ORANGE CITY COUNCIL

Finance Policy Committee

Agenda

7 February 2017

Notice

is hereby given, in accordance with the provisions of the Local Government Act

1993 that a Finance Policy Committee

meeting of ORANGE CITY

COUNCIL will be held in the Council

Chamber, Civic Centre, Byng Street, Orange on Tuesday, 7

February 2017.

Garry

Styles

General Manager

For apologies please

contact Michelle Catlin on 6393 8246.

Finance Policy Committee 7

February 2017

1 Introduction

1.1 Declaration

of pecuniary interests, significant non-pecuniary interests and less than

significant non-pecuniary interests

The

provisions of Chapter 14 of the Local Government Act, 1993 (the Act)

regulate the way in which Councillors and designated staff of Council conduct

themselves to ensure that there is no conflict between their private interests

and their public role.

The

Act prescribes that where a member of Council (or a Committee of Council) has a

direct or indirect financial (pecuniary) interest in a matter to be considered

at a meeting of the Council (or Committee), that interest must be disclosed as

soon as practicable after the start of the meeting and the reasons given for

declaring such interest.

As

members are aware, the provisions of the Local Government Act restrict any

member who has declared a pecuniary interest in any matter from participating

in the discussion or voting on that matter, and requires that member to vacate

the Chamber.

Council’s Code of Conduct provides that if members

have a non-pecuniary conflict of interest, the nature of the conflict must be

disclosed. The Code of Conduct also provides for a number of ways in which a

member may manage non pecuniary conflicts of interest.

|

Recommendation

It is recommended that Committee Members now disclose any

conflicts of interest in matters under consideration by the Finance Policy

Committee at this meeting.

|

2 Committee

Minutes

2.1 Minutes

of the Audit and Risk Management Committee - 25 November 2016

TRIM

REFERENCE: 2016/2978

AUTHOR: Kathy

Woolley, Director Corporate and Commercial Services

EXECUTIVE Summary

The Audit and Risk Management Committee met on 25 November

2016 and the minutes of that meeting are provided to the Finance Policy

Committee for adoption.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “1.3 Our City -

Ensure a robust framework that supports the community’s and

Council’s current and evolving activities, services and functions”.

Financial Implications

Council has been advised that as a council included in the

NSW Government’s merger proposals under consideration by the Office of

Local Government since referral on 6 January 2016, Council must comply with the

merger proposal period guidelines issued under S23A of the Local Government Act

1993.

The guidelines instruct Council it should expend money in

accordance with the detailed budget adopted for the purposes of implementing

the Delivery/Operational Plan for the

2015/16 year.

Any expenditure outside the adopted budget requires the

identification of clear and compelling grounds and must be approved by Council

at a meeting that is open to the public. The guidelines indicate the resolution

of Council for increased expenditure must specify the reasons why the

expenditure is required and warranted.

If increased expenditure is greater than $250,000 or 1% of

the Council’s revenue from rates in

the preceding year, whichever is the greater, Council

is required to exhibit the increase to the budget and consider comments

received.

Council must also avoid entering into contracts or

undertakings where expenditure or revenue is greater than $250,000 or 1% of the

Council’s revenue from rates in the

preceding year, whichever is the greater, unless the contract or undertaking is

as a result of a decision or procurement process commenced prior to the merger

proposal period or where entering into a contract or undertaking is reasonably

necessary for the purposes of meeting the ongoing service delivery commitments

of the Council or was previously approved in the Council’s

Delivery/Operational Plan.

Policy and Governance Implications

Nil

|

Recommendation

That the minutes of the meeting of the Audit and Risk

Management Committee held on 25 November 2016 be adopted.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

SUPPORTING INFORMATION

One of the items the Committee has been

considering is the amendments to the Committee’s functions which will be

altered by the amendments to the Local Government Act 1993. Council is waiting

the creation of the Regulations that provide greater guidance on what the NSW

Government is requiring the Audit and Risk Management Committee to undertake.

The Act has been amended via the Local Government Amendment (Governance and

Planning) Act 2016 to include the following broad parameters for the Committee

from July 2017:

Part

4A - Internal audit

428A Audit, Risk and Improvement

Committee

(1) A council must appoint an

Audit, Risk and Improvement Committee.

(2) The Committee must keep under

review the following aspects of the council’s operations:

(a) compliance,

(b) risk management,

(c) fraud control,

(d) financial management,

(e) governance,

(f) implementation of the strategic

plan, delivery program and strategies,

(g) service reviews,

(h) collection of performance

measurement data by the council,

(i) any other matters prescribed by

the regulations.

(3) The Committee is also to

provide information to the council for the purpose of improving the

council’s performance of its functions.

428B Joint internal audit

arrangements

A council may enter into an

arrangement with another council, or a body prescribed by the regulations for

the purposes of this section, to jointly appoint an Audit, Risk and Improvement

Committee to exercise functions for more than one council or body.

There will be likely budget implications arising from the

amendments to the Act on the functions of Committee.

Attachment

1 Minutes

of the Meeting of the Audit and Risk Management Committee held on 25 November

2016

ORANGE CITY COUNCIL

MINUTES OF THE

Audit and Risk Management

Committee

HELD IN Committee Room 3, Civic Centre, Byng Street, Orange

ON 25 November 2016

COMMENCING AT 9.15am

1 Introduction

Mr P Burgett (Chairperson), Cr J Davis (Mayor), Mr A

Fletcher (voting members)

General Manager, Director Corporate and Commercial Services,

Manager Financial Services, Internal Auditor (Non-voting members) Manager

Administration and Governance (invited attendee).

1.1 Apologies and Leave of

Absence

|

RESOLVED

Cr

J Davis/Mr A Fletcher

That the apologies be

accepted from Cr R Kidd, Cr J Whitton and Mr J O’Malley

(External Auditor) for the Audit and Risk Management Committee meeting on

25 November 2016.

|

1.2 Acknowledgement of Country

1.3 Declaration of pecuniary

interests, significant non-pecuniary interests and less than significant

non-pecuniary interests

2 Previous

Minutes

|

RESOLVED

Mr

A Fletcher/Mr P Burgett

That the Minutes of the

Meeting of the Audit and Risk Management Committee held on 30 September 2016

(copies of which were circulated to all members) be and are hereby confirmed

as a true and accurate record of the proceedings of the Audit and Risk

Management Committee meeting held on 30 September 2016.

|

3 General

Reports

3.1 ARMC Action List as at

November 2016

TRIM Reference: 2016/2675

|

|

RecommendationS Mr A Fletcher/Cr J Davis

1.

That the report by the Internal Auditor on ARMC Action List as at

November 2016 be acknowledged.

2.

That action items marked as completed be deleted from the ARMC Action

List.

3.

That the verbal report by the Manager Financial Services regarding the

2016 financial year-end statements external audit be noted.

4.

That a copy of the External Auditor’s amended conduct of audit

report be circulated to members of the Committee out of session.

5.

That a copy of the External Auditor’s Management Letter

including management comments be circulated to members of the Committee out

of session

6.

That a meeting of the Chairs of the Audit and Risk Management

Committees and the General Managers of Bathurst, Orange and Dubbo Councils be

organised through the General Manager’s office.

7.

That the 6 joint process improvement initiatives identified in the

Action List (Action item number 2016A04.01) be included on the agenda for the

meeting between the Chairs of the Audit and Risk Committees and the General

Managers of Bathurst, Orange and Dubbo Councils.

|

3.2 Internal Audit

Programme Status Report as at November 2016

TRIM Reference: 2016/2673

|

|

Recommendation Cr J Davis/Mr A Fletcher

1. That

the allocation of programme tasks for completion by other resources in the

Internal Audit program be noted.

2. That

the balance of the report be noted.

|

3.3 Review of Corporate

Risk Register

TRIM Reference: 2016/2751

|

|

Recommendation Mr A Fletcher/Cr J Davis

1. That

the update to the Corporate Risk Register be acknowledged.

2. That

an updated copy of the Corporate Risk Register with the inclusion of risk

tolerance be circulated to members of the Committee out of session.

3.

That the format of future Corporate Risk Registers revise mitigation

strategies so they are outcomes focused and tasks are separated into the

relevant section of the system.

|

The Meeting

Closed at 9:55AM.

