ORANGE CITY COUNCIL

Finance Policy Committee

Agenda

1 November 2016

Notice

is hereby given, in accordance with the provisions of the Local Government Act

1993 that a Finance Policy Committee

meeting of ORANGE CITY

COUNCIL will be held in the Council

Chamber, Civic Centre, Byng Street, Orange on Tuesday, 1 November

2016.

Garry

Styles

General Manager

For apologies please

contact Michelle Catlin on 6393 8246.

1 Introduction

1.1 Declaration

of pecuniary interests, significant non-pecuniary interests and less than

significant non-pecuniary interests

The

provisions of Chapter 14 of the Local Government Act, 1993 (the Act)

regulate the way in which Councillors and designated staff of Council conduct

themselves to ensure that there is no conflict between their private interests

and their public role.

The

Act prescribes that where a member of Council (or a Committee of Council) has a

direct or indirect financial (pecuniary) interest in a matter to be considered

at a meeting of the Council (or Committee), that interest must be disclosed as

soon as practicable after the start of the meeting and the reasons given for declaring

such interest.

As

members are aware, the provisions of the Local Government Act restrict any

member who has declared a pecuniary interest in any matter from participating

in the discussion or voting on that matter, and requires that member to vacate

the Chamber.

Council’s Code of Conduct provides that if members

have a non-pecuniary conflict of interest, the nature of the conflict must be

disclosed. The Code of Conduct also provides for a number of ways in which a

member may manage non pecuniary conflicts of interest.

|

Recommendation

It is recommended that Committee Members now disclose any

conflicts of interest in matters under consideration by the Finance Policy

Committee at this meeting.

|

2 Committee

Minutes

2.1 Minutes of the

Audit and Risk Management Committee - 30 September 2016

TRIM

REFERENCE: 2016/2527

AUTHOR: Kathy

Woolley, Director Corporate and Commercial Services

EXECUTIVE Summary

The Audit and Risk Management Committee met on 30 September

2016 and the minutes of that meeting are provided to the Finance Policy

Committee for adoption.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “1.3 Our City -

Ensure a robust framework that supports the community’s and

Council’s current and evolving activities, services and functions”.

Financial Implications

Council has been advised that as a council included in the

NSW Government’s merger proposals under consideration by the Office of

Local Government since referral on 6 January 2016, Council must comply with the

merger proposal period guidelines issued under S23A of the Local Government Act

1993.

The guidelines instruct Council it should expend money in

accordance with the detailed budget adopted for the purposes of implementing

the Delivery/Operational Plan for the

2015/16 year.

Any expenditure outside the adopted budget requires the

identification of clear and compelling grounds and must be approved by Council

at a meeting that is open to the public. The guidelines indicate the resolution

of Council for increased expenditure must specify the reasons why the

expenditure is required and warranted.

If increased expenditure is greater than $250,000 or 1% of

the Council’s revenue from rates in

the preceding year, whichever is the greater, Council

is required to exhibit the increase to the budget and consider comments

received.

Council must also avoid entering into contracts or

undertakings where expenditure or revenue is greater than $250,000 or 1% of the

Council’s revenue from rates in the

preceding year, whichever is the greater, unless the contract or undertaking is

as a result of a decision or procurement process commenced prior to the merger

proposal period or where entering into a contract or undertaking is reasonably

necessary for the purposes of meeting the ongoing service delivery commitments

of the Council or was previously approved in the Council’s

Delivery/Operational Plan.

Policy and Governance Implications

Nil

|

Recommendation

That the minutes of the meeting of the Audit and Risk

Management Committee held on 30 September 2016 be adopted.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

SUPPORTING INFORMATION

The Committee noted progress achieved with

the preparation of Council’s 2015/16 financial year end statements.

The Committee also considered the External

Auditor’s second interim audit management letter and provided feedback.

It is recommended that the annual review of

the Audit and Risk Management Committee Charter be deferred until after a

decision regarding the mergers of the member councils in Bathurst, Dubbo and

Orange have been made.

The Committee also recommended amendments

to the internal audit program as necessary to allow completion of an assessment

of various processes.

Attachments

1 Minutes

of the Meeting of the Audit and Risk Management Committee held on 30 September

2016

ORANGE CITY COUNCIL

MINUTES OF THE

Audit and Risk Management

Committee

HELD IN Committee Room 3, Civic Centre, Byng Street, Orange

ON 30 September 2016

COMMENCING AT 9.00am

1 Introduction

Mr P Burgett (Chairperson), Cr R Kidd, Mr A Fletcher (voting

members).

Acting General Manager (Chris Devitt), Director Corporate

and Commercial Services, Internal Auditor (non-voting members), Manager

Financial Services (invited attendee).

1.1 Apologies and Leave of

Absence

|

RESOLVED Cr

R Kidd/Mr A Fletcher

That the apologies be

accepted from Cr J Davis OAM (Mayor), Cr J Whitton, Mr G Styles

(General Manager) and Mr J O’Malley (External Auditor) for the Audit

and Risk Management Committee meeting on 30 September 2016.

|

1.2 Acknowledgement of Country

1.3 Declaration of pecuniary

interests, significant non-pecuniary interests and less than significant

non-pecuniary interests

Nil

2 Previous

Minutes

|

RESOLVED Mr

A Fletcher/Mr P Burgett

1

That the Minutes of the Meeting of the Audit and Risk Management

Committee held on 24 June 2016 (copies of which were circulated to all

members) be amended to distinguish between voting members, non-voting members

and invited attendees.

2

That subject to the above amendment, the Minutes of the Meeting of the

Audit and Risk Management Committee held on 24 June 2016 (copies of which

were circulated to all members) be and are hereby confirmed as a true and

accurate record of the proceedings of the Audit and Risk Management Committee

meeting held on 24 June 2016.

|

3 General

Reports

3.1 Financial Statements -

External Audit Timetable

TRIM Reference: 2016/2226

|

|

Recommendation Mr A Fletcher/Cr R Kidd

1

That the Audit and Risk Management Committee note the change of

the end of year audit date to the week commencing 17 October 2016.

2

That a copy of the draft financial statements be circulated to

Committee members out of session as soon as they are available for their

review.

3

That individual members of the Committee provide their comments

and feedback on the 2016 draft financial statements to the Committee

Chairperson.

4

That the Committee Chairperson discuss any matters arising from

members comments and feedback with the External Auditor prior to presentation

of the financial statements to Council.

|

3.2 Management Letter -

Second Interim Audit

TRIM Reference: 2016/2227

|

|

Recommendation Mr A Fletcher/Cr R Kidd

1

That the members of the Audit and Risk Management Committee note the

second interim audit management letter.

2

That the Committee noted the additional information provided by

management in relation to mitigating controls over payroll transactions.

3

That the Committee considered this additional commentary on payroll

control processes and deemed it satisfactory to mitigate the risk issues

raised by the External Auditor.

4

That management be requested to provide feedback on the payroll

mitigating controls discussion to the External Auditor.

|

3.3 Audit and Risk

Management Committee Charter Annual Review

TRIM Reference: 2016/2141

|

|

Recommendation Cr R Kidd/Mr A Fletcher

1

That the annual review of the Audit and Risk Management Committee

Charter be deferred until after a decision regarding the mergers of the

member councils in Bathurst, Dubbo and Orange have been made.

2

That the charter review also contemplate the impact of the amendments

to the Local Government Act (1993) relating to the Internal Audit function.

3

That management enquire with the Office of Local Government as to when

Local Government Act Regulations relating to internal audit functions are

likely to be published.

|

3.4 Internal Audit

Programme Status Report as at September 2016

TRIM Reference: 2016/2148

|

|

Recommendation Cr R Kidd/Mr A Fletcher

1

That changes to the Internal Audit program as follows be noted:

a The

fees and charges audit delivery date will be in the October to December

2016 period.

b The

development services processes audit delivery date will be in the October to

December 2016 period.

c That

the Records Management audit be deleted from the program for 2016/17 and be

reconsidered in the review of subsequent years’ programming when next

reviewed in March 2017.

d That

the Business Continuity Plan audit delivery be deferred to the April to June

2017 period.

e That

the Work Health Safety compliance review audit program delivery date be in

the January to March 2017 period.

