ORANGE CITY COUNCIL

Employment and Economic

Development Policy Committee

Agenda

6 June 2017

Notice

is hereby given, in accordance with the provisions of the Local Government Act

1993 that a Employment and Economic

Development Policy Committee meeting

of ORANGE CITY COUNCIL will be held in the Council Chamber, Civic Centre, Byng Street, Orange on Tuesday,

6 June 2017.

Garry

Styles

General Manager

For apologies please

contact Michelle Catlin on 6393 8246.

Employment and Economic Development Policy Committee 6

June 2017

1 Introduction

1.1 Declaration

of pecuniary interests, significant non-pecuniary interests and less than

significant non-pecuniary interests

The

provisions of Chapter 14 of the Local Government Act, 1993 (the Act)

regulate the way in which Councillors and designated staff of Council conduct

themselves to ensure that there is no conflict between their private interests

and their public role.

The

Act prescribes that where a member of Council (or a Committee of Council) has a

direct or indirect financial (pecuniary) interest in a matter to be considered

at a meeting of the Council (or Committee), that interest must be disclosed as

soon as practicable after the start of the meeting and the reasons given for declaring

such interest.

As

members are aware, the provisions of the Local Government Act restrict any

member who has declared a pecuniary interest in any matter from participating

in the discussion or voting on that matter, and requires that member to vacate

the Chamber.

Council’s Code of Conduct provides that if members

have a non-pecuniary conflict of interest, the nature of the conflict must be

disclosed. The Code of Conduct also provides for a number of ways in which a

member may manage non pecuniary conflicts of interest.

|

Recommendation

It is recommended that Committee Members now disclose any

conflicts of interest in matters under consideration by the Employment and

Economic Development Policy Committee at this meeting.

|

2 General

Reports

2.1 Quarterly

Housing Data for Orange and the Region

TRIM

REFERENCE: 2017/237

AUTHOR: Tony

Boland, Business Projects Officer

EXECUTIVE Summary

At the meeting of 7 February 2017, a question was taken on

notice for Council to receive regular reports on property sales in Orange.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “11.1 Our Economy – Encourage

the growth of local business, support emerging industry sectors and attract new

investment to Orange”.

Financial Implications

Nil

Policy and Governance Implications

Nil

|

Recommendation

That the report on housing data for Orange and the

region be acknowledged.

|

further considerations

Consideration has been given to the recommendation’s

impact on Council’s service delivery; image and reputation; political;

environmental; health and safety; employees; stakeholders and project

management; and no further implications or risks have been identified.

SUPPORTING

INFORMATION

The most comprehensive reports on property sales and rental

data is published by Housing NSW. Council has used other data sources to

supplement the Housing NSW information.

There are two other commonly reported sources of data on

housing prices:

· RP Data (trading

as CoreLogic)

· Domain

(combination of former Australian Property Monitors and Pricefinder and owned

by Fairfax media)

Both of these sources are more

commonly reported in the media, however the source of the data and the

methodology applied to the collection and inclusion of the data makes these

sources less certain to use. The only advantage of these data sources is that

they are more ‘real time’ than the Housing NSW data.

The supporting information in this

report is broken into five categories:

· median

sales price

· mean

sales price

· number

of sales

· median rental

price

· building approvals

Median

Sales Price

The information surrounding housing

sales and rent data is reported in terms of a median price.

The Housing NSW sales data is captured three months after

the end of the reporting period. On average, around 80% of all sales contracts

have been notified in this timeframe. Statistical analysis and testing by

Housing NSW has shown that the housing mean and median prices do not vary

greatly if data is captured at the six month point. The sales statistics are

derived from information provided on the “Notice of Sale or Transfer of

Land” form that is lodged with Land and Property Information NSW.

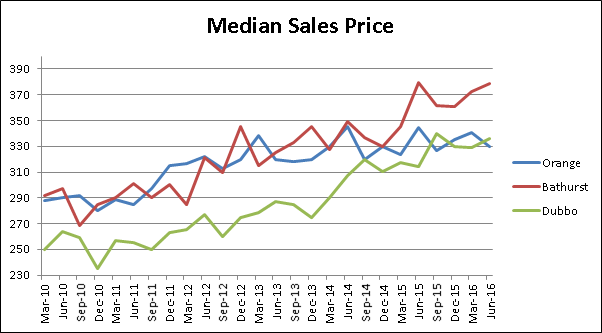

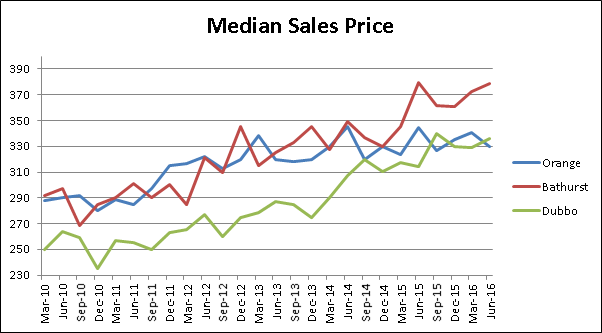

The Housing NSW median sales price in Orange in the June

2016 quarter was $336,000, down from a peak of $345,000 in June 2015. This is

less than both Bathurst and Dubbo as shown in the graph below.

