ORANGE CITY COUNCIL

Finance Policy Committee

Agenda

2 May 2017

Notice

is hereby given, in accordance with the provisions of the Local Government Act

1993 that a Finance Policy Committee

meeting of ORANGE CITY

COUNCIL will be held in the Council

Chamber, Civic Centre, Byng Street, Orange on Tuesday, 2 May 2017.

Garry

Styles

General Manager

For apologies please

contact Michelle Catlin on 6393 8246.

Finance Policy Committee 2

May 2017

1 Introduction

The

provisions of Chapter 14 of the Local Government Act, 1993 (the Act)

regulate the way in which Councillors and designated staff of Council conduct

themselves to ensure that there is no conflict between their private interests

and their public role.

The

Act prescribes that where a member of Council (or a Committee of Council) has a

direct or indirect financial (pecuniary) interest in a matter to be considered

at a meeting of the Council (or Committee), that interest must be disclosed as

soon as practicable after the start of the meeting and the reasons given for

declaring such interest.

As

members are aware, the provisions of the Local Government Act restrict any

member who has declared a pecuniary interest in any matter from participating

in the discussion or voting on that matter, and requires that member to vacate

the Chamber.

Council’s Code of Conduct provides that if members have

a non-pecuniary conflict of interest, the nature of the conflict must be

disclosed. The Code of Conduct also provides for a number of ways in which a

member may manage non pecuniary conflicts of interest.

|

Recommendation

It is recommended that Committee Members now disclose any

conflicts of interest in matters under consideration by the Finance Policy

Committee at this meeting.

|

2 Committee

Minutes

2.1 Minutes of the

Audit and Risk Management Committee - 24 March 2017

TRIM

REFERENCE: 2017/758

AUTHOR: Kathy

Woolley, Director Corporate and Commercial Services

EXECUTIVE Summary

The Audit and Risk Management Committee (ARMC) met on 24

March 2017 and the minutes of that meeting are provided to the Finance Policy

Committee for adoption.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “1.3 Our City -

Ensure a robust framework that supports the community’s and

Council’s current and evolving activities, services and functions”.

Financial Implications

If an external resource is to be engaged to review the

internal audit function across the three councils who share the internal audit

function, the ARMC Chairperson has indicated the costs would be in the order of

$10,000 per Council for a total of $30,000. There is no current allocation of

this amount in the budget so this money would have to be allocated in a

quarterly review. The ARMC Chairperson is to finalise the brief and present it

to the three General Managers prior to the commissioning of this task. If an

external resource is to be engaged as suggested by the Committee to undertake a

review of Council’s Risk Management system mitigation strategies,

additional funds will be required.

Policy and Governance Implications

Nil

|

Recommendation

1 That

Council note the proposed external review of the internal audit function will

be considered by the General Managers in Bathurst, Orange and Dubbo Councils,

before the review is commissioned with a quarterly budget adjustment to be

made to allocate funding to the item if required.

2 That

in regard to item 3.7 of the draft ARMC meeting minutes of 24 March

2017, the item concerning the review of the implementation

of the mitigation strategies in the Corporate Risk Register be undertaken by

staff, not an external resource, given:

a the

level of knowledge across the entire Council required to undertake such a

review

b the

work already done by staff who are Council’s risk experts on this

specific task

c the

costs associated with bringing in an external resource in dollar terms plus

time staff will have to dedicate to manage the process

d That

the ARMC Committee members be given an opportunity to comment on the

methodology to be undertaken for the mitigation strategy review for the

General Manager’s consideration in finalising the scope of the project.

3 That

the balance of the minutes of the meeting of the Audit and Risk Management

Committee held on 24 March 2017 be adopted.

4 That

the Annual Report of the Audit and Risk Management Committee for year to

December 2016 from the Chairperson be acknowledged.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

SUPPORTING INFORMATION

The Committee received a report covering

the Audit Office’s proposed client service plan and an update on

expectations arising from the appointment of the Audit Office as the

Council’s external auditor. Intentus has been subcontracted to undertake

the audit.

The minutes illustrate two comments

suggesting additional resourcing for the Internal Audit function.

1 The first is a component in the

Chairperson’s update on the joint meeting of the Bathurst, Orange and

Dubbo Councils regarding their shared Internal Audit project. At this meeting

the discussion included possible consideration of an external resource to undertake

a review of the internal audit function across the three councils. It is

suggested by the ARMC Chairperson that the cost associated with this review

would be in the order of $10,000 per Council. There is no current budget

allocation for this item and it would have to be the subject of a quarterly

budget adjustment. As the Committee is not empowered to allocate funding, the

minutes suggestion that an agreement was made on the allocation of funds is

unable to be accepted. Hence, the recommendation is that, subject to the

approval of the scope of the works, the costs associated with the matter would

require a quarterly adjustment to the budget to allocate funds to this

exercise.

2 The second comment is implied in item 3.7

as the minutes indicate the Committee is recommending the outsourcing of a

review of the achievement of the Council’s Corporate Risk Register

mitigation strategies implementation within the Enterprise Risk Management

System. The Committee received an updated Corporate Risk Register at a prior

meeting held in November 2016 and were advised that the mitigation strategies

had been reviewed and any that had not been actioned were reclassified as tasks

to be done. This action occurred as a direct request from the Committee.

The Manager Administration and Governance is responsible for managing the

Enterprise Risk environment for Council. Individual risks are

“owned” by other staff and they are responsible for implementing

the mitigation strategies on their risk issues. The Manager Administration and

Governance has a broad view across the Council’s functions which is not

easily learnt by an external resource and given the recent review of the

strategies the Manager did to provide the Risk Register update in November

2016, it is considered the most effective cost management and efficient

approach is for the Manager to be charged with the further review of the

implementation of the mitigation strategies. In essence, the Committee is

seeking assurance that the council is managing its risks via the mitigation

strategies and that these strategies have actually been implemented.

Other compliance based checks of a similar nature are undertaken by

staff.