2

That the balance of the report be noted.

3

That the Internal Auditor be requested to amend the 2016/17

internal audit programme to include a review of the corporate risk register.

The review will focus on establishing whether the risk mitigation strategies

identified in the corporate risk registers are in place. That the impact of

this amendment to the internal audit programme be reported to the next

meeting.

4

That the cumulative number of audit days as indicated on the copy of

the internal audit programme for the 2016/17 financial year be reviewed and

reconciled with the total number of days allocated to Orange City Council.

5

That the revised copy of the 2016/17 financial year internal audit

programme be distributed to Committee members out of session.

|

3.5 ARMC Action List as at

September 2016

TRIM Reference: 2016/2229

|

|

Recommendation Mr A Fletcher/Cr R Kidd

1 That the report by the

Internal Auditor on ARMC Action List as at September 2016 be acknowledged.

2 That action

items marked as completed be deleted from the ARMC Action List.

3 That the Committee noted

the information provided on Action Item number 2016A06.04 and that this item

be deleted from the Action List.

4 That Committee

members identify additional inspections of interest.

5 That the insurance review

conducted annually be added to the “Process Improvement Projects by

Other Resources” section of the internal audit programme, with scope to

include the process used to review insurance coverage.

|

The Meeting

Closed at 10:57AM.

3 General

Reports

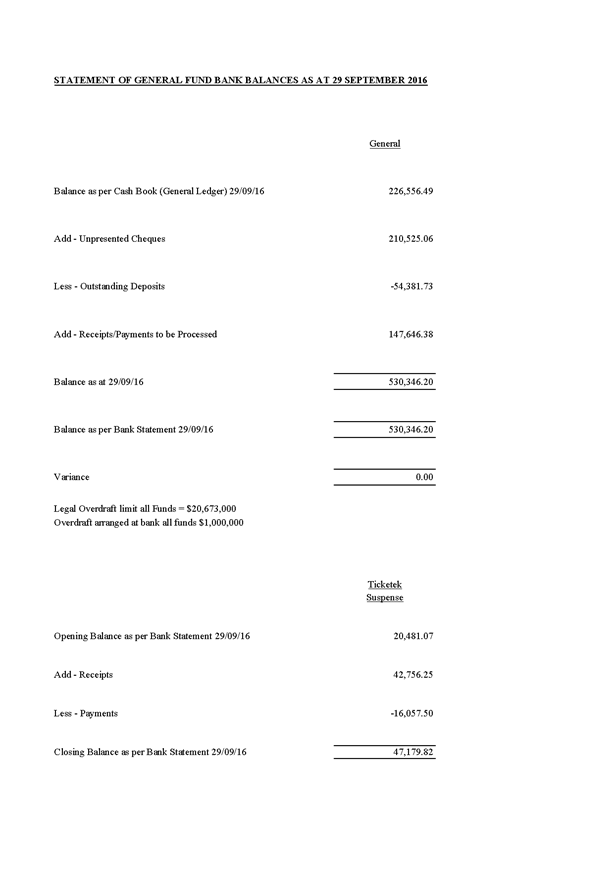

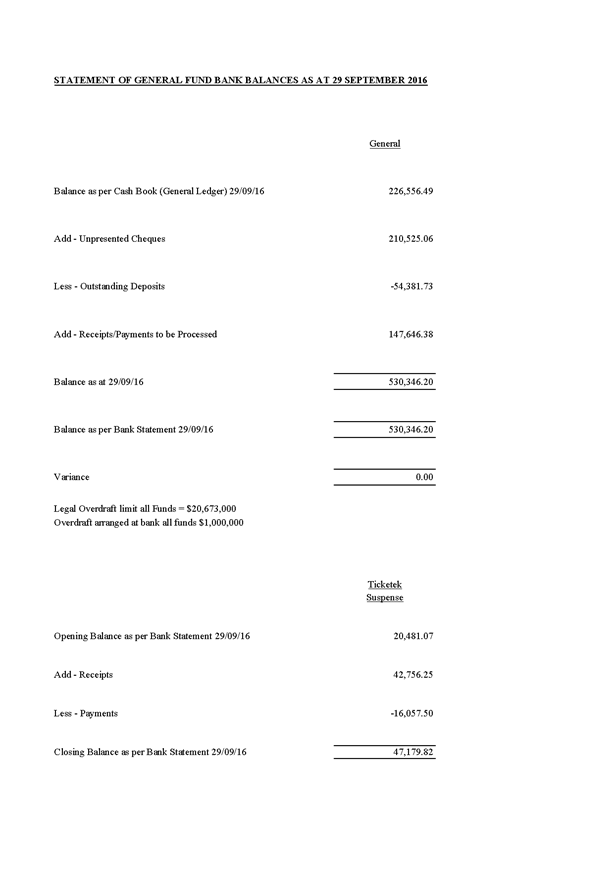

3.1 Statement of Bank

Balances as at 29 September 2016

TRIM

REFERENCE: 2016/2493

AUTHOR: Kim

Thompson, Accounting Officer - Management

EXECUTIVE Summary

Council operates one Bank Account and is required to carry

out a Bank Reconciliation at the end of each month. As at 29 September 2016,

the Cash Book Balance was $226,556.49.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “1.2 Our City -

Information and advice provided for the decision-making process will be

succinct, reasoned, accurate, timely and balanced”.

Financial Implications

Council has been advised that as a council included in the

NSW Government’s merger proposals under consideration by the Office of

Local Government since referral on 6 January 2016, Council must comply with the

merger proposal period guidelines issued under S23A of the Local Government Act

1993.

The guidelines instruct Council it should expend money in

accordance with the detailed budget adopted for the purposes of implementing

the Delivery/Operational Plan for the 2015/16 year.

Any expenditure outside the adopted budget requires the

identification of clear and compelling grounds and must be approved by Council

at a meeting that is open to the public. The guidelines indicate the resolution

of Council for increased expenditure must specify the reasons why the

expenditure is required and warranted.

If increased expenditure is greater than $250,000 or 1% of

the Council’s revenue from rates in

the preceding year, whichever is the greater, Council

is required to exhibit the increase to the budget and consider comments

received.

Council must also avoid entering into contracts or

undertakings where expenditure or revenue is greater than $250,000 or 1% of the

Council’s revenue from rates in the

preceding year, whichever is the greater, unless the contract or undertaking is

as a result of a decision or procurement process commenced prior to the merger

proposal period or where entering into a contract or undertaking is reasonably

necessary for the purposes of meeting the ongoing service delivery commitments

of the Council or was previously approved in the Council’s

Delivery/Operational Plan.