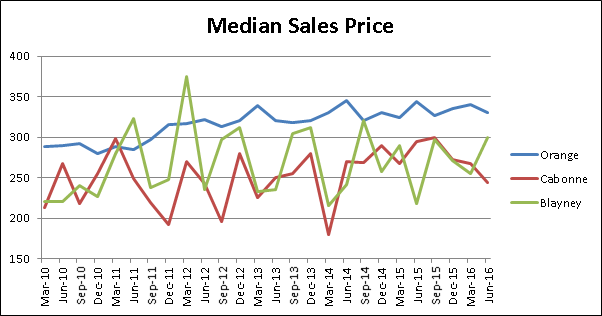

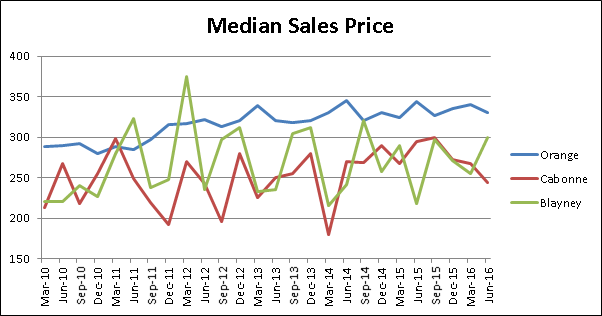

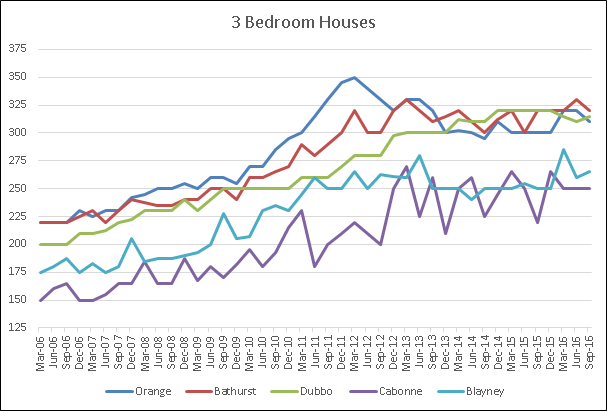

Due to the smaller nature of both the

Cabonne and Blayney residential housing sales markets, the median sales price

is subject to increased volatility in pricing as can be seen in the graph below.

Data from other sources can fluctuate significantly from the

Housing NSW data. As an example, the median price listed by RP Data on 10

February 2017 was $345,000 and the median price from Domain for 2016 was

$347,000. The median listed by Domain in their 2017 Domain House Price Report

was $368,000.

The net growth in the median sales price for Dubbo and

Bathurst for the period March 2010 to June 2016 was more than double that of

Orange.

Mean Sales Price

The mean (average) sales price from Housing NSW is reported on

a Statistical Area Level 3 (SA3) basis. The Orange SA3 is very similar to the

local government areas of Orange, Cabonne and Blayney but doesn’t include

Eugowra or Canowindra. The Bathurst SA3 aligns closely with the boundaries for

Bathurst and Oberon LGAs.

When calculating a mean price, Housing NSW excludes the top 5%

and bottom 5% of sales from each LGA to account for any anomalies or

aberrations in the housing market sales. The result is a more accurate

reflection of the true average price for the market.

The Dubbo SA3 includes parts or all of the LGAs of: Dubbo;

Narromine; Wellington; Coonabarabran; and Gilgandra. The size of this SA3 makes

comparison to Orange and Bathurst impractical.

The mean house price for the June 2016 quarter for Orange SA3

was $333,000 and for the Bathurst SA3 it was $387,000.

Number of Sales

Identifying the number of houses sold in a twelve month period

is not possible through the Housing NSW reports. The two commercial sources

listed the number of units and houses sold as 738 and 729 respectively for

Orange. Comparatively, Bathurst was listed at 456 and 533 sales by the two

sources and Dubbo was listed as 507 (there was an error with one of the Dubbo

listings).