The minutes also suggest Council should

consider increasing the budget for internal audit. Council is advised

that there has been no increase in the internal audit program in the draft

Delivery/Operational Plan for 2017/18 – 2020/21 that Council has been

discussing at the three recent budget briefing sessions. There does not seem to

be an immediate need for this to be increased because:

· The Committee received the presentation from an Audit Office session

held in March 2017 which confirms that the Office of Local Government will not

enact the changes to the Local Government Act regarding internal audit

committees and their functions until after the next general local government

election in 2020. Therefore the committee and the internal audit program can

continue to function as it currently is.

· The proposed external review of the audit function is yet to be

scoped and costed and until these elements are known an assessment of the

affordability assessment cannot be undertaken.

The Committee also considered the rolling 3

year internal audit program including the list of other process improvement initiatives

and other management representations as necessary to give the Committee an

insight on the Council’s governance and risk management framework.

The Committee also considered the ARMC Chair’s annual

report which shows the Committee’s achievements for the year ended 31

December 2017 and recommended that it be referred to Council. This report is

attached.

Attachments

1 Minutes

of the Meeting of the Audit and Risk Management Committee held on 24 March

2017

2 Audit

and Risk Management Committee Chair Annual report - year ended 31 December

2016, D17/18505⇩

ORANGE CITY COUNCIL

MINUTES OF THE

Audit and Risk Management

Committee

HELD IN THE GENERAL MANAGER’S OFFICE, Civic Centre, Byng Street,

Orange

ON 24 March 2017

COMMENCING AT 9:34am

1 Introduction

Voting Members: Mr P Burgett (Chairperson), Cr J

Davis (Mayor), Cr J Whitton, Mr A Fletcher,

Non-Voting Members: Acting General Manager (Mr Chris

Devitt) , Director Corporate and Commercial Services, Internal Auditor

Invited: External Auditors – Mr J

O’Malley Audit Partner (Intentus Chartered Accountants), Mr D Klein

Director Financial Audit Services (Audit Office of NSW) via teleconference (for

item 3.5 only), Manager Administration and Governance (for items 1 to 3.2),

Manager Human Resources (for item 3.3 only).

1.1 Apologies and Leave of

Absence

|

RESOLVED

Cr

J Davis/Cr J Whitton

That the apologies be

accepted from Cr R Kidd and the General Manager for the Audit and Risk

Management Committee meeting on 24 March 2017.

|

1.2 Acknowledgement of Country

1.3 Declaration of pecuniary

interests, significant non-pecuniary interests and less than significant

non-pecuniary interests

Cr J Whitton declared a non-pecuniary interest in item

3.6 as he is a practitioner in cyber security and information technology services

and that that his business dealt with offering solutions to the risks raised by

this issue.

2 Previous

Minutes

|

RESOLVED

Cr

J Davis/Mr A Fletcher

That the Minutes of the

Meeting of the Audit and Risk Management Committee held on 25 November 2016 (copies

of which were circulated to all members) be and are hereby confirmed as a

true and accurate record of the proceedings of the Audit and Risk Management

Committee meeting held on 25 November 2016.

|

MATTER ARISING

The Chair gave an update on the results of a meeting between

the General Managers of the Bathrust Orange Dubbo (BOD) Alliance member

councils and their Audit and Risk Management Committee Chairpersons, noting the

Dubbo Chair was absent. The group resolved that each of the 3 Councils proceed

to purchase ACL software. The meeting also dicussed the review of the

effectiveness of the internal audit function and resourcing of the internal

audit function was also identified along with a consideration by the Councils

of funding these matters in 2017/18 budget considerations.

3 General

Reports

3.1 Internal Audit Review

Report - Fees and Charges Transactions

TRIM Reference: 2017/311

|

|

Recommendation Cr J Davis/Cr J Whitton

1

That the report by the Internal Auditor on Internal Audit Review

Report – Fees and Charges Transactions, be acknowledged.

2

That no further management action is expected to occur based on

management comments against the recommendations arising from

Observation 2 on page 25 of the report, therefore the status of the

issue should be amended to ‘closed’.

|

3.2 Audit - Asbestos

Management Plan Implementation

TRIM Reference: 2017/310

|

|

Recommendation Mr A Fletcher/Cr J Whitton

That the Audit of the Asbestos Management Plan be noted.

|

The Manager Administration and

Governance left the meeting with the time being 10:07AM.

The Manager Human Resources joined

the meeting with the time being 10:08AM.

3.3 Internal audit review

report- Work Health and Safety

TRIM Reference: 2017/394

|

|

Recommendation Mr A Fletcher/Cr J Davis

That the Internal Audit Review – Work Health and

Safety be noted.

|

The Manager Human Resources left the

meeting with the time being 10:24AM.

3.4 Audit Office

information session

TRIM Reference: 2017/477

|

|

Recommendation Mr A Fletcher/Cr J Davis

That the Committee note the update from the Audit Office

for Audit and Risk Management Committees.

|

Mr David Klein (Director Financial

Audit Services – Audit Office of NSW) joined the meeting via

teleconference with the time being 10:45AM

3.5 Audit Office Client

Service Plan

TRIM Reference: 2017/491

|

|

Recommendation Mr A Fletcher/Cr J Davis

1

That the Audit and Risk Management Committee note the Audit Office

Client Service Plan.

2

That the Committee noted that the Audit Office’s sector-wide

performance audit program for local government identifies 3 topics:

a) Council

reporting on service delivery

b) Fraud

control in local government

c) Shared

services

|

Mr David Klein (Director Financial

Audit Services – Audit Office of NSW) left the meeting with the time

being 11:07AM

3.6 External Audit

arrangements for 2016/17 and onwards

TRIM Reference: 2017/291

|

|

Cr J Whitton declared a less than significant

non-pecuniary interest in this item as he is a practitioner in cyber security

and information technology services and that his business dealt with offering

solutions to the risks raised by this issue. Cr Whitton remained in the

meeting and participated in the debate and voting on this item.

|

|

Recommendation Cr J Whitton/Mr A Fletcher

1

That the Audit and Risk Management Committee note the timetable for

the 2016/17 Audit and progress Council has made in working with the Audit

Office on the audit engagement.