Policy and Governance Implications

Nil

|

Recommendation

That the information provided in the report by the

Accounting Officer – Management on the Statement of Bank Balances as at

29 September 2016 be acknowledged.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

Attachments

1 Bank

Reconciliation as at 29 September 2016, D16/50275⇩

Finance Policy Committee

1 November 2016

3.1 Statement

of Bank Balances as at 29 September 2016

Attachment 1 Bank

Reconciliation as at 29 September 2016

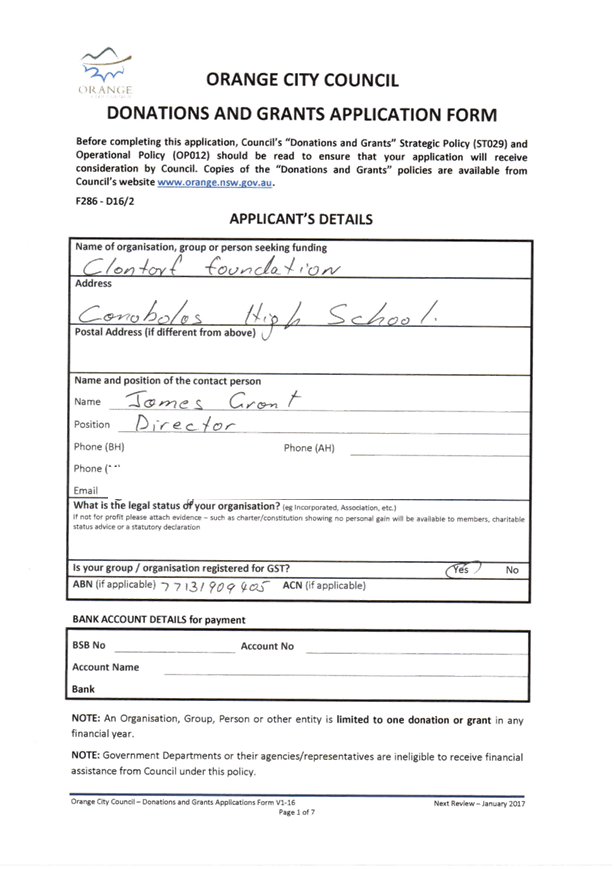

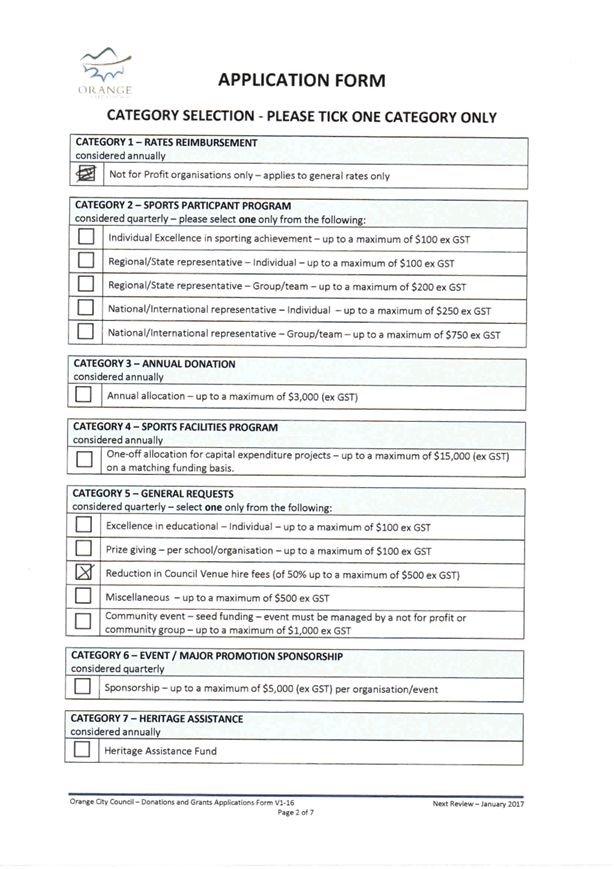

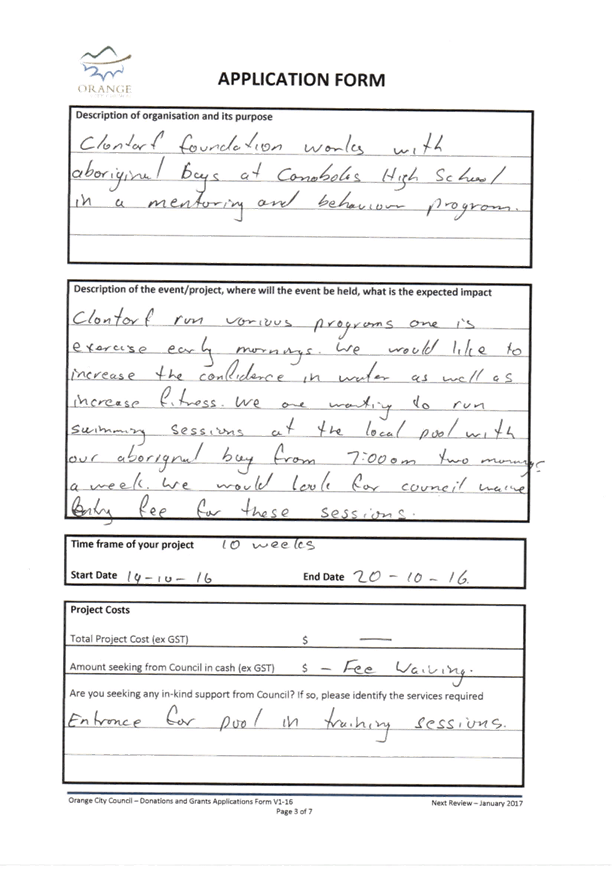

3.2 Request

For Financial Assistance

TRIM

REFERENCE: 2016/2470

AUTHOR: Josie

Sanders, Management Accountant

EXECUTIVE Summary

Council is in receipt of requests for financial assistance

under section 356 of the Local Government Act 1993. The report provides details

of applications received.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “3.3 Our City –

Recognise that members of the community will take different leadership

pathways, the Council will support this growth and development through

appropriate activities, initiatives and assistance”.

Financial Implications

Council has been advised that as a council included in the

NSW Government’s merger proposals under consideration by the Office of

Local Government since referral on 6 January 2016, Council must comply with the

merger proposal period guidelines issued under S23A of the Local Government Act

1993.

The guidelines instruct Council it should expend money in

accordance with the detailed budget adopted for the purposes of implementing

the Delivery/Operational Plan for the 2015/16 year.

Any expenditure outside the adopted budget requires the

identification of clear and compelling grounds and must be approved by Council

at a meeting that is open to the public. The guidelines indicate the resolution

of Council for increased expenditure must specify the reasons why the

expenditure is required and warranted.

If increased expenditure is greater than $250,000 or 1% of

the Council’s revenue from rates in the

preceding year, whichever is the greater, Council

is required to exhibit the increase to the budget and consider comments

received.

Council must also avoid entering into contracts or

undertakings where expenditure or revenue is greater than $250,000 or 1% of the

Council’s revenue from rates in the

preceding year, whichever is the greater, unless the contract or undertaking is

as a result of a decision or procurement process commenced prior to the merger

proposal period or where entering into a contract or undertaking is reasonably

necessary for the purposes of meeting the ongoing service delivery commitments

of the Council or was previously approved in the Council’s

Delivery/Operational Plan.

Implications in this report

None of the applications are recommended to be funded

because there are no uncommitted available funds for the applications attached

to the report given both the General Donations, and Major Promotions budget

have been fully expended.

As Council is aware, the Donations Policy is promoted widely

as part of the budget process and all applicants (successful or not) who have

sought donations in the past couple of years are individually written to with

an invitation for them to make submissions for donations/sponsorships so their

allocation is more certain given it is included in the budget processes. This

has been successfully completed again this year.

However, for the first time this year, $2,000 for each

Councillor has been reserved to enable Councillors to allocate up to $2,000

each to requests as they arise throughout the year. If any of the attached are

supported by a Councillor, an allocation can be made from their remaining

allocation. A table is provided below and it will be updated with each report

to show how much each Councillor has apportioned to their supported projects.

The overall donations/sponsorship budget for 2016/17 is as

follows:

|

Program

|

Adopted Budget

|

Actual/Committed

|

Remaining balance

|

|

General Donations

|

84,378

|

84,378*

|

Nil

|

|

Major Promotions

|

72,127

|

72,127

|

Nil

|

* The allocation of 19 x $100 reserved for school prize

giving is accounted for in the actual/committed column of the table. The

actual/committed column also includes the Councillor allocation of $24,000

($2,000 per Councillor) which is available to be allocated by Councillors

throughout the year.

Process for the application of the remaining budget

allocation

A Council resolution is required to allocate funds to any

external entity, including as a donation. Hence, the provision of donations can

only occur upon a Councillor’s request being specifically included in a

resolution.

Applications are considered against the criteria

outlined in the Donations Policy. There is an application form that

should be submitted to commence the process of making a donation to another

entity. The form contains details that inform Council that the donation aligns

with the intentions the Council has established in the Community Strategic

Plan.

Where a Councillor has advised they wish to pledge

money to a particular cause, the pledge will be noted in the financial

assistance report.

The steps to have donations considered is as follows:

1 Applicant

completes donations form – available on the Council website or can be

sent to the applicant.

2 Application

is assessed against the criteria in the Donations Policy and reported to

Council in the financial assistance report.

3 Council

considers applications at a Council Meeting with Councillors specifically

including in a resolution the amount and recipient of any donations supported.

4 In

accordance with s356 of the Local Government Act, some donations require

advertising and then a report back to Council of any submissions is required

(i.e. where the recipient acts for financial benefit for example).