As the commercial sources would not be reporting houses that

haven’t been sold, the variation in the figures are likely to be

attributed to market share or some slight differences in geography. So, along

with using the only available Dubbo result, the number of sales over the

previous year are:

· Orange

- 738

· Bathurst

- 556

· Dubbo

- 468

According to realestate.com.au (RP Data), the number of house

sales in Orange each calendar year over the past 9 years are:

|

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Orange

|

348

|

492

|

585

|

732

|

569

|

562

|

630

|

811

|

752

|

|

Bathurst

|

223

|

353

|

299

|

421

|

417

|

443

|

444

|

570

|

556

|

The turnover in housing is

consistently higher in Orange than in Bathurst. This could be for a number of

reasons including:

· More

people using Orange as a stepping stone in their career path

· Orange

has a larger population therefore a higher turnover is expected

· Lack

of supply and increased demand could be driving up the Bathurst price

· The

construction of new homes has not been able to keep pace as well in Bathurst.

Currently in Orange, the number of properties for sale across

the 17 real estate agents listed in Council’s Business Directory range

from 13 to 49. Most of these properties are listed online with each

individual business, or on domain and real estate. When searching Orange

current real estate market, 564 properties are listed on domain and 622

properties on real estate. Both of these sites have duplication of

listings.

The current sales turnover of housing in Orange is

steady. The sales turnover is influenced by the appropriateness of the

pricing and the location of the property. Properties over $500,000 are slower

to sell and properties under $400,000 are faster.

Median Rental Price

The rental statistics from Housing NSW is derived from

information provided on the rental bond lodgement form that is lodged with the

Office of Fair Trading. Where there are less than 10 bonds lodged in a quarter

the data will return a nil result.

The median rents for the region in the September 2016 quarter

are listed in the following table. The areas are Local Government Area

boundaries.

|

Type

|

All Dwellings

|

Separate Houses

|

Flats/Units

|

|

Bedrooms

|

1

|

2

|

3

|

4

|

2

|

3

|

1

|

2

|

|

|

|

|

|

|

|

|

|

|

Orange

|

208

|

250

|

310

|

395

|

270

|

310

|

210

|

240

|

|

Bathurst

|

190

|

260

|

320

|

420

|

268

|

320

|

190

|

260

|

|

Dubbo

|

178

|

250

|

320

|

380

|

270

|

315

|

175

|

230

|

|

Cabonne

|

-

|

-

|

250

|

280

|

-

|

250

|

-

|

-

|

|

Blayney

|

-

|

210

|

250

|

335

|

-

|

265

|

-

|

-

|

The rent for a one bedroom unit is higher in Orange than both

Bathurst and Dubbo. The rent for a two bedroom unit in Bathurst is

significantly higher than for a one bedroom unit. The prices for 2 and 3

bedroom separate houses is very similar across Orange, Bathurst and Dubbo while

a four bedroom house brings significantly more in Bathurst than Orange or

Dubbo.