2

That a report be submitted to the next meeting outlining the risk

issues around the recent legislative changes from the Commonwealth

legislation regarding reporting on breaches of privacy in respect of personal

data held by council.

|

3.7 Internal Audit

Programme Status Report as at March 2017

TRIM Reference: 2017/467

|

|

Recommendation Mr Cr Whitton/Cr J Davis

1

That additional tasks added to the Process Improvement Programme for

completion by other resources be noted.

2

That the Committee notes the changes to the Internal Audit program as:

a)

The completion of a review of the development applications process has

been delayed but is expected to be completed by the end of the financial

year.

b)

The Business Continuity Plan task has been moved from the Internal

Auditor projects to the list of process improvement initiatives.

c)

The review of accounts receivable process be deleted from the program

noting that the residual risk for this area is currently assessed as being

minor based on the results of previous audits.

d)

The review of section 64 contributions processes will not be completed

by the end of the current financial year by the Internal Auditor due to the

lack of allocated time in his program.

3

That the scope document for the development applications process audit

be distributed to members of the Committee out of session.

4

The Committee noted the Director Corporate and Commercial Services

advice that Corporate Risk Register Mitigation Strategies Review asked for at

the December 2016 meeting is to be undertaken by management. The

Committee’s view is that this review is an assurance review and should

be subject to the same planning, execution and reporting standards as

required if it was undertaken by the Internal Auditor. Accordingly, the

Director Corporate and Commercial Services agreed that the scope document for

this review will be distributed to members of the Committee out of session.

5

That as Cr Whitton’s and Mr Fletcher’s concerns around the

importance of The Corporate Risk Register Mitigation Strategies Review being

undertaken independently of management were not resolved, the Committee

authorised the independent members of the Committee to further discuss and

resolve the matter with management and update the Committee out of session.

6

That the balance of the report be noted.

7

That the Committee notes management’s intention to

restructure the current list of process improvement initiatives by other

resources under headings of compliance and process improvement.

|

The Acting General Manager (Mr C

Devitt) left the meeting with the time being 11:30AM.

3.8 ARMC Action List as at

February 2017

TRIM Reference: 2017/479

|

|

Recommendation Cr J Davis/Mr A Fletcher

1 That the report by the

Internal Auditor on ARMC Action List as at February 2017 be acknowledged.

2 That

action items marked as completed be deleted from the ARMC Action List.

|

3.9 Audit and Risk Management

Committee Chair's Annual Report for the Year Ended December 2016

TRIM Reference: 2017/245

|

|

Recommendation Mr P Burgett/Cr J Davis

1

That the ARMC annual report for the year ended 31 December 2016 by the

Audit and Risk Management Committee Chair be acknowledged.

2

That the report be referred to Council.

|

3.10 Internal Audit and Process

Improvement Plan 2017/18

TRIM Reference: 2017/493

|

|

Recommendation Cr J Whitton/Cr J Davis

1

That the item be deferred for further consideration at the June

Committee meeting.

2

That the members of the Committee provide feedback to management on

the programme out of session.

|

The Meeting

Closed at 12:30Pm.

Finance Policy Committee

2 May 2017

2.1 Minutes

of the Audit and Risk Management Committee - 24 March 2017

Attachment 1 Audit

and Risk Management Committee Chair Annual report - year ended 31 December 2016

Orange City

Council

Audit and Risk

Management Committee

Annual Report

For Year Ended 31 December 2016

CONTENTS

1.0

Introduction. 3

2.0

ARMC Purpose. 3

3.0

Membership and Meetings. 4

3.1

Management Meetings. 4

3.2

ARMC Meeting Attendance. 4

4.0

ARMC Charter. 4

5.0

Internal Audit. 5

5.1

Internal Audit appointment 5

5.2

Internal Audit Performance. 5

5.3

Internal Audit Plan. 5

5.4

Internal Audit Assignments 6

5.5

Limitation on the Internal Auditor. 6

5.6

Management Responses. 7

5.7

Internal Audit Resource Distribution. 7

6.0

Other Reports and Presentations Considered by the ARMC. 7

7.0

External Audit. 8

8.0

Risk Management. 8

9.0

Conclusion…………………………………………………………………………………………………………….8

1.0 Introduction

The

Bathurst, Orange and Dubbo (BOD) Alliance introduced the services of an

Internal Auditor in April 2009 and each Council created an Audit and Risk

Management Committee (ARMC).

One

of the benefits of sharing an Internal Audit function is that it allows the

three (3) Councils to share “best practice” experience and

knowledge. This has been further enhanced with the ARMC having a shared

independent member that provides an exchange of ideas and experience at a

senior level. This report covers the period 1 January 2016 to 31 December 2016.

The support,

experience and commitment of the General Manager, Directors and staff during

the year in facilitating the work of the ARMC enabled continuing improvement in

the effectiveness of the ARMC meeting its responsibilities under the ARMC

Charter.

2.0 ARMC

Purpose

The ARMC is an

independent advisory Committee assisting the Council to fulfil its governance

and oversight responsibilities. The primary duties and responsibilities of the

ARMC are to assist the Council to discharge its responsibilities relating to:

§ Financial

reporting process

§ Business

ethics, policies and practices

§ Management

and internal controls

§ The

integrity of the Council’s financial reporting practices and finance and

accounting compliance

§ Council’s

internal control framework, key corporate risks and all internal and external

audit related matters

§ Encouraging

continuous improvement of Council’s systems and practices

§ Internal

audit

§ The

Council's process for monitoring compliance with policies, laws and regulations

and the Council code of conduct.

During the period under review a number of

changes to the framework governing the terms of reference for audit and risk

committees in the local government sector were introduced. However, at the time

of preparing this report the sector was still awaiting promulgation of detailed

Internal Audit Guidelines by the Office of Local Government. These Regulations

are expected to provide further clarification on certain major changes to the

structure and purpose of audit and risk committees in local government but from

what is known at this time, the objectives and responsibilities are likely to

be more expansive. Essentially, the new legislation has indicated that the

Audit, Risk and Improvement Committees will be expected to carry out certain

functions which includes a strong emphasis on process improvement. While the

current practice has been that the Audit and Risk Management Committee provides

input on process improvement initiatives, the extent of the proposed

legislative requirements in this area is not yet clear. The level of resources

which Council is expected to commit to this purpose is also not yet defined but

in view of the foreshadowed wider objectives and responsibilities, the

investment by Council is likely to increase.