3 General

Reports

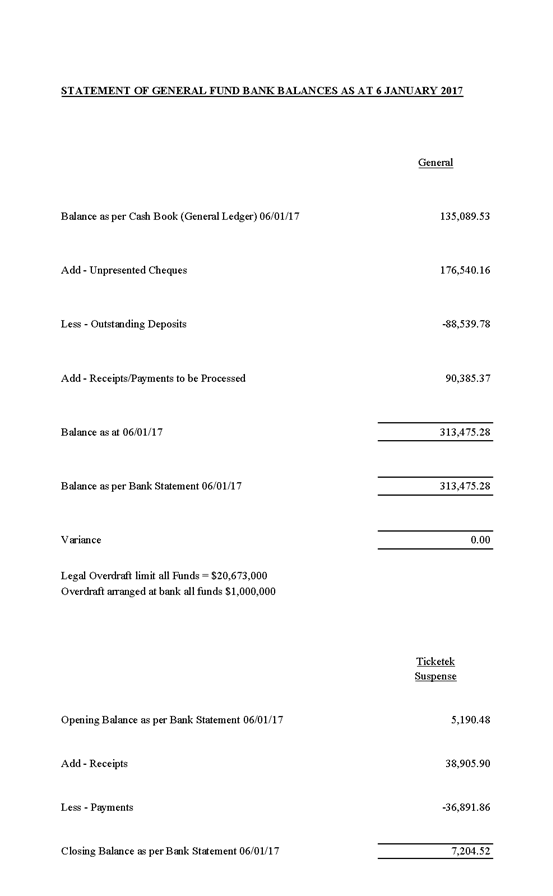

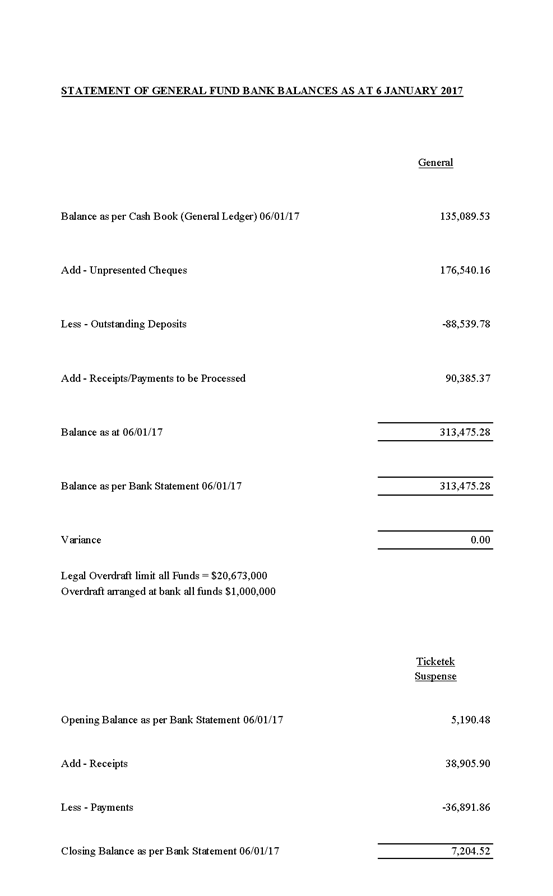

3.1 Statement

of Bank Balances as at 6 January 2017

TRIM

REFERENCE: 2017/33

AUTHOR: Kim

Thompson, Accounting Officer - Management

EXECUTIVE Summary

Council operates one Bank Account and is required to carry

out a Bank Reconciliation at the end of each month. As at 6 January 2017 the

Cash Book Balance was $135,089.53.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “1.2 Our City - Information

and advice provided for the decision-making process will be succinct, reasoned,

accurate, timely and balanced”.

Financial Implications

Council has been advised that as a council included in the

NSW Government’s merger proposals under consideration by the Office of

Local Government since referral on 6 January 2016, Council must comply with the

merger proposal period guidelines issued under S23A of the Local Government Act

1993.

The guidelines instruct Council it should expend money in

accordance with the detailed budget adopted for the purposes of implementing

the Delivery/Operational Plan for the 2015/16 year.

Any expenditure outside the adopted budget requires the

identification of clear and compelling grounds and must be approved by Council

at a meeting that is open to the public. The guidelines indicate the resolution

of Council for increased expenditure must specify the reasons why the

expenditure is required and warranted.

If increased expenditure is greater than $250,000 or 1% of

the Council’s revenue from rates in

the preceding year, whichever is the greater, Council

is required to exhibit the increase to the budget and consider comments

received.

Council must also avoid entering into contracts or

undertakings where expenditure or revenue is greater than $250,000 or 1% of the

Council’s revenue from rates in the

preceding year, whichever is the greater, unless the contract or undertaking is

as a result of a decision or procurement process commenced prior to the merger

proposal period or where entering into a contract or undertaking is reasonably

necessary for the purposes of meeting the ongoing service delivery commitments

of the Council or was previously approved in the Council’s

Delivery/Operational Plan.

Policy and Governance Implications

Nil.

|

Recommendation

That the information provided in the report by the

Accounting Officer – Management on the Statement of Bank Balances as at

6 January 2017 be acknowledged.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

Attachment

1 Bank

Reconciliation as at 6 January 2017, D17/1434⇩

Finance Policy Committee

7 February 2017

3.1 Statement

of Bank Balances as at 6 January 2017

Attachment 1 Bank

Reconciliation as at 6 January 2017

3.2 Request

For Financial Assistance

TRIM

REFERENCE: 2017/83

AUTHOR: Josie

Sanders, Management Accountant

EXECUTIVE Summary

Council is in receipt of requests for financial assistance

under section 356 of the Local Government Act 1993. The report provides details

of applications received.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “3.3 Our City –

Recognise that members of the community will take different leadership

pathways, the Council will support this growth and development through

appropriate activities, initiatives and assistance”.

Financial Implications

Council has been advised that as a council included in the

NSW Government’s merger proposals under consideration by the Office of

Local Government since referral on 6 January 2016, Council must comply with the

merger proposal period guidelines issued under S23A of the Local Government Act

1993.

The guidelines instruct Council it should expend money in

accordance with the detailed budget adopted for the purposes of implementing

the Delivery/Operational Plan for the 2015/16 year.

Any expenditure outside the adopted budget requires the

identification of clear and compelling grounds and must be approved by Council

at a meeting that is open to the public. The guidelines indicate the resolution

of Council for increased expenditure must specify the reasons why the

expenditure is required and warranted.

If increased expenditure is greater than $250,000 or 1% of

the Council’s revenue from rates in

the preceding year, whichever is the greater, Council

is required to exhibit the increase to the budget and consider comments

received.

Council must also avoid entering into contracts or

undertakings where expenditure or revenue is greater than $250,000 or 1% of the

Council’s revenue from rates in the

preceding year, whichever is the greater, unless the contract or undertaking is

as a result of a decision or procurement process commenced prior to the merger

proposal period or where entering into a contract or undertaking is reasonably

necessary for the purposes of meeting the ongoing service delivery commitments

of the Council or was previously approved in the Council’s

Delivery/Operational Plan.

Implications in this report

None of the applications are recommended to be funded

because there are no uncommitted available funds for the applications attached

to the report given both the General Donations and Major Promotions budget have

been fully expended.

The Donations Policy is promoted widely as part of the

budget process and all applicants (successful or not) who have sought donations

in the past couple of years, are individually written to with an invitation for

them to make submissions for donations/sponsorships so their allocation is more

certain given it is included in the budget processes.

For the first time this year, $2,000 for each Councillor has

been reserved to enable Councillors to allocate up to $2,000 each to requests

as they arise throughout the year. If any of the attached are supported by a

Councillor, an allocation can be made from their remaining allocation. A table

is provided below and it will be updated with each report to show how much each

Councillor has apportioned to their supported projects.

The overall donations/sponsorship budget for 2016/17 is as

follows:

|

Program

|

Adopted Budget

|

Actual/Committed

|

Remaining balance

|

|

General Donations

|

84,378

|

84,378*

|

Nil

|

|

Major Promotions

|

72,127

|

72,127

|

Nil

|

* The allocation of 19 x $100 reserved for school prize

giving is accounted for in the actual/committed column of the table. The

actual/committed column also includes the Councillor allocation of $24,000

($2,000 per Councillor) which is available to be allocated by Councillors

throughout the year.

Process for the application of the remaining budget

allocation

A Council resolution is required to allocate funds to any

external entity, including as a donation. Hence, the provision of donations can

only occur upon a Councillor’s request being specifically included in a

resolution.

Applications are considered against the criteria outlined in

the Donations Policy. There is an application form that should be

submitted to commence the process of making a donation to another entity. The

form contains details that inform Council that the donation aligns with the

intentions the Council has established in the Community Strategic Plan.

Where a Councillor has advised they wish to pledge money to

a particular cause, the pledge will be noted in the financial assistance

report.

The steps to have donations considered are as follows:

1 Applicant

completes donations form – available on the Council website or can be

sent to the applicant.

2 Application

is assessed against the criteria in the Donations Policy and reported to

Council in the financial assistance report.

3 Council

considers applications at a Council Meeting with Councillors specifically

including in a resolution the amount and recipient of any donations supported.

4 In

accordance with s356 of the Local Government Act, some donations require

advertising and then a report back to Council of any submissions is required

(i.e. where the recipient acts for financial benefit for example).

Individual

Councillor allocations are as follows:

|

Councillor

|

Adopted

Budget

|

Actual/Committed

(as

resolved)

|

Remaining

balance

|

|

Councillor Davis

|

$2,000

|

$2,000 – Forbes Flood Appeal

|

Nil

|

|

Councillor Hamling

|

$2,000

|

$500 – Canobolas High School

$500 – Orange White Ribbon

$500 – Clontarf Foundation

$500 – Orange Bush Nippers

|

Nil

|

|

Councillor Brown

|

$2,000

|

$2,000 - Leukaemia Foundation

|

Nil

|

|

Councillor Duffy

|

$2,000

|

$500 – Come Together Choir

$500 – Foodcare Orange

$500 – Fusion

$500 – Carewest Preschool

|

Nil

|

|

Councillor Gander

|

$2,000

|

$1,500 – Foodcare Orange

$500 - Fusion

|

Nil

|

|

Councillor Gryllis

|

$2,000

|

$500 – Canobolas High School

$500 – Carewest Preschool

$1,000 – Forbes Flood Appeal

|

Nil

|

|

Councillor Jones

|

$2,000

|

$2,000 - Riding for the Disabled

|

Nil

|

|

Councillor Kidd

|

$2,000

|

$2,000 – Light it Red for

Dyslexia

|

Nil

|

|

Councillor Munro

|

$2,000

|

$2,000 – Anson St School

|

Nil

|

|

Councillor Taylor

|

$2,000

|

$500 – Community Christmas

Lunch

|

$1,500

|

|

Councillor Turner

|

$2,000

|

$500 – Come Together Choir

|

$1,500

|

|

Councillor Whitton

|

$2,000

|

$350 – Riding for the

Disabled

$500 – Community Christmas

Lunch

$200 – Tiarah Jade Fisher

|

$950

|

Policy and Governance Implications

Nil

|

Recommendation

1 That

a donation of $1,500 to be made to At the Vineyard from Cr Turner’s

allocation.

2 That

Councillors specify any other donation recipients and the amounts for each donation.

|

further considerations

Consideration has been given to the

recommendation’s impact on Council’s service delivery; image and

reputation; political; environmental; health and safety; employees;

stakeholders and project management; and no further implications or risks have

been identified.