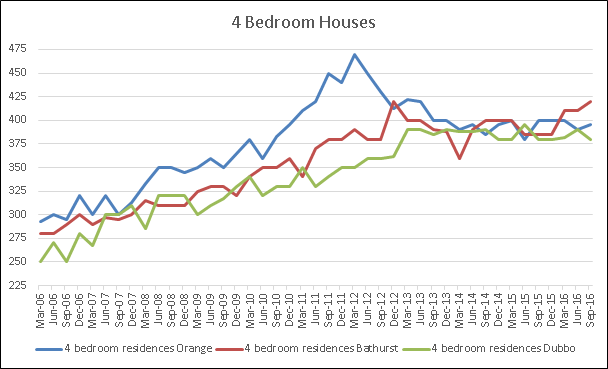

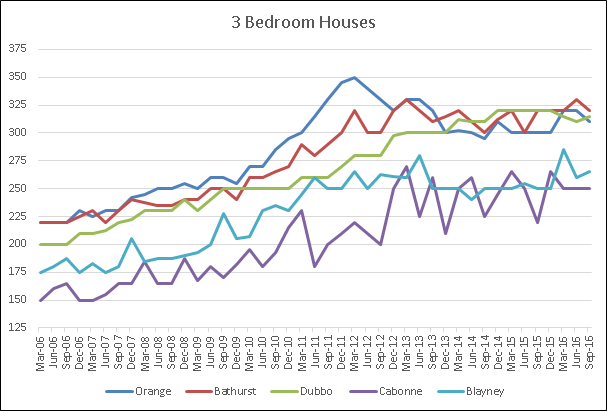

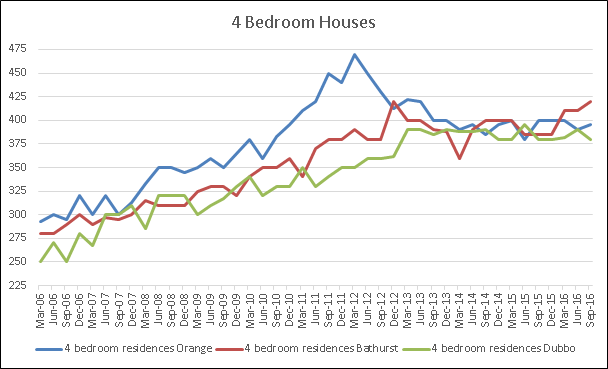

The rental costs for 3 and 4 bedroom houses were at an

all-time high between June 2011 and September 2012. This was a period of

intense commercial and mining construction with a number of projects going on

in and around the city. Accommodation at that time was at an absolute premium,

driving up the price.

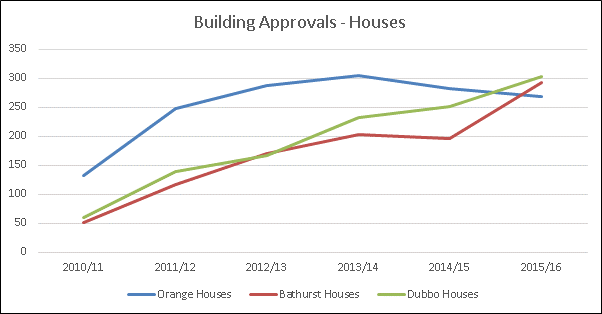

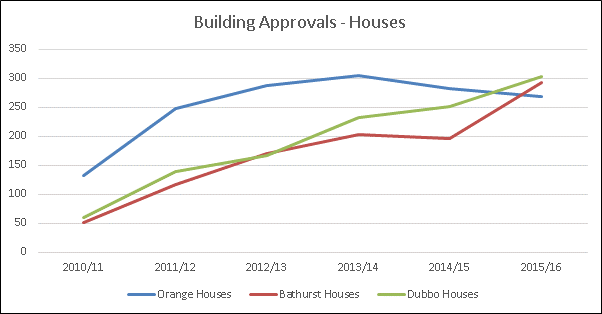

Building approvals

The number of building approvals is a key indicator in the

confidence and growth of a geographic location. While not all approvals

graduate to the commencement of construction, it is a consistent way to measure

potential building activity between regions and from year to year. This

information is from the Australian Bureau of Statistics (Category 8731.0

– Building Approvals).

The table below shows the comparison between the cities (not

LGAs) of Orange, Bathurst and Dubbo. The three measures are new houses

(houses), other new residential premises (other) and the total numbers of new

residential premises approved (Total).

|

|

|

2010/11

|

2011/12

|

2012/13

|

2013/14

|

2014/15

|

2015/16

|

2016/17

|

|

Orange

|

Houses

|

133

|

248

|

287

|

305

|

283

|

269

|

141

|

|

Other

|

2

|

19

|

20

|

14

|

21

|

193

|

10

|

|

Total

|

135

|

267

|

307

|

319

|

304

|

462

|

151

|

|

Bathurst

|

Houses

|

52

|

118

|

171

|

203

|

196

|

293

|

115

|

|

Other

|

0

|

38

|

64

|

58

|

116

|

77

|

13

|

|

Total

|

52

|

156

|

235

|

261

|

312

|

370

|

128

|

|

Dubbo

|

Houses

|

61

|

139

|

168

|

232

|

251

|

303

|

142

|

|

Other

|

20

|

26

|

20

|

112

|

58

|

87

|

64

|

|

Total

|

81

|

165

|

188

|

344

|

309

|

390

|

206

|

There was a rapid growth in building approvals in 2011. This

rapid growth has been sustained and was still at 269 at the end of last

financial year. This rapid growth in approvals (and subsequent construction)

would have contributed to keeping the median sales and rent prices in check in

Orange. Both Dubbo and Bathurst experienced a steady growth in approvals over

the same period. Although they had a higher number of approvals last financial

year, they both had less net approvals over the same period, potentially

leading to shortage in supply and driving up the median sales price.