Orange City Council has fortunately already

taken a path of converting the Internal Audit planning into a broader process

improvement approach. The Annual Plan includes updates on compliance

based reporting against many operational areas. This monitoring is in

addition to the internal audit program the Internal Auditor is tasked to

deliver during the year.

3.0

Membership and Meetings

The Council makes all appointments to the

ARMC. The ARMC consists of voting and non-voting members. The tables below

shows the list of members and schedule of meetings held during the period and

the number of meetings attended.

3.1

Management Meetings

The

independent members met with the General Manager to discuss the operations of

the ARMC as required.

3.2 ARMC

Meeting Attendance

The

table below shows the attendance of voting and non-voting members at each

meeting scheduled by Council for the year.

|

Voting Members

|

Name

|

Meetings

|

Appointed/Resigned

|

|

Councillor Members

|

|

Attended

|

Held

|

|

|

Mayor

|

Cr John Davis

|

1

|

4

|

Appointed 1/11/’09

|

|

Councillor

|

Cr Chris Gryllis

|

2

|

4

|

Appointed 1/11/’09

|

|

Councillor

|

Cr Reg Kidd

|

1

|

1

|

Appointed 6/9/16

|

|

|

|

|

|

|

|

Independent External Members

|

|

|

|

|

|

Chair

|

Phillip Burgett

|

4

|

4

|

Appointed 11/6/’14

|

|

Independent Member

|

Andrew Fletcher

|

4

|

4

|

Appointed 1/11/’09

|

|

|

|

|

|

|

|

Non-Voting Attendees

|

|

|

|

|

|

General Manager/Acting General Manager

|

Garry Styles

|

3

|

3

|

|

|

Director - Technical Services/Acting GM

|

Chris Devitt

|

1

|

1

|

|

|

Director - Corporate & Commercial Services

|

Kathy Woolley

|

3

|

4

|

|

|

Internal Auditor

|

Shephard Shambira

|

4

|

4

|

|

|

Invitees

|

|

|

|

|

|

Manager Financial Services

|

Aaron Jones

|

4

|

|

|

|

Manager Administration & Governance

|

Michelle Caitlin

|

2

|

|

|

|

External Auditor

|

John O’Malley

|

-

|

|

|

4.0 ARMC

Charter and Internal Audit Activity Charter

The

ARMC Charter was adopted by Orange City Council meeting held on 3 July 2009.

The

Charter is reviewed annually and where necessary changes are recommended to

Council for a resolution. The ARMC resolved at its meeting on 30 September 2016

that a review of the ARMC Charter be deferred until after a decision

regarding the mergers of member councils in Bathurst, Dubbo and Orange have

been made. The Charter review should also contemplate the impact of the

amendments to the Local Government Act (1993) (NSW) relating to the Internal

Audit function.

5.0 Internal

Audit

5.1 Internal Audit Appointment

Mr

Shephard Shambira (CPA) was appointed to the position

of Internal Auditor for the BOD Alliance on 20 April 2009. This

appointment was for an initial term of 3 years, which has been extended. The

current contract extension will expire in 2017.

5.2 Internal Audit Performance

The ARMC has approved the annual and three (3) year audit plan and

overseen the satisfactory implementation of the internal audit function into

the governance activities of Council.

The Internal Auditor has built strong relationships with staff based

on the quality and manner of the reviews and the recommendations made in

internal audit reports presented to date.

The ARMC expects a strong direct correlation of the annual and

medium term internal audit plans and the risk ratings identified in

Council’s corporate risk register. Over the course of 2016 the Internal

Auditor has improved the linkage between Council’s corporate risks and

internal audit work priorities incorporated in the internal audit plans and

will be expected to continue to develop the narrative between Council’s

corporate risks and the scope of work covered in the internal audit plans to

ensure appropriate assurance is provided on the effective application of

controls managing the major corporate risks of Council.

Clause 7.3(d) of the ARMC Charter requires the ARMC to review the

effectiveness of the internal audit function and objectives, including

compliance with The Institute of Internal Auditors' International Standards

for the Professional Practice of Internal Auditing’. Whilst the ARMC

has been satisfied with the work being undertaken by the internal audit

function, best practice requires a formal independent assessment of the

performance of the Internal Audit function. A review was foreshadowed in the

2016 ARMC Report to Council but was not undertaken as no budgetary allocation

was available and Council was in the midst of the merger considerations.

The review should be contemplated by all BOD Councils again. The General

Managers of the BOD Councils have agreed to make an appropriate budget

allocation in their respective Councils 2017 – ’18 budgets.

5.3 Internal Audit Plan

The ARMC is responsible to approve the internal audit plan and

amendments including the scope of work covered in each specific review

undertaken during the period. Over the course of the year the internal audit

plan structure was modified to improve the alignment of the work undertaken

with Council’s corporate risk register.

The table of Internal Audit Assignments in Paragraph 5.4 confirms

that a limited number of reviews were completed in 2016 and none were finalised

for consideration by the Committee in the second-half of the year. The

Committee is concerned with this outcome and will examine the contributing

factors with a commitment to ensure adequate resources are committed to

complete the agreed internal audit programme in 2017 –’18.

5.4 Internal Audit Assignments

The ARMC also requires the scope of work for each internal audit

review to be documented and agreed by each member of the ARMC. This ensures

that the work undertaken addresses the specific needs of Council, management

and the ARMC.

Each meeting of the

ARMC received status reports on the Rolling 3 Year Internal Audit Programme.