SUPPORTING INFORMATION

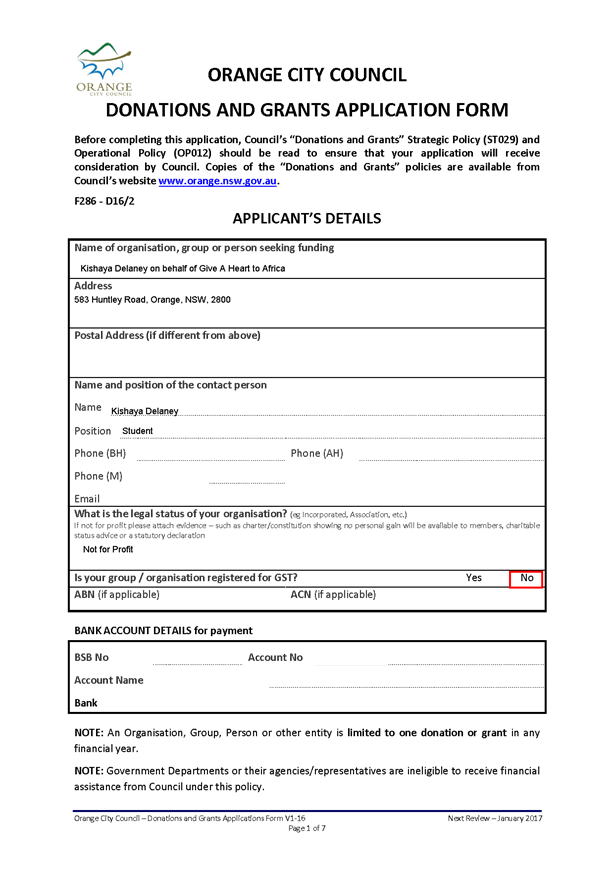

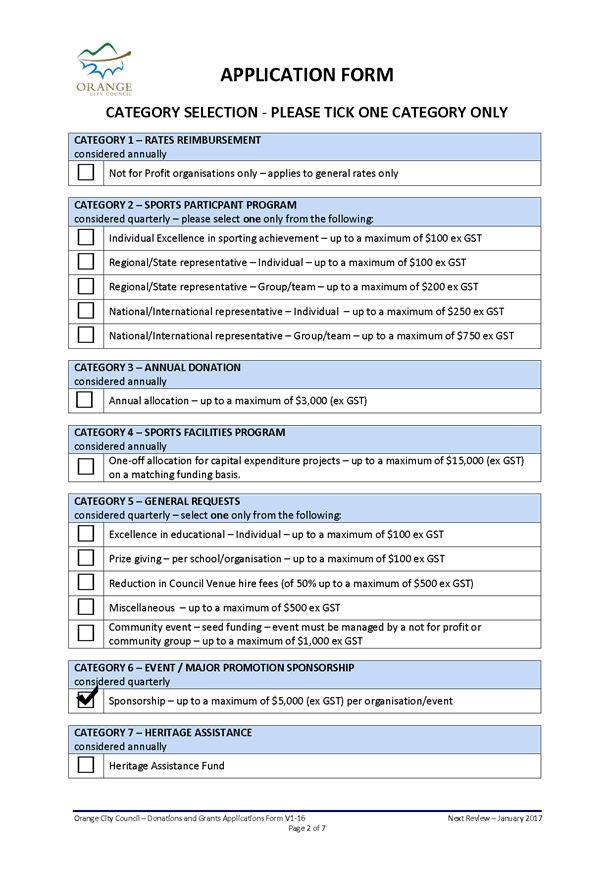

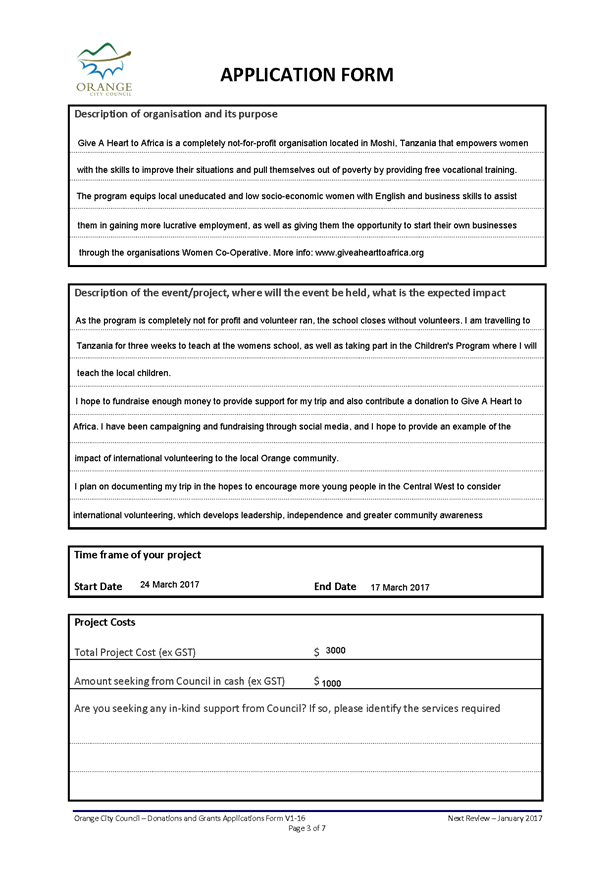

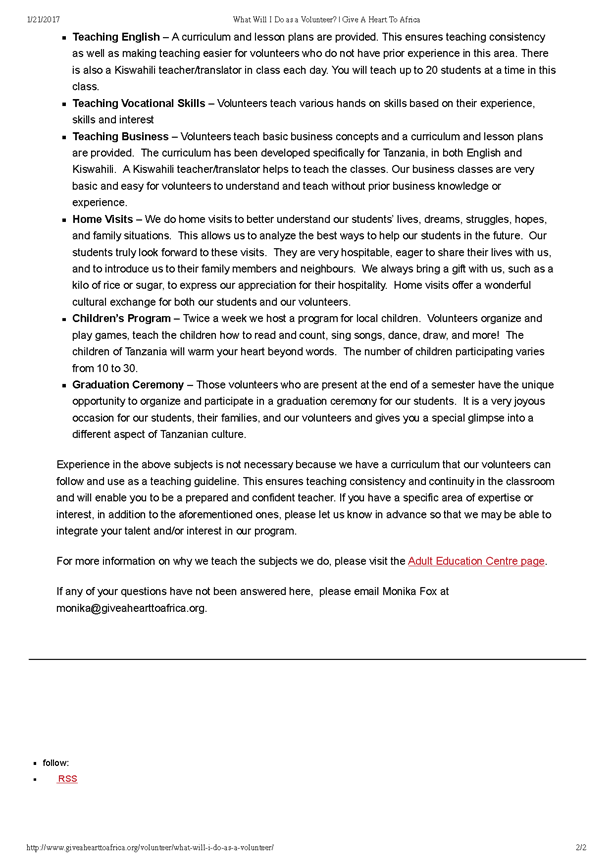

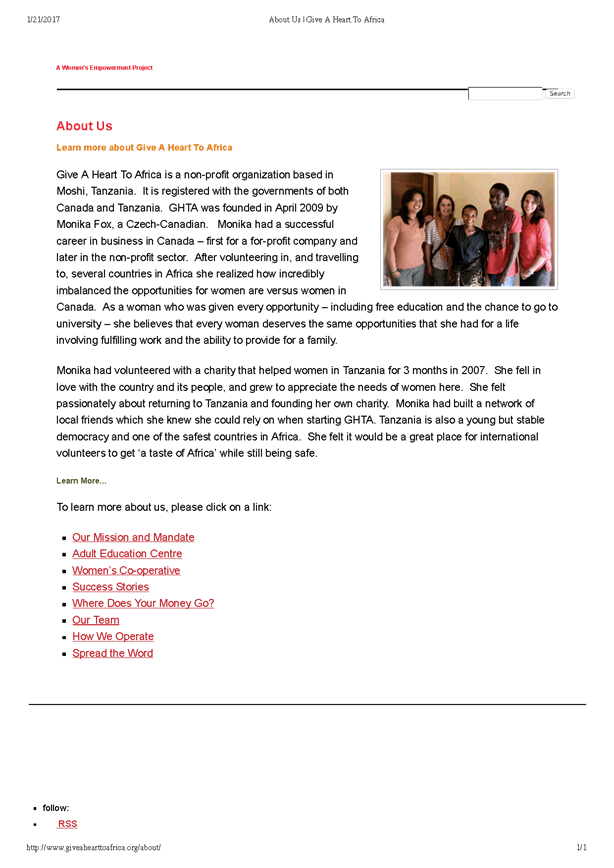

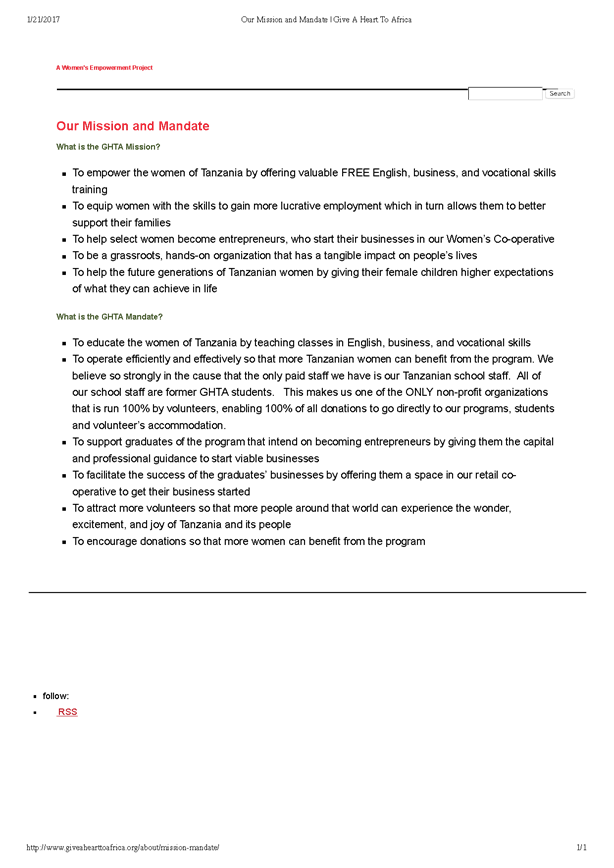

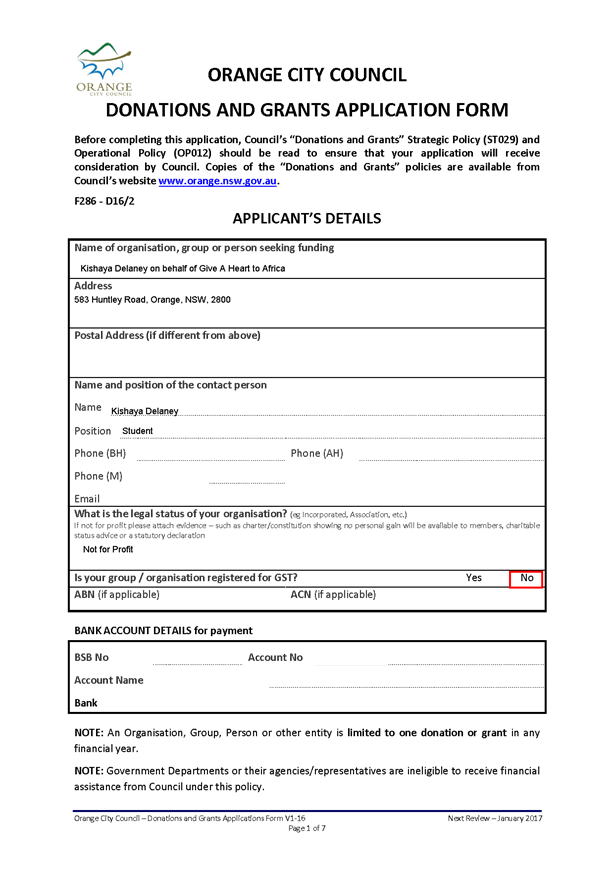