Individual

Councillor allocations are as follows:

|

Councillor

|

Adopted

Budget

|

Actual/Committed

(as

resolved)

|

Remaining

balance

|

|

Councillor Davis

|

$2,000

|

$2,000 – Forbes Flood Appeal

|

Nil

|

|

Councillor Hamling

|

$2,000

|

$500 – Canobolas High School

$500 – Orange White Ribbon

|

$1,000

|

|

Councillor Brown

|

$2,000

|

$2,000 - Leukaemia Foundation

|

Nil

|

|

Councillor Duffy

|

$2,000

|

$500 – Come Together Choir

$500 – Foodcare Orange

$500 – Fusion

$500 – Carewest Preschool

|

Nil

|

|

Councillor Gander

|

$2,000

|

$1,500 – Foodcare Orange

$500 - Fusion

|

Nil

|

|

Councillor Gryllis

|

$2,000

|

$500 – Canobolas High School

$500 – Carewest Preschool

$1,000 – Forbes Flood Appeal

|

Nil

|

|

Councillor Jones

|

$2,000

|

$0

|

$2,000

|

|

Councillor Kidd

|

$2,000

|

$2,000 – Light it Red for

Dyslexia

|

Nil

|

|

Councillor Munro

|

$2,000

|

$2,000 – Anson St School

|

Nil

|

|

Councillor Taylor

|

$2,000

|

$0

|

$2,000

|

|

Councillor Turner

|

$2,000

|

$500 – Come Together Choir

|

$1,500

|

|

Councillor Whitton

|

$2,000

|

$0

|

$2,000

|

Policy and Governance Implications

Nil

|

Recommendation

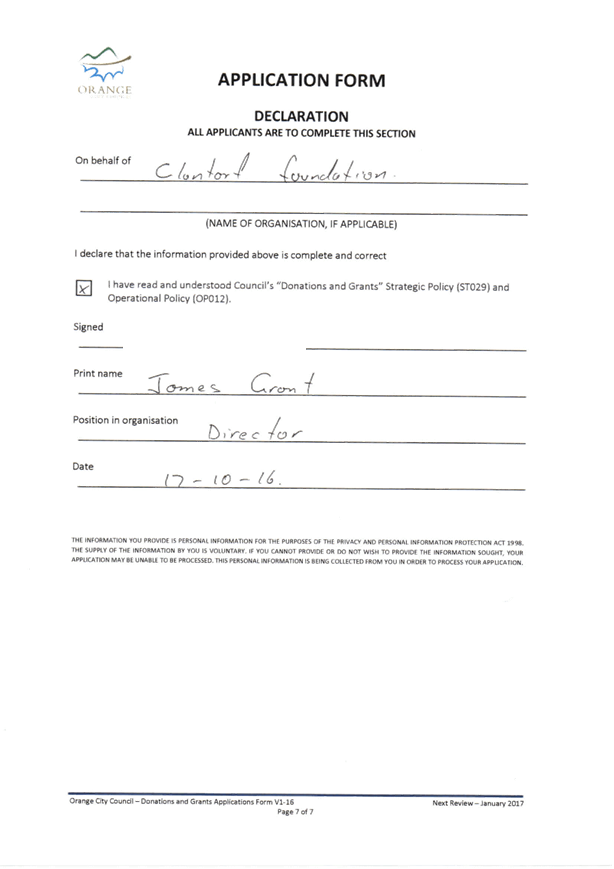

1 That

a donation of $500 be made to the Clontarf Foundation as a pool fees entry

credit from Cr Hamling’s allocation.