The table below shows the status of various assignments carried out by internal

audit during the year under review.

|

Process

reviewed

|

Status

|

Comments

|

|

Compliance framework

|

Completed

|

Tabled at ARMC Meeting – June 2016

|

|

Fees and Charges

|

Not completed

|

Work in progress as at 31 December 2016

|

|

Work Health and Safety Compliance Review

|

Not completed

|

Work in progress as at 31 December 2016

|

|

Section 64 Contributions Process

|

Not undertaken

|

Deferred to future years

|

|

Development Applications Process

|

Not completed

|

Work in progress as at 31 December 2016

|

|

Developer Contribution Plans

|

Not undertaken

|

Deferred for completion in 2017

|

|

Records Management – Compliance with policies, responsiveness

to incoming correspondence

|

Deleted

|

Now that the merger plans are unlikely to proceed this review needs

to be scheduled in Council’s Three-Year Internal Audit Plan.

|

|

Asbestos Management Plan – rollout success, compliance and

awareness, testing of application of site controls on Naturally Occurring

Asbestos sites

|

Not completed

|

Work in progress as at 31 December 2016

|

|

Coordinating joint process improvement initiatives across the BOD

Alliance

|

On-going

|

The consultative forums in place have not resulted in any tangible

benefits and are not continuing in a structured manner. BOD Councils need to

reconsider the philosophy of ‘joint process improvement’ and

resolve the level of commitment. ARMC Chairs met with BOD General Managers in

February 2017.

|

|

Annual review of the ARMC Charter and Internal Audit Activity Charter

(Operational Policy OP081)

|

Completed

|

Annual review of the Audit and Risk Management Committee Charter was

deferred until after a decision regarding the mergers of the member councils

in Bathurst, Dubbo and Orange have been made. The charter review will

also contemplate the impact of the amendments to the Local Government Act

(1993) relating to the Internal Audit function. The review will be completed

in the 2017 calendar year.

|

|

Specific requests from the General Manager

|

Completed

|

Specific requests made by the General Manager are made in

consultation with the ARMC Chair

|

5.5

Limitations on Internal Auditor

The ARMC is not aware of any restrictions placed on the work of the

Internal Auditor.

5.6 Management Responses

The ARMC reviews all internal audit reports including unplanned or

special reports and has satisfied itself that management’s responses to

audit findings and recommendations are constructive, responsible and timely.

All issues arising have been dealt with, or are being dealt with to the

satisfaction of the ARMC.

5.7

Internal Audit Resource Distribution

The following table shows the distribution of internal audit time

among the three (3) BOD Alliance member Councils as at December 2016. On

average, 20% of the time allocated to Orange City Council is utilised on

operational meetings, administrative activities such as ARMC meetings,

professional workshops and training.

Allocation of Internal Audit Time

|

Council

|

Bathurst Regional Council

|

Orange City Council

|

Dubbo Regional Council

|

|

Percentage share of time available from 1 January 2016 to 31

December 2016*

|

27%

|

55%

|

18%

|

* At the end of the financial year each of the three (3) Councils

will have received a 33% share of the available internal audit time.

6.0 Other

Reports and Presentations Considered by the ARMC

6.1 Other

Reports

§ Presentation on

the Macquarie Pipeline Project Key Milestones and Risk Management Framework

(April 2016)

§ Analysis of Wages

and Related Risks of Financial Sustainability (April 2016)

§ Asbestos

Management Procedures (June 2016)

§ Draft Emergency

Procedures and Business Continuity Plan (June 2016)

§ Financial

Statements External Audit Timetable (September 2016)

§ 2016 Audited

Financial Statements

§ External

Auditor’s Management Letter – Second Interim Audit (September 2016)

§ Review of Corporate Risks Register

(November 2016)

7.0 External

Audit

During the period under review, the

Council’s external audit was contracted to Intentus Chartered

Accountants. However, due to legislative changes the Audit Office was appointed

as the External Auditor to all Councils in New South Wales. The Audit Office

retained the services of Intentus Chartered Accountants as a contractor to the

Auditor General assigned to carry out the external audit of Council’s

financial statements for the 2016/17 year.

The ARMC has not independently assessed

the performance of the External Auditor for the year but has reviewed the

external audit plan and have maintained contact with the Audit Principal, John

O’Malley and satisfied itself that all undertakings required under the

contract have been addressed.

The ARMC is not aware

of any non-audit services provided or any other circumstances which would pose

a threat to the independence of the external auditor.

The External Auditor’s interim and

final management letters were presented to the ARMC during the year under

review and the ARMC is monitoring management’s implementation of the

agreed action plans and responses to issues raised by the External Auditor.

The

ARMC has no concerns with the External Auditor’s audit report on

Council’s Financial Statements for the 2015/16 financial year. The ARMC

Chair discussed the audit work with the Audit Principal and there are no

outstanding issues.

8.0 Risk

Management

ARMC has reviewed Council’s risk

management strategy and continues to monitor progress on the implementation of

an enterprise wide risk management (ERM) plan.

Council made significant progress with

the development and implementation of a Corporate Risk Register. Over the

course of the period under review the number of risks identified was reviewed

and consolidated to better reflect an organisation-wide perspective allowing

more efficient prioritisation of key risks. Whilst the ERM Plan retains a

record of all identified operational and strategic risks the ARMC now regularly

receives a report on Council’s 20 Top Corporate Risks and how they are

being managed to deliver a residual risk outcome within Council’s risk

tolerances.

9.0 Conclusion

The ARMC has overseen an internal audit

and external audit program for the year under review in which the scope and

approach to the work undertaken has been appropriate and consistent with the

current understanding of Council’s enterprise risk framework.

The ARMC confirms that based on the

information provided to the ARMC from management, internal audit and external

audit, it is satisfied with the adequacy and effectiveness of Council’s

arrangements for governance, risk management, internal control and regulatory

compliance.

The areas of responsibility of the ARMC

set out in Clause 7 of the Audit and Risk Management Committee Charter are

managed in conjunction with the internal audit and external audit plans

executed during the year.

In that regard, following a recommendation

from the ARMC, the Councils explored the implementation of an internal audit

software platform which will provide the capability of more extensive

interrogation of transactions to verify the application of risk management

controls and policies as mitigation factors in managing the residual risks

recorded in the enterprise risk management register.

The impact of this objective on the

structure of the internal audit plan and allocation of resources between

internal audit and external audit will be reflected in the 2017-’18

Internal Audit Plan.