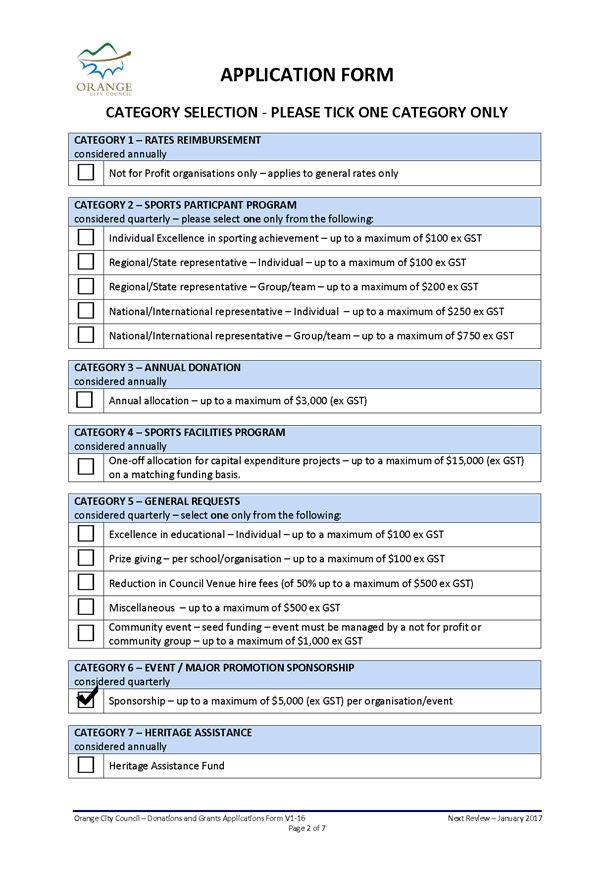

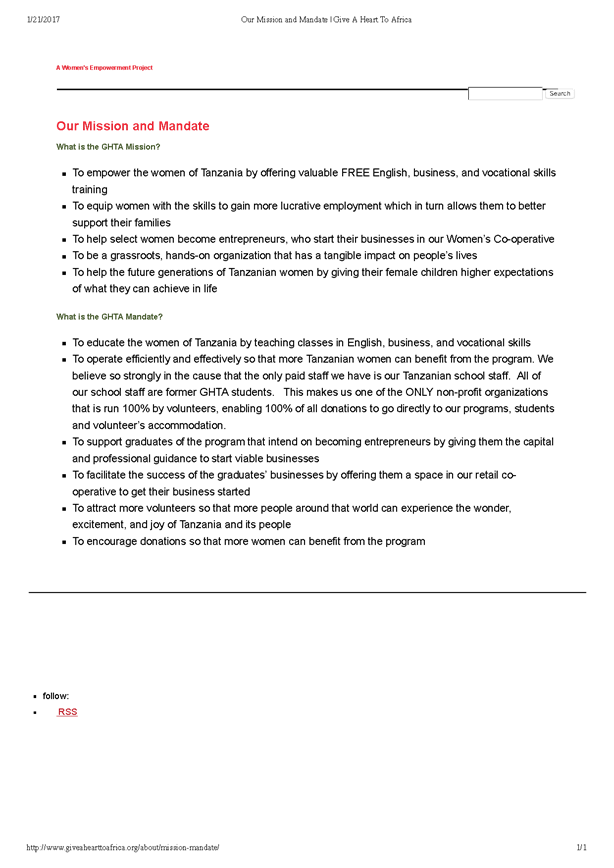

Kishaya Delaney – Give a

Heart to Africa

Kishaya is participating in a not for

profit program to teach at a women’s school in Tanzania, and teach local

children.

Policy position – Outside scope

of Council Policy - $1,000 has been requested.