2 That

councillors specify any other donation recipients and the amounts for each

donation

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

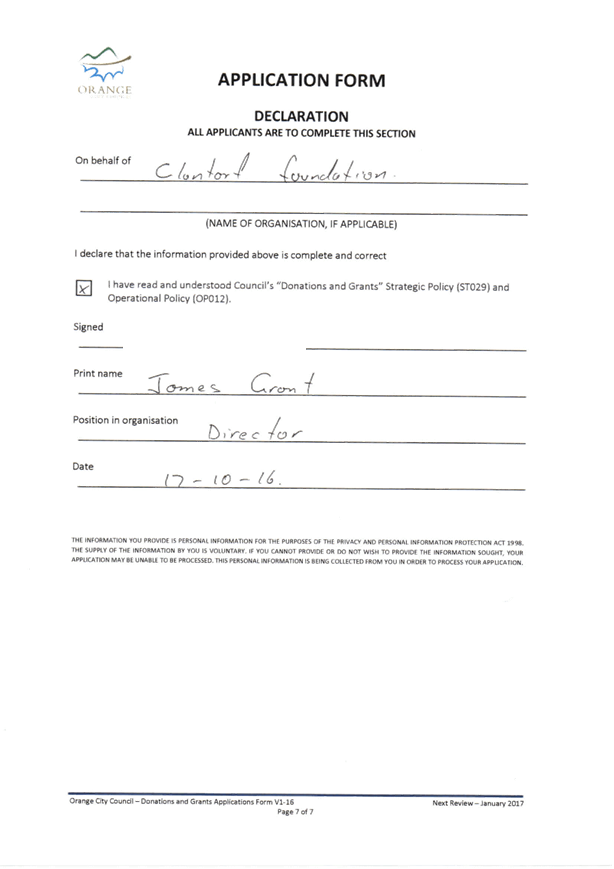

SUPPORTING INFORMATION

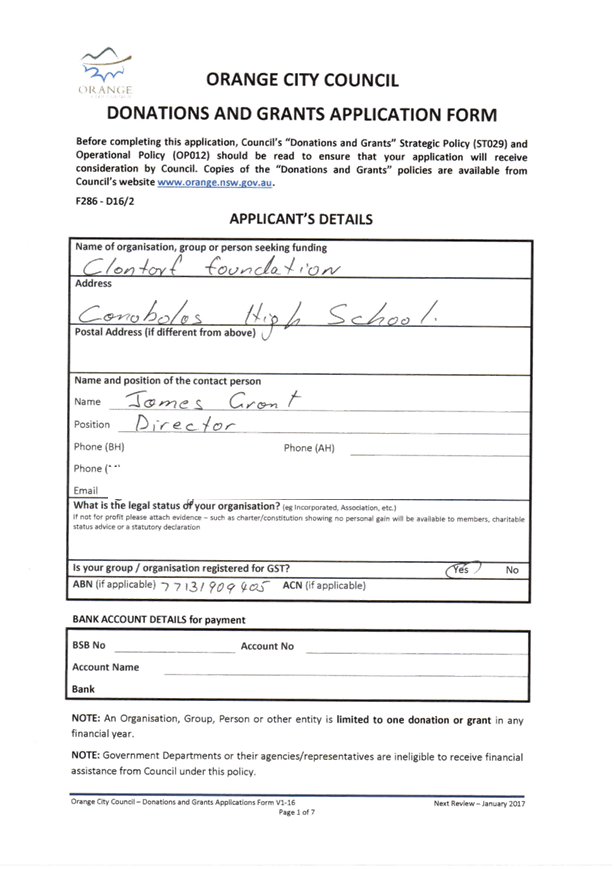

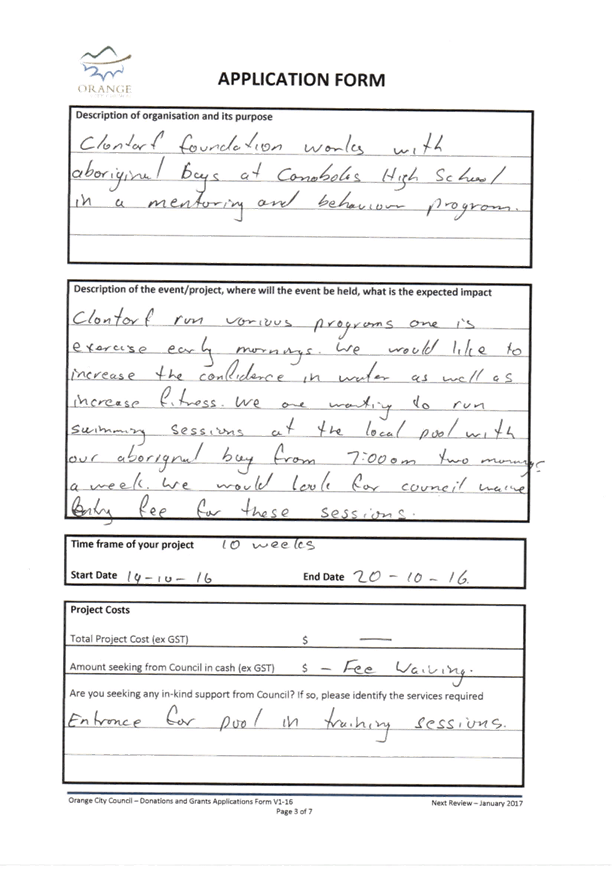

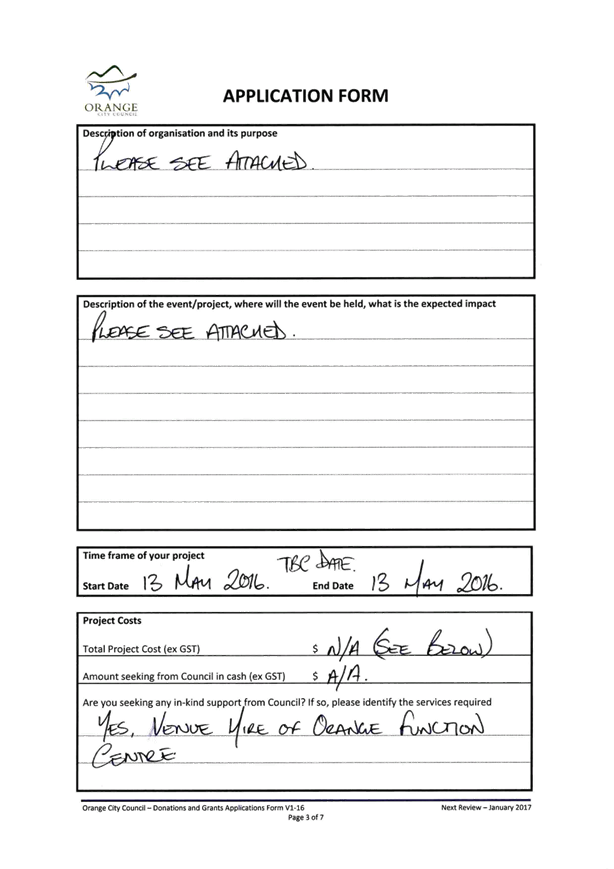

· Clontarf

Foundation – Request is for Pool fees waiver

o Policy position – Complies

with policy and if budget had been available staff would have recommended

approval of the application.

o Pool entry fee is $3.40 student per

visit, estimated max amount of student x 25, to be used twice weekly for a 10

week program. Approximate value $1,700

o Cr Hamling has pledged to support

this event to the value of $500, from his $1,000 remaining in his individual

allocation. This pledge has been converted into the recommendation.

