Currently working with one business

to investigate feasibility.

|

|

|

18/4/18

|

Support local retailers to move

into the online shopping space

|

Business Projects Officer

|

11.1 Our Economy

|

$0

|

18/4/18

|

|

Staff have been

identifying opportunities for information and training as well as teaming

with CenWest Innovate from CSU.

|

|

|

18/4/18

|

Work with key stakeholders to

develop a program to encourage locals to give local businesses a chance to

quote before going elsewhere to purchase.

|

Committee

|

11.1 Our Economy

|

$0

|

18/4/18

|

|

Council have been running the Shop

Orange campaign to encourage locals to shop locally.

|

|

|

18/4/18

|

Better facilities for holding large

state sporting events

|

Director Community Recreation and

Cultural Services

|

2.3.1, 4.1.1, 5.2.2,

6.2.1, 6.2.2, 6.2.3, 6.3.1, 6.3.2

|

Variable

|

18/4/18

|

ongoing

|

Council looking at rectangular

sporting complex and cricketing centre of excellence. Rectangular sports field is expected to cost upwards of $20M.

|

|

|

18/4/18

|

Build on the cycling activity and

visitation

|

Tourism Manager

|

14.1.16

|

$2m+ over 4 years

|

18/4/18

|

|

Council continues to

install the cycle ways infrastructure which a large grant had been secured

for. Cycling tourism is part of the recent funding agreement with the

industry led tourism entity.

|

|

|

18/4/18

|

Lobbying of government for upgrade

of the NBN FTTN to FTTP and the improvement of mobile service.

|

Business Projects Officer

|

11.4.3

|

$0

|

18/4/18

|

|

Will also be considered

within the concepts of smart cities and CBD upgrade.

|

|

|

18/4/18

|

Separation of heavy vehicle routes

from built up areas remains relevant. Rail crossings around south Orange and

the completion for the Southern Feeder road a priority to complete the

City’s long term ring road.

|

Manager Operations

|

14.1.1

14.1.8

15.1.1

|

$ various sources including

council and other govt funding.

|

18/4/18

|

|

Approximately $15M has

been allocated to the roads renewal over 4 years. $8M worth of projects

brought forward in the 2017/18 budget on top of other roads project funding.

SFR project remains high priority but is subject to securing funding.

|

|

|

18/4/18

|

Secure Tesla and universal charging

stations.

|

Business Projects Officer

|

11.1

|

$0

|

18/4/18

|

|

Tesla will supply a two

car charging station. Currently looking for an appropriate site. To chase up universal

charging stations. Committee Clerks from EDCC and ESCC to meet to discuss

progress.

|

|

|

18/4/18

|

Collective Renewable Energy

Purchasing

|

Orange Business Chamber

|

11.1 Our Economy

|

$0

|

18/4/18

|

|

Will approach Orange

Business Chamber and discuss viability of applying for a grant to coordinate

this.

|

|

|

18/4/18

|

Business forum on CBD redevelopment

|

Business Projects Officer

|

11.1 Our Economy

|

$0

|

18/4/18

|

|

Forum to discuss

potential CBD redevelopment, smart cities concept and issues affecting

business in the city.

|

|

|

18/4/18

|

Recreation use of Suma Park dam for

water based activities including fishing, sailing etc

|

Manager Water and Sewer Strategic

|

10.2 Facilitate & support the

attraction & development of events, festivals, venues and activities

|

$0

|

18/4/18

|

|

Report to Council in

June progressed with need to update the Gosling Creek Plan of Management

identified – this is because this is community land. Resolution

identified Suma and Spring Creek dams recreational use would be considered

subsequently. An update will be sought.

|

|

|

18/4/18

|

Improving the amenity at Mt

Canobolas

|

Director Community Recreation and

Cultural Services

|

Section

75A of the National Parks and Wildlife Act 1974

|

$0

|

18/4/18

|

|

Council has made a large funding

application seeking $10M for the development of the Mt Canobolas Mountain

Bike Trail.

|

|