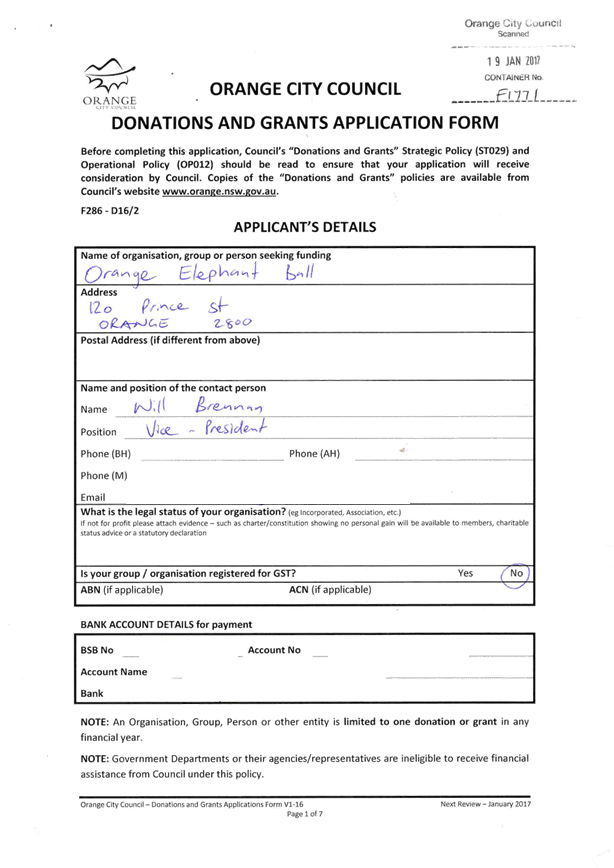

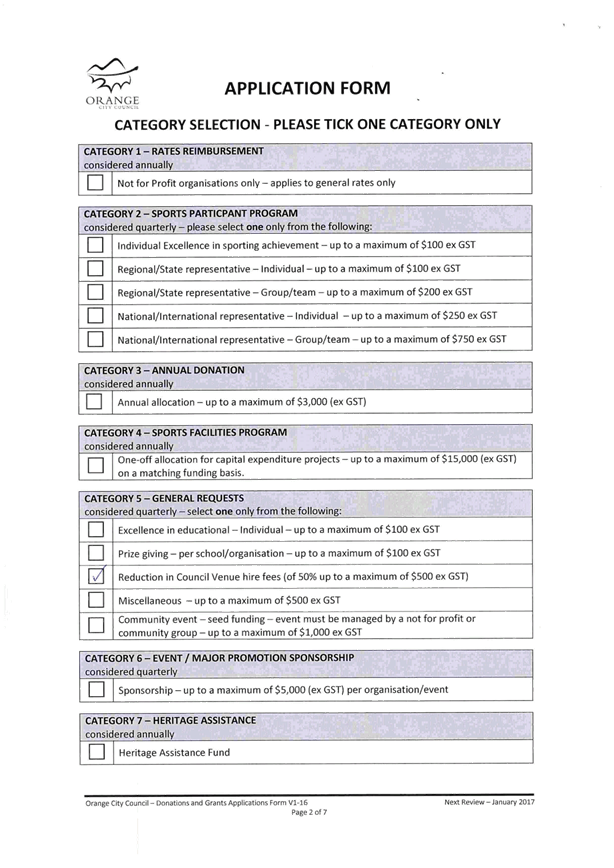

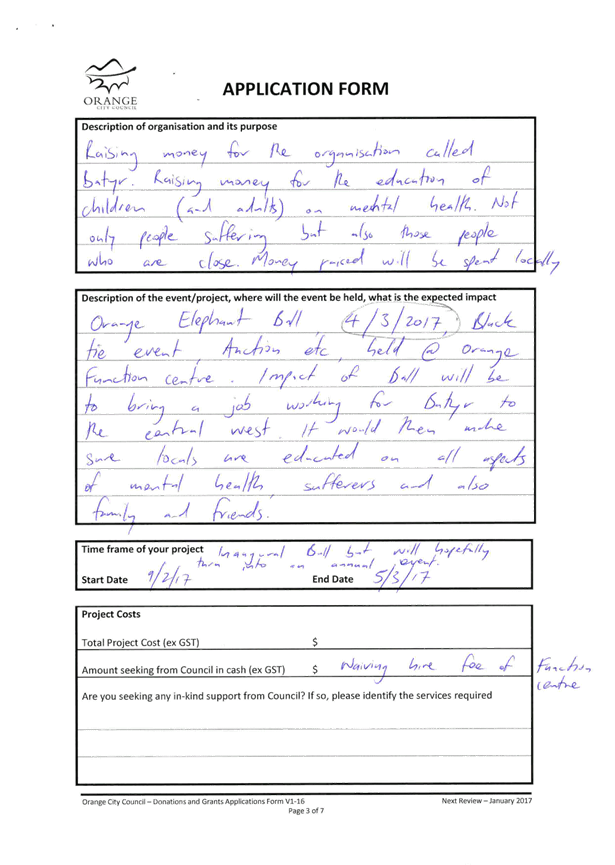

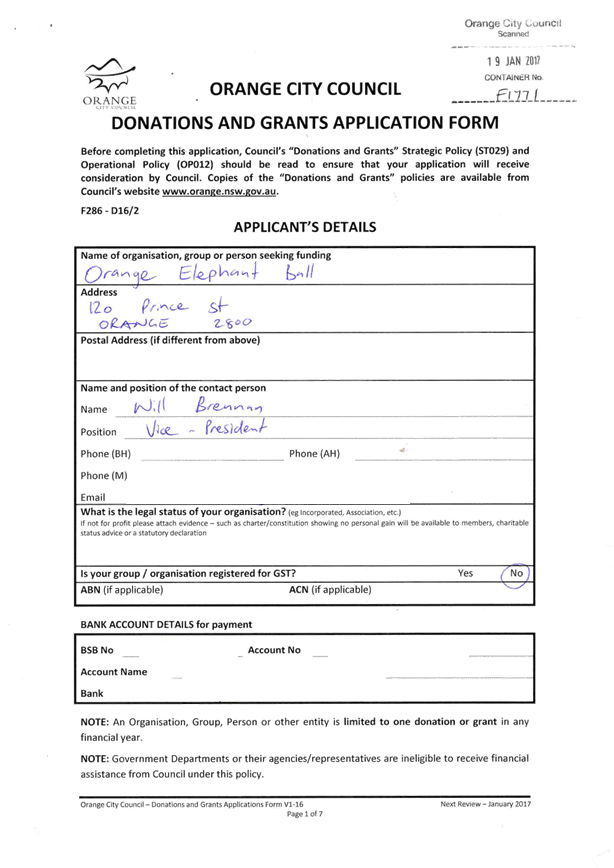

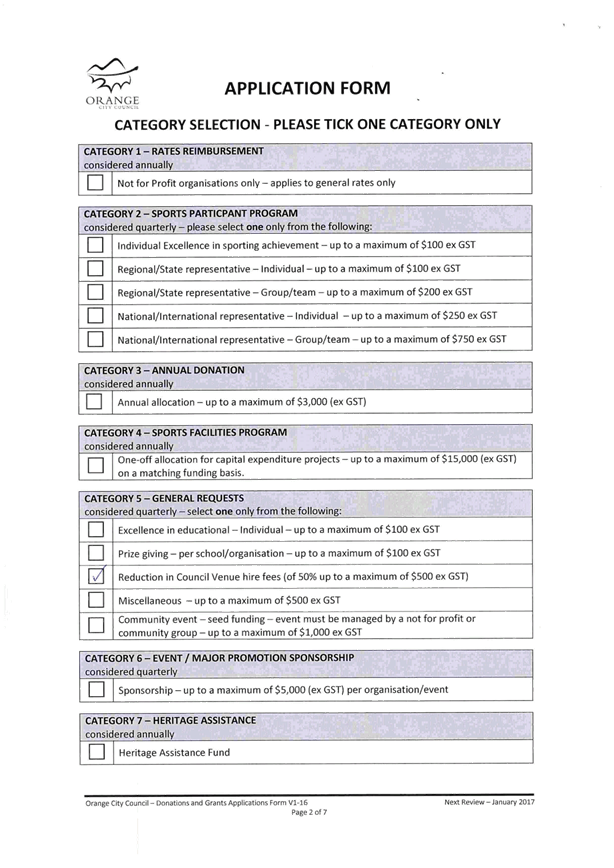

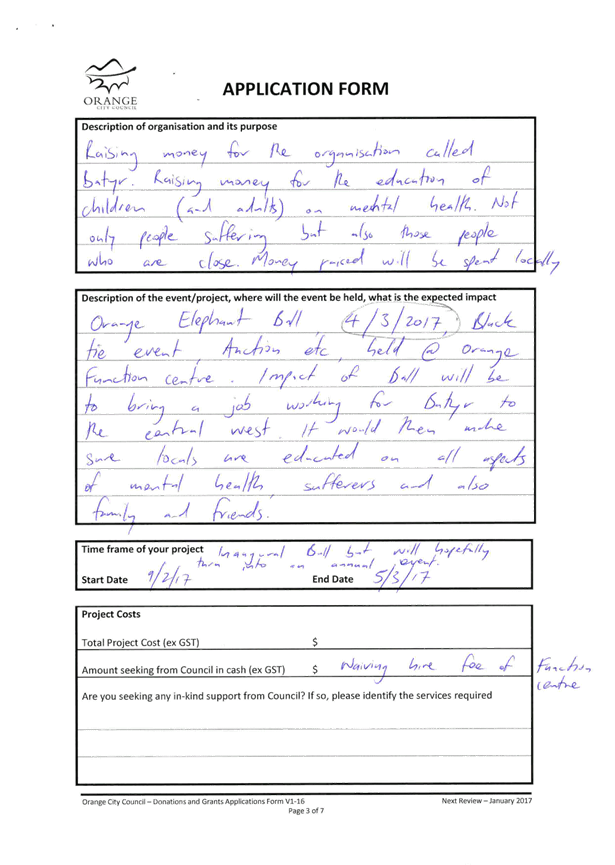

Orange Elephant Ball

The Batyr organisation focuses on preventative education in the area

of youth mental health, and raises money for people living with mental health.

Policy position – 50% up to a

maximum of $500. Complies with policy and if budget had been available staff

would have recommended approval of the application. $3,228 has been requested for

all costs associated with the hire of the Function Centre.

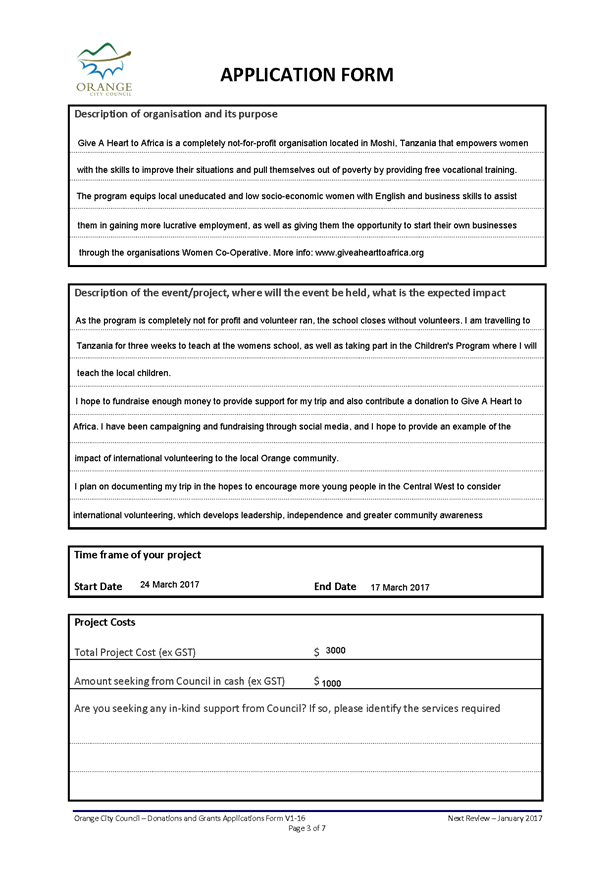

At the Vineyard

A

concert will be held at Borrodell and workshops with school children are

proposed. The application is seeking $15,000 in total. Half of the funds is to

be put towards costs of running the children’s workshops and the other

half to the costs of the concert.

Policy

position – Maximum of $5,000 in sponsorship category. Complies with the

Policy and if budget had been available, staff would have recommended

approval of the application.

Councillor Turner has advised of a

pledge of $1,500.

Attachments

1 Donation

Table, D17/3209⇩

2 Kishaya

Delaney, IC17/1140⇩

3 Orange

Elephant Ball, IC17/840⇩

4 At

the Vineyard application, D17/3859⇩

Finance Policy Committee

7 February 2017

3.2 Request

For Financial Assistance

Attachment 1 Donation

Table

|

No

|

Applicant

|

Amount Sought

|

Policy Position

|

Purpose

|

Comment

|

Recom-mended

|

To be advertised

|

|

A.1

|

Kishaya Delaney

|

$1,000

|

General Request – Up to a maximum of $500

|

To teach women and local children in Tanzania

|

Policy Applied

|

No

|

No

|

|

A.2

|

Orange Elephant Ball

|

$3,228

|

Reduction in Council Hire Fees – 50% up to a

maximum of $500

|

Charity Ball being held at the Orange Function

Centre for preventative education for youth mental health.

|

Policy Applied

|

No

|

No

|

|

A.3

|

At the Vineyard

|

$1,500

|

General Request – policy position would be up

to $5,000 if funds were still available

|

Concert and workshops for children who play string

instruments

|

Policy Applied

|

No

|

Yes

|

Finance

Policy Committee

7 February 2017

3.2 Request

For Financial Assistance

Attachment 2 Kishaya

Delaney

Finance

Policy Committee

7 February 2017

3.2 Request

For Financial Assistance

Attachment 3 Orange

Elephant Ball

Finance

Policy Committee

7 February 2017

3.2 Request

For Financial Assistance

Attachment 4 At the

Vineyard application

DONATIONS AND GRANTS APPLICATION FORM

Before

completing this application, Council’s “Donations and Grants”

Strategic Policy (ST029) and Operational Policy (OP012) should be read to

ensure that your application will receive consideration by Council. Copies of

the “Donations and Grants” policies are available from

Council’s website www.orange.nsw.gov.au.