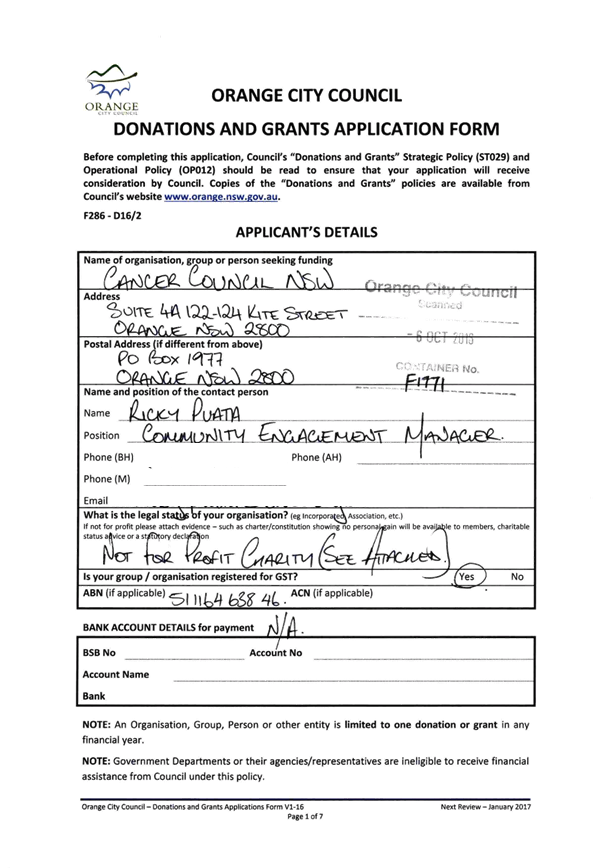

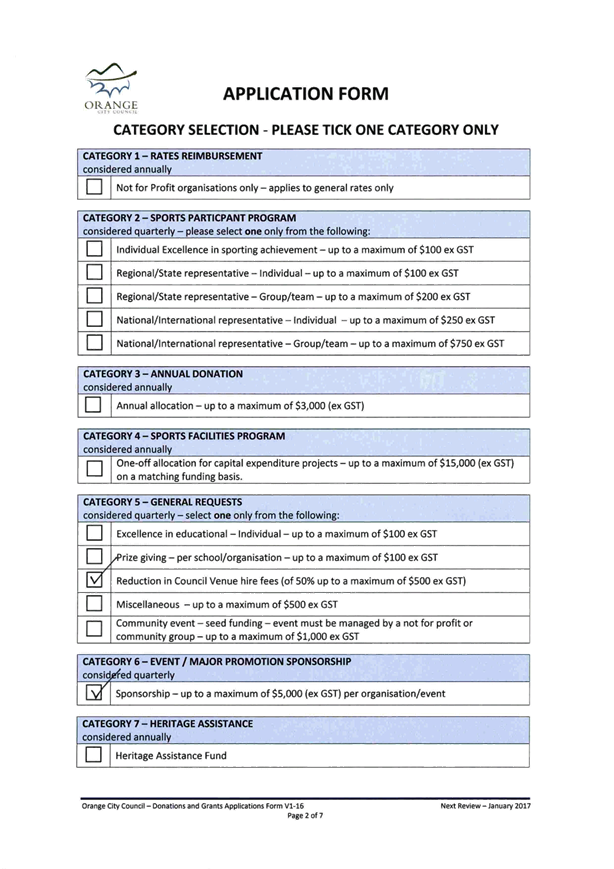

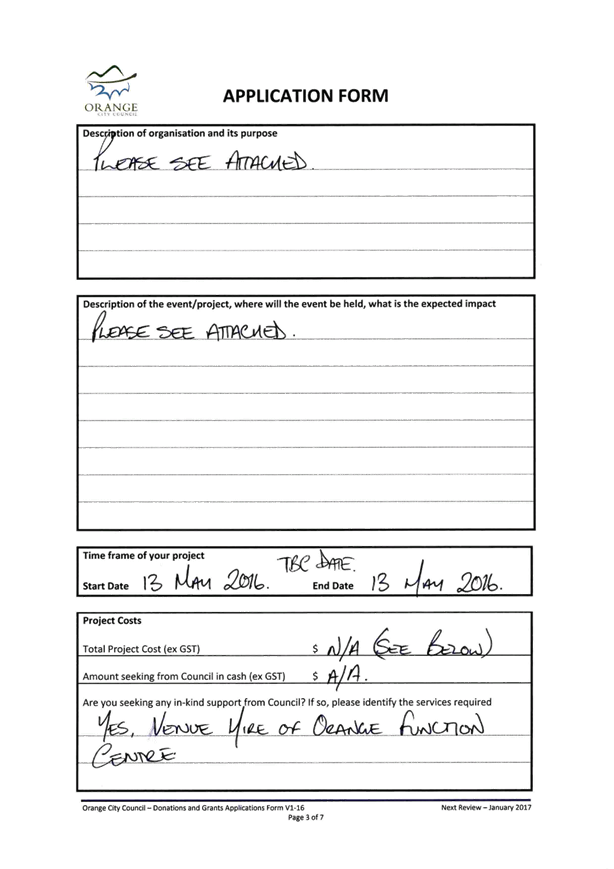

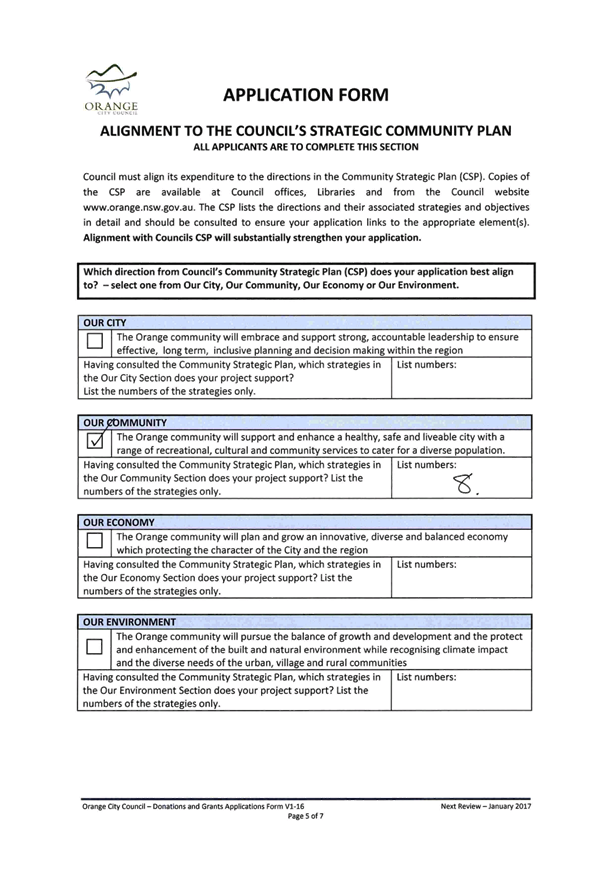

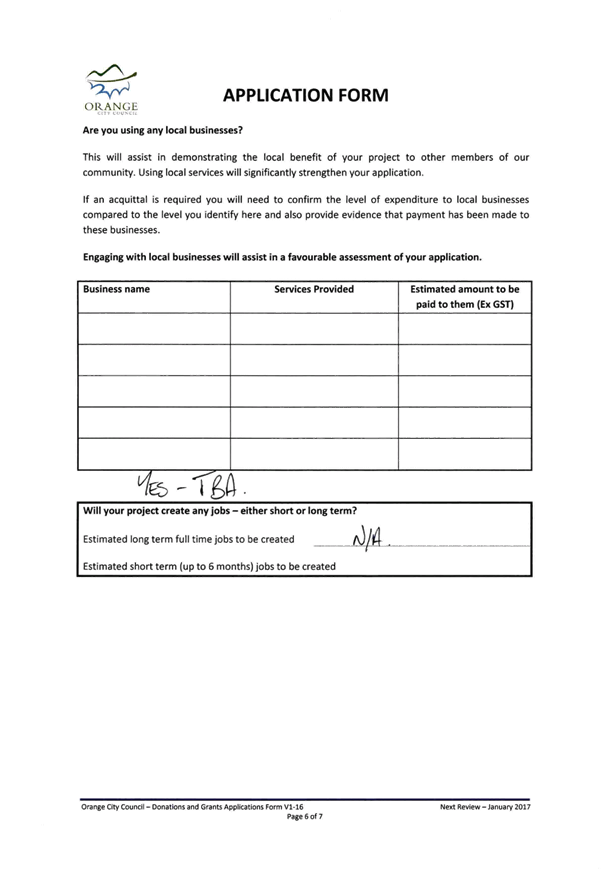

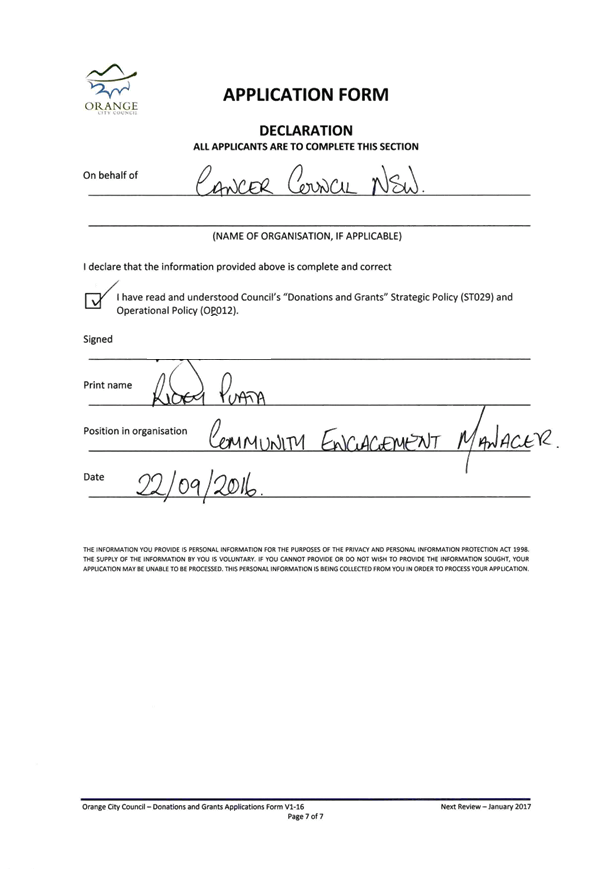

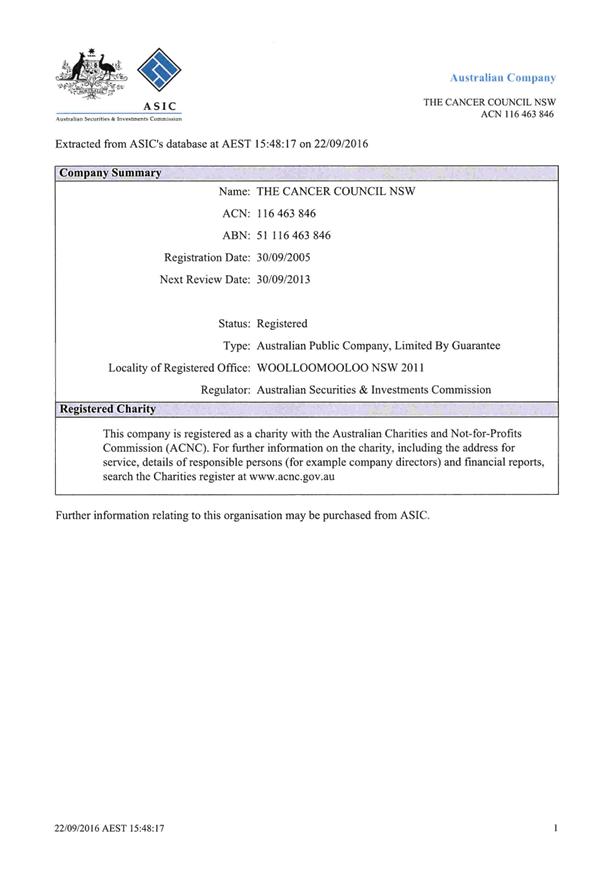

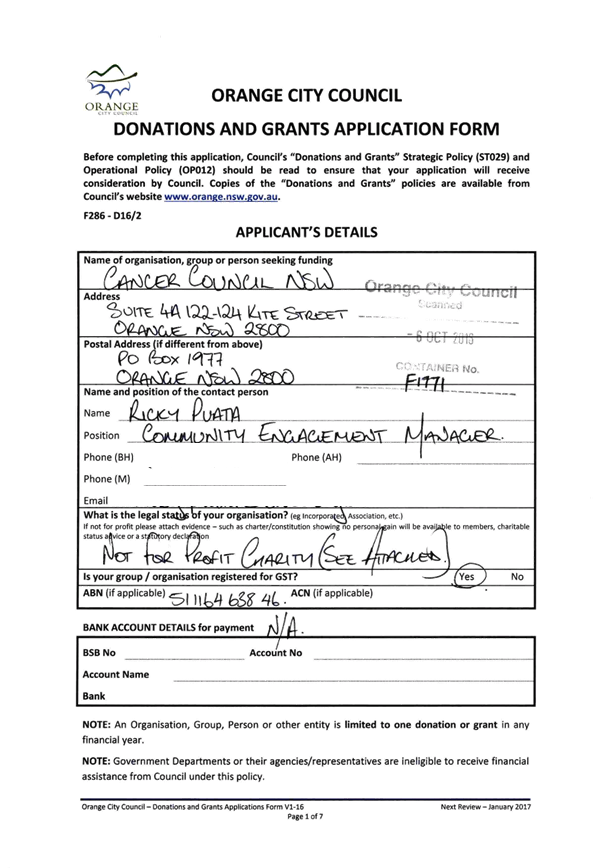

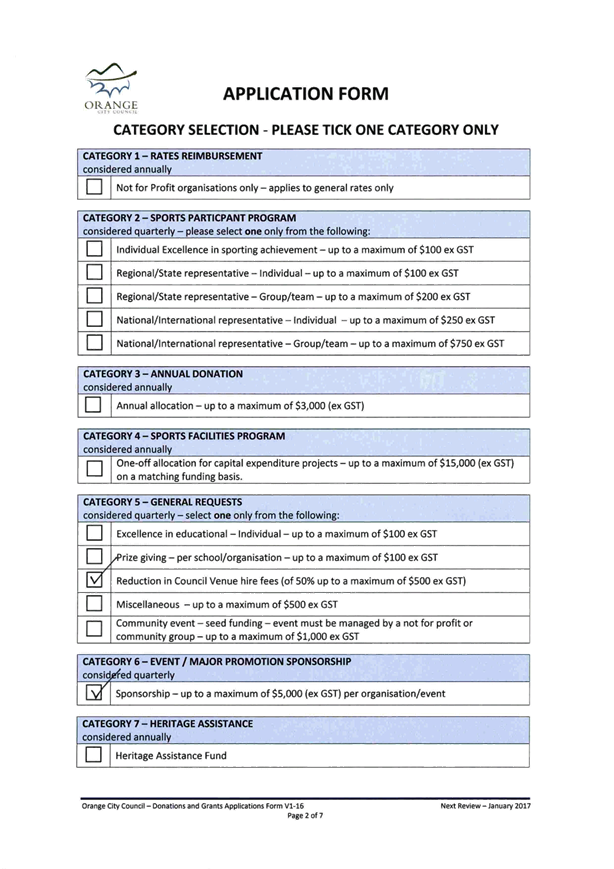

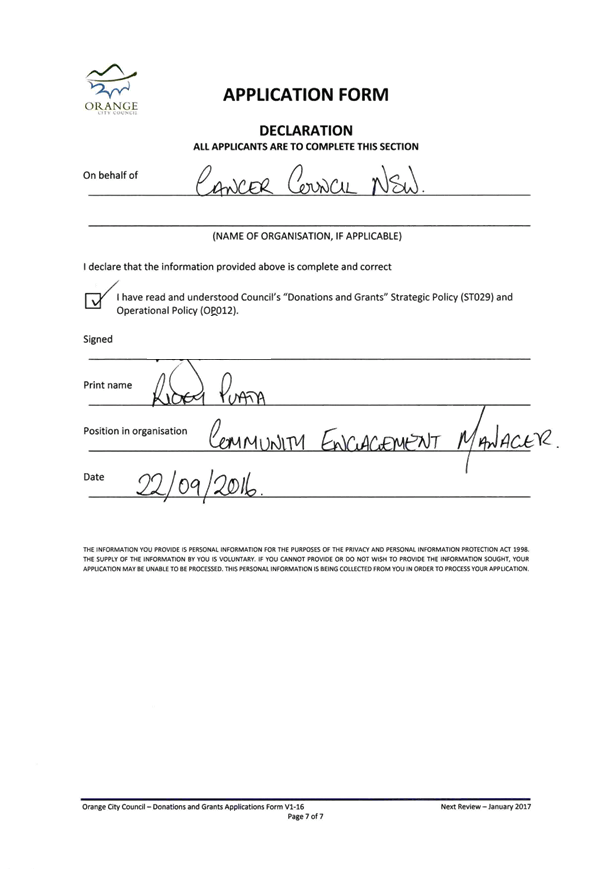

· Cancer Council NSW

– Waiver of Council venue hire Fees – Unspecified amount

o Policy position – Decline this

request as donations are limited to one donation per organisation in any

financial year. Council has already provided Cancer Council NSW with a $3,000

donation in this financial year.

o Cost of Function Centre hire:

>500 people $1,380, and < 500 $1,218.

Attachments

1 Donation

Table, D16/50268⇩

2 Clontarf

Foundation , IC16/16449⇩

3 Cancer

Council NSW, IC16/15735⇩

Finance Policy Committee

1 November 2016

3.2 Request

For Financial Assistance

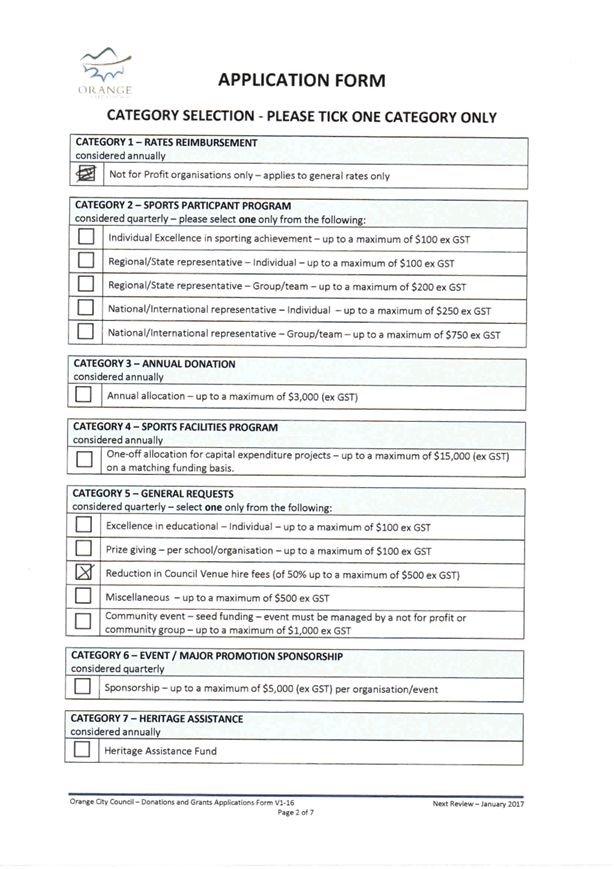

Attachment 1 Donation

Table

|

No

|

Applicant

|

Amount Sought

|

Policy Position

|

Purpose

|

Comment

|

Recom-mended

|

To be advertised

|

|

A.1

|

Clontarf Foundation

|

Not Specified

|

Reduction in Council Venue hire fees (of 50% up to

$500)

|

Clontarf foundation works with aboriginal boys at

Canobolas High School as part of a mentoring and behaviour program.

|

Policy Applied

|

Yes

|

No

|

|

A.2

|

Cancer Council NSW