PP

Burgett

Chairman

3 General

Reports

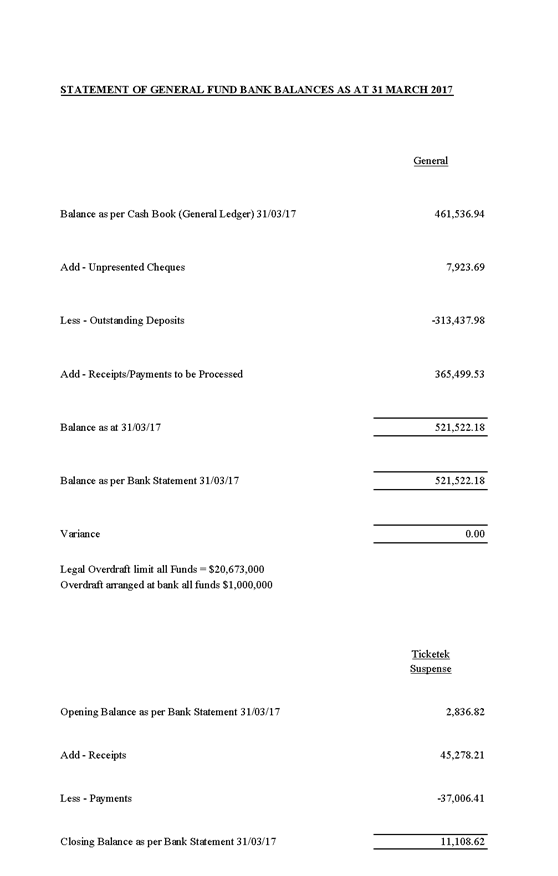

3.1 Statement of Bank

Balances as at 31 March 2017

TRIM

REFERENCE: 2017/774

AUTHOR: Kim

Thompson, Accounting Officer - Management

EXECUTIVE Summary

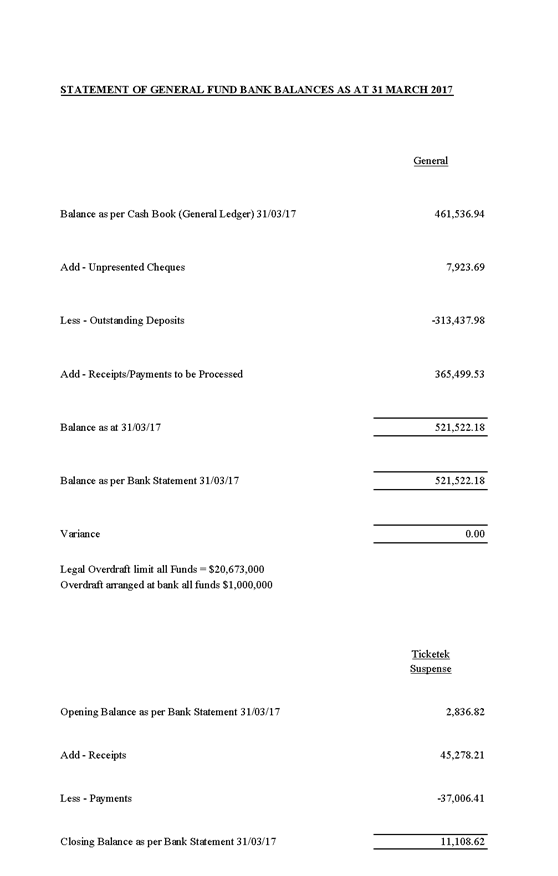

Council operates one Bank Account and is required to carry

out a Bank Reconciliation at the end of each month. As at 31 March 2017 the

Cash Book Balance was $461,536.94.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the Delivery/Operational

Plan strategy “1.2 Our City - Information and advice

provided for the decision-making process will be succinct, reasoned, accurate,

timely and balanced”.