F286 - D16/2

APPLICANT’S DETAILS

|

Name of organisation, group or person seeking funding

At the

Vineyard

|

|

Address

Lake

Canobolas Road

Orange NSW

|

|

Postal Address (if different from above)

|

|

Name and position of the contact person

|

|

Name

|

Luisa Machielse

|

|

Position

|

|

|

Phone (BH)

|

|

Phone (AH)

|

|

|

Phone (M)

|

|

|

|

|

Email

|

|

|

What is the legal status of your organisation? (eg Incorporated, Association, etc.)

If not for profit please attach evidence – such as

charter/constitution showing no personal gain will be available to members,

charitable status advice or a statutory declaration

Company

|

|

Is your group / organisation registered for GST?

|

Yes

No

|

|

ABN (if applicable)

|

50616757129

|

ACN (if applicable)

|

|

|

|

|

|

|

|

|

|

|

|

BANK ACCOUNT DETAILS for payment

|

BSB No

|

|

Account No

|

|

|

Account Name

|

|

|

Bank

|

|

|

|

|

|

|

NOTE: An Organisation, Group, Person or

other entity is limited to one donation or grant in any financial year.

NOTE: Government Departments or their agencies/representatives are ineligible

to receive financial assistance from Council under this policy.

CATEGORY SELECTION - PLEASE TICK ONE CATEGORY ONLY

|

CATEGORY 1 – RATES REIMBURSEMENT

considered annually

|

|

£

|

Not for Profit organisations only – applies to

general rates only

|

|

CATEGORY 2 – SPORTS PARTICPANT PROGRAM

considered quarterly – please select one

only from the following:

|

|

£

|

Individual Excellence in sporting achievement

– up to a maximum of $100 ex GST

|

|

£

|

Regional/State representative – Individual

– up to a maximum of $100 ex GST

|

|

£

|

Regional/State representative – Group/team

– up to a maximum of $200 ex GST

|

|

£

|

National/International representative –

Individual – up to a maximum of $250 ex GST

|

|

£

|

National/International representative –

Group/team – up to a maximum of $750 ex GST

|

|

CATEGORY 3 – ANNUAL DONATION

considered annually

|

|

£

|

Annual allocation – up to a maximum of $3,000

(ex GST)

|

|

CATEGORY 4 – SPORTS FACILITIES PROGRAM

considered annually

|

|

£

|

One-off allocation for capital expenditure projects

– up to a maximum of $15,000 (ex GST) on a matching funding basis.

|

|

CATEGORY 5 – GENERAL REQUESTS

considered quarterly – select one only

from the following:

|

|

£

|

Excellence in educational – Individual –

up to a maximum of $100 ex GST

|

|

£

|

Prize giving – per school/organisation –

up to a maximum of $100 ex GST

|

|

£

|

Reduction in Council Venue hire fees (of 50% up to a

maximum of $500 ex GST)

|

|

£

|

Miscellaneous – up to a maximum of $500

ex GST

|

|

£

|

Community event – seed funding – event

must be managed by a not for profit or community group – up to a

maximum of $1,000 ex GST

|

|

CATEGORY 6 – EVENT / MAJOR PROMOTION

SPONSORSHIP

considered quarterly

|

|

ü

|

Sponsorship – up to a maximum of $5,000 (ex

GST) per organisation/event

|

|

CATEGORY 7 – HERITAGE ASSISTANCE

considered annually

|

|

£

|

Heritage Assistance Fund

|

|

Description of organisation and its

purpose

|

|

One of the venues for the national inaugural concert series

Charlie Siem and the Omega Ensemble is scheduled for 1 April at Borrodell

Vineyard.

Charlie

Siem will also be conducting workshops with school children offering them a

unique first hand experience with an international musician.

|

|

Description of the event/project,

where will the event be held, what is the expected impact

|

|

The

workshops offer a wonderful opportunity for local students to see an

international artist and learn from a virtuoso. Council sponsorship of

the workshops is sought to the value of $7,500. The organiser

will work with the Orange Regional Conservatorium and local schools to

develop a program where Charlie Siem works with children to provide guidance

in the development of their musical skills.

|

|

The Concert will provide an opportunity to see Charlie Siem

perform with the Omega Ensemble. Council sponsorship of the concert is sought

to a value of $7,500.

|

|

This concert is part of a national tour and marketing and

advertising will promote the Orang region to a broad audience.

|

|

The concert will be held at Borrodell on 1st

April. The workshops will be held in the week prior to the event.

|

|

Time

frame of your project

|

|

Start

Date mid January 201

|

End Date

2 April 2017

|

|

Project

Costs

|

|

Total Project Cost (ex GST)

|

$ 33,000

|

|

Amount seeking from Council in cash (ex GST)

|

$15,000

|

|

Are you seeking any in-kind support from Council? If so,

please identify the services required

|

|

Use of baby grand piano, assistance with organising

promotion of the workshops and concert, assistance in contact lists to

organise the concert.