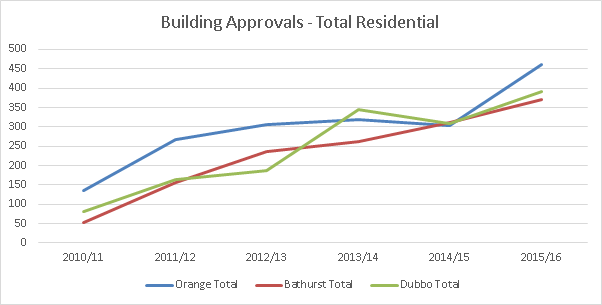

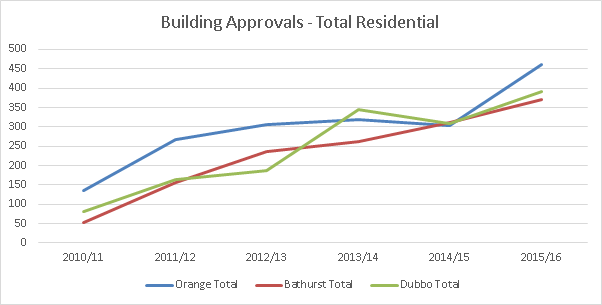

The total building approvals for Orange shows a rapid growth

from 30/6/14 to 30/6/15. This growth is in spite of a reduction of houses being

approved in the same period. For the majority of the time the total residential

approvals in Orange are higher than in Bathurst and Dubbo. This will be in part

from having a larger population.

2.2 Update

on Quarterly Unemployment Data for Orange

TRIM

REFERENCE: 2017/815

AUTHOR: Tony

Boland, Business Projects Officer

EXECUTIVE Summary

At the Employment and Economic Development Policy Committee

meeting of 3 May 2016, Council requested that the quarterly unemployment

figures be reported to Council.

The Federal Department of Employment compiles and reports

Small Area Labour Market (SALM) data. This report provides the most recently

published data.

Link To Delivery/OPerational Plan

The recommendation in this report relates to the

Delivery/Operational Plan strategy “11.1 Our Economy – Encourage

the growth of local business, support emerging industry sectors and attract new

investment to Orange”.

Financial Implications

Nil

Policy and Governance Implications

Nil

|

Recommendation

That the report by the Business Projects Officer on Unemployment

Figures for Orange be acknowledged.

|

further considerations

The recommendation of this report has been assessed against

Council’s other key risk categories and the following comments are

provided:

|

Service Delivery

|

The data provided within this

report is also provided to companies looking for assistance with information

as well as being used by staff in submissions.

|

SUPPORTING INFORMATION

The figures are published on a quarterly basis by the

Department of Employment in the Small Area Labour Markets publication https://www.employment.gov.au/small-area-labour-markets-publication.

The SALM data is released by the Department of Employment

three to four months after the end of the quarter. The most recent data

available is for the quarter ending 31 December 2016. The data in this report

is on a Local Government Area basis in the first section and then on a city by

city (SA2) basis for the second half of the report. There is additional

information on SA2 geography in the second part of the report.

|

Measurement – Orange LGA

|

December Qtr 2016

|

|

Labour force

|

22,555

|

|

Unemployed persons

|

983

|

|

Unemployment rate – September

2016

|

4.4%

|

The unemployment rate for the Orange LGA was 6.6% in the

December 2015 quarter. The Department of Employment cautions consideration of

quarter on quarter comparison due to the volatility of the data. It recommends

analysis on year to year basis.

A comparison of the Orange LGA results in the December 2016

quarter to other LGAs is shown in the table below (noting this relates to the

LGAs as they were in December 2016):

|

LGA

|

UE

rate – Dec 2016

|

|

LGA

|

UE

rate –Dec 2016

|

|

Albury

|

7.4%

|

|

Lithgow

|

6.2%

|

|

Armidale

|

7.1%

|

|

Maitland

|

4.4%

|

|

Bathurst

|

3.9%

|

|

Mid-Western

|

5.2%

|

|

Blayney

|

3.8%

|

|

Oberon

|

3.7%

|

|

Cabonne

|

2.8%

|

|

Orange

|

4.4%

|

|

Coffs Harbour

|

3.4%

|

|

Parkes

|

6.5%

|

|

Cowra

|

6.2%

|

|

Port Macquarie

|

4.6%

|

|

Forbes

|

4.2%

|

|

Tamworth

|

7.2%

|

|

Griffith

|

4.1%

|

|

Wagga Wagga

|

4.3%

|

|

Hilltops +

|

5.0%

|

|

Western Plains+

|

4.7%

|

|

|

|

|

NSW

|

5.2%

|

+

Dubbo and Young Councils were amalgamated with other Councils to form new

merged entities.

Previous reports have reported the Dubbo and Young unemployment rate.

The SALM data has been measured for

over 30 years. This information has been provided on a geographic basis where

the boundaries match the appropriate Local Government Area. The graphs in the

first section below depict the historical data for the Orange LGA. Data has

only been collected on a SA2 basis since 2010. There are two or three SA2 areas

that form an equivalent geographical area to each of the cities.