|

Not Specified

|

Donations are limited to one donation or grant in

any financial year.

|

Dancing with the Stars – fundraiser event.

|

Policy Applied

|

No

|

No

|

Finance

Policy Committee

1 November 2016

3.2 Request

For Financial Assistance

Attachment 2 Clontarf

Foundation

Finance

Policy Committee

1 November 2016

3.2 Request

For Financial Assistance

Attachment 3 Cancer

Council NSW

3.3 Proposed

amendments to Schedule of Fees and Charges

TRIM

REFERENCE: 2016/2560

AUTHOR: Michelle

Catlin, Manager Administration and Governance

EXECUTIVE Summary

This report seeks Council’s approval to put on public exhibition

changes to the schedule of Fees and Charges. These changes include amendments

to fees charged at the Colour City Caravan Park and Wade Park, and to formalise

the payments to the independent members of Council’s Audit and Risk

Management Committee and to the Council appointed members of the Conduct Review

Panel.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “1.2 Our City -

Information and advice provided for the decision-making process will be

succinct, reasoned, accurate, timely and balanced”.

Financial Implications

Council has been advised that as a council included in the

NSW Government’s merger proposals under consideration by the Office of

Local Government since referral on 6 January 2016, Council must comply with the

merger proposal period guidelines issued under S23A of the Local Government Act

1993.