|

|

|

|

|

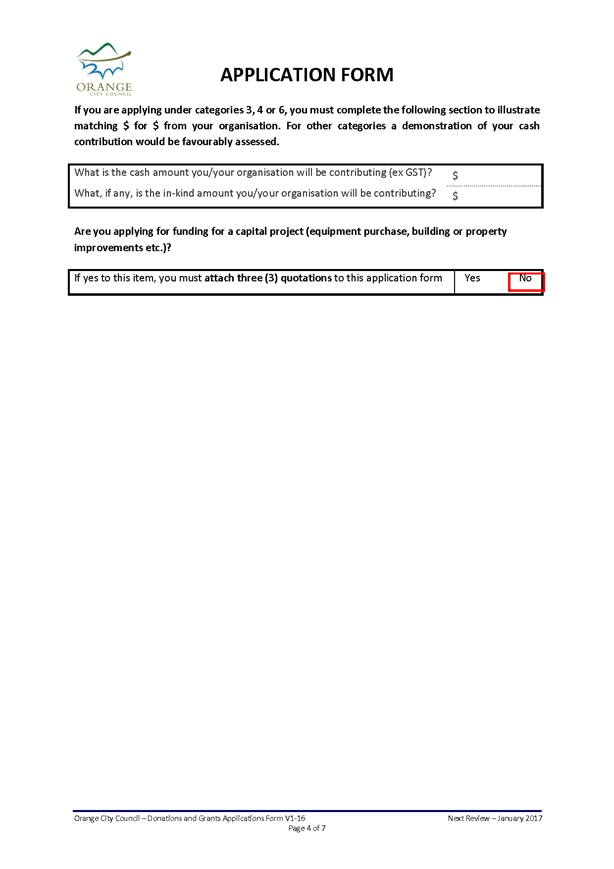

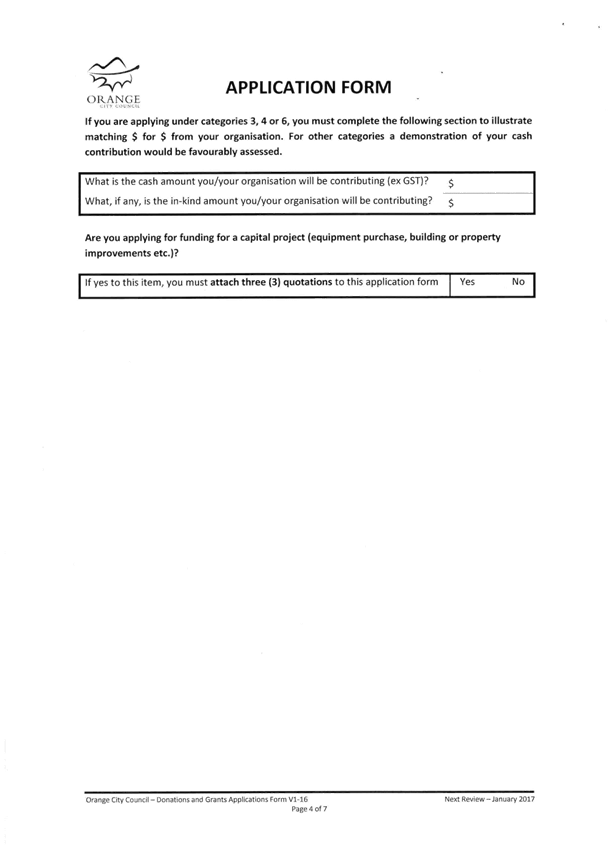

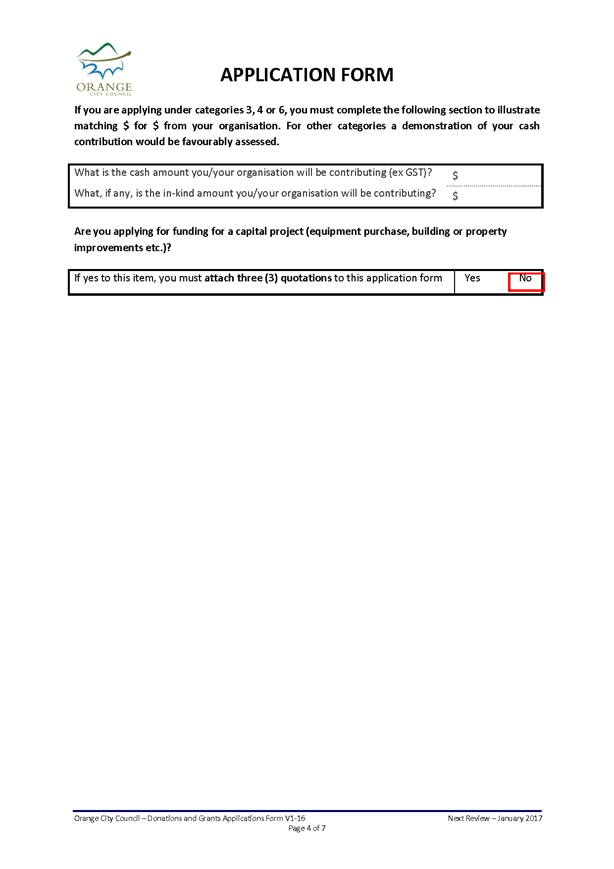

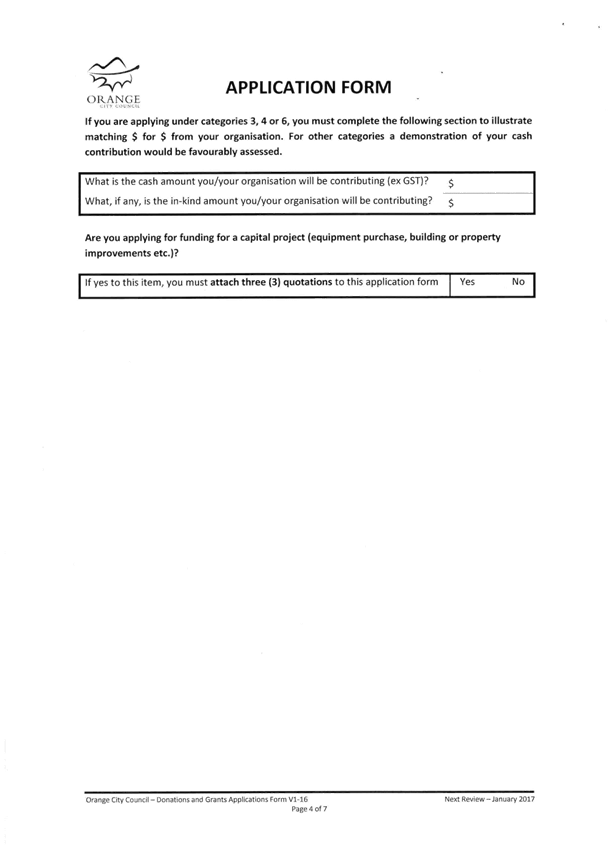

If you are applying under categories 3, 4 or 6, you must complete the

following section to illustrate matching $ for $ from your organisation. For

other categories a demonstration of your cash contribution would be favourably

assessed.

|

What is the

cash amount you/your organisation will be contributing (ex GST)?

|

$ 18,000

|

|

What, if any,

is the in-kind amount you/your organisation will be contributing?

|

$

|

Are you applying for funding for a

capital project (equipment purchase, building or property improvements etc.)?

|

If yes to this item, you must attach

three (3) quotations to this application form

|

No

|

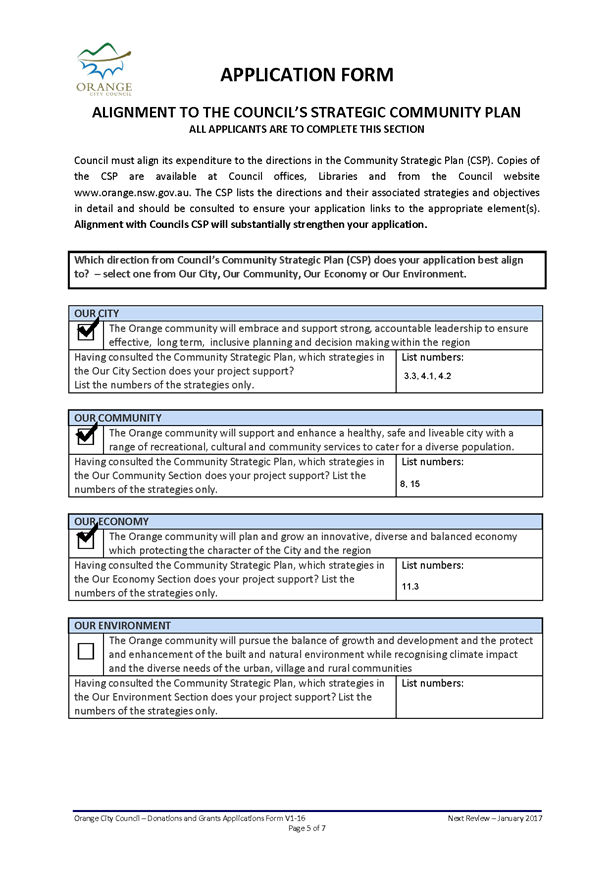

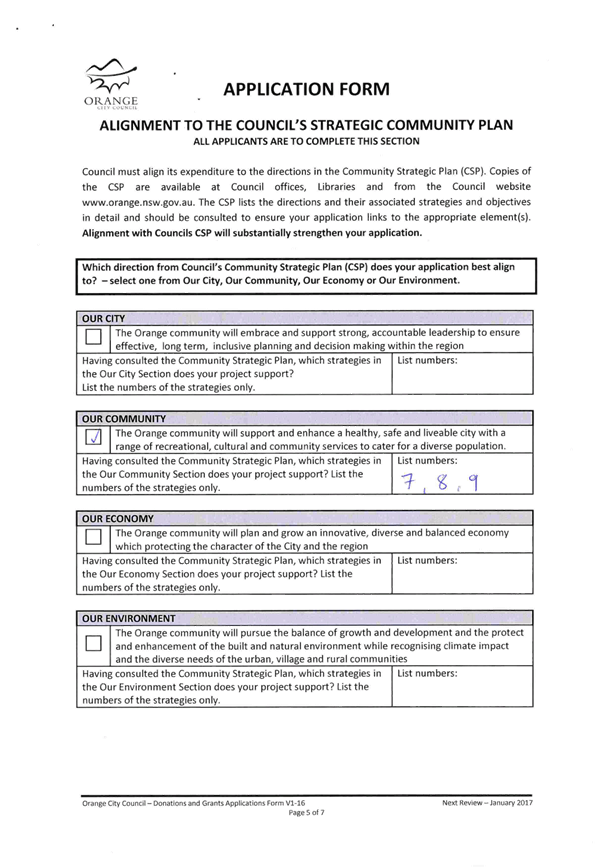

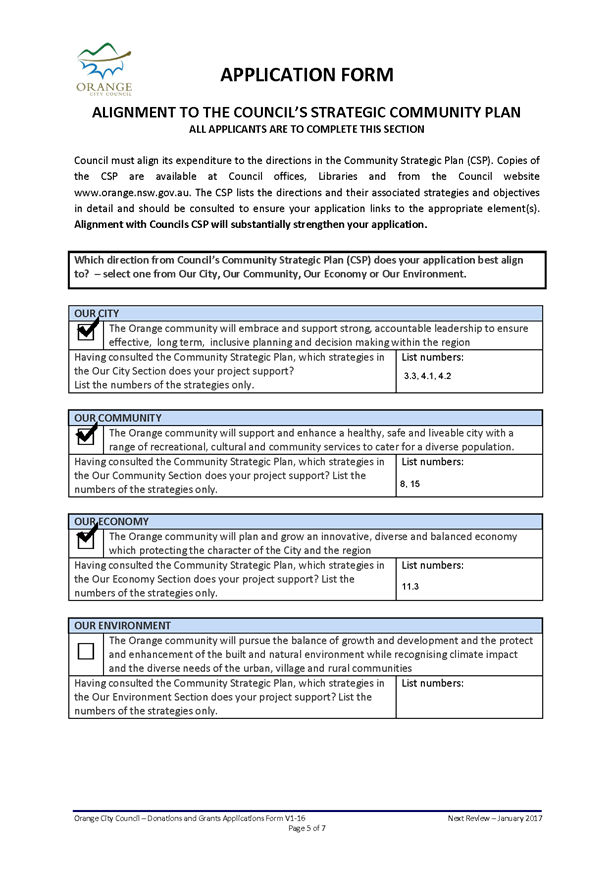

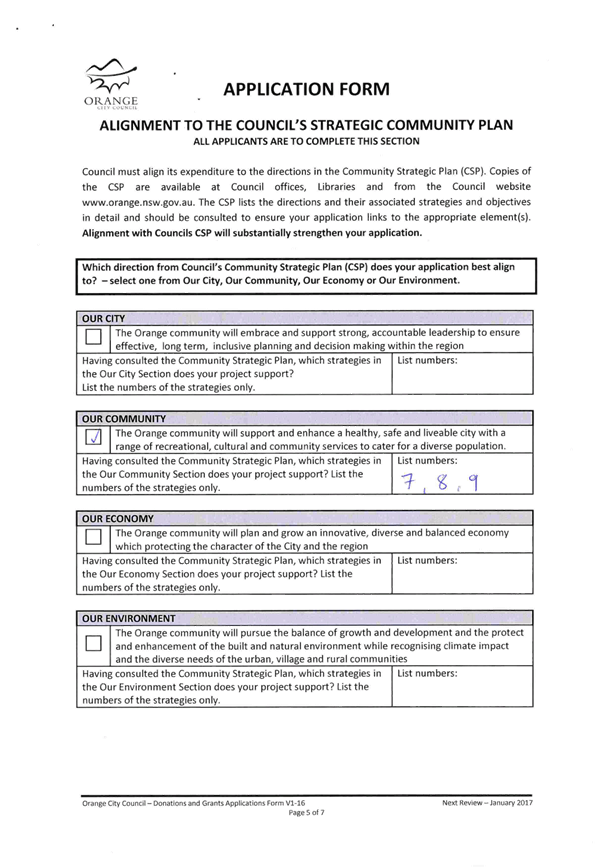

ALIGNMENT TO THE COUNCIL’S STRATEGIC COMMUNITY

PLAN

ALL APPLICANTS ARE TO COMPLETE THIS SECTION

Council must align its expenditure to

the directions in the Community Strategic Plan (CSP). Copies of the CSP are

available at Council offices, Libraries and from the Council website

www.orange.nsw.gov.au. The CSP lists the directions and their associated

strategies and objectives in detail and should be consulted to ensure your

application links to the appropriate element(s). Alignment with Councils CSP

will substantially strengthen your application.

|

Which direction from Council’s

Community Strategic Plan (CSP) does your application best align to?

– select one from Our City, Our Community, Our Economy or Our

Environment.

|

|

OUR CITY

|

|

£

|

The Orange community will embrace and

support strong, accountable leadership to ensure effective, long

term, inclusive planning and decision making within the region

|

|

Having consulted the Community

Strategic Plan, which strategies in the Our City Section does your project

support?