Financial Implications

Nil

Policy and Governance Implications

Nil

|

Recommendation

That the information provided in the report by the

Accounting Officer – Management on the Statement of Bank Balances as at

31 March 2017 be acknowledged.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

Attachments

1 Bank

Reconciliation as at 31 March 2017, D17/25389⇩

Finance Policy Committee

2 May 2017

3.1 Statement

of Bank Balances as at 31 March 2017

Attachment 1 Bank

Reconciliation as at 31 March 2017

3.2 Request

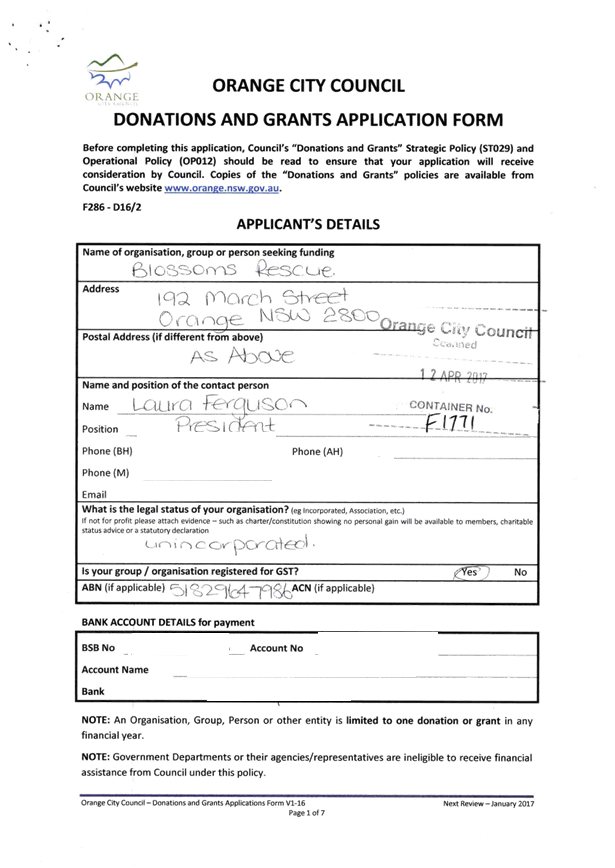

for Financial Assistance

TRIM

REFERENCE: 2017/775

AUTHOR: Josie

Sanders, Management Accountant

EXECUTIVE Summary

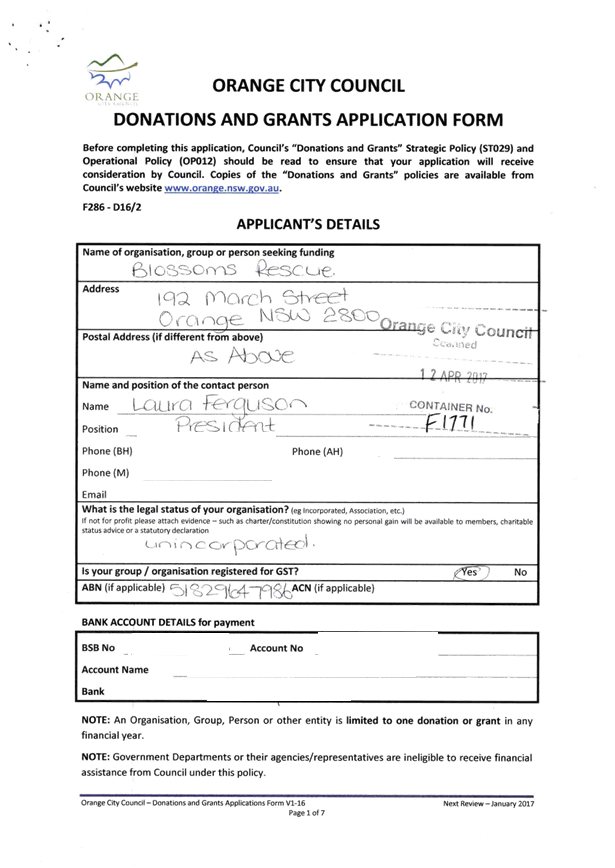

Council is in receipt of requests for financial assistance

under section 356 of the Local Government Act 1993. The report provides details

of applications received.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “3.3 Our City –

Recognise that members of the community will take different leadership

pathways, the Council will support this growth and development through

appropriate activities, initiatives and assistance”.

Financial Implications

None of the applications are recommended to be funded

because there are no uncommitted available funds for the applications attached

to the report given both the General Donations and Major Promotions budget have

been fully expended.

The Donations Policy is promoted widely as part of the

budget process and all applicants (successful or not) who have sought donations

in the past couple of years, are individually written to with an invitation for

them to make submissions for donations/sponsorships so their allocation is more

certain given it is included in the budget processes.

$2,000 for each Councillor has been reserved to enable

Councillors to allocate up to $2,000 each to requests as they arise throughout

the year. If any of the attached are supported by a Councillor, an allocation

can be made from their remaining allocation. A table is provided below and it

will be updated with each report to show how much each Councillor has

apportioned to their supported projects.

The overall donations/sponsorship budget for 2016/17 is as

follows:

|

Program

|

Adopted Budget

|

Actual/Committed

|

Remaining balance

|

|

General Donations

|

$84,378

|

$84,378*

|

Nil

|

|

Major Promotions

|

$72,127

|

$72,127

|

Nil

|

* The allocation of 19 x $100 reserved for school prize

giving is accounted for in the actual/committed column of the table. The

actual/committed column also includes the Councillor allocation of $24,000

($2,000 per Councillor) which is available to be allocated by Councillors

throughout the year.

Process for the application of the remaining budget

allocation

A Council resolution is required to allocate funds to any

external entity, including as a donation. Hence, the provision of donations can

only occur upon a Councillor’s request being specifically included in a

resolution.

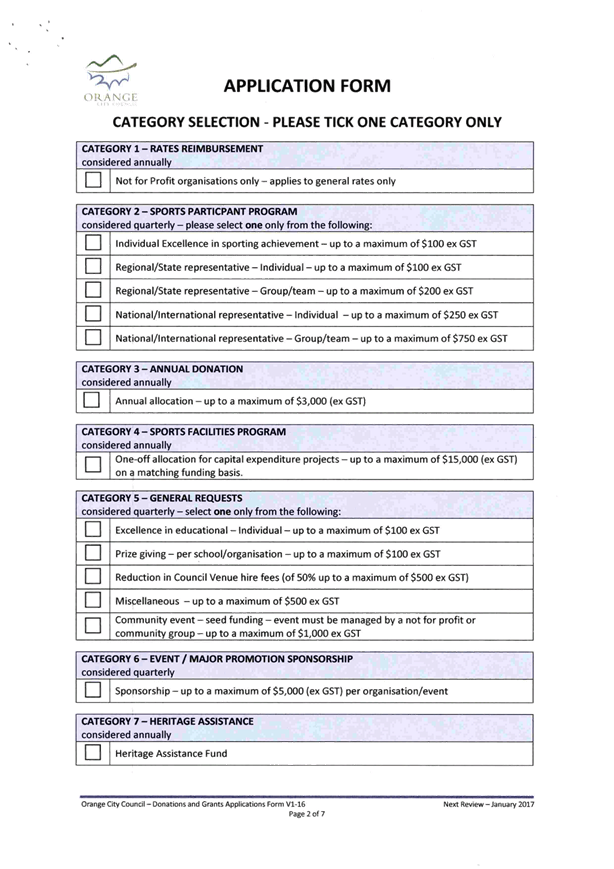

Applications are considered against the criteria outlined in

the Donations Policy. There is an application form that should be submitted to

commence the process of making a donation to another entity. The form contains

details that inform Council that the donation aligns with the intentions the

Council has established in the Community Strategic Plan.

Where a Councillor has advised they wish to pledge money to

a particular cause, the pledge will be noted in the financial assistance

report.

The steps to have donations considered are as follows:

1 Applicant

completes donations form – available on the Council website or can be

sent to the applicant.

2 Application

is assessed against the criteria in the Donations Policy and reported to

Council in the financial assistance report.

3 Council

considers applications at a Council Meeting with Councillors specifically

including in a resolution the amount and recipient of any donations supported.

4 In

accordance with s356 of the Local Government Act, some donations require

advertising and then a report back to Council of any submissions is required

(i.e. where the recipient acts for financial benefit for example).