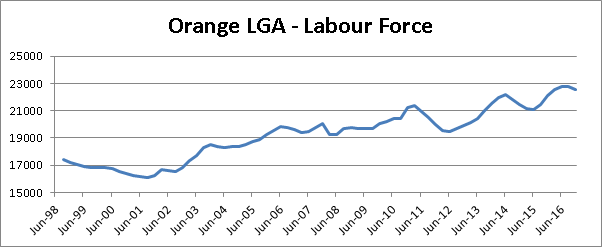

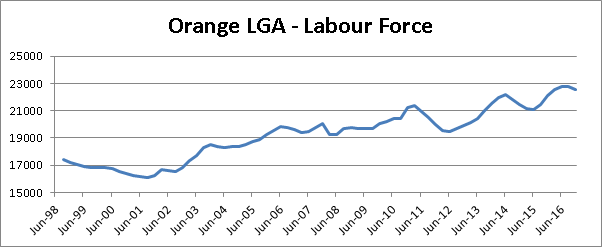

Labour Force

The labour force is the number of persons aged over 15 years

with the exclusion of certain persons, including those in permanent defence

force positions, overseas residents in Australia and some diplomatic roles. The

labour force is the number of non-excluded people who are working or actively

looking for work, so the labour force figure includes people who are

unemployed.

For Orange LGA, the graph below displays a peak in the labour

force in March 2011 which

coincided with a significant number of construction projects including Cadia

East, CSU and new hospital by the Orange Health Service.

The period from December 2013 to September 2014 includes a

significant number of people who relocated for the purposes of the Cadia East

construction project and Orange Airport Development. This is reflected within

our population statistics. September 2014 saw the completion of the last of

these projects, with the conclusion of the Cadia East construction.

From September 2014 to June 2015 there was a significant

reduction in the labour force. This was potentially linked to jobseeker

confidence in the light of the scaling back of Electrolux operations. Jobseeker

confidence and jobs have recovered well for the labour force to be at an all

time high in June 2016 and only slightly less than that in the September 2016

quarter.

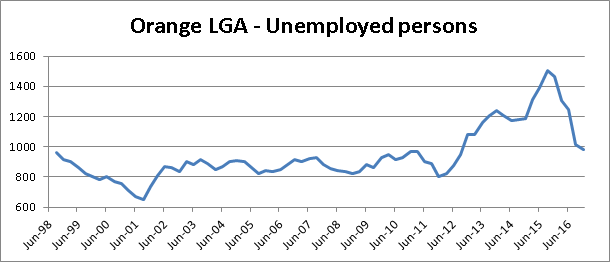

Unemployed

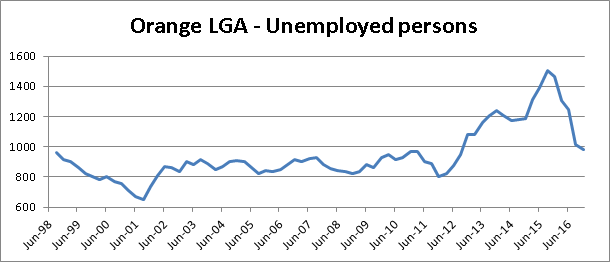

persons

The number of unemployed persons in Orange LGA has

traditionally been less than 1,000 persons.

The 1,000 person ‘barrier’ was broken after

September 2012 quarter. This coincided with the completion of a number of large

projects. The number of unemployed continued to climb quarter on quarter (with

the exception of March and June 2014) until a peak of 1,504 was realised in

September 2015 quarter.

There was a rapid decline in the number of unemployed people

(to 1,018) in the twelve months from September 2015 to September 2016. This is

a net reduction of 486 unemployed people over the twelve month period. The

labour force also increased by 1047 people in this same period. This decline

continued in the December quarter, albeit at a lesser rate of decline.

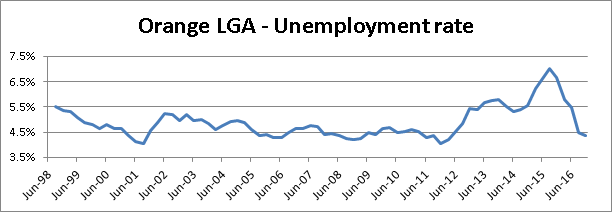

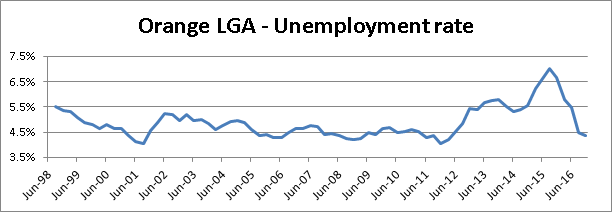

Unemployment rate

The unemployment rate has historically been relatively

conservative in the 4-5 per cent range. The unemployment rate peaked in

September 2015 at 7.0%. This quarter coincided with a significant number of

retrenchments from Electrolux and the reduction of contractors at Cadia Valley

Operations.