The guidelines instruct Council it should expend money in

accordance with the detailed budget adopted for the purposes of implementing

the Delivery/Operational Plan for the 2015/16 year.

Any expenditure outside the adopted budget requires the

identification of clear and compelling grounds and must be approved by Council

at a meeting that is open to the public. The guidelines indicate the resolution

of Council for increased expenditure must specify the reasons why the

expenditure is required and warranted. If increased expenditure is greater than

$250,000 or 1% of the Council’s

revenue from rates in the preceding year, whichever is the greater, Council is required to exhibit the increase to

the budget and consider comments received.

Council must also avoid entering into contracts or

undertakings where expenditure or revenue is greater than $250,000 or 1% of the

Council’s revenue from rates in the

preceding year, whichever is the greater, unless the contract or undertaking is

as a result of a decision or procurement process commenced prior to the merger

proposal period or where entering into a contract or undertaking is reasonably

necessary for the purposes of meeting the ongoing service delivery commitments

of the Council or was previously approved in the Council’s

Delivery/Operational Plan.

Policy and Governance Implications

The proposed amendments, if approved, will be placed on

public exhibition for a period of 28 days and any submissions will be reported

back to Council for consideration following the exhibition period. Under the

Local Government Act 1993, Council cannot impose a fee or charge without first

being through a public exhibition process.

|

Recommendation

That the following amendments to the Schedule of Fees

and Charges be placed on public exhibition:

1 Colour

City Caravan Park – Four Seasons Cottage – for up to 4 persons:

a) Remove

the minimum length of stay

b) Retain

maximum length of stay of 2 weeks

c) Low

season: Night fee of $180 (Inc. GST)

d) Low

Season: Per week fee of $1,260 (Inc. GST)

e) Peak

Season: Night fee of $200 (Inc. GST)

f) Peak

Season: Per week fee of $1,400 (Inc. GST)

g) Additional

person to be charged at $30 (Inc. GST) per head

2 Fees

for commercial hire of Wade Park to be as follows:

a) Charge

per day $1,000 (plus GST)

b) Security

bond $10,000 (plus GST)

3 Payment

for Service – Audit and Risk Independent Committee Members:

a) Independent

Chairperson $1,050 per meeting (plus GST) inclusive of all reading/other

time.

b) Independent

member $840 per meeting (plus GST) inclusive of all reading/other time.

c) All

travel costs for independent members and chairperson to attend ARMC meetings

as to be at the km rate in the Local Government State Award for the use of

own vehicles.

d) All

other expenses are considered to be covered in the meeting fees.

4 Payment

for Service – Conduct Review Panel Members:

a) Preliminary

Assessment of complaint - $1,250 (plus GST) inclusive of all expenses.

b) Sole

Reviewer investigation costs:

i. For

the first 10 hours - $250 (plus GST) per hour inclusive of all expenses.

ii. For

subsequent hours - $220 (plus GST) per hour inclusive of all expenses.

iii. Where

pre-approved, a per km rate for the use of private vehicles owned by Conduct

Reviewers to attend meetings will be paid in accordance with the own use

schedule in the Local Government State Award.

iv. Payment

for any other expenses will not be made unless pre-approved by Council on a

matter by matter basis and if so approved, will be at cost.

c) Conduct

Review Panel members (where a Conduct Committee is formed – minimum

three members):

i. For

the first 10 hours - $220 (plus GST) per hour inclusive of all

reading/meeting time and all expenses.

ii. For

all hours after the first 10 hours - $200 (plus GST) per hour inclusive of

all reading/meeting time and all expenses.

iii. Where

approved at the time of engagement on a matter by matter basis, panel members

may be paid travel costs associated with use of their own vehicle which will

be reimbursed at the own vehicle per km rate as listed in the Local

Government State Award.

iv. Payment

for any other expenses will not be made unless preapproved by Council on a

matter by matter basis and if so approved, will be at cost.

|

further considerations

The recommendation of this report has been

assessed against Council’s other key risk categories and the following

comments are provided:

|

Service Delivery

|

The amendments to the fees for the

Four Seasons Cottage at the Caravan Park are proposed to increase utilisation

of the Cottage.

The payments for services are

required to be set for the statutory committees Council is required to have,

the Audit and Risk Committee and the Conduct Review Panel.

|

SUPPORTING INFORMATION

Colour City Caravan Park

A reduction in the fees for the

Four Seasons Cottage is proposed to stimulate utilisation of the Cottage. These

reductions are set out below. It is also proposed to remove the minimum length

of stay being two nights, but retain the two weeks maximum stay.

|

Fee

|

Adopted fee (GST inc)

|

Proposed fee (GST inc)

|

|

Per night (low season)

|

$225.00

|

$180.00

|

|

Per week (low season)

|

$1,575.00

|

$1,260.00

|

|

Per night (peak)

|

$245.00

|

$200.00

|

|

Per week (peak)

|

$1,715.00

|

$1,400.00

|

All fees are based on four people staying. Additional people

would be charged $30 per person per night.

Wade Park fees

The Schedule of Fees and Charges include a number of fees for

the use of Wade Park, however all fees relate to a sporting use of the

facility. There is a need to provide for commercial use of Wade Park for events

and other activities. A daily fee of $1,000 plus GST is proposed, together with

a security bond of $10,000 plus GST.

Payment for Service – Audit and Risk Management

Committee

Council last considered the level of remuneration for

independent members for the Audit and Risk Management Committee on 7 October

2014. Councillor members do not receive remuneration for their membership on

the Committee.

|

5.3 Audit and

Risk Management Committee Charter Review

TRIM

Reference:

2014/1741

|

|

RESOLVED

- 14/961

Cr C Gryllis/Cr R Kidd

1 …

3 That

the Council approve that the payment to Audit and Risk Management Committee

independent members be set at $1,000 per meeting for the Chair and $800 per

meeting for the other independent member, plus travel costs to attend

meetings as identified in the Local Government (State) Award allowance

tables.

4 That

the Council consider linking annual increments for independent ARMC member

remuneration to the equivalent increase to Councillor remuneration levels as

set by the NSW Government.

|

The payment for service for independent members of the Audit

and Risk Management Committee has been reviewed. The Local Government

Remuneration Tribunal has increased Councillor allocations by 2.5% in each of

the two years since the last consideration of the fees by Council.

The proposed new fee levels are set out below for the

independent members of the Committee for attendance at the meetings specified

in the Charter or for meetings approved by the General Manager from time to

time (extraordinary meetings) take into account the two increases to the

fees paid to Councillors:

· Chairperson $1,050

per meeting (plus GST) inclusive of all reading/other time.

· Member $840 per

meeting (plus GST) inclusive of all reading/other time.

· A per km rate for

the use of the independent members’ private vehicles as specified in the

Local Government State Award to attend the meetings specified in the charter

may be made if pre-approved by Council.

· Reimbursement of

any other expenses to be preapproved by Council on a matter by matter basis and

will be at cost.

Payment for Service – Conduct Review Panel Members

Generally the payments to Conduct Review Panel members are

reviewed when the Panel membership is determined by an expression of interest

process following the Local Government elections. Given the election for Orange

has been postponed, it is appropriate to review these payments.

For the first time, it is proposed to implement a flat rate

for undertaking some elements of the Code of Conduct process, including the

undertaking of a preliminary assessment.

· Preliminary

Assessment of complaint - $1,250 (plus GST) inclusive of all expenses.

· Sole Reviewer

investigation costs

o For first 10 hours: $250 (plus GST)

per hour inclusive of all expenses

o For subsequent hours: $220 (plus

GST) per hour inclusive of all expenses

· Conduct Review

Panel members (where a Conduct Committee is formed - minimum three members)

o For the first 10 hours: $220 (plus

GST) per hour inclusive of all reading/meeting time and expenses.

o For subsequent hours: $200

(plus GST) per hour inclusive of all reading/meeting time and all expenses.

· A per km rate for

the use of the panel members’ private vehicles as specified in the Local Government

State Award to attend the meetings may be made if pre-approved by Council.

· Reimbursement of

any other expenses to be pre-approved by Council on a matter by matter basis

and will be at cost.