Individual

Councillor allocations are as follows:

|

Councillor

|

Adopted

Budget

|

Actual/Committed

(as

resolved)

|

Remaining

balance

|

|

Councillor Davis

|

$2,000

|

$2,000 – Forbes Flood Appeal

|

Nil

|

|

Councillor Hamling

|

$2,000

|

$500 – Canobolas High School

$500 – Orange White Ribbon

$500 – Clontarf Foundation

$500 – Orange Bush Nippers

|

Nil

|

|

Councillor Brown

|

$2,000

|

$2,000 - Leukaemia Foundation

|

Nil

|

|

Councillor Duffy

|

$2,000

|

$500 – Come Together Choir

$500 – Foodcare Orange

$500 – Fusion

$500 – Carewest Preschool

|

Nil

|

|

Councillor Gander

|

$2,000

|

$1,500 – Foodcare Orange

$500 - Fusion

|

Nil

|

|

Councillor Gryllis

|

$2,000

|

$500 – Canobolas High School

$500 – Carewest Preschool

$1,000 – Forbes Flood Appeal

|

Nil

|

|

Councillor Jones

|

$2,000

|

$2,000 - Riding for the Disabled

|

Nil

|

|

Councillor Kidd

|

$2,000

|

$2,000 – Light it Red for

Dyslexia

|

Nil

|

|

Councillor Munro

|

$2,000

|

$2,000 – Anson St School

|

Nil

|

|

Councillor Taylor

|

$2,000

|

$500 – Community Christmas

Lunch

$500 – Blossoms Rescue

|

$1,000

|

|

Councillor Turner

|

$2,000

|

$500 – Come Together Choir

$1,500 – At The Vineyard

|

Nil

|

|

Councillor Whitton

|

$2,000

|

$350 – Riding for the

Disabled

$500 – Community Christmas

Lunch

$200 – Tiarah Jade Fisher

|

$950

|

Policy and Governance Implications

Nil

|

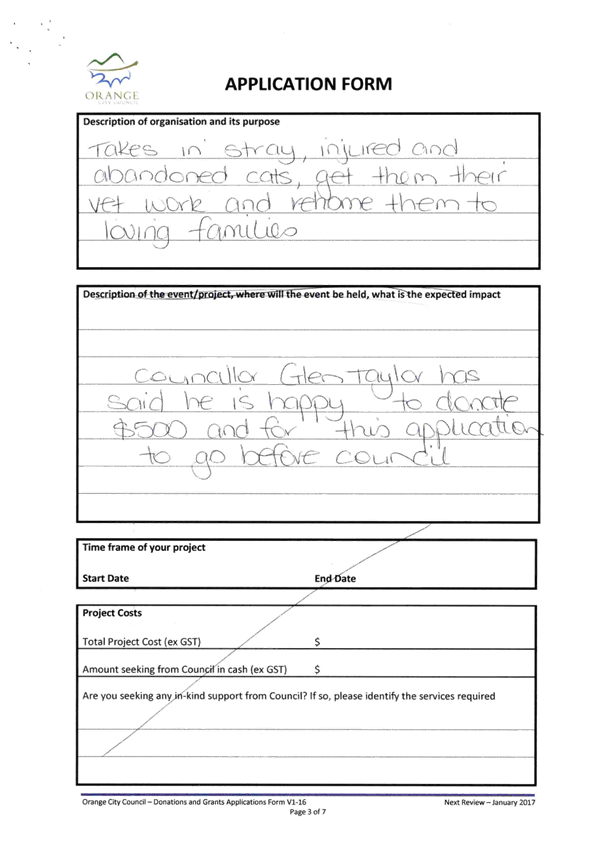

Recommendation

That Council approve the donation request to Blossoms

Rescue of $500 from Councillor Taylor’s allocation.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

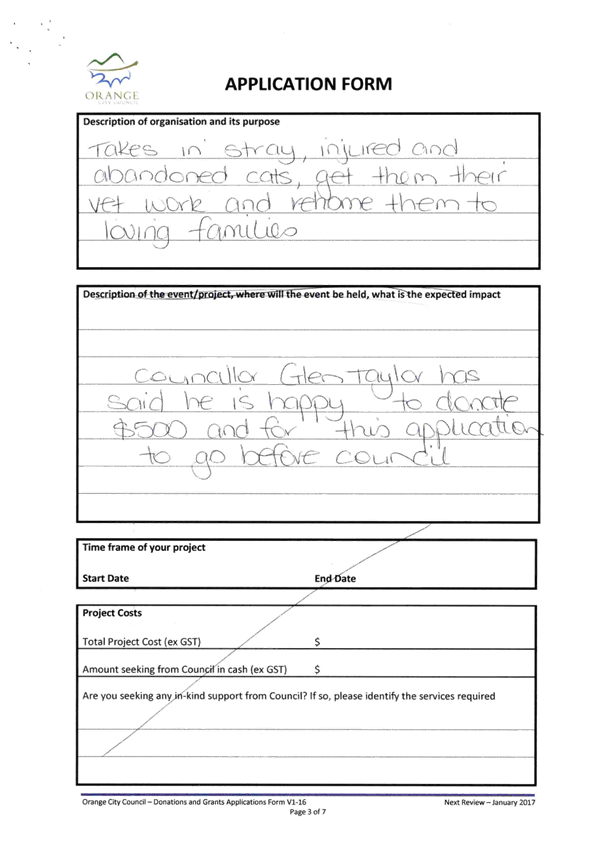

SUPPORTING INFORMATION

Blossoms Rescue – This organisation rehomes

stray, injured and abandoned cats. Cr Taylor has pledged $500 from his

remaining allocation.

Attachments

1 Donation

Table - 2 May 2017, D17/25396⇩

2 Blossoms

Rescue, IC17/7335⇩

Finance Policy Committee

2 May 2017

3.2 Request

for Financial Assistance

Attachment 1 Donation

Table - 2 May 2017

|

No

|

Applicant

|

Amount Sought

|

Policy Position

|

Purpose

|

Comment

|

Recom-mended

|

To be advertised

|

|

A.1

|

Blossoms Rescue

|

$500

|

General Request – Up to a maximum of $500

|

Blossoms Rescue rehomes stray, injured and abandoned

cats.

|

Cr Taylor has pledged to support this

request from his remaining allocation

|

Yes

|

No

|

Finance

Policy Committee

2 May 2017

3.2 Request

for Financial Assistance

Attachment 2 Blossoms

Rescue