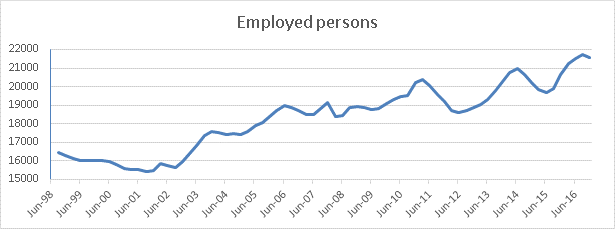

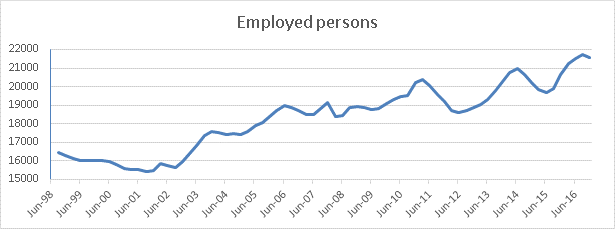

Employed

persons

The figure for employed persons is not reported by the

Department of Employment but is derived by taking the unemployed persons out of

the labour force. The December 2016 quarter saw a slight drop from the highest

ever level of people in employment (21,724 people) achieved in Orange. This

figure is higher than the number of people employed at any time during the

major construction projects or in the mining boom.

City to City Comparisons

It has become increasingly unreliable to do city to city

comparisons using LGA boundaries as a number of Local Government Areas are now

merged, and therefore increase in geographic and population size. The

Department of Employment now releases employment data using the Australian

Statistical Geography Standard Statistical Area Level 2 geography. This allows

data to be closely matched to the geography of a city as well as a Local

Government Area.

By matching to the geography of a city, direct comparisons can

be made between each city’s labour market rather than guessing how much

of the LGA data is attributable to the city and how much is attributable to

villages and rural communities.

To help put the city based employment data in context, it is

useful to gain an understanding of each city’s population. The table

below shows the estimated residential population for the year ending June 30

for each of the cities.

|

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Orange City

|

36,988

|

37,785

|

38,523

|

39,208

|

39,741

|

40,075

|

40,582

|

|

Bathurst City

|

33,328

|

33,754

|

34,203

|

34,855

|

35,369

|

36,013

|

36,701

|

|

Dubbo City

|

35,056

|

35,281

|

35,701

|

36,073

|

36,599

|

36,941

|

37,245

|

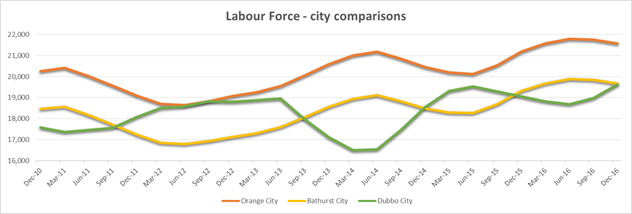

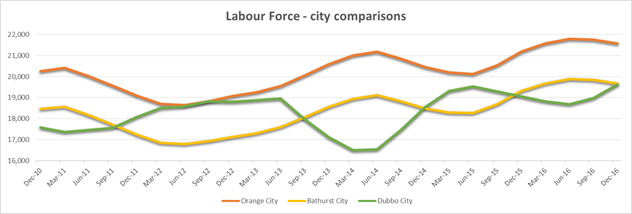

The Labour Force for the three cities is contained in the

following graph. Of note, the lines denoting the Orange and Bathurst labour

force almost run parallel over the entire period. Orange has consistently had a

workforce of around 2,000 more people than Bathurst. This is consistent with

having around an extra 4,000 residents in Orange compared to Bathurst.