List the numbers of the strategies

only.

|

List

numbers:

|

|

|

|

|

OUR COMMUNITY

|

|

£

|

The Orange community will support and

enhance a healthy, safe and liveable city with a range of recreational,

cultural and community services to cater for a diverse population.

|

|

Having consulted the Community

Strategic Plan, which strategies in the Our Community Section does your

project support? List the numbers of the strategies only.

|

List

numbers:

|

|

|

|

|

OUR ECONOMY

|

|

ü

|

The Orange community will plan and

grow an innovative, diverse and balanced economy which protecting the

character of the City and the region

|

|

Having consulted the Community

Strategic Plan, which strategies in the Our Economy Section does your project

support? List the numbers of the strategies only.

|

List

numbers: 11.1

|

|

|

|

|

OUR

ENVIRONMENT

|

|

£

|

The Orange community will pursue the

balance of growth and development and the protect and enhancement of the

built and natural environment while recognising climate impact and the

diverse needs of the urban, village and rural communities

|

|

Having consulted the Community

Strategic Plan, which strategies in the Our Environment Section does your

project support? List the numbers of the strategies only.

|

List

numbers:

|

|

|

|

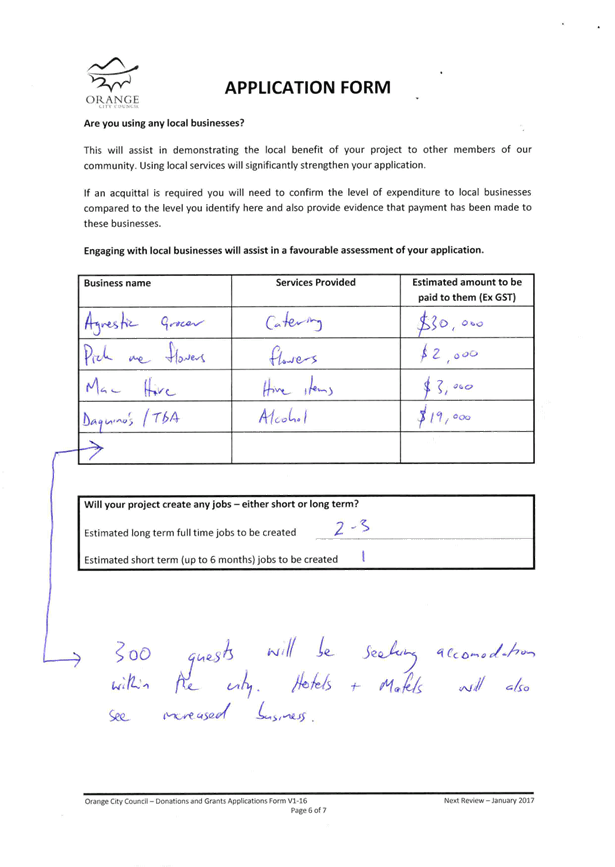

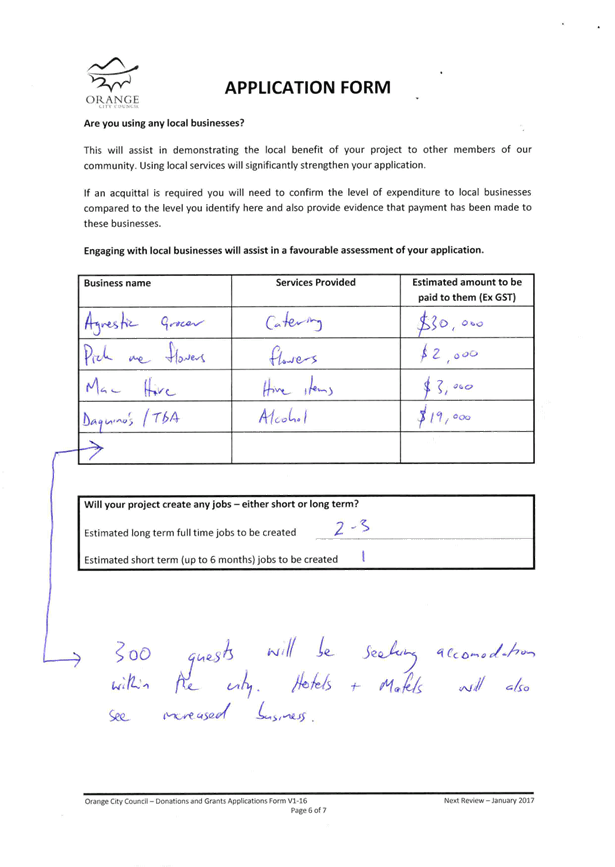

Are you using any local businesses?

This will assist in demonstrating the

local benefit of your project to other members of our community. Using local

services will significantly strengthen your application.

If an acquittal is required you will

need to confirm the level of expenditure to local businesses compared to the

level you identify here and also provide evidence that payment has been made to

these businesses.

Engaging with local businesses will

assist in a favourable assessment of your application.

|

Business

name

|

Services

Provided

|

Estimated

amount to be paid to them (Ex GST)

|

|

Kennards

Hire

|

Television

at launch event

|

$200

|

|

Orange City

Council

|

Use of Baby

Grand

|

$0 –

although this would have cost $4,000 if had to be hired

|

|

Marquee

hire

|

Hire

|

$4,500

|

|

Advertising

|

Promotions

|

$2,000

|

|

Sound and

stage

|

Hire

|

$2,000

|

|

Buses

|

Hire

|

$1000

|

|

Toilets

|

Hire

|

$500

|

|

Printing

|

Program

printing

|

$500

|

|

Will

your project create any jobs – either short or long term?

|

|

Estimated long term full time jobs to

be created

|

0

|

|

Estimated

short term (up to 6 months) jobs to be created

|

1

|

|

|

|

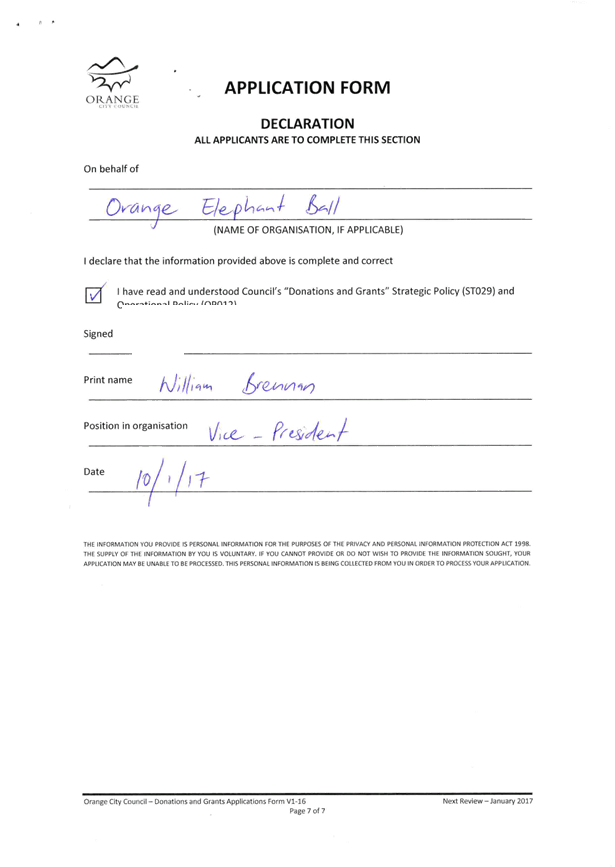

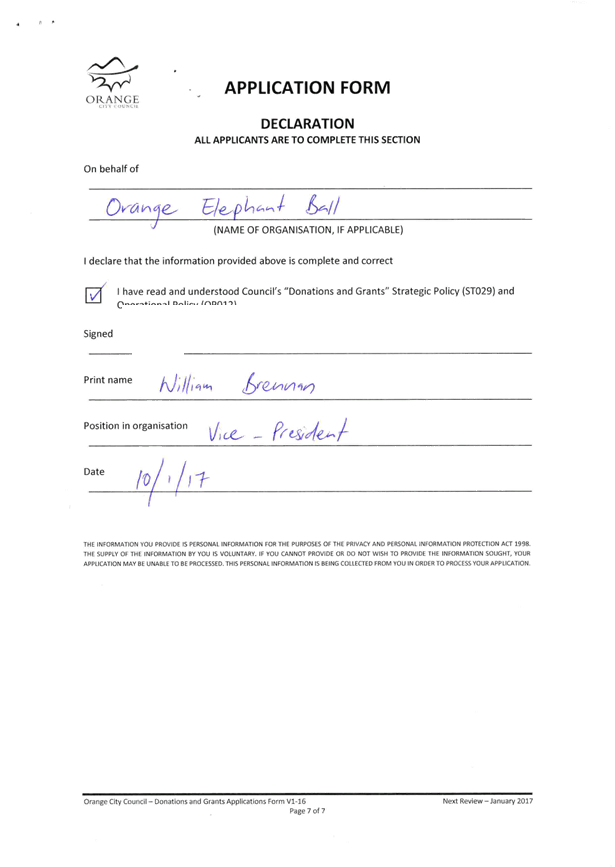

DECLARATION

ALL APPLICANTS ARE TO COMPLETE THIS SECTION

On behalf of

At the Vineyard

I declare

that the information provided above is complete and correct

|

ü

|

I have read and understood

Council’s “Donations and Grants” Strategic Policy (ST029)

and Operational Policy (OP012).

|

Signed

Luisa

Machielse

___________________________________________________________________________

Print name

___________________________________________________________________________

Position in

organisation

Owner______________________________________________________________________

Date 26

January 2017

___________________________________________________________________________

THE INFORMATION YOU PROVIDE IS

PERSONAL INFORMATION FOR THE PURPOSES OF THE PRIVACY AND PERSONAL INFORMATION

PROTECTION ACT 1998. THE SUPPLY OF THE INFORMATION BY YOU IS VOLUNTARY. IF YOU

CANNOT PROVIDE OR DO NOT WISH TO PROVIDE THE INFORMATION SOUGHT, YOUR

APPLICATION MAY BE UNABLE TO BE PROCESSED. THIS PERSONAL INFORMATION IS BEING

COLLECTED FROM YOU IN ORDER TO PROCESS YOUR APPLICATION.