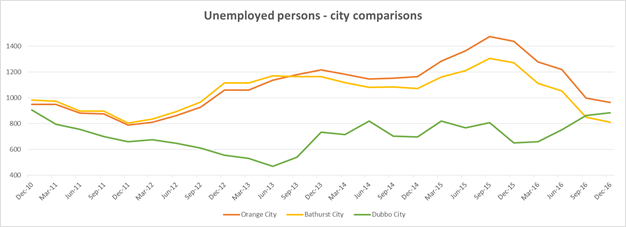

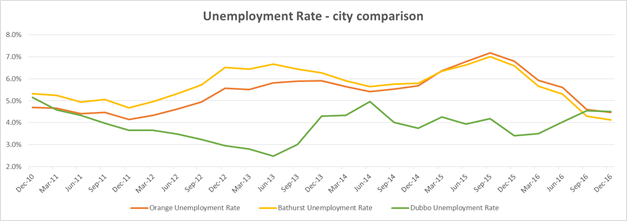

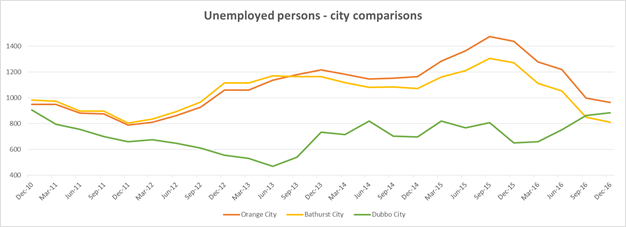

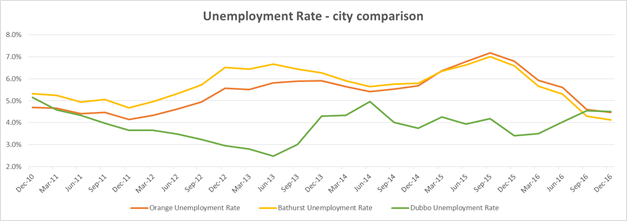

It is interesting to note in the following two graphs that the

unemployed persons and the unemployed rate for Orange and Bathurst follow a

similar trend while the unemployed persons and rate for Dubbo trends

differently. Some of the similarity in the Orange and Bathurst trends could be

apportioned to the relatively close geographic positioning of the two cities to

each other, allowing flexibility of people to move between the two labour

markets for work. This would help to counter individual city labour market peaks

and troughs in Bathurst and Orange.

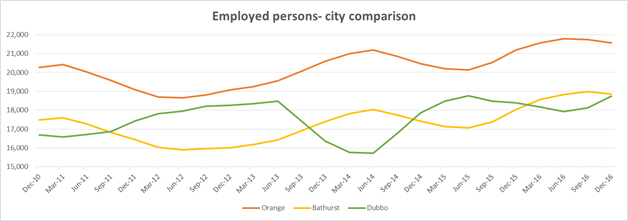

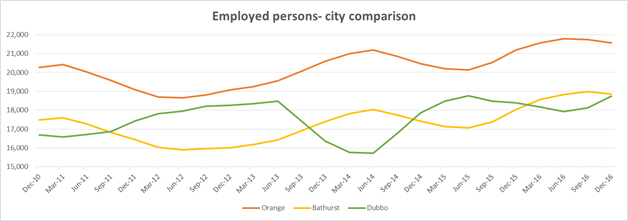

The figure for employed persons is not reported by the

Department of Employment but is derived by taking the number of unemployed

persons out of the labour force figure. The graph below shows Orange has around

2,500 more jobs than either Bathurst or Dubbo in December 2016.

Impact of Council’s Jobs Creation Strategy on local

jobs

Council has allocated $110,000 p.a. to its Jobs Creation

Strategy initiatives over a 10 year period. The Grow Local Campaign was

one of the initiatives funded where Council obtained matching funding from the

NSW Government in a program designed to assist local businesses impacted by the

closing of the Electrolux factory and other structural changes that could

impact on jobs.

An example of the impact of Council’s efforts in

supporting local businesses is provided to illustrate how even a small

allocation can have a large impact.

One of the local businesses assisted was Wangarang.

Wangarang is a local not for profit company that operates as

an Australian Disability Enterprise (ADE). An ADE is partially funded through

government funds and grants but it must find the majority of its funding

through work sought and gained in the private marketplace.

A significant proportion of Wangarang’s income in the

past has been from work performed for Electrolux. Wangarang was awarded a Grow

Local grant in January 2016 to assist with a marketing plan and delivery. The

grant was awarded based on the effect on business from the downturn at Electrolux

(primarily) and Cadia (secondary). The grant proved to be effective in stemming

the loss of work to Wangarang by attracting new business.

A significant further reduction in the work from Electrolux

occurred in April and September/October of 2016. The program allowed for a

second grant in extenuating circumstances but not within the same financial

year. As such, Wangarang was approved for a second grant to market additional

and alternative sources for work. This proved successful again in supporting

the employees within the business with alternative, meaningful work.

The net result was that 52 full time, 105 part time and 8

casual staff still have a job. Wangarang faced the biggest challenges of any

company with the closure of Electrolux, yet with the assistance of the Grow

Local program and the buoyancy in the local economy and labour market, not one

position was lost and an income stream from Electrolux has been effectively

